Certain micro-captive transactions are back to being reportable. On January 14, 2025, the Treasury Department and the Internal Revenue Service (“IRS”) published final regulations (the “Regulations”) that named some micro-captive insurance transactions as listed transactions and others as transactions of interest. See Internal Revenue Service, Treasury. “Micro-Captive Listed Transactions and Micro-Captive Transactions of Interest. 90 Fed. Reg. 3534 (Jan. 14, 2025). These formal rules replace the reporting regime that developed first under IRS Notice 2016-66, which was voided for failure to comply with the Administrative Procedure Act.

A “Captive” elects 831(b) treatment and is at least 20% owned by an Insured-related party

The Regulations apply only to certain companies defined as “Captives.” A “Captive” is an entity that elects to be taxed under Section 831(b) of the Internal Revenue Code, issues or reinsures a contract that any party treats as insurance when filing federal taxes, and is at least 20 percent owned by an “Insured”, an “Owner” of an Insured, or a person related to an Insured or an Owner. The Regulations further define an “Insured” as any person who enters a contract with a Captive and treats amounts paid under the contract as insurance premiums for federal income tax purposes. An “Owner” is someone with a direct or indirect ownership interest in an Insured or its assets.

Reportability depends on loss ratio and related-party financing

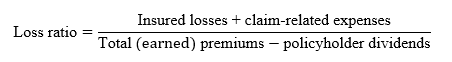

The Regulations define the micro-captive listed transaction and the micro-captive transaction of interest based on two core ideas: loss ratio and related-party financing. The regulations calculate the loss ratio as:

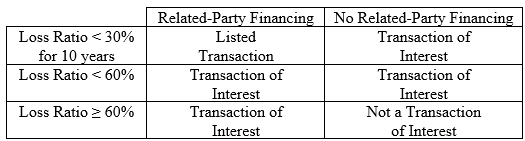

The loss ratio is measured over a period of years, not just a single taxable year. For a transaction of interest, the loss ratio is measured over ten years or the life of the Captive, whichever is shorter. If the loss ratio is less than 60 percent over those years, then the Captive is a transaction of interest. For a listed transaction, the time period is the most recent ten years. So, a Captive must be at least ten years old to become a listed transaction. If the loss ratio over the most recent ten years is less than 30 percent, then the Captive may be a listed transaction.

The Regulations’ other focus is related-party financing. Related-party financing occurs when the Captive makes funds available to an Insured, an Owner, or some other related party through a non-taxable arrangement (e.g., a loan) and the amount made available is greater than the Captive’s cumulative after-tax earnings on investments. A Captive that has engaged in a related party financing in the last five years with an outstanding balance in effect at any point during an open tax year is a transaction of interest. If that Captive also has a loss ratio less than 30 percent over the most recent ten years, then the Captive is a listed transaction.

This interaction can be summarized in a convenient tabular format:

A transaction of interest is one where the IRS requires additional information to consider whether tax avoidance is present. A listed transaction is one where the IRS believes tax avoidance is present. Listed transactions are treated more consequentially than transactions of interest. Therefore, a Captive that meets both categories must file as a listed transaction.

“Seller’s Captives” and some employee-benefits captives are excluded

The Regulations offer two exceptions, both of which are excluded from the definition of a transaction of interest or listed transaction. First, Captives for which the U.S. Department of Labor has issued a Prohibited Transaction exception and that provide insurance for employee compensation or benefits are excluded.

Second, “Seller’s Captives” are also excluded. A “Seller” is an entity that sells products or services to customers and also sells those customers insurance contracts connected to the goods or services. A “Seller’s Captive” is a Captive related to a Seller, a Seller’s owner, or parties related to a Seller or owners of Sellers. To qualify for the exception, the Seller’s Captive’s only business must be to issue or reinsure insurance contracts in connection with the sales made by the Seller or its related persons, and at least 95 percent of the Seller’s Captive’s business in a year must be in connection to contracts purchased by customers unrelated to the Seller. If those conditions are met, then the Seller’s Captive has not engaged in a listed transaction or a transaction of interest.

Reporting requirements for participants in the transaction

The Regulations place reporting requirements on parties involved in any transaction covered by the Regulations (a “reportable transaction”). These reporting requirements apply to participants in the transaction and to “material advisors” to the transaction, both for the current year and for all years where the statute of limitations for assessing tax has not yet expired. The Regulations do not by themselves require the filing of amended tax returns. [NTD: This question of amended returns came up at WCF and with RMA.]

Captives, Owners, Insureds, and any other parties to a reportable transaction must file Form 8886, Reportable Transaction Disclosure Statement, with the IRS Office of Tax Shelter Analysis (“OTSA”). The filing must describe the transaction in sufficient detail, including the party’s involvement in the transaction and how the party learned about the transaction.

Captives and Insureds have additional reporting burdens. For every year that a Captive participated in a reportable transaction, it must also disclose the types of policies it provided, how much it received in premiums, how much it paid in claims, the contact information of those who helped determine premiums, and the names and ownership interest of anyone who meets a 20% ownership threshold in the Captive. An Insured must describe how much it paid in premiums for coverage by a Captive.

Participants have 90 days from the date the regulations were published, January 14, 2025, to file their initial reports. The initial filing should include all applicable open tax years and must be sent to OTSA. A copy of the initial filing, and all subsequent filings, should be included with the applicable tax return.

There are two ways that a taxpayer can avoid filing under the Regulations. If a taxpayer has finalized a settlement with the IRS regarding a reportable transaction that was in examination or litigation, that taxpayer is treated as having made a disclosure for the years covered by the settlement. A taxpayer engaged in a transaction of interest who has been diligent in filing under the now-defunct Notice 2016-66 regime has a reduced filing burden. The taxpayer’s previous transaction of interest filings count under the Regulations, so the taxpayer does not have to refile for those past years.

There are also two “safe harbor” provisions which allow a taxpayer to not file a Form 8886. The first relates specifically to Owners who only participate in reportable transactions due to their ownership interests. In that case, the Owner does not have to file if the Insured complies with its own filing obligation, acknowledges the obligation in writing to the Owner, and identifies the Owner on its own Form 8886 as the recipient of the acknowledgement. The other safe harbor arises when a Captive revokes its Section 831(b) election. If a Captive revokes its election, then the transaction ceases to be a reportable transaction for any years that the revocation is effective and none of the participating taxpayers will have been party to a reportable transaction. To facilitate revocations, the IRS also released Revenue Procedure 2025-13 (Rev. Proc. 2025-13), which provides a streamlined procedure to revoke a taxpayer’s Section 831(b) election.

Reporting requirements for material advisors to the transaction

Material advisors to reportable transactions must also file with the IRS. A “material advisor” is a person who makes a tax statement to a party that needs or will need to disclose the transaction and the advisor derives gross income from it that surpasses a threshold. The advisor’s gross income can be based on almost anything the advisor does related to the transaction. The threshold for income on a listed transaction is $10,000 when most of the transaction’s benefits go to natural persons and $25,000 in other cases. For a transaction of interest, the threshold is higher, at $50,000 when the transaction mostly benefits natural persons and $250,000 otherwise.

Material advisors must file Form 8918, Material Advisor Disclosure Statement, with OTSA. Form 8918 must be filed with OTSA by the last day of the month following the end of the calendar quarter when one becomes a material advisor. In this case, that means by April 30, 2025.

Under these Regulations, material advisors are required to report for tax statements up to six years before the date of publication, or January 14, 2019. Additionally, there is no exception in the Regulations for material advisors who filed previously.

Differences between the proposed and final regulations

While the IRS continues to look unfavorably upon micro-captives, there are some positive signs in the Regulations. In particular, the IRS received comments from the regulated community, considered those comments, and adjusted its final position based on those comments.

The result is that the final regulations are less burdensome than the proposed regulations. The proposed regulations would have treated any related-party financing as a listed transaction. They also would have treated any Captive with a loss ratio of less than 65 percent over 10 years as a listed transaction. Finally, they would have treated a Captive with a loss ratio of less than 65 percent over the preceding nine years or the Captive’s lifetime, whichever was shorter, as engaging in a transaction of interest. The final regulations dramatically reduced the loss ratio needed to escape being considered a listed transaction, required a listed transaction to meet both the funding and loss ratio criteria, and slightly lowered the threshold to escape transaction of interest status.

Seek guidance for comprehensive compliance

The Regulations were issued with a lengthy background discussion and include many definitions and references to other laws. This article highlights the key provisions of the Regulations. Taxpayers that may be subject to the Regulations should consult (consider consulting?) professional advisors for detailed review and guidance on potential reporting requirements.

/>i

/>i