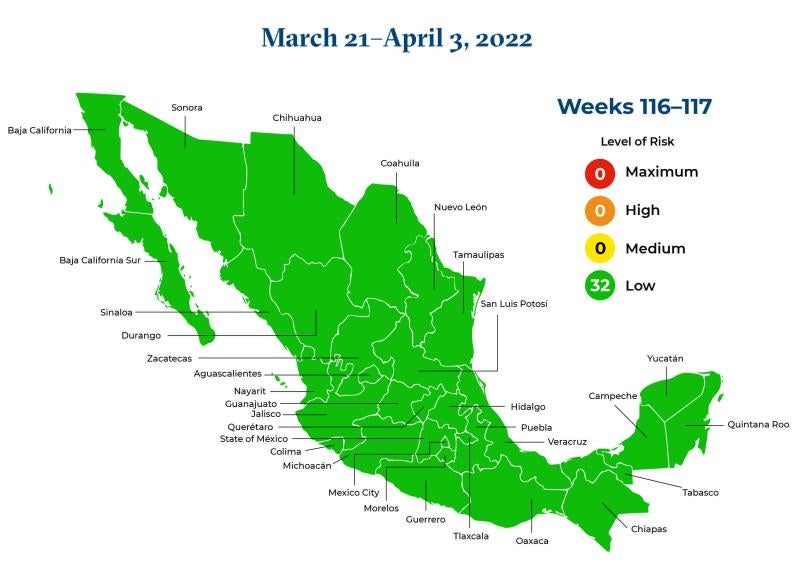

For the first time since Mexico’s federal government rolled out its pandemic monitoring system in June 2020, all of the nation’s thirty-two states have been given the green light to conduct social and business activities without restriction, although face masks are still required while using public transportation.

The biweekly four-tiered monitoring system is used to alert residents to the epidemiological risks of COVID-19 and provide guidance on restrictions on certain activities in each of the country’s states.

Each state may designate its own traffic light status, from green (all activities allowed) through red (only essential activities allowed). The vast majority of states have assigned statewide green status. Puebla, however, has designated five of its six regions in yellow status (medium risk), and Region 3, seat of the state’s capital, Puebla, in orange status (high risk). Veracruz has assigned the majority of its municipalities green light status, but it has assigned red light status to two coastal municipalities.

Below is a map for the period of March 21, 2022, through April 3, 2022, indicating the COVID-19 risk level in each of the states and the capital.

This chart presents the traffic light status of each state, and, as applicable, variations between federal and local traffic light statuses based on publications of the federal Ministry of Health and status reports provided by each state.

Other News: Profit-Sharing Payment Deadlines

Most for-profit Mexico-based companies that have been in business for at least one year are required on an annual basis to make profit-sharing distributions—currently, 10 percent of annual income—with their employees, under a legal regime called the National Commission on Employee Participation in Company Profits (Participación de los Trabajadores en las Utilidades de las Empresas [PTU]). The deadlines for 2022 for legal entities and individuals to distribute profit-sharing payments are quickly approaching and are as follows:

-

Legal entities (companies): May 30, 2022

-

Individuals (e.g., sole proprietors): June 29, 2022

Under an amendment made on April 23, 2021, to the Federal Labor Law, the profit-sharing amount is limited to one of the following, depending on which is more favorable to the employee:

-

ninety days of the employee’s salary; or

-

the average of the last three years of PTU payments received by the employee.

According to guidance released by the Ministry of Labor and Social Welfare, seniority is not factored into calculating an employee’s profit share. Benefits and bonuses are also not factored into an employee’s profit share.

/>i

/>i