The modern semiconductor industry was born in the 1950s in the United States, and the United States remained the indisputable industry leader for the first few decades of its development. But over the last few decades, the industry has increasingly globalized and in many areas, such as foundries, the United States has lost its preeminence. Factors such as the ubiquity of semiconductors in commercial and military products, the importance of robust semiconductor supply chains (evidenced by supply chain backlogs during the COVID-19 pandemic), the disproportionate benefits of being at the forefront of industry developments, the high paying jobs, and the significant implications for national defense, spurred the adoption of the CHIPS and Science Act in the summer of 2022. The legislation provides for US$52.7 billion in funding for R&D, manufacturing, and workforce development in the U.S.[1]

The Track Record

Based on historical data involving similar U.S. federal government initiatives, the CHIPS Act is likely to spur innovation in the semiconductor industry. This pattern has been observed before, such as with the LED revolution in the early 2000’s and the electric vehicle (EV) industry more recently.[2]

In 2007, the Energy Independence and Security Act (EISA) triggered development and mass adoption of LED lighting products, eventually replacing traditional lighting products such as the incandescent bulbs.[3] Similarly, the Fixing America’s Surface Transportation (FAST) Act of 2015 and the Inflation Reduction Act (IRA) of 2022 fueled growth in the EV industry space by providing financial incentives and US$92.3 billion of investments across clean energy technologies.[4],[5] Several large automobile businesses have leveraged these incentives to enhance their EV initiatives and commit to prioritizing EV sales by 2035, demonstrating once again the significance of government investments in these technologies.[6]

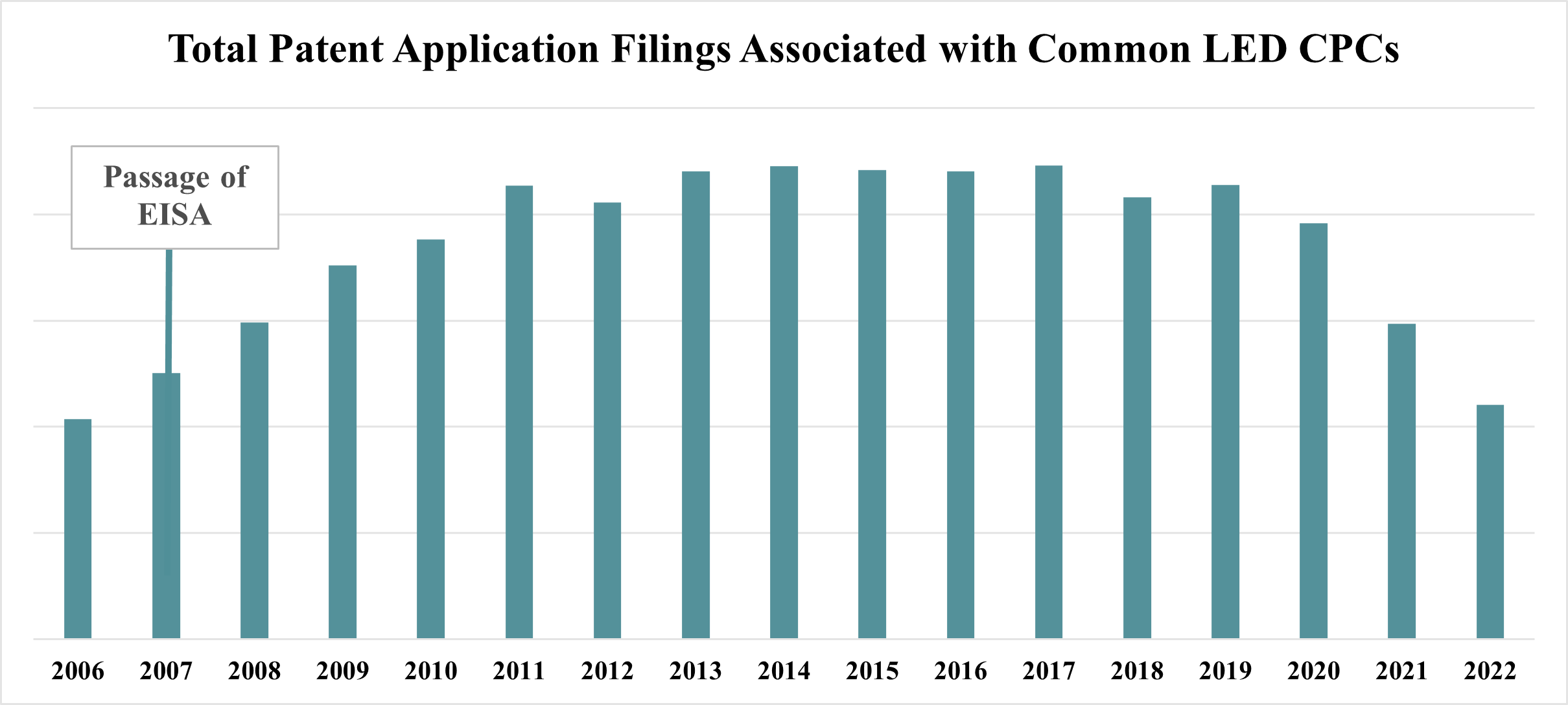

The following graphs illustrate the impact of these initiatives on patent filings.[7] The first graph represents the number of patent applications filed from 2006 to 2022 classified in U.S. Patent and Trademark Office (USPTO) classifications typically associated with LED patent applications (i.e., F21Y 2115/10, H05B 45/00, & F21K 9/00). As can be seen, after the passage of EISA in 2007, LED patent filings increased for about ten years indicating a decade of rapid innovation in this space.

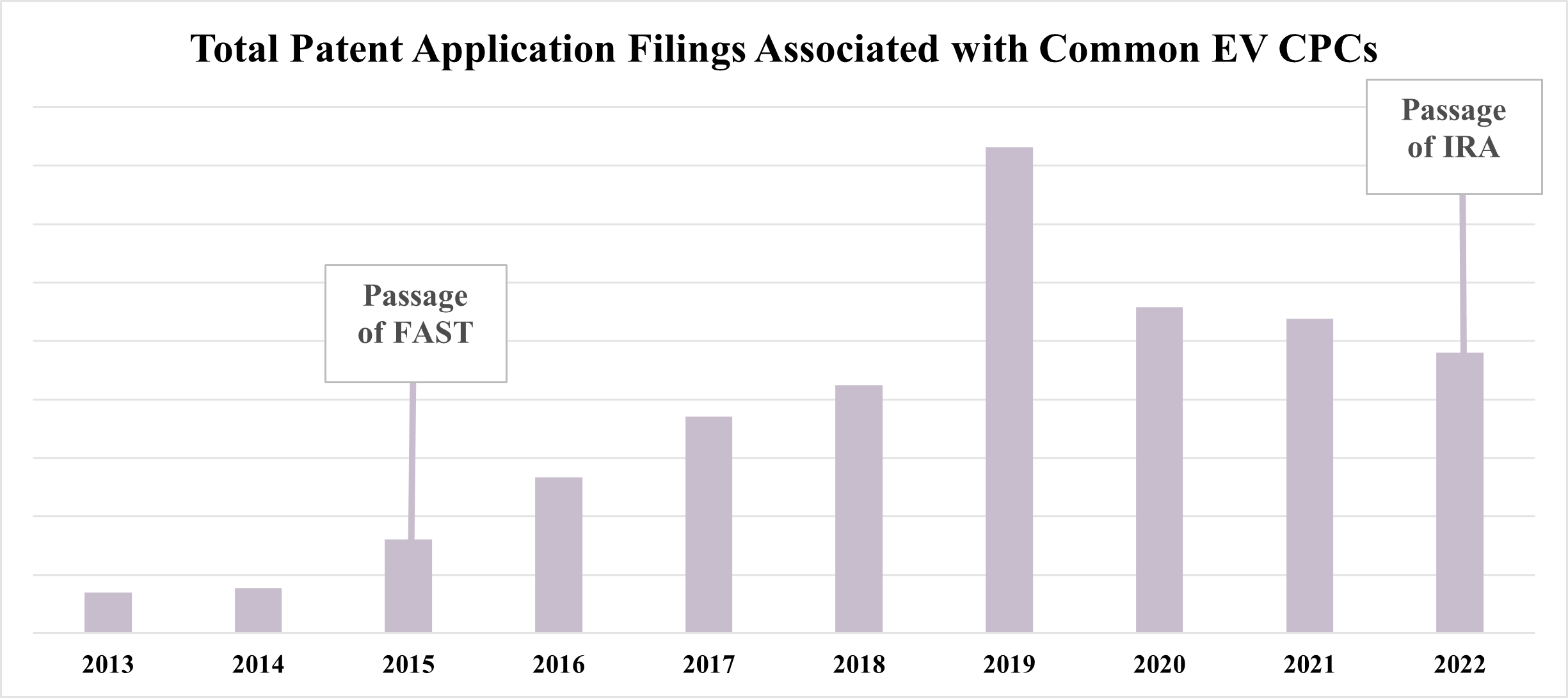

A similar trend is illustrated in the second graph after the passage of the FAST Act in 2015, displaying the number of patent applications filed from 2013-2022 in USPTO classifications typically associated with EV patent applications (B60L 15/00, B60Y 2200/91, & B60L 50/60).

Patents Paving The Way

Internationally, we can already see early signs of increases in the patent filings in the semiconductor space. In both 2022 and 2023, the most patents granted globally were for semiconductor technology.[8] Over the past decade, global patent filings for semiconductors have increased by more than 50%, with a 9% increase from 2021 to 2023, likely due in part to the CHIPS Act.[9]

To support the CHIPS Act and increase in patent filings, the USPTO created the Semiconductor Technology Pilot Program.[10] This Pilot Program prioritizes semiconductor patent applications by granting special status to eligible applications for expedited review, thus reducing typical lengthy examination wait times.[11] As of July 2024, over 175 applications have been filed, with more than 80 granted since the program launched in December 2023.[12]

If history is our guide, based on the impact of government actions on innovation in both the LED and EV revolutions, we can expect a similar wave of innovation in the semiconductor space over the next several years. Accordingly, companies innovating in the semiconductor space should consider taking advantage of the USPTO program to better position their patent portfolio development relative to their competitors.

Special thanks to Rachel Vierra, a summer associate in Foley’s Boston office, for her contributions to this article.

[1] “Fact Sheet: CHIPS and Science Act Will Lower Costs, Create Jobs, Strengthen Supply Chains, and Counter China.” The White House, 9 Aug. 2022

[2] “The Eve of the Electric Vehicle Revolution.” Foley & Lardner LLP, 12 Apr. 2022.

[3] “Lighting Choices to Save You Money.” Energy.gov.

[4] “Inflation Reduction Act Guidebook.” The White House.

[5] “How the Inflation Reduction Act Electric Vehicle Incentives Are Driving a U.S. Manufacturing Renaissance.” Center for American Progress, 22 Nov. 2023.

[6] “Advances in Technology Are Driving the Popularity of EVs.” Yale School of the Environment, 28 May 2023.

[7] Data sourced from the USPTO Patent Public Search Console.

[8] “Semiconductor Tech Received Most Granted Patents in 2023.” Semiconductor Digest, 26 Jan. 2024.

[9] “Semiconductor Patents Rise by 59% in Five Years to Reach Record High.” Patent Lawyer Magazine.

[10] “Semiconductor Technology Pilot Program.” United States Patent and Trademark Office.

[11] Id.

[12] Id.

/>i

/>i