The Federal Reserve has established the “Main Street Lending Program” (MSLP) under The Coronavirus Aid, Relief, and Economic Security Act (CARES Act), that provides for up to $600 billion of new or expanded credit facilities to small and medium-sized businesses. MSLP loans are funded by a combination of “Eligible Lenders” and a Federal Reserve “special purpose vehicle” (SPV) lender in favor of “Eligible Borrowers”. The scope of qualified “Eligible Borrowers” is very broad. The Fed’s SPV will purchase a 95% participation in each loan made by an Eligible Lender to an Eligible Borrower, with the remainder of the loan retained by the Eligible Lender.

MSLP loans may be secured or unsecured (subject to certain lien priority requirements), and the program includes loans structured as either term loans or revolving credits. Within the MSLP, there are three different types of loan facilities: (1) term loans under the Main Street Priority Loan Facility (MSPLF), (2) term loans under the Main Street New Loan Facility (MSNLF), and (3) term loans and revolving credits under the Main Street Expanded Loan Facility (MSELF).

Following is a summary of certain key conditions and requirements that apply to each type of MSLP loan. Note that this summary does not describe all requirements of the MSLP program. We have included links to MSLP program documents at the end of this summary for further information. We would be pleased to assist you if you want further information or have any questions regarding the Main Street Lending Program.

Key Business Terms:

-

Term and Repayment - The loans will have a five-year maturity, be pre-payable without penalty, have deferred interest payments for one year, and deferred principal payments for two years. Unpaid interest that accrues during the first year will be capitalized, and such capitalized interest would become part of the principal of the loan and accrue additional interest. Annual principal amortization payments of 15%, 15%, and 70% are required at the end of each of years three through five of the term. MSLP loans may be prepaid without penalty.

-

Interest Rate - The applicable interest rate is LIBOR + 300 basis points.

-

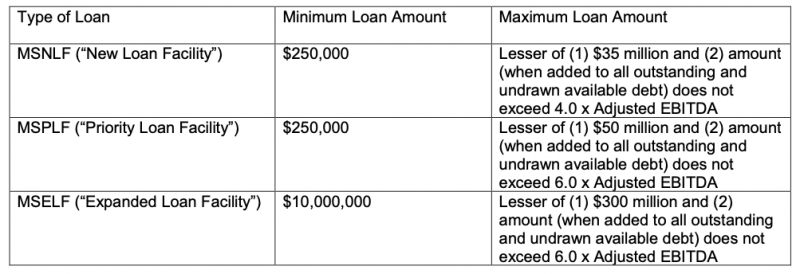

Loan Amounts:

Click here to view original table.

Fees:

-

Origination Fees - The borrower will pay the Eligible Lender an origination fee of up to 1.0% (0.75% for MSELF upsizes) of the principal amount of the loan.

-

Transaction Fees - The Eligible Lender will pay the SPV a transaction fee of 1.0% (0.75% for MSELF upsizes) of the principal amount of the SPV’s participation. This fee may be passed through to the borrower.

-

Servicing Fees - The SPV will pay the Eligible Lender an annual servicing fee equal to 0.25% of the SPV’s loan participation.

Key Requirements and Covenants:

-

Recourse - Unlike the Paycheck Protection Program (PPP) loans, MSLP loans are not forgivable and lenders may require personal guarantees.

-

Single Loan Limitation; Affiliation Restriction – A borrower (including its “affiliated group”) may not receive more than one of MSLP loan, however prior receipt of a PPP loan does not disqualify a borrower from receipt of an MSLP loan. Determination of an “affiliated group” is based on the small business administration’s (SBA) rules set forth in 13 CFR 121.301(f), but unlike the PPP loan program, the borrower does not need to qualify as a small business concern or an exception thereto.

-

Inability to Secure Adequate Credit - An Eligible Borrower must certify that it is otherwise unable to secure “adequate credit accommodations,” and this can be certified if “the amount, price, or terms of credit available from other sources are inadequate for the borrower’s needs during the current unusual and exigent circumstances.”

-

Restricted Payments – For so long as the MSLP loan is outstanding, and for a period of 12 months following repayment of the loan, borrowers must comply with the restrictions regarding executive compensation, stock repurchases and capital distribution restrictions that apply under Section 4003 of the CARES Act. During such period, a borrower is prohibited from making (1) repurchases of public stock (unless contractually required before adoption of the CARES Act), (2) dividends and capital distributions (excluding tax distributions by pass-through entities), and (3) compensation and severance payments above certain specified levels for individuals whose 2019 compensation exceeded $425,000.

-

Other Debt Prepayments – For so long as the MSLP loan is outstanding, the borrower is prohibited from prepaying other debt ahead of scheduled repayment dates.

-

Existing Committed Lines of Credit - An Eligible Lender must commit that it will not cancel or reduce any existing committed lines of credit outstanding to the Eligible Borrower, except in an event of default. The Eligible Borrower must also commit that it will not seek to cancel or reduce any of its committed lines of credit with the Eligible Lender or any other lender.

-

Payroll and Employees - Borrowers are obligated to make "reasonable efforts" to maintain payroll and retain employees while the loan is outstanding.

-

“Eligible Borrower” - Any U.S. business that existed before March 13, 2020, and that has either (1) 15,000 or fewer employees, or (2) $5 billion or less in 2019 annual revenues. The borrower must have positive 2019 EBITDA (including permitted add-backs), and cannot be an “ineligible business” as defined in SBA PPP guidelines. Certain other limited requirements apply. Simply meeting the standards of an Eligible Borrower does not ensure that a company will be approved for an MSLP loan. Each lender will apply its own underwriting standards.

-

“Eligible Lender” – Any U.S. federally insured depository institution (including a bank, savings association, or credit union), a U.S. branch or agency of a foreign bank, a U.S. bank holding company, a U.S. savings and loan holding company, a U.S. intermediate holding company of a foreign banking organization, or a U.S. subsidiary of any of the foregoing.

-

Timing - The Fed SPV will cease purchasing loan participations under the MSLP on September 30, 2020. It is possible such date may be extended by the Fed, but that is not assured.

Priority of Debt and Liens:

Main Street loans may be secured or unsecured, but certain priority rules apply in the event the borrower has other outstanding debt:

Priority Requirements for MSNLF (“New Loan Facility”) Loans – MSNLF loans may not be expressly “contractually subordinated” to the borrower’s other debt. The Fed guidance indicates this only requires that an MSNLF loan may not be junior in bankruptcy to the Eligible Borrower’s other unsecured loans or debt instruments.

Priority Requirements for MSPLF (“Priority Loan Facility”) and MSELF (“Expanded Loan Facility”) Loans – MSPLF and MSELF loans may be secured or unsecured, but in any event they must be senior to or pari passu with the Eligible Borrower’s other debt, and may not be subordinated to the Eligible Borrower’s other debt, except for outstanding mortgage debt.

-

Unsecured MSPLF and MSELF Loans: MSPLF and MSELF loans can be unsecured only if the Borrower does not have, at loan origination, other outstanding secured debt (other than outstanding mortgage debt). Also, the loan documentation for unsecured MSPLF and MSELF loans must: (1) ensure that the MSPLF and MSELF loans do notbecome contractually subordinated to any of the Borrower’s other debt; and (2) contain a lien covenant or negative pledge consistent with those used by the Eligible Lender in its ordinary course lending to similarly situated borrowers.

-

Secured MSPLF and MSELF Loans: MSPLF and MSELF loans must be secured if, at loan origination, the Borrower has any outstanding secured debt (other than outstanding mortgage debt). In such case the MSPLF or MSELF loan (1) may not be contractually subordinated to any of the Borrower’s other debt, and (2) must be secured by the same collateral as the Borrower’s other debt (other than mortgage debt) on a senior or pari passu basis with the other creditors (or with respect to MSPLF loans a specified "Collateral Coverage Ratio" may be used).

Continuing Mezzanine or Other Subordinate Debt – If an Eligible Borrower has existing mezzanine or other subordinate debt that it seeks to continue outstanding following an MSLP loan, various issues should be considered.

MSNLF Loans - Existing mezzanine debt likely could remain outstanding following incurrence of an MSNLF loan so long as the MSNLF loan is not expressly made contractually subordinate to the mezzanine debt.

MSPLF and MSELF Loans – Existing mezzanine debt cannot not be senior to (but may be pari passu with) MSPLF and MSELF loans. The parties would need to consider the terms of any existing continuing mezzanine debt documents to determine if they conform to this requirement. If such documents include terms that automatically continue subordination of the mezzanine debt to future financings or other future debt, then a new MSPLF or MSELF loan automatically may be prior to the continuing mezzanine debt. However mezzanine debt terms often include a limit on the amount and scope of permitted senior debt. Thus, it is possible that an agreement would need to be reached with the mezzanine debt holder to satisfy the requirement that MSPLF and MSELF loans must be senior or pari passu with the borrower’s other debt.

Other Requirements and Considerations:

-

Existing Debt Covenants – Even if all the MSLP eligibility criteria are satisfied, a potential MSLP borrower would need to ensure that the MSLP loan is permitted under the terms of any existing debt documents. Such documents typically include restrictions on additional debt and liens, and may include other restrictions that would not permit the new MSLP debt, so consent of the existing lender(s) may be necessary for the borrower to procure new MSLP debt. In many cases, the MSLP lender will already be an existing lender to the borrower, which would facilitate the consent process.

-

Existing Risk Rating - Any existing loan that the borrower had outstanding with the Eligible Lender as of December 31, 2019 must have had an internal risk rating (based on the Eligible Lender’s risk rating system) that was equivalent to a “pass” in the Federal Financial Institutions Examination Council’s (FFIEC) supervisory rating system as of that date.

-

Assessment of Financial Condition - Eligible Borrowers must have been in “sound financial condition” prior to the onset of the COVID-19 pandemic. Eligible Lenders must conduct an assessment of each potential borrower's financial condition to determine if is criteria is satisfied. The Fed rules provide no objective criteria for conducting such assessment.

-

Conflicts of Interest - Section 4019(c) of the CARES Act requires each Eligible Borrower and Eligible Lender to certify that it is not an entity in which a "Covered Individual" (i.e., the President, Vice President, head of an executive department, member of Congress, or certain immediate family members of such government officials) directly or indirectly holds a “controlling interest.”

MSLP Term Sheets and FAQs:

Following are links to loan Term Sheets, Frequently Asked Questions (FAQs), and other materials published by the Fed. These provide more detailed information about the terms of the various loan facilities established under the Main Street Lending Program:

MSLP - MSNLF (New Loan Facility Term Sheet) https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a1.pdf

MSLP - MSPLF (Priority Loan Facility Term Sheet) https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a2.pdf

MSLP - MSELF (Expanded Loan Facility Term Sheet) https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200608a3.pdf

Summary and FAQ https://www.federalreserve.gov/monetarypolicy/mainstreetlending.htm

https://www.bostonfed.org/-/media/Documents/special-lending-facilities/mslp/legal/frequently- asked-questions-faqs.pdf

Conclusion:

Potential borrowers will need to consider whether the MSLP loan requirements, including restrictions regarding distributions, compensation and employees, would be appropriate in their particular circumstances. However, with relatively low interest rates at a fixed spread plus generous deferral periods, MSLP loans may be a good solution for companies seeking credit in the current economic environment.

/>i

/>i