Compensating attorneys effectively is a combination of art and science. A well-structured bonus plan is integral to most law firms' overall compensation strategy, playing a key role in retaining talent, driving performance, and fostering a collaborative culture. Whether the focus is on individual productivity or firm-wide profitability, bonuses help align attorney performance with the firm's goals.

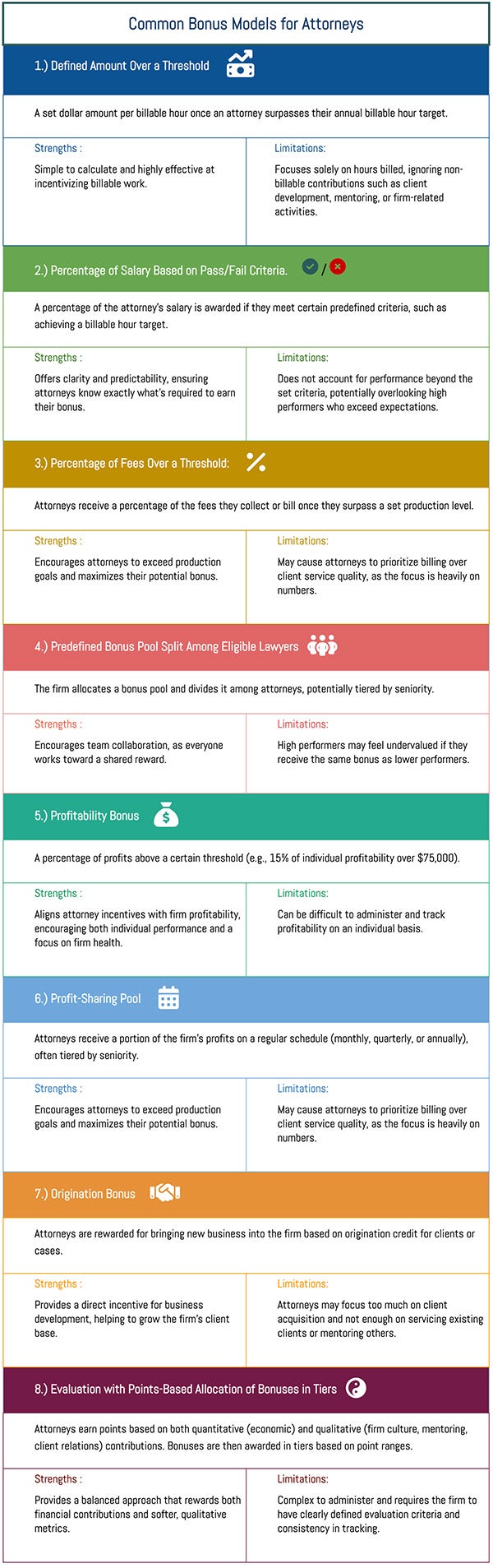

This guide provides an overview of various bonus strategies law firms use to compensate attorneys, along with their advantages, disadvantages, and key considerations for selecting the right bonus structure.

Best Practices for Structuring Attorney Bonuses

When selecting a bonus model, law firm leaders should carefully consider their firm culture, values, and strategic objectives. Here are some best practices for creating a sustainable and motivating bonus system:

- Incorporate Both Economic and Qualitative Performance: While revenue generation is critical, a successful bonus plan should also recognize contributions like mentoring, client satisfaction, and leadership.

- Tailor Bonuses to Career Stages: Junior associates, senior associates, and partners may need different incentives to stay motivated. Consider tiered bonus systems or increasing potential bonus payouts as attorneys advance.

- Incorporate Regular Feedback: Rather than waiting for the annual bonus review, provide regular feedback to help attorneys stay on track and improve throughout the year.

- Use Data-Driven Systems: Consider leveraging technology to streamline bonus calculations. Tools like PerformLaw’s Attorney Relationship Management System (ARMS) can help firms objectively track both billable and qualitative contributions, ensuring fairness and transparency in bonus distribution.

Conclusion

Choosing the right bonus structure for your law firm is not a one-size-fits-all solution. It requires thoughtful consideration of firm goals, attorney performance, and the behaviors you want to incentivize. A well-rounded approach to rewarding economic and qualitative contributions is crucial for long-term success. By combining structured salary increases and performance-driven bonuses, law firms can boost morale, improve retention, and ultimately, drive greater firm profitability.

/>i

/>i