In a recent decision, a divided PTAB panel has ruled that a patent by Trading Technologies is directed to an ineligible abstract idea. While a post-Alice patent ineligible ruling is not itself unusual, the case, IBG v. Trading Technologies,[1] is noteworthy because it involves a member of the same patent family, and indeed nearly identical claim language, as a Trading Technologies patent that the Federal Circuit previously held was not directed to an abstract idea.

Key Takeaway: Despite nearly identical claim language, the IBG majority panel reached a conclusion as to patent eligibility opposite to that of the Federal Circuit in a prior case involving the same patent family — thus demonstrating how unpredictable the issue can be and raising more questions about making abstract idea determinations.

Background: Petitioner IBG filed a CBM petition challenging U.S. Patent No. 7,813,996, which relates to a graphical user interface for electronic trading of commodities. The Board instituted trial on grounds that the challenged claims are unpatentable under section 101.

After trial was instituted in IBG, the Federal Circuit issued a non-precedential opinion in Trading Technologies v. CQG,[2] a case involving two patents from the same family as the ’996 patent. In CQG, the Federal Circuit affirmed a lower court ruling that those related patents, U.S. Patent Nos. 6,766,304 and 6,772,132, recite patent-eligible subject matter. Both patents share a common specification with the ’996 patent, which are related via continuation and divisional filings (and, as discussed below, claim 1 of the ’304 patent is nearly identical to claim 1 of the ’996 patent).

Addressing Alice Step 1, the Federal Circuit in CQG agreed that the ’304 and ’132 patents did not merely claim the function of displaying information on a graphical user interface (GUI), but rather the claims require a specifically-structured GUI paired with prescribed functionality directed to a specifically identified problem in the prior art. As explained by the court, the GUI system claimed by the two patents is not an idea that has long existed — a threshold criterion for an ineligible abstract idea. Thus, the court concluded that the patents are not directed to an abstract idea. Turning to Alice Step 2, the Federal Circuit also agreed that the claims recite the inventive concept of a static price index that allows traders to more efficiently and accurately place trades electronically, thus satisfying the eligibility criteria of this step in the analysis.

IBG Majority: ’996 Patent Claims Ineligible Abstract Idea

Two judges, forming the PTAB panel majority, agreed in the Board’s final written decision that the ’996 patent claims are not patent-eligible under section 101. In applying the now-familiar two-step Alice framework, the Board considered (1) whether the claims of the ’996 patent are directed to an abstract idea, and (2) whether the claims recite additional elements constituting an inventive concept. With respect to Step 1, Petitioner argued that the claims are directed to the “fundamental economic practice of trading based on displayed market information and user input.” The PTAB panel majority agreed, explaining that the focus of claim 1 is placing trade orders based on displayed market information as well as updating the market information. According to the panel majority, the claims do not recite any limitations specifying how the computer should implement the GUI functionality. In particular, the majority pointed out that claim 1 fails to specify how the computer should map bid quantities, ask quantities and price axis to the display; that the specification states mapping of such information to a screen grid can be done by any known technique; and that patent owner argued that the invention is “agnostic” as to any specific algorithm used for processing or mapping the data. Further, pointing to statements in the specification and in other portions of the evidence regarding trading practices and electronic trading systems, the majority concluded that placing orders based on displayed market information, as well as updating the market information, is a fundamental economic and conventional business practice.

To support its conclusion, the panel majority compared the ’996 patent claims to those in Affinity Labs[3] and Ameranth,[4] two cases in which the Federal Circuit found the claims not directed to an improvement in computer operation. Both cases involved claims reciting GUI functionality, and in each case, as the majority explained, the court concluded that the claims were not directed to a particular way of programming or designing the software but rather merely claimed the resulting GUI system. Similarly, according to the majority, the claims of the ’996 patent recite the resulting GUI and do not claim a specific improvement in the way the computers operate.

The majority also compared the claims of the ’996 patent to those in three cases where the Federal Circuit concluded that the claims were not directed to an abstract idea, DDR Holdings,[5] Enfish[6] and McRO.[7] As the majority explained, the claims in DDR Holdings were rooted in computer technology and directed to overcoming a problem — retaining web site visitors — particular to the Internet; in Enfish, the claims were directed to improvements in data storage and retrieval; and in McRO, the claims were directed to a specific improvement in computer animation. In contrast, according to the majority, here the claims are not directed to an improvement in computer functionality but rather the use of a GUI in placing electronic trading orders based on displayed market information, and merely organize market information.

As for the CQG decision, the PTAB panel majority determined that it did not need to follow the Federal Circuit’s lead in CQG because that decision was not designated as a precedential opinion, and the record developed in the present case was different from the record in CQG. In particular, the majority noted that the issue of patent eligibility turned on construction of the claims and evidence in the present proceeding, including evidence of what was routine and conventional that differed from evidence in CQG.

Having concluded that the claims of the ’996 patent are directed to an abstract idea, the Board turned to Alice Step 2, describing this step as one that examines the claims individually and as an ordered combination to determine whether additional elements transform the nature of the claim into a patent-eligible application; but noting that the additional elements must be more than well-understood, routine, conventional activity. According to the Board, the ’996 patent discloses that the system can be implemented on any existing or future terminal or device, which are known to include displays, and can use a mouse as an input device, also a known device. Further, according to the Board, the mere recitation of a generic GUI does nothing more than limit the abstract idea to a particular technical environment, which does not make the claims patent-eligible, and elements relating to displaying bid and ask indicators essentially involve plotting market information along a price axis, a well-understood, routine, conventional activity. Similarly, the Board discussed that elements relating to displaying an order entry region for receiving commands to submit trade orders, set order parameters and send orders to an electronic exchange in a single action involves known technology. In sum, the Board concluded that the ’996 patent claims simply recite use of a generic GUI with routine and conventional functions, thus failing to transform the claims into patent-eligible subject matter.

IBG Dissent: ’996 Patent Not Directed to Abstract Idea

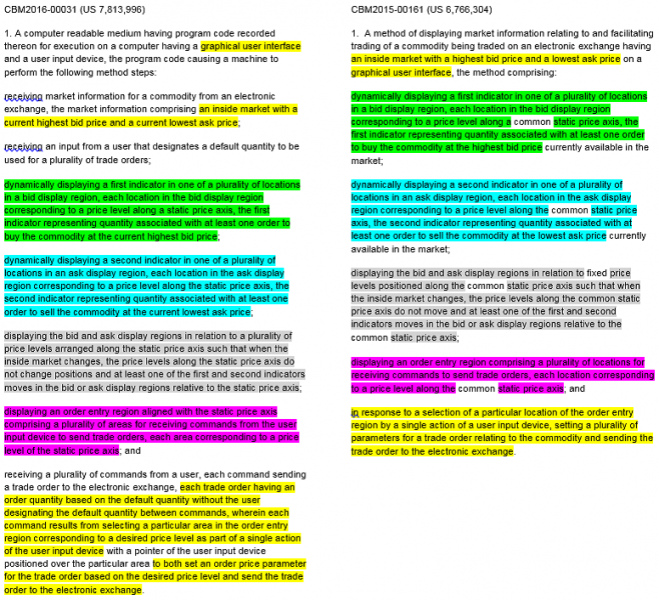

In dissent, Judge Plenzler focused on the Alice Step 1 question of whether the claims are directed to an abstract idea, and — in disagreement with the majority — concluded that they are not. The dissent focused on the Federal Circuit’s conclusion in CQG that similar claims in related patents were not directed to an abstract idea. In particular, the dissent explained that claim 1 of the ’996 patent in the present proceeding is nearly identical to claim 1 of the ’304 patent from CQG, and provided a color-annotated comparison of these claims to make the point:

Panel Split Raises Questions as to Abstract Idea Determinations

As mentioned above, this case is noteworthy because the Board concluded that the ’996 patent claims are directed to an abstract idea, a result that appears contrary to the Federal Circuit’s ruling on related patents in CQG. Despite nearly identical claim language in these two cases, the IBG panel majority concluded that the ’996 patent claims are directed to the abstract idea of trading based on displayed market information and user input, whereas the Federal Circuit in CQG determined that the ’304 and ’132 patent claims are not directed to an abstract idea at all. The split in the administrative panel opinions and divergence from the Federal Circuit’s view of related patents shows how unpredictable the issue can be and raises questions regarding how practitioners should apply Step 1 of the Alice test.

The analysis in the IBG majority opinion, containing minimal discussion of CQG, may further contribute to the unpredictability of abstract idea determinations under Alice Step 1. While the designation of CQG as a non-precedential opinion provided some additional leeway for the Board in IBG to take a fresh look at the abstract idea issue, the panel majority’s explanation as to why a different conclusion was warranted leaves some questions unanswered. For example, the IBG panel majority stated that its determination is based on facts and evidence in the present CBM proceeding, and mentioned that the petitioner explained differences in the record as compared with the record in CQG. But aside from a conclusory statement that petitioner submitted different evidence as to what was routine and conventional, the majority did not identify what those differences are, or explain how any such differences in the record impacted the analysis or led to a different conclusion as compared to the abstract idea determination in CQG. Also, the panel majority noted that the petitioner’s challenge in IBG was based on a construction of the claims as well as evidence submitted in the instant proceeding, but did not mention what, if any, any differences in claim construction between the two cases may have led to the Board’s contrary conclusion here.[8] And while the majority commented on the lack of technical detail in the claims as to how the system should map the market data to the display, the majority did not address the fact that claim 1 of the ’304 patent contains a similar level of detail. Indeed, the majority’s lack of explanation as to these items is striking in view of the dissent’s side-by-side comparison of claim 1 in ’996 patent to claim 1 of the ’304 patent.

Given the patent owner’s success in defending patent eligibility in CQG along with the divergence of opinions in CQG and IBG, the IBG case bears watching as to the potential for rehearing or appeal.

[1] IBG LLC v. Trading Techs. Int’l, Inc., CBM2016-00031, Paper 47 (PTAB Aug. 7, 2017).

[2] Trading Techs. Int’l, Inc. v. CQG, Inc., 675 F. App’x 1001 (Fed. Cir. Jan. 18, 2017).

[3] Affinity Labs of Texas v. DirectTV, LLC, 838 F.3d 1253, (Fed. Cir. 2016).

[4] Apple, Inc. v. Ameranth, Inc., 842 F.3d 1229 (Fed. Cir. 2016).

[5] DDR Holdings, LLC v. Hotels.com, L.P., 773 F.3d 1245 (Fed. Cir. 2014).

[6] Enfish, LLC v. Microsoft Corp., 822 F.3d 1327 (Fed. Cir. 2016).

[7] McRO, Inc. v. Bandai Namco Games America Inc., 837 F.3d. 1299 (Fed. Cir. 2016).

[8] As to claim construction, the Board determined that no particular term requires explicit construction and applied ordinary and customary meaning in view of the specification.

/>i

/>i