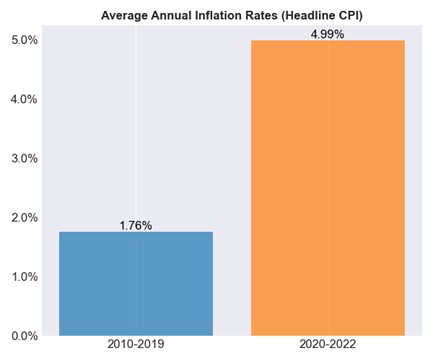

Old habits die hard. For the decade leading up to Covid, inflation averaged a very comfortable 1.5%-2.0%. Stable, low inflation meant no one could be blamed for letting “real,” inflation-adjusted thinking fall by the wayside. In 2023, however, clear differentiations between real and nominal trends probably need to stage a comeback.

Source: Bureau of Labor Statistics and Cadwalader, Wickersham & Taft LLP

Since inflation measures the overall level of prices, and by extension the purchasing power of a fixed sum of money, it matters to pretty much everything financial. At home the impact on inflation is fairly obvious in the grocery store bill or at the daycare, but that’s a relatively narrow view. Over the past three years, inflation has been a pervasive component of everything from corporate earnings, investment returns, asset price appreciation, to debt growth.

In fund finance, as in any other business in 2023, we would be well served to get more specific about how much of our business trends are explained by inflation. Failure to differentiate nominal (gross) trends from real (inflation adjusted) trends means we risk getting a false sense of growth or accomplishment from results that are simply attributable to dollars becoming worth less. It could also delay us in recognizing underperforming fundamentals when nominal numbers are marginally in the black.

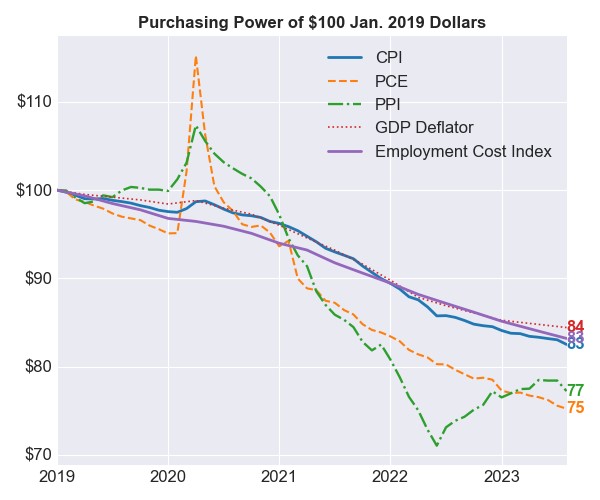

Source: Bureau of Labor Statistics and Cadwalader, Wickersham & Taft LLP

Inflation reporting does us a disservice, with the emphasis most often falling on the change in the rate of change — not exactly an intuitive framing. When inflation numbers “come down” month over month, it means that price levels are still increasing and purchasing power is still diminishing (as long as the inflation rate is positive). It may just not be happening as fast as it did the prior month. Going one step further, slowing inflation does not mean that the purchasing power of a fixed hourly wage job or the spending power of a retirement savings that were lost in prior months is in any way restored.

Thinking in real terms will help us make sense of things that are happening around us. Since 2020, the supply of money in the economy has increased by 43% while average hourly earnings grew by 30% over the same period. This means a significant share of the expansion in the monetary base wasn’t passed through to workers, which is, not surprisingly, creating tensions in certain places.

Paid experts expect the rate of inflation to moderate, and they’ll keep rolling the forecast forward until it proves correct. I’m not equipped to make a forecast, but I think we should prepare for more than one possible scenario. The Philly Fed survey shows a 2.5% consensus headline CPI forecast for 2024. Given events from the past week, it may be fair to question whether a 2.5% forecast adequately reflects the inflation upside probabilities given (1) the unwinding of globalization, which is progressively looking less and less gradual, (2) the wage imbalances highlighted above, (3) materially higher uncertainty in global energy supply, (4) the potential that the mountain of Federal debt and its short tenor could influence the Fed’s wherewithal to raise rates, (5) historical examples of geopolitical conflict driving inflation higher by rerouting supply chains, raising commodity demand, and amping-up deficit spending.

Bringing it back to fund finance, I’m simply making the case that bringing “nominal” and “real” back into the lexicon may help us better understand our market growth, our revenue outcomes, and perhaps can help refine forward expectations.

Chris van Heerden, Director | Fund Finance, authored this article.

/>i

/>i