On April 9, 2020, the Federal Reserve took additional actions to provide up to $2.3 trillion in loans to support the economy. This blog focuses on the Main Street Lending Program, which is a $600 billion loan program, that will include $75 billion capitalized by the Treasury Department under the $454 billion Congressional appropriation of Section 4003(b)(4) of Title IV of the CARES Act. The loans will target mid-sized companies, defined as having less than 10,000 employees or $2.5 billion in 2019 annual revenue, and will be made by banks and other eligible lenders, with the government then purchasing 95% of the lenders’ interest in the loans.

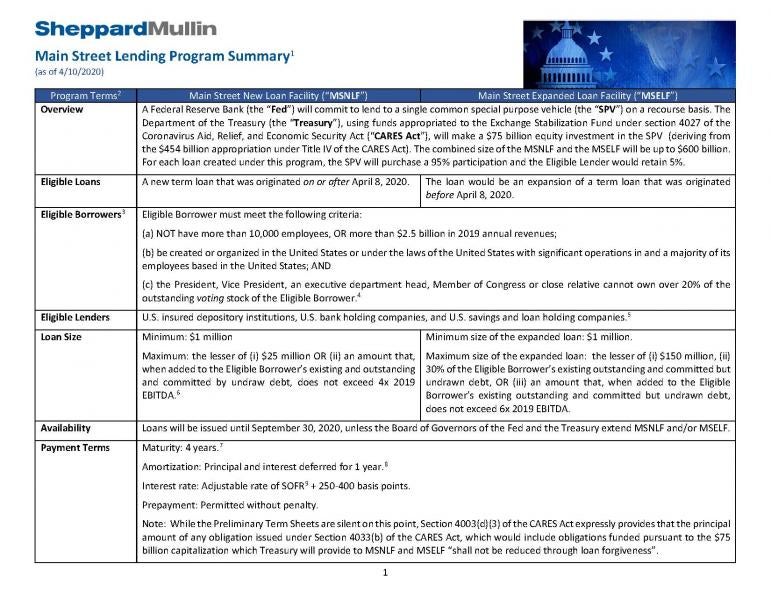

The summary we are releasing today highlights key aspects of, and compares differences between, the two types of loans that are available under the Main Street Lending Program. The Federal Reserve is seeking input on the Main Street Lending Program until April 16, 2020 from lenders, borrowers, and other stakeholders.

Click to view full PDF.

As you are aware, things are changing quickly and the aid measures and interpretations described here may change. The summary attached to this post represents our best understanding and interpretation based on where things currently stand as of April 10, 2020.

/>i

/>i