The Guidance emphasizes the importance of reviewing market conditions and the related effect on fund investments on an ongoing basis and ensuring that fund disclosure is appropriately up-to-date.

In early March, the staff of the US Securities and Exchange Commission’s (SEC’s) Division of Investment Management published IM Guidance Update 2016-02 (the Guidance) regarding the disclosure practices of registered funds.[1] The Guidance indicates that because risk is dynamic in nature, the degree and types of risk that a fund may be exposed to will vary over time and, accordingly, fund managers should periodically evaluate the sufficiency of fund disclosures in light of changing market conditions. In the Guidance, the staff outlines a three-part process that it believes will assist funds with providing robust disclosure to investors during changing marketing conditions:

- An adviser should monitor market conditions on an ongoing basis and assess the effect of any changes on the funds that it manages.

- Next, the adviser should assess whether the changes would be material to investors and whether the applicable funds’ disclosure is adequate.

- Finally, the adviser, if it has determined that disclosure changes are necessary, should update its communications to investors as needed, which may include the prospectus, shareholder reports (including letters from management), marketing materials, web disclosures, or some combination of the foregoing.

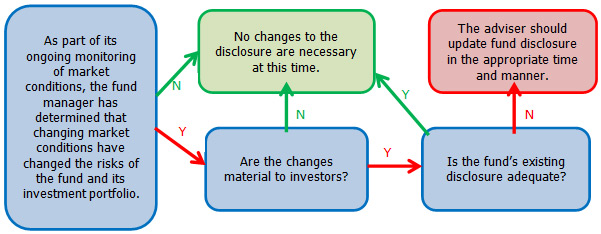

The following diagram summarizes the analysis that the SEC staff suggests fund managers employ:

The staff also indicated in the Guidance that it believes many fund advisers report to fund boards about an adviser’s process for preparing fund disclosure and that advisers should consider providing information to the board on the steps they take to evaluate risk disclosure. In addition, the Guidance states that the staff believes monitoring market conditions for their effect on the fund is a part of “prudent portfolio management” on the part of the adviser and that the staff expects fund managers to “routinely engage” in monitoring market conditions as part of their day-to-day operations.

Shortly after the Guidance was published, David Grim, the director of the Division of Investment Management, referenced the Guidance during his remarks at the Investment Company Institute’s annual mutual funds and investment management conference. In particular, he emphasized the importance of routinely monitoring market conditions and providing robust disclosures to investors during changing market conditions.[2]

Market Examples

The Guidance also discusses examples where the staff has observed the principle of updating guidance to reflect changing market conditions. Two examples where the staff said it has seen disclosure updated on account of changing market conditions are (i) disclosures by fixed-income funds regarding interest rate risk, liquidity risk, and duration risk during the current period of rising interest rates after the end of quantitative easing and (ii) disclosures by funds with investments in debt securities issued by the Commonwealth of Puerto Rico and its agencies and instrumentalities in light of recent failures to make scheduled payments to bondholders. In these instances, the staff identified the use of prospectuses, shareholder reports, and fund websites as means of delivering timely disclosure about these market conditions.

With respect to fixed-income investments, the staff indicated that it has seen changes in disclosure regarding interest rate risk (e.g., that a rise in interest rates may result in a decline in the value of fixed-income investments held by funds), liquidity risk (e.g., market volatility, the effect of increased redemptions, and reductions in dealer inventory), and duration risk (e.g., that longer-term securities may be more sensitive to interest-rate changes). The staff similarly indicated that it has seen increased disclosure with respect to investments in Puerto Rico debt instruments. The staff suggested that any fund investing in Puerto Rico debt should consider whether disclosure regarding the issuer’s financial difficulties, budget deficits, and recent ratings downgrades are appropriate for the fund, depending on the nature and significance of the fund’s investments in such instruments.

Key Takeaways

In light of the Guidance, fund managers may want to consider reviewing their processes, generally, for considering both the adequacy of disclosure to investors and whether to make changes or enhancements to such disclosure. A number of factors could influence a fund’s assessment of its risk disclosure in light of changing marketing conditions, including how the fund’s investment strategy and current portfolio could be affected. For example, a fund with a small allocation to a particular industry, sector, or region may not need to enhance its disclosure as would a fund with a much larger allocation if there are events that affect that particular industry, sector, or region.

Fund managers should also carefully consider the consistency of risk disclosure across a large fund complex, particularly where different fund or share classes are offered through different distribution channels or may have different fiscal years (resulting in gaps between annual updates to their registration statements). All of these considerations should also take into account available resources at the fund manager.

Although the Guidance is neither binding nor approved or issued by the Securities and Exchange Commission, it provides funds with a window into the current thinking of the staff within the SEC’s Division of Investment Management. Given the staff’s particular focus on the fixed-income markets and with respect to investments in Puerto Rico debt, funds that invest in those instruments should apply a heightened level of consideration to the comments set forth in the Guidance. Interestingly, the staff seems to use the Guidance as a means of endorsing certain market practices that it views as positive. However, with respect to fixed-income investments, it is likely that some of the changes in market disclosure practices are at least partially in response to the staff’s prior guidance from 2014,[3] particularly considering that the staff frequently references that guidance when providing comments on registration statements.

[1] See IM Guidance Update 2016-02 (Mar. 2016).

[2] See David W. Grim, Dir. of Inv. Mgmt., Remarks to the Investment Company Institute’s 2016 Mutual Funds and Investment Management Conference, Orlando, Florida (Mar. 14, 2016).

/>i

/>i