The Federal Reserve’s “easy money” programs set in place to mitigate the effects of the Great Recession and the related credit crisis have alleviated the liquidity concerns of many financial institutions, but not without certain consequences. One such consequence is the compression of net interest margins, and thus net interest income, of community banks. Beginning in December 2008, the Federal Reserve, through the Federal Open Market Committee, set a goal of 25 basis points (bps) for the federal funds rate, a historic low. Low interest rates and lackluster loan demand have squeezed the net interest margin of community banks, leaving little opportunity for earnings growth at a time when banks are expected, and will soon be required, to have increasing amounts of capital. While the Federal Reserve has stated that it intends to keep interest rates depressed until the unemployment rate is reduced to 6.5% or until inflation reaches 2.5%, it is expected that interest rates will again rise in the relative near term. This inevitable rise in interest rates is especially problematic for community banks which, in order to effectively contend in today’s competitive commercial lending market, must offer borrowers longer terms and fixed rates, increasing the banks’ sensitivity to interest rate risk and potentially subjecting the banks to regulatory scrutiny. Though the situation is far less than optimal, community banks have access to interest rate derivatives designed to mitigate or hedge interest rate risk while, in certain circumstances, being accretive to earnings.

Not only are community banks permitted by their regulators to manage interest rate risk through hedging instruments, in some cases such actions may be mandatory. In addition to the Interagency Guidelines Establishing Standards for Safety and Soundness, the regulators issued the Advisory on Interest Rate Risk Management in January 2010 to remind banks of the sound practices for managing interest rate risk in the current low interest rate environment. These practices must include policies and procedures, measurement and monitoring, risk-mitigating steps, internal controls and validation. Ultimately, the board of directors of each bank is responsible for establishing the risks undertaken by an institution, and the board should oversee the establishment, adoption, implementation and review of the institution’s interest rate risk policies, procedures and exposure. To that end, boards should assist in developing comprehensive policies and procedures that govern all aspects of their interest rate risk management process, including tolerances and controls for hedging strategies. Second, each board should develop systems commensurate with the size and complexity of the institution to measure, monitor and test (i.e., stress testing) the institution’s sensitivity to changes in interest rates and their effect on earnings and capital. In doing so, the board may rely on third-party models so long as it understands the underlying analytics, assumptions and methodologies and ensures that such systems are appropriate given the institution’s goals. Third, the board should implement hedging strategies to mitigate the institution’s sensitivity to changes in interest rates.

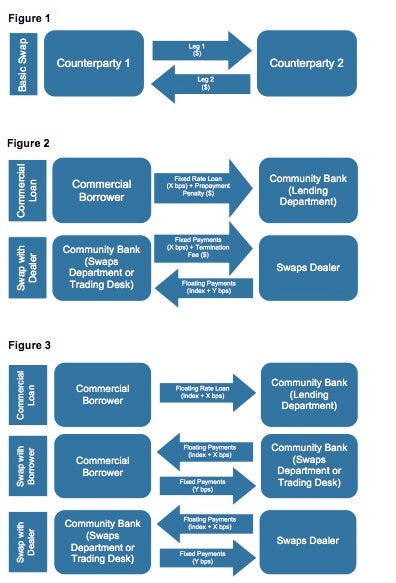

Commonly, community banks structure and balance the maturities of their assets and liabilities to avoid potentially harmful mismatches—a strategy which, the FDIC opines in an October 8, 2013 Financial Institution Letter (“FIL-46-2013”), has recently produced decidedly liability-sensitive positions. However, regulators also encourage community banks to reduce their interest rate risk by utilizing interest rate swaps. As discussed below in more detail, interest rate swaps may be used in different ways by community banks to boost loan demand without unnecessarily exposing the lending institution to greater interest rate risk.Given the upwardly trending interest rate environment and the FDIC’s renewed emphasis on interest rate risk management processes, community banks should familiarize themselves with how interest rate swaps function and how they may be utilized to reduce the bank’s interest rate exposure. In their most basic form, interest rate swaps are contractual arrangements between two parties (often referred to as “counterparties”) whereby the parties agree to exchange payments (each payment stream is a “leg” of the swap) based on a defined principal amount (the “notional amount” or “notional principal”) for a certain duration (“tenor”). See Figure 1. Certain interest rate swaps convert fixed interest rates to floating interest rates (or vice versa) based on an index (e.g., LIBOR). Indices that expire before the maturity of the swap will automatically reset. Fixed for floating (or vice versa) swaps allow counterparties to hedge against increases (and decreases) in interest rates. Because swaps have a present value of zero when executed, the counterparty paying the fixed leg is generally predicting, and thus hedging against, a rise in interest rates, while the counterparty paying the floating leg is generally predicting, and thus hedging against, a decrease in interest rates.In the lending context, community banks have two particularly appealing means of using interest rate swaps to hedge interest rate risk while attracting commercial borrowers. The first option is for the bank to make a commercial loan to a borrower at a fixed rate while swapping the fixed rate for a floating rate with a swaps dealer. See Figure 2.

To mitigate against any losses resulting from early termination of the loan, the bank should include prepayment language in the loan documents making the borrower responsible for the economic impact of a possible early termination of the swap. The main advantages of this option are that the bank may offer customers longer-term fixed-rate loans by passing on the risk of the fixed-rate loan to the swaps dealer without ever involving the borrower, while decreases in the value of the swap will be offset by increases in the value of the loan and vice versa.

As a second option, the community bank may make a commercial loan to a borrower at a floating rate while swapping the floating rate for a fixed rate with the borrower, and by entering into an offsetting or mirrored swap with a swaps dealer. See Figure 3. The interest rate swap and commercial loan with the borrower are separate contracts; however, the two contracts will be cross-defaulted and cross-collateralized, and the interest rate swap will have a notional amortization scheduleidentical to that of the commercial loan. The net effect on the borrower will be the payment of principal and a fixed rate of interest. The main advantages of this option are that the bank may avoid problematic accounting issues as the swaps identically offset one another, and they will be marked to market on a daily basis, and borrowers may benefit from rising interest rates, increasing the market value of their swap with the bank.

As shown above, community banks may provide alternative solutions to their commercial borrowers by utilizing interest rate swaps. Not only will this allow community banks to grow their balance sheets without incurring additional interest rate risk, these banks may also generate additional fee income. These benefits may be offset to some extent by the additional regulatory and accounting oversight to which interest rate swaps are subject. Currently under U.S. GAAP, interest rate swaps may be carried on bank balance sheets on a net basis only when the bank and its accounting advisors determine, pursuant to Accounting Standards Codification Section 815-10-45, that either (A) a master netting agreement is established with each of the community bank’s counterparties, or (B) the ISDA Master Agreement (1992 ISDA Master Agreement with set-off provisions included in the Schedule thereto or a 2002 ISDA Master Agreement) or other trading documentation with appropriate set-off language included satisfies the standards of Section 815-10-45 and is in place between the bank and each applicable counterparty.

While beyond the scope of this article, the enactment of the Wall Street Reform and Consumer Protection Act of 2010 (the “Dodd-Frank Act”) imposed a series of regulatory, compliance, reporting and “Know Your Customer” requirements and obligations on certain types of entities—most notably, Swaps Dealers and Major Swaps Participants. Further, in the absence of a specific exemption or exception, certain types of swaps (primarily credit default swaps and interest rate swaps) are now subject to mandatory clearing requirements. However, in both instances, it is possible, under certain circumstances, for a community bank to avoid being deemed a Swaps Dealer or Major Swaps Participant, and to rely on either the small-bank exemption ($10 billion or less in total capital) or the end-user exception to the clearing requirement (and with respect to swaps between the bank and its customer, it is possible that the customer will also be able to avail itself of the end-user exception). Accordingly, each community bank should carefully review with counsel the applicable provisions of the Dodd-Frank Act and its implementing regulations to ensure full compliance.

As noted previously, FIL-46-2013 reemphasizes the importance of prudent interest rate risk oversight and effective risk management processes. In particular, FIL-46-2013 cautions that: (i) boards should be aware of interest rate risk exposure during the entire business cycle and not just in advance of volatile periods; (ii) asset-liability and investment policies should be revised not less frequently than annually to ensure that proper risk tolerances, exposures and limits are in place; (iii) management should focus on a variety of modeling techniques, such as gap analyses, earnings simulations, economic value of equity estimations and stress tests; and (iv) institutions using derivative-based hedging, such as interest rate swaps, must either retain directors and senior managers who fully understand such instruments and their potential risks or implement an in-depth training program designed to bring these directors and employees to a satisfactory level of knowledge and understanding. A failure to do so may result in increased regulator scrutiny and criticism during on-site regulatory examinations.Community banks should determine how sensitive their balance sheets are to interest rate risk and consider using interest rate swap products to mitigate this risk as the market for long-term fixed-rate loans continues to grow. Rest assured that your larger competitor banks will offer these products. At a time of compressed net interest margins, muted loan demand and the so-called Basel III increases in minimum capital requirements taking effect on January 1, 2015 (for all but the largest institutions), through prudent strategic capital planning and cash-flow analyses, institutions should no longer shy away from hedging derivatives such as interest rate swaps. As interest rates continue their ascent, community banks should not be hampered by poorly designed loan product offerings. Rather, prudent risk management practices and hedging strategies can position community banks to compete effectively with larger financial institutions in the commercial lending context and to prosper in a post-low interest rate environment.

/>i

/>i