Securities Class Action Filings—2021 Midyear Assessment

Executive Summary

Overall filing activity dropped considerably in the first half of 2021, falling to 112 filings from 150 filings in the second half of 2020. This decline was largely driven by a substantial reduction in the number of M&A class actions and federal and state 1933 Act filings, although core filings with Section 10(b) allegations were also down modestly.

Filings in the first half of 2021 were generally smaller, resulting in lower MDL and DDL indices. DDL fell 50% from $162 billion in 2020 H2 to $80 billion in 2021 H1. Similarly, MDL fell 64% from $991 billion in 2020 H2 to $361 billion in 2021 H1.

Special purpose acquisition company (SPAC) IPOs have continued to explode. Filings against SPAC-related entities increased sharply in the first half of 2021. There were also 10 filings related to COVID-19, largely concentrated in the first four months of the year.

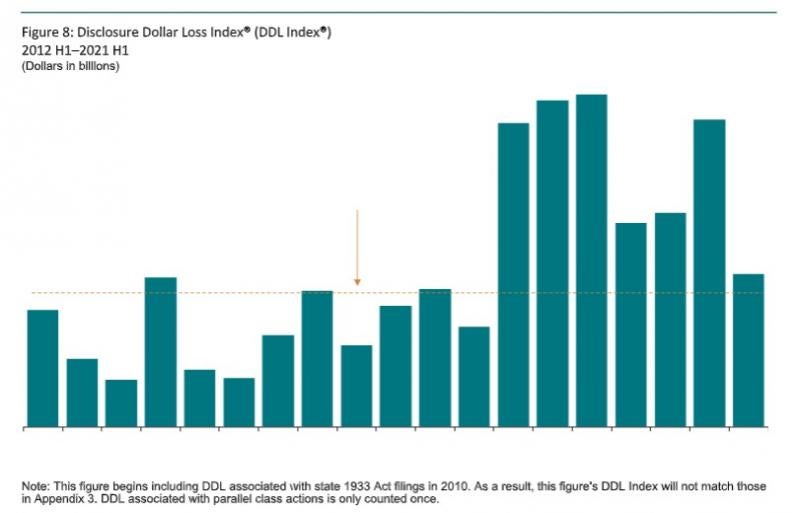

Disclosure Dollar Loss Index® (DDL Index®)

This index measures the aggregate annual DDL for all federal and state filings. DDL is the dollar value change in the defendant firm’s market capitalization between the trading day immediately preceding the end of the class period and the trading day immediately following the end of the class period. See the Glossary for additional discussion on market capitalization losses and DDL.

After a sharp increase in 2020 H2, the DDL Index declined to its lowest semiannual level since 2017 H2, down 54% from its high in 2019 H1.

-

The DDL Index fell to $80 billion in 2021 H1, down 50% from 2020 H2 and 54% below its all-time high in 2019 H1. This represents the lowest total for a semiannual period since 2017 H2, but remains above the 1997–2020 semiannual average.

-

The number of core filings in 2021 H1 was only slightly down from 2020 H2, suggesting that the decline in the DDL was primarily due to a decrease in average DDL per filing.

-

The sectors with the highest share of state and federal DDL in 2021 H1 were Consumer Cyclical (32%), Consumer Non-Cyclical (23%), and Communications (17%). See Appendix 3 for federal DDL Index information.

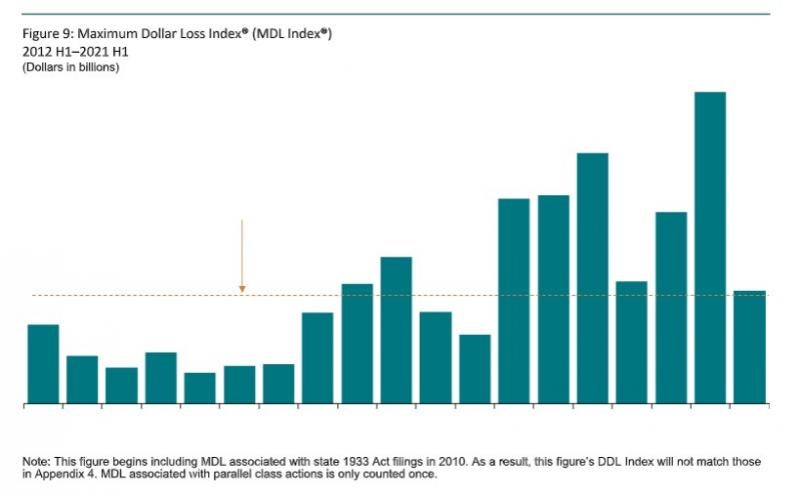

Maximum Dollar Loss Index® (MDL Index®)

This index measures the aggregate annual MDL for all federal and state filings. MDL is the dollar value change in the defendant firm’s market capitalization from the trading day with the highest market capitalization during the class period to the trading day immediately following the end of the class period. See the Glossary for additional discussion on market capitalization losses and MDL.

-

The MDL Index was $361 billion in the first half of 2021. Relative to the second half of 2020—which, at $991 billion, was the second highest on record—the MDL Index decreased nearly 64%. This represents the single largest semiannual drop since the 70% decline in 2003 H1.

See Appendix 1 for MDL totals and averages from 1997 H1 to 2021 H1.

-

The largest contributor to the MDL Index was the Energy sector, which comprised 44% of total MDL. Three Oil and Gas filings alone amounted to 38% of total MDL.

-

The MDL Index in 2021 H1 was in line with the 1997–2020 semiannual average.

The MDL Index dropped sharply in the first half of the year, down nearly 64% from 2020 H2.

/>i

/>i