The UK Financial Conduct Authority (“FCA”)[1] has in recent years intensified its efforts in securities and commodities markets to detect and pursue the type of disruptive trading behaviour called “spoofing.” This emphasis coincides with a similarly increasing focus by the US Commodity Futures Trading Commission (“CFTC”) and the US Department of Justice (“DOJ”) on spoofing cases in the US. Spoofing may take different forms, but usually involves the placing of non-bona fide orders, often of large quantity, on one side of the market while trying to execute a bona fide order on the other side of the market. Once the bona fide order has been executed, the trader cancels the non-bona fide orders quickly. To date, more than 40 enforcement actions targeting spoofing have been filed against individuals and companies by US regulators and more than 5 have been filed by UK regulators. In February 2019, Julia Hoggett, the FCA’s Director of Market Oversight, delivered a speech about the FCA’s commitment to tackling market abuse, calling compliance with such rules “critical to the integrity and health of our financial markets.”[2]

Although there is some variation in the characteristics of alleged wrongful conduct, depending on the regulator or the specific financial market, regulators have broadly focused on the following behaviour to determine if a trading pattern constitutes spoofing: (1) size of supposed non-bona fide orders; (2) order imbalance or size discrepancy between bona fide and supposed non-bona fide orders; (3) placing of multiple orders on the non-bona fide side at different price levels; (4) the length of time during which the supposed non-bona fide orders stay pending on the market, especially after the bona fide orders are executed; and (5) the ratio of cancelled orders relative to the total orders placed. Two early cases of enforcement of spoofing laws by UK authorities stand out and provide guidance in evaluating subsequent conduct: the FCA’s investigation of Michael Coscia,[3] and FCA v. Da Vinci Invest Limited.[4]

On 3 November 2015, Michael Coscia (“Coscia”), the owner of Panther Energy Trading (“Panther”), became the first person convicted of spoofing in the US. This conviction represented the first-ever criminal case to use the anti-manipulation authority provided in Section 747 of the Dodd-Frank Act to charge spoofing in the context of commodities transactions.[5] The DOJ’s indictment alleged that Coscia designed and relied on an algorithmic trading program that would purportedly first place a relatively small order on one side of the market, and then rapidly place a number of large orders on the opposite side of the market at prices that increasingly approached the price of Coscia’s initial small order.[6] The large orders were cancelled immediately upon execution of Coscia’s bona fide order. At trial, the government successfully demonstrated that Coscia designed his algorithm with the intent to spoof.[7] Coscia was convicted and sentenced to three years in prison.[8] His conviction came more than two years after the July 2013 announcement of several civil actions brought against Panther/Coscia by the CFTC, the Chicago Mercantile Exchange’s (“CME”), and the FCA. In particular, the FCA imposed a fine on Coscia for £597,993 in response to allegations of market abuse on Intercontinental Exchange (“ICE”) Futures Europe for the same conduct.[9]

In light of the factual patterns and evolution of the Panther/Coscia legal and regulatory actions, another early spoofing case in the UK warrants a close look by market participants and advisors. In 2015, the High Court of Justice in London imposed penalties and awarded injunctions against five defendants for alleged spoofing that had taken place in 2010 and 2011.[10] The defendants included companies and traders associated with Da Vinci Invest Limited.[11] In this instance, the traders did not trade directly in the company shares, but rather traded contracts for differences (“CFDs”),[12] a type of derivatives contracts that were priced in relation to company shares traded on the London Stock Exchange (“LSE”) and multilateral trading facilities (“MTFs”), including BATS Europe, Chi-X Europe, and Turquoise. According to the FCA, the “nature of the CFD/DMA [i.e., Direct Market Access] accounts was such that the defendants knew that CFD orders placed with the DMA providers would immediately and automatically result in the placement of equivalent orders in the underlying shares on the relevant trading platform, so as to affect the underlying share price.”[13]

According to the FCA, unlike Coscia, whose trading pattern is described below, the “defendants [in the Da Vinci matter] typically used a mixture of large and small orders entered on one side of the LSE’s order book” as the non-bona fide orders.[14] Once the share “price had been moved to an advantageous level, the defendants initiated a trade on the other side of the order book in order to profit from the price movement that they had created.”[15] Defendants subsequently cancelled the “large ‘layered’ orders” and started “the process … over again, typically aimed at moving the share price in the opposite direction,”[16] thus creating a “saw-tooth” price pattern.

These two early examples of enforcement of spoofing laws by UK authorities have had important legal implications in the sense that they highlight key differences from how US authorities enforce spoofing laws:

-

In the UK, spoofing is not a specified offence. However, spoofing behaviour may violate the civil and/or regulatory provisions set forth in the EU Market Abuse Regulation (596/2014) (“MAR”) and/or amount to a criminal offence under the Financial Services Act 2012 (Sections 89 and 90) or the Fraud Act 2006 (Section 2).

-

To enforce spoofing laws, US authorities must prove that there was an intent to cancel the alleged spoof order at the time it was submitted.[17] In the UK, authorities generally focus on the impact of the spoof order on the market. In a civil case, the FCA need only prove that the order submission created a false or misleading impression in the market, regardless of the trader’s intent. In other words, it is an effects-based regime. In a criminal case under the Financial Services Act 2012, however, a prosecutor must prove that the behaviour had an actual effect on the market and must also prove some element of intent.

Recent Developments in the UK Regulatory Landscape Concerning Spoofing

In the Enforcement Guide contained in the FCA Handbook, the FCA describes its approach to exercising enforcement powers given to it by the Financial Services and Markets Act 2000 (“FSMA”) and other legislation. Some factors the FCA might use to decide whether to bring a criminal prosecution for market misconduct include: the “seriousness of the misconduct,” “the effect of the misconduct on the market,” including whether the misconduct “resulted in significant distortion or disruption to the market and/or has significantly damaged market confidence.”[18]

The FCA has the requisite authority to bring criminal charges against individuals engaged in financial crime including market abuse.[19] However, it most often acts as a civil regulator. For instance, in 2018/2019, the FCA “secured 288 outcomes” using its enforcement powers, and only 12 of those were criminal cases.[20] Further, to this day, the UK regulators have not criminally prosecuted anyone for spoofing.

While there have not been as many enforcement actions targeting spoofing in the UK as in the US, the FCA has clearly remained focused on market manipulation. For example, the FCA sets forth guidance on steps a firm can take to reduce the risk that it may be used to further financial crime (the Financial Crime Guide).[21] It added a new chapter in December 2018 that applies to firms subject to the FCA’s Senior Management Arrangements, Systems and Controls Sourcebook (“SYSC”) 6.1.1R (which requires firms to have policies and procedures in place for countering the risk that the firm might be used to further financial crime).[22] The new Chapter 8 clarifies that the FCA considers conduct that violates sections 89–91 of the Financial Services Act 2012 (i.e., market manipulation) to constitute financial crime.[23]

Other examples of the FCA’s continued focus on market manipulation prosecution are recent warnings and public statements provided by the FCA. Most recently, in March 2020, the FCA gave an unnamed individual a warning, proposing to take action after the individual “placed large orders for Contracts for Difference . . . on an inter-dealer trading platform that he did not intend to execute . . . on the opposite side of the order book to existing smaller orders which he intended to execute.”[24] The FCA explained that by placing these orders, the trader “falsely represented to the market an intention to buy or sell when his true intention was the opposite. The individual’s intention in placing the Misleading Orders was to facilitate the execution of the Genuine Orders at a more advantageous price, or on a more timely basis, than he would otherwise have achieved . . . .”[25]

More generally, the FCA recently published a Business Plan for 2020/21, in which it listed one of its “Key outcomes” as providing for “[c]lean markets that make it difficult to commit market abuse and financial crime.”[26]

What Constitutes Spoofing According to the Allegations?

To date, regulators have provided market participants with little guidance around the definition of spoofing, and it is unclear of what elements the offence of spoofing consists.[27] Neither the MAR, the Financial Services Act 2012, nor the Fraud Act 2006 have defined what constitutes spoofing. Nonetheless, the MAR currently defines market manipulation as “entering into a transaction, placing an order to trade or any other behaviour which … gives, or is likely to give, false or misleading signals as to the supply of, demand for, or price of, a financial instrument … unless the person entering into a transaction, placing an order to trade or engaging in any other behaviour establishes that such transaction, order or behaviour have been carried out for legitimate reasons, and conform with an accepted market practice.”[28] The MAR further states that any behaviour aimed at “creating or being likely to create a false or misleading signal about the supply of, or demand for, or price of, a financial instrument, in particular by entering orders to initiate or exacerbate a trend” shall be considered market manipulation.[29]

Both UK and US regulators have so far offered some interpretive guidance on what constitutes spoofing. The FCA, for example, issued relevant commentary on “layering or spoofing” in its publication Market Watch, Issue No. 33 August 2009. The publication stated that the FCA had considered spoofing and layering to be present when clients “layer the order book, in which multiple orders are submitted at different prices on one side of the order book slightly away from the [midpoint] … submitted an order to the other side of the order book (which reflected the client’s true intention to trade) … and following the execution of the latter order, rapidly [removed] the multiple initial orders from the book.”[30] In the US, the CFTC issued similar guidance. According to the CFTC Interpretive Guidance and Policy Statement (“CFTC Interpretive Guidance”) related to Antidisruptive Practices Authority dated 28 May 2013, “spoofing” is defined as “bidding or offering with the intent to cancel the bid or offer before execution.”[31] As also noted in the CME’s Market Regulation Advisory Notice effective 15 September 2014, wherein the CME Group adopted Rule 575, “[a]ll orders must be entered for the purpose of executing bona fide transactions . . . No person shall enter or cause to be entered an order with the intent, at the time of order entry, to cancel the order before execution or to modify the order to avoid execution….”[32] In addition, the CME noted that “[p]lacing a bona fide order on one side of the market while entering order(s) on the other side of the market without intention to trade those orders violates Rule 575.”[33]

To shed more light on the potential considerations that have been discussed by regulators to assess “spoofing” or similar manipulative activity, we will discuss the various fact patterns as well as examples of actual trading patterns discussed in the FCA Final Notice to Michael Coscia and in FCA v. Da Vinci Invest Limited.

FCA / US v. Michael Coscia

According to the Coscia Indictment and the FCA Final Notice, Coscia’s trading scheme involved designing trading algorithms which placed several layers of large orders (“quote orders”) near the best bid or offer (“BBO”), often within three ticks (the minimum upward or downward movement in the price of a security), “with the intention of creating a false impression as to the weight of buyer or seller interest.”[34] As noted in the Coscia Indictment, “[Coscia] intended to, and did, mislead other traders, causing them to react, because his quote orders appeared to represent a substantial change in the market.”[35] Similarly, the FCA concluded that “Mr Coscia’s behaviour amounted to deliberate market abuse (market manipulation) contrary to section 118(5) of the Act in that it gave a false or misleading impression as to the supply, demand, or price for qualifying investments and secured the price of such investments at an artificial level.”[36]

The court and regulatory documents highlight several aspects of Coscia’s trading algorithm that concerned prosecutors. First, Coscia’s algorithm was designed to cancel the “misleading quote orders” either “within a fraction of a second automatically” or if any quote order was partially filled.[37] As a result, the vast majority of quote orders were cancelled, going either underfilled or not filled at all.[38] On the other hand, a partial execution of trade orders would not lead to cancellation of these orders.[39] A higher percentage of (smaller) trade orders on the opposite side of the (large) quote orders were therefore filled.

Second, Coscia’s algorithm purportedly looked for what prosecutors considered to be favourable market conditions for Coscia’s trading strategy, such as price stability, low volume at the BBO, and a narrow bid-ask spread.[40] Correspondingly, in the Coscia Indictment, it said that Coscia’s “fraudulent trading strategy worked best under these conditions” as his large quote orders were at lower risk of being executed in calm, stable markets.[41]

Third, after Coscia filled a trade order, his algorithm was purportedly designed to immediately perform the same trading pattern on the other side of the market.[42] This trading strategy allowed Coscia to make a profit on the difference in price between the first and second trade orders.[43]

Furthermore, the FCA noted in its Final Notice that while there was “no significant impact” on prices, Coscia’s trading purportedly “created false liquidity in the market which he used to his advantage and to the detriment of other market participants.”[44]

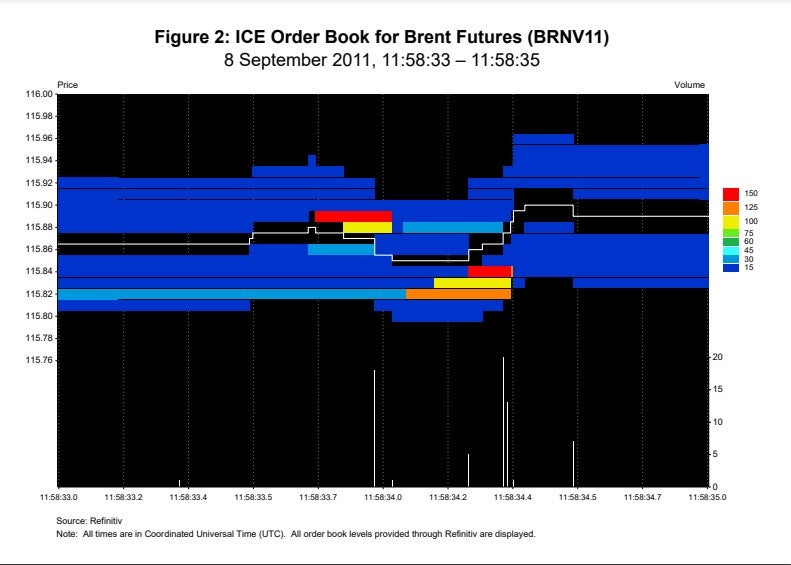

Before discussing the conduct at issue in the context of the market data, it would be beneficial to mention a bit of background on the interpretation of data. An order book consists of offers to sell contracts at specified prices and bids to buy contracts at specified prices. Figure 1 shows the ICE order book and transactions for the Brent oil futures contract on 8 September 2011 from 11:58:30 to 11:58:50 UTC, a day within the period when alleged spoofing activity described in the FCA Final Notice occurred. The horizontal bars above the horizontal white line (the midpoint) represent offers to sell Brent futures; the horizontal bars below the white line represent bids to buy Brent futures, with each bar representing orders placed at a distinct price level.[45] Thus, at 11:58:30 UTC, there are offers to sell oil futures at prices from 115.89 (the best offer) and higher, and bids to buy at 115.87 (the best bid) and lower. The 0.02 gap between 115.87 and 115.89 represents the bid-ask spread. The colours of the horizontal bars at each price level represent the quantity shown to be offered or bid at each price level.[46] Finally, the lower portion of each panel shows the quantity of consummated transactions.

The FCA Final Notice notes that Coscia implemented a two “leg” algorithm. The first “leg” of the algorithm involved placing a small order around the best bid or offer, and then placing one or multiple large orders on the opposite side of the book. These offers would be placed at price levels that increasingly approached the midline. All orders were cancelled immediately and simultaneously if they were not executed within a certain amount of time. The second “leg” of this algorithm involved following the same sequence, but on the opposite side of the order book. In its Final Notice, the FCA provides an “example of how [Coscia’s] orders appeared on the order book.”[47] Information that could help identify the example in the data has been anonymised by the FCA (e.g., timestamps are set to 00:00:00:000). The FCA has, however, provided information on price levels and quantities of orders and how they appeared in the market. Based on analysing the ICE Brent futures data during the relevant time period, we find that there are three instances that match significant aspects of the example trading pattern as identified by the FCA.[48] Figure 2 shows one such example. Around 11:58:33.769, 17 contracts were placed at the best bid of 115.86. Almost simultaneously, 125 contracts were placed on the sell side at 115.89. Eighty-six milliseconds thereafter, an additional 89 contracts were placed on the sell side at 115.88. Ninety-five milliseconds thereafter, five contracts were placed at a price of 115.87. In this example, the last sell order of five lots improved the best offer price to 115.87. After the best offer improved to 115.86, the 17 contracts previously placed on the buy side traded in several transactions at a price of 115.86. The layers of large sell “quote orders” were quickly cancelled after the transactions of the 17 lots on the buy side.

Thirty-three milliseconds later, at around 11:58:34.061, a similar pattern appeared on the opposite side of the order book. On the sell side, 17 contracts were placed at 115.88. By around 11:58:34.263, three layers of large buy “quote orders” appeared, including one for 122 contracts at 115.84. Following this layered order structure, the best bid improved gradually from 115.85 to 115.88. Once the level of 115.88 was hit, the small sell order fully executed at a price of 115.88. The layers of large buy “quote orders” were immediately cancelled after the “trade order” was executed.

According to the FCA Final Notice, “Mr Coscia made a profit of USD 340 from buying and selling 17 lots in trading that lasted less than one second.”[49] Over the entire period of Coscia’s conduct, the FCA found that he made a net profit of $217,510 on Brent oil futures,[50] and that his larger orders which were subsequently cancelled typically made up “over 75% of all orders within five ticks of the best bid of best offer price.”[51] Although these orders did not have a significant impact on ICE product prices, this did create a “false impression of liquidity provided by Mr. Coscia’s large orders.”[52]

The Financial Conduct Authority v. Da Vinci Invest Limited

According to the Judgment of the High Court of Justice Chancery Division, the manipulative behaviour of Da Vinci traders consisted of “layering” or “spoofing” on the electronic trading platform of the LSE and MTFs, such as BATS Europe and Chi-X Europe. The FCA alleged and the High Court agreed that the defendants traded in a way as to create a “false or misleading impression as to the supply and demand for those shares” [53] and “[enabled] them to trade those shares at an artificial price.”[54]

The FCA concluded that the “defendants typically used a mixture of large and small orders entered on one side of the LSE’s order book” while not intending to trade these orders.[55] In its final press release, the FCA stated that the “large orders were carefully placed at prices close enough to the best bid or offer prevailing on the LSE at the time to give a false impression of supply and demand, but far enough away to minimise the risk that they would be traded.”[56] The smaller orders, on the other hand, which were “typically around 100 shares,” were placed more aggressively and “used to improve the best bid or offer price.”[57] Furthermore, the FCA and the documents from the High Court's Judgment mentioned that as the “price improved, further large orders were strategically placed at prices close to the new best bid or offer in order to support the improved price.”[58] The FCA alleged that following this trading sequence, defendants typically repeated a similar trading pattern on the other side of the market to move the price in the opposite direction.[59]

The FCA’s investigation found a total of 1,862 suspicious incidents, amounting to approximately 83 percent of orders placed by defendants and 97 percent of their gross profit.[60] The FCA’s investigation also found that defendants’ trading took place during periods averaging 12 minutes and concentrated on a few particular stocks.[61] In each incident there was a “saw-tooth” pattern caused by the successive creation of large cumulative net order positions on opposite sides of the order book.[62] According to the FCA, “[t]he share price movement correlated with the saw-tooth pattern of order entry in almost every case.”[63]

Figure 3 shows the LSE order book and transactions for the stock of Aquarius Platinum Limited (“AQP”) from a period when alleged layering and spoofing activity described by Judge Snowden occurred (6 December 2010 between 11:00:00 and 11:45:00 UTC). Figure 3 represents the order book in the same way described for Figures 1 through 2.[64]

The pattern shown in Figure 3 is consistent with the allegations that defendants entered cumulative net buy orders until just before 11:06 and then reversed that position, entering cumulative net sell orders until just after 11:09, when they reversed that position again and began to enter cumulative buy orders. They allegedly repeated that cycle six times over the almost 39 minutes of trading. The red vertical droplines indicate the start of each of the six trading cycles. This pattern of trading can also be identified based on the changing pattern of the quantity colouring. Around 11:09 a block of blue (indicative of relatively small orders) underneath a large block of orange and red (indicative of large orders) appears close to the market midpoint on the sell side. Shortly after this block of blue disappears, and after an increase in the price of AQP, a large block of blue appears on the buy side, seemingly pushing up the price of AQP further. When this block disappears from the buy side, another block of blue underneath a large block of orange and red appears close to the midline on the sell side. This pattern repeats another five times. The FCA clarified that the midpoint share price tracked that order activity, resulting in a clear “saw-tooth” pattern of price movement.

Figure 4 allows for a closer examination of one of the six incidents that allegedly was part of the “saw-tooth” pattern.[65] According to the High Court Judgment and consistent with the allegations, the data show that, beginning at 11:19:17, defendants entered four small and four large passive sell orders for AQP (total size greater than 30,000 shares) on the LSE, which was followed by a subsequent decrease in AQP’s price. According to the High Court Judgment, at 11:20:48, defendants turned from the LSE to Chi-X and entered two aggressive[66] buy orders for AQP (total size 2,767 shares) at prices in excess of their sell orders resting on the LSE order book. Defendants continued placing smaller and larger passive sell orders for AQP on the LSE, which were followed by additional declines of AQP’s price. According to the High Court Judgment, at 11:21:40, defendants entered an aggressive buy order for AQP (size 2,500 shares) on BATS, again at a higher price than they were offering to sell on the LSE. The pattern continued with defendants placing further smaller and larger sell orders for AQP on the LSE and subsequently, at 11:23:30, placing a larger buy order (size 6,300 shares) on the LSE. As this buy order was entered at a price above that at which defendants were offering to sell shares, this led to “three wash-trades” with sell orders of 100 shares each.[67] Part of the buy order was also executed against larger sell orders that were placed by other market participants, leading to a total execution of 6,000 shares.

The High Court Judgment describes that “immediately after the execution of [their] buy order,” defendants “reversed [its trading] pattern” and started entering buy orders while cancelling the (unfilled) sell orders.[68] By 11:26:22, defendants had placed buy orders for AQP for a cumulative volume of 62,726 shares and cancelled all outstanding sell orders.[69] AQP’s prices “had risen by this time,” and defendants subsequently sold “12,812 shares, making a profit on the sales of the shares [they] had bought a few minutes earlier.”[70]

What Do We Learn from the Evidence of the Two Cases?

Although the trading strategies employed by Coscia and DaVinci were different in some respects,[71] the two cases share important common characteristics that the regulators rely on to determine whether the conduct constitutes “spoofing.”

As mentioned in the FCA’s 2009 Market Watch Letter, regulators consider a variety of factors in assessing whether certain conduct “give[s] a false or misleading impression about the supply and demand for securities” and can therefore resemble “the intentional pattern of behaviour called layering or spoofing.” These factors include the size, layering structure, duration, and price priority of the orders relative to the relevant market.[72] Interestingly, for the US, the CFTC Interpretive Guidance and the Advisory Notice explicitly state that factors such as an execution or a partial fill of an order do not automatically cause the order to be considered compliant with regulation.[73]

Indeed, as seen in both the Coscia and DaVinci cases, regulators pointed to factors such as the duration and cancellation rate of the large quote orders (relative to that of the small order or other market participants), whether the large quote orders were placed systematically on the opposite side of the trading, or other tactics used in order to assess whether certain conduct should be deemed as “spoofing.”

This differs in certain aspects from another UK matter, FCA v. Paul Axel Walter. Paul Axel Walter (“Walter”) was a trader for fixed income securities.[74] The FCA stated that on “11 occasions, Mr. Walter entered a series of quotes that became the best bids on BrokerTec, an electronic trading platform, giving the impression that he was a buyer in a [Dutch State Loans (‘DSL’)].”[75] The FCA’s description of Walter’s conduct was that he had inferred that other “market participants who were tracking his quotes with algorithms followed him in response and raised their bids.”[76] While Walter’s quote orders—which were of the smallest permissible size and rested at the best bid—were resting in the order book, Walter submitted marketable sell orders. He did so knowing that he could sell into his bids without execution, as a mechanism at BrokerTec prevented self-trades.[77] After having improved the best bid, “Walter then sold to those other participants and cancelled his own quote.”[78]

Contrary to comparable matters, Walter did not use a large and / or layered order structure to move the BBO towards its trade order. Instead, he used the smallest permissible order size to trigger algorithms to track his orders as he improved the best bid. Indeed, the FCA acknowledged that:[79]

Mr Walter’s bids were high-quality (best bid/offer and improving the bid/offer spread) and available for multiple seconds, which is a long time in the context of the market in question. They were available for trading long enough that their validity should not be questioned and, indeed, they were highly likely to trade. There were no safeguards in place to prevent the bids from trading, and they did not have the characteristics seen in cases of “spoofing” and “layering” (such as layering quotes placed some distance from the “touch” which survive for extremely short periods before being cancelled, and a “saw-tooth” pattern).

Surveying the landscape of spoofing prosecutions and actions in the UK, particularly in the years after Coscia and Da Vinci, the UK’s smaller number of public enforcement actions relative to the US is notable. However, the FCA has taken a number of actions in recent years that signal its commitment to enforcing laws against market manipulation in general, and spoofing in particular. It would be a mistake to assume that the lack of enforcement activity indicates a lack of focus in this area by the FCA.

[1] Some of the rules and regulations described herein were enacted by the FCA’s predecessor, the UK Financial Services Authority (“FSA”), which was responsible for the regulation of the financial services industry in the UK between 2001 and 2013. For the purposes of this publication, we will refer to the FCA even if a rule, regulation, or guidance was enacted by the FSA. This is in accordance with how the FCA is referring to publications by its predecessor.

[2] “Market abuse requires a dynamic response to a changing risk profile,” FCA, 13 February, 2019, available at https://www.fca.org.uk/news/speeches/market-abuse-requires-dynamic-response-changing-risk-profile.

[3] FCA, Final Notice to Michael Coscia, 3 July, 2013 (“FCA Final Notice”).

[4] England and Wales High Court Decision, The Financial Conduct Authority v. Da Vinci Invest Ltd [2015] EWHC 2401 (Ch), 12 August, 2015 (“High Court Judgment”).

[5] Section 747 of the Dodd-Frank Act amended Section 4c(a) of the Commodity Exchange Act (7 U.S.C. 6c(a)) “by adding at the end the following: ‘‘(5) DISRUPTIVE PRACTICES.—It shall be unlawful for any person to engage in any trading, practice, or conduct on or subject to the rules of a registered entity that— ‘‘(A) violates bids or offers; ‘‘(B) demonstrates intentional or reckless disregard for the orderly execution of transactions during the closing period; or ‘‘(C) is, is of the character of, or is commonly known to the trade as, ‘spoofing’ (bidding or offering with the intent to cancel the bid or offer before execution). ‘‘(6) RULEMAKING AUTHORITY.—The Commission may make and promulgate such rules and regulations as, in the judgment of the Commission, are reasonably necessary to prohibit the trading practices described in paragraph (5) and any other trading practice that is disruptive of fair and equitable trading. ‘‘(7) USE OF SWAPS TO DEFRAUD.—It shall be unlawful for any person to enter into a swap knowing, or acting in reckless disregard of the fact, that its counterparty will use the swap as part of a device, scheme, or artifice to defraud any third party.’’.” See, Dodd-Frank Wall Street Reform and Consumer Protection Act.

[6] Indictment, United States v. Coscia, No. 14- CR-551 (N.D. Ill.), 1 October, 2014 (“Coscia Indictment”).

[7] Appeal from the United States District Court for the Northern District of Illinois, Eastern Division, United States v. Coscia, No. 16-3017 (7th Cir.), WL 33814433, 7 August, 2017, at 22 & 29.

[8] “High-Frequency Trader Sentenced to Three Years in Prison for Disrupting Futures Market in First Federal Prosecution of ‘Spoofing,’” Department of Justice, US Attorney’s Office, Northern District of Illinois, 13 July, 2016.

[9] The FCA imposed its fine on 3 July, 2013. See FCA Final Notice. Specifically, on 22 July, 2013, the CME settled a disciplinary action against Panther and Coscia that resulted in the imposition of fines totaling $200,000 and ordered disgorgement of approximately $1.3 million in profits. In addition, the CME placed a six-month trading ban on Coscia. See CME Group, “Notice of Disciplinary Action Against Michael Coscia,“File No. CME 11-8581-BC, 22 July, 2013. Also on 22 July, 2013, Panther and Coscia settled the CFTC claims for $2.8 million, comprised of a $1.4 million civil monetary penalty and $1.4 million in disgorged profits. See Order Instituting Proceedings Pursuant to Sections 6(c) and 6(d) of the Commodity Exchange Act, As Amended, Making Findings and Imposing Remedial Sanctions, In the Matter of Panther Energy Trading LLC and Michael Coscia, CFTC Docket No. 13-26, 22 July, 2013. The disgorgement ordered by the CME Group offset the CFTC’s disgorgement order.

[10] High Court Judgment.

[11] Those defendants were two companies that at the relevant time belonged to the same group headed by Da Vinci Invest Limited (“DVI” and “DVPte”), three traders, and a Seychelles company, Mineworld, which was owned and controlled by the traders and used as a vehicle for derivatives trading on their own account. The Singaporean company DVPte was dissolved and held no assets at the time of the trial. As a consequence, the FCA did not proceed with the case against it. See High Court Judgment.

[12] A CFD is a contract between two parties written on an underlying instrument such as a stock, whereby the parties agree to pay or receive the difference in value of the underlying instrument between the time and date when the contract is opened and the time and date when the contract is closed. If the difference is positive, the buyer pays the difference in value to the seller, and vice versa. CFDs are cash-settled.

[13] “FCA secures High Court Judgment awarding injunction and over £7 million in penalties against five defendants for market abuse,” FCA, 12 August, 2015, available at https://www.fca.org.uk/news/press-releases/fca-secures-high-court-judgment-awarding-injunction-and-over-%C2%A37-million (“FCA Da Vinci Press Release”).

[14] Id.

[15] Id.

[16] Id.

[17] “Interpretive Guidance and Policy Statement,” Antidisruptive Practices Authority, 78 Fed. Reg. 31,890, 28 May 2013. See also 7 U.S.C. §13(a)(2) (2012).

[18] “Criminal prosecutions in cases of market abuse,” FCA, Enforcement Guide (EG), EG 12.3, available at https://www.handbook.fca.org.uk/handbook/EG/12/3.html.

[19] Id.

[20] “Enforcement Annual Performance Report 2018/19,” FCA, available at https://www.fca.org.uk/publication/corporate/annual-report-2018-19-enforcement-performance.pdf.

[21] “Financial Crime Guide: A firm’s guide to countering financial crime risks (FCG),” FCA, available at https://www.handbook.fca.org.uk/handbook/FCG.pdf (“FCA Financial Crime Guide”).

[22] FCA Financial Crime Guide, Chapter 8.

[23] FCA Financial Crime Guide, Chapter 8.1.2.

[24] “Warning Notice Statement 20-1,” FCA, 19 March, 2020, available at https://www.fca.org.uk/publication/warning-notices/warning-notice-statement-20-1.pdf (“FCA Warning Notice Statement 20-1”).

[25] Id.

[26] “Business Plan 2020/2021,” FCA, 7 April, 2020, available at https://www.fca.org.uk/publication/business-plans/business-plan-2020-21.pdf.

[27] See, e.g., “Interpretive Guidance and Policy Statement,” Antidisruptive Practices Authority, 78 Fed. Reg. 31,890, 28 May 2013; “Proposed Interpretive Order,” Antidisruptive Practices Authority, 76 Fed. Reg. 14,943, 18 March 2011.

[28] EU Market Abuse Regulation (596/2014), Article 12(1).

[29] EU Market Abuse Regulation (596/2014), Article 12(2).

[30] “Market Watch, Market Division: Newsletter on Trade Publication Issues, Issue No. 33,” FCA, August 2009 (“FCA 2009 Market Watch Letter”).

[31] “Interpretive Guidance and Policy Statement,” Antidisruptive Practices Authority, 78 Fed. Reg. 31,890, 28 May 2013.

[32] “Market Regulation Advisory Notice: Disruptive Practices Prohibited,” CME Group, RA1405-5, at 2, effective on 15 September 2014 (“Rule 575 Advisory Notice”).

[33] Rule 575 Advisory Notice at 9. This includes cases in which a market participant enters orders in Market A that are not intended to be executed but rather to elicit certain reactions in a related Market B.

[34] FCA Final Notice at 3. Coscia allegedly designed programming algorithms that would place orders on CME Globex for metals, energy, interest rate, agricultural, stock index, and foreign currency products, and on ICE Futures Europe for three contracts during the period from August to October 2011. See Order Instituting Proceedings Pursuant to Sections 6(c) and 6(d) of the Commodity Exchange Act, As Amended, Making Findings and Imposing Remedial Sanctions, In the Matter of Panther Energy Trading LLC and Michael Coscia, CFTC Docket No. 13-26, 22 July, 2013. See also, FCA Final Notice.

[35] Coscia Indictment at 10.

[36] FCA Final Notice at 4. Note that market abuse offenses in Section 118 of the FSMA were repealed and replaced in July 2016, when the MAR came into effect.

[37] Coscia Indictment at 10. See also, FCA Final Notice at 10–11.

[38] Coscia Indictment at 10.

[39] Id.

[40] Coscia Indictment at 6; FCA Final Notice at 9.

[41] Coscia Indictment at 6.

[42] FCA Final Notice at 10 and 17.

[43] Coscia Indictment at 12; FCA Final Notice at 19.

[44] FCA Final Notice at 45.

[45] The data used to create the chart come from Refinitiv, which provides data for up to a 10-depth order book (i.e., an order book that shows ten price levels on each side of the market) for Brent futures.

[46] Note that the colour represents only the quantity shown to the market. Additional quantities may be available at each level through iceberg/hidden quantity orders (i.e., orders which make only a portion of the quantity visible to other market participants even though the order is valid for a larger quantity).

[47] FCA Final Notice at 11.

[48] The relevant period identified by the FCA for Brent Oil Futures is 6 September, 2011 to 18 October, 2011. See FCA Final Notice at 3. To identify instances that match the example trading pattern within the relevant period as identified by the FCA, we screened ICE Brent transaction data as provided by Refinitiv for transactions at a price of 115.86, which are followed closely (less than one second) by a transaction at a price of 115.88. These are the transactions that the FCA specifies for Legs 1 and 2 in its exemplary description of Coscia’s conduct (see FCA Final Notice at 15 and 17). There are 49 such transaction pairings in the data during the relevant time period that fit this criterion. Of these pairs, three events broadly fit the order submission pattern as described by the FCA in its Final Notice (see FCA Final Notice at 11–17). None of the three events perfectly aligns with what the FCA describes, but all three generally closely align with how the FCA characterizes how Coscia’s “orders appeared on the order book” (see FCA Final Notice at 11).

[49] FCA Final Notice at 19.

[50] Coscia also incurred $9,350 in net losses and $71,760 in net profit from Gas Oil Futures and Western Texas intermediate Crude Futures, respectively. Overall, Coscia made a total net profit of $279.920. See FCA Final Notice at 26.

[51] FCA Final Notice at 45.

[52] FCA Final Notice at 23.

[53] High Court Judgment at 2. See also FCA Da Vinci Press Release.

[54] High Court Judgment at 62. See also FCA Da Vinci Press Release.

[55] FCA Da Vinci Press Release.

[56] Id.

[57] Id.

[58] Id.

[59] Id.

[60] High Court Judgment at 135.

[61] High Court Judgment at 138.

[62] Id.

[63] Id.

[64] The data used to create the chart come from Refinitiv, which provides data for up to a 10-depth order book (i.e., an order book that shows ten price levels on each side of the market) for the stock of AQP.

[65] High Court Judgment at 147. Figure 4 only displays orders on the LSE but is representative for the other market places.

[66] An “aggressive” order is an order that crosses the bid-ask spread and can instantly execute against orders resting in the order book. These orders are also referred to in the literature as marketable orders and are a normal part of electronic markets. In contrast to aggressive orders, “passive” orders rest on the order book awaiting an aggressive order to meet for an execution.

[67] High Court Judgment at 147.

[68] Id.

[69] Id.

[70] Id.

[71] Da Vinci’s and Coscia’s trading strategies differed with respect to (1) the instrument through which the traders attempted to spoof (directly through the underlying or indirectly through derivatives); (2) whether a programming algorithm was used; (3) if orders were directed to a single venue or split across multiple venues; (4) whether there was an observable midpoint movement; and (5) the frequency and duration of the order submissions and cancellations.

[72] FCA 2009 Market Watch Letter, at 1, which states that the FCA has seen “intentional patterns of behaviour called layering or spoofing […] most frequently when clients [(i)] layer the order book, in which multiple orders are submitted at different prices on one side of the order book slightly away from the touch; [(ii)] submitted an order to the other side of the order book (which reflected the client’s true intention to trade); and [(iii)] following the execution of the latter order, rapidly removing the multiple initial orders from the book.”

[73] Antidisruptive Practices Authority, Interpretive Guidance and Policy Statement, 78 Fed. Reg. 31,896, 28 May, 2013; Rule 575 Advisory Notice at 4.

[74] “FCA fines bond trader £60,000 for market abuse,” FCA, 22 November, 2017, available at https://www.fca.org.uk/news/press-releases/fca-fines-bond-trader-60k-market-abuse.

[75] Id.

[76] Id.

[77] FCA, Final Notice to Paul Axel Walter; 22 November, 2017 at 4.29.

[78] “FCA fines bond trader £60,000 for market abuse,” FCA, 22 November, 2017, available at https://www.fca.org.uk/news/press-releases/fca-fines-bond-trader-60k-market-abuse.

[79] FCA, Final Notice to Paul Axel Walter, 22 November, 2017, Annex B, Representations at 10.

Co-authored by Gregory Mocek, a Partner at Allen & Overy LLP in Washington, DC, and the former Director of Enforcement at the U.S. Commodity Futures Trading Commission.

/>i

/>i