Overview

You probably have heard or read about the SEC’s adoption1, on Dec. 14, 2022, of amendments to Rule 10b5-1. That rule provides an affirmative defense to insider trading liability under Section 10(b) of the Exchange Act and Rule 10b-5 promulgated under the Exchange Act in circumstances when, before becoming aware of material non-public information (MNPI), a trader enters into a binding contract to purchase or sell a security, instructs another person to execute the trade for the instructing person’s account, or adopts a written plan (a 10b5-1 plan) for trading. The SEC first proposed the amendments in late 2021 and delivered them just in time for Christmas in 2022 — we suspect that you would have preferred a lump of coal — and perhaps that’s precisely what we got.

The Rule 10b5-1 amendments, according to the SEC, were “designed to address concerns about abuse of [Rule 10b5-1] to trade securities opportunistically on the basis of material non-public information in ways that harm investors and undermine the integrity of the securities markets.” The amendments:

-

Include new conditions to the affirmative defense under Rule 10b5-1;

-

Create new disclosure requirements in companies’ periodic reports regarding the use of 10b5-1 plans by their insiders; and

-

Amend Forms 4 and 5 beneficial ownership reports under Section 16 of the Exchange Act.

We examine the details of the rule amendments below.

The new rules, unlike a number of recent controversial SEC regulations, were adopted unanimously by the SEC Commissioners. Commissioners Peirce and Uyeda nevertheless expressed reservations about certain aspects of the final rules, including:

-

The length of the cooling off period;

-

The “unnecessary” condition for the individual to have “acted in good faith with respect to” the plan;

-

“Unnecessary” tabular disclosure requirements about awards of options;

-

The requirement to file insider trading policies on EDGAR instead of allowing website posting; and

-

The “unreasonable” Form 4 deadlines for gifts.

The amendments to Rule 10b5-1 do not change the underlying elements of a cause of action for insider trading but instead impose additional requirements that must be satisfied if a person wishes to rely upon the particular affirmative defense under Rule 10b5-1(c)(1). Rule 10b5-1 by its express terms does not supplant the body of law behind insider trading (including case law), and proof of scienter (among other elements) will still be required in an insider trading case as it is an element of a cause of action under Section 10(b). Thus, regardless of whether a defendant complies with the new conditions of the affirmative defense (such as not trading within the cooling-off period), the fundamental elements of insider trading must be proven in order for liability to attach.

Effective Date(s)

The Rule 10b5-1 amendments with respect to 10b5-1 plans are effective Feb. 27, 2023.2 There is a lot to think about and do before that date — and there will be much to do afterwards as well. For example, persons subject to Exchange Act Section 16 (including insiders at smaller reporting companies (SRCs) and emerging growth companies (EGCs)) must comply with the amendments to Forms 4 and 5 for beneficial ownership reports filed on or after April 1, 2023. Companies other than SRCs must comply with new disclosure requirements in Exchange Act periodic reports (e.g., Forms 10-Q, 10-K, and 20-F) and in any proxy or information statements in the first filing that covers the first full fiscal period that begins on or after April 1, 2023.3 For calendar year companies that are not SRCs, that means the new disclosure requirements will be required beginning with Forms 10-Q for the second quarter of 2023.

Changes to the 10b5-1 Defense

Rule 10b5-1(c)(1) provides an affirmative defense against insider trading liability. The defense allows any person (including directors, officers,4 and issuers themselves) who engages in transactions in the issuer’s securities to be deemed to not have entered such transactions “on the basis of” material non-public information if the transactions were made pursuant to a 10b5-1 plan. After the effective date of the amendments, persons wishing to rely on Rule 10b5-1 as a defense must comply with several new conditions, including:

-

Good faith requirement. Directors, officers or other insiders must not only have entered into the Rule 10b5-1 plan in good faith (the current requirement) but also must act in good faith with respect to any contract, instruction, or plan they adopt.5 The addition of an “act in good faith” condition is intended to address concerns that after Rule 10b5-1 plans are adopted, corporate insiders may take actions (e.g., timing the release of MNPI; terminating or modifying a plan) to benefit from MNPI that an insider acquires after establishment of the plan.

-

Cooling Off Periods. Trading under a 10b5-1 plan may not begin until:

-

For directors and officers, the later of: (i) 90 days following a plan adoption or modification6; or (ii) two business days after the disclosure of the company’s financial results in a Form 10-Q or Form 10-K for the completed fiscal period in which the plan was adopted7, or, for foreign private issuers, in a Form 20-F or Form 6-K that discloses the company’s financial results for that quarter (all subject to a maximum cooling off period of 120 days after adoption); and

-

For persons other than directors and officers, 30 days after the adoption of the plan.

-

Issuers, for now, are not subject to a cooling off period — for example, with respect to 10b5-1 plans adopted to effect stock repurchase programs.

The purpose of a cooling-off period is to provide a separation in time between the adoption of a 10b5-1 plan and the commencement of trading under the plan to minimize the ability of an insider to benefit from MNPI. The addition of that as a condition is intended to deter opportunistic trading that may be occurring under the current rule and, by extension, to increase investor confidence that directors and officers are not using Rule 10b5-1 plans for such purposes. There is no “hardship” exemption for these cooling off periods.

-

Certifications. An issuer’s directors and officers must include in any 10b5-1 plan a representation that, at the time of adoption (or modification) of a plan, they: (i) are not aware of MNPI about the issuer or its securities; and (ii) are adopting the plan in good faith and not to evade the prohibitions of Rule 10b5-1. The addition of a certification condition is intended to reinforce directors’ and officers’ cognizance of their obligation not to trade or enter into a trading plan while aware of MNPI about the issuer or its securities; that it is their responsibility to determine whether they are aware of MNPI when adopting 10b5-1 plans; and that the Rule 10b5-1 affirmative defense requires them to act in good faith and not to adopt such plans as part of a plan or scheme to evade the insider trading laws. Apart from the certification requirement, this amendment adds little substantively because the current rule requires that at adoption of a plan, the person not possess MNPI and that the plan must be adopted in good faith.

-

No Overlapping Plans. Insiders may not use multiple overlapping Rule 10b5-1 plans for transactions on the open market, with the following exceptions:

-

A series of separate contracts with different broker-dealers or agents that, when taken as a whole, effectively function as a single “plan” and meet the applicable conditions of Rule 10b5-1 – this permits persons holding securities in separate accounts with different financial institutions to execute their trading plan through each of these institutions, rather than move securities from one financial institution to another.

-

One plan under which trading is authorized to begin only after all trades under an earlier-commencing plan are completed or expired — this is meant to prevent people from being able to cancel the earlier-commencing plan before its scheduled completion but still trade under the later-commencing plan without adhering to the applicable cooling-off period for a new plan that is established after a plan termination. Both plans must meet all other conditions of Rule 10b5-1, including the cooling-off period.

-

A plan providing for an agent to sell securities only as necessary to satisfy tax withholding obligations (“sell-to-cover transactions”) arising exclusively from the vesting of compensatory awards.8

-

-

Limitation on Single-Trade Plans. Insiders may rely on Rule 10b5-1 for only one single-trade plan (a plan designed to effect the open-market purchase or sale of the total amount of securities in a single transaction) within any consecutive 12-month period. The addition of this limitation as well as the limitation on overlapping plans is intended to address concerns about an insider’s use of multiple overlapping plans or the selective alteration or cancellation of a Rule 10b5-1 plan, to achieve a particular trading outcome when an insider is aware of MNPI. Single-trade plans authorizing only sell-to-cover transactions are exempt from this limitation.

As was the case with cooling off periods, the SEC did not adopt a prohibition on overlapping plans and single-trade plans for issuers but noted the potential for future action following further consideration.

New Quarterly Disclosure Requirements for Issuers

The new rules add a new Item 408 to Regulation S-K, which requires an issuer to disclose whether, during the last fiscal quarter, a director or officer adopted, terminated or modified a 10b5-1 plan or other “Non-Rule 10b5-1 Trading Arrangement”9 and, if so, to disclose the material terms of the plan or arrangement (but excluding the terms with respect to the price at which the individual executing the respective trading arrangement is authorized to trade), including:

-

Whether the plan is a 10b5-1 plan or a Non-Rule 10b5-1 Trading Arrangement;

-

The name and title of the director or officer;

-

The date of adoption, modification, or termination;

-

The duration of the plan or arrangement; and

-

The aggregate amount of securities to be bought or sold pursuant to the plan or arrangement.

These disclosures will appear in Forms 10-Q and 10-K. These new disclosures must be tagged using Inline XBRL. Foreign private issuers will not be required to include these disclosures in their Forms 20-F.

New Annual Disclosure Requirements for Issuers

In addition, new Regulation S-K Item 408 requires an issuer to disclose annually in its Form 10-K and any proxy and information statements10 whether it has adopted insider trading policies and procedures that are reasonably designed to promote compliance with insider trading laws, rules, and regulations. If not, the regulation requires the issuer to give an explanation of why it has not done so. These new disclosures will be required to be tagged using Inline XBRL. Issuers that have adopted insider trading policies and procedures will also be required to file a copy of them as an exhibit to Forms 10-K and 20-F, as applicable.11 Currently, all issuers do not necessarily publicly disclose their insider trading programs; now, they will be required to do so.

The new rules also added Item 402(x) to Regulation S-K to require issuers to discuss their policies and practices on the timing of awards of stock options, stock appreciation rights, or similar option-like instruments (Option Awards). These disclosures would include how the board determines to grant Option Awards, whether the board takes into consideration MNPI when determining the timing and terms of Option Awards, and whether the company has timed the disclosure of MNPI for the purpose of affecting the value of executive compensation.

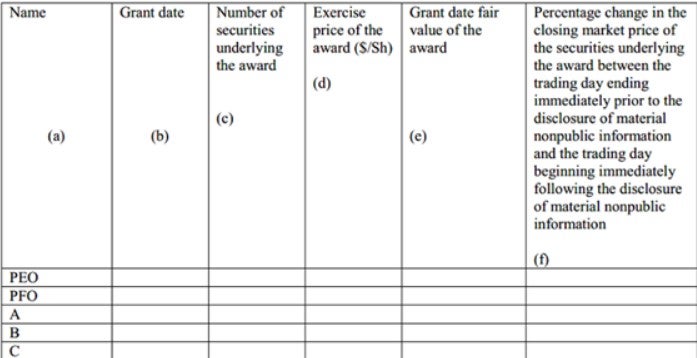

New Regulation S-K Item 402(x) further requires that if, during the last fiscal year, Option Awards were issued to a named executive officer within four business days before or one business day after the filing of a periodic report on Form 10-K or 10-Q or the filing or furnishing of a Form 8-K that discloses MNPI (other than an Item 5.02(e) Form 8-K relating to executive compensation), the company must disclose, in a tabular format, for each named executive officer,12 on an award-by-award basis:

-

The date of the grant;

-

The number of securities underlying the grant,

-

The per-share exercise price,

-

The grant date fair value of each award computed using the same methodology used for the company’s financial statements, and

-

The percentage change in the market price of the underlying securities between the closing market price of the security one trading day prior to and one trading day following the disclosure of the MNPI.

The tabular format for companies other than SRCs and EGCs is as follows:

These new disclosures required by Regulation S-K 402(x) also are required to be tagged using Inline XBRL.

Updates to Forms 4 and 5

Forms 4 and 5 have been updated, for beneficial ownership reports filed on or after April 1, 2023, to include a mandatory checkbox, pursuant to which filers will indicate whether the reported transaction is made pursuant to a plan that is intended to satisfy the affirmative defense conditions of Rule 10b5-1(c). If the box is checked, the form would also need to disclose when the relevant 10b5-1 plan was adopted. In addition, Section 16 reporting persons would be required to report bona fide gifts of equity securities on Form 4, rather than Form 5, which will significantly reduce the time the filer has to report the gifts.

Currently, corporate insiders may disclose bona fide gifts of equity securities on a Form 5 using a delayed reporting schedule (within 45 days after the issuer’s fiscal year). This schedule has resulted, in certain circumstances, with the corporate insider reporting the gift more than a year after the gift was made. The SEC believes that the delay in reporting may have led to abuse, for example by backdating a gift for maximum tax benefit. The new rules require reporting of bona fide gifts of equity securities on Form 4 before the end of the second business day following the transaction, thus accelerating disclosure to a time close to the occurrence. In making this change, the SEC confirmed that Rule 10b5-1 can be available for bona fide gifts of securities, noting that, in its view, the terms “trade” and “sale” in Rule 10b5-1(c)(1) include bona fide gifts.

What Companies Need to Do

Most companies maintain insider trading policies, in part to avoid claims of “recklessness” that could result in “controlling person” liability under Securities Act Section 15 and Exchange Act Section 20. These insider trading policies generally contain broad prohibitions on all employees against trading in securities while in possession of MNPI as well as “window” or “blackout” periods during which officers and directors are either allowed to trade (window) or prohibited from trading (blackout). Some companies require directors and officers to obtain pre-clearance for trading, in part to assist in Exchange Act Section 16 compliance. These policies sometimes require approval of 10b5-1 plans by officers and directors and prohibit officers and directors from adopting 10b5-1 plans while in possession of MNPI, often restricting their adoption to open trading window periods.

In light of these amendments, public companies may want to consider taking the following actions:

-

Now that insider trading policies for the first time will be required to be publicly disclosed, companies should review and, as and to the extent necessary, amend existing insider trading policies, including:

-

Imposition of pre-approval requirements for trades and adoption of 10b5-1 plans;

-

Notification requirements for plan modifications and terminations;

-

Ensure that 10b5-1 plans adopted by directors and officers comply with the new requirements of the rules, such as the required cooling-off periods, limitations on overlapping plans, restrictions on the number of single-trade plans and modification or termination of plans; and

-

Given the SEC’s treatment of gifts, ensure that they are covered by the plan’s pre-approval and notification requirements and determine whether they are going to be subject to the plan’s “blackout” or “window” periods.

-

-

Review existing 10b5-1 plans of insiders and other employees, and confirm that the company is aware of all such plans.

-

Advise persons with existing 10b5-1 plans that any modification or termination that occurs on or after Feb. 27, 2023 will be subject to the new rules. In some cases, it might be prudent to enter into new 10b5-1 plans prior to the effective date.

-

Adopt or amend, as necessary, disclosure controls and procedures and adequate reporting systems to capture and report information now required to be disclosed on a timely basis to individuals responsible for insider trading policy compliance as well as public reporting. This includes:

-

Quarterly information from insiders regarding adoption, modification, or termination of 10b5-1 plans; consider an initial confirmation (or question in the annual D&O questionnaire, assuming the timing works) addressing whether directors and officers have adopted any 10b5-1 plans, and reminding them to inform appropriate company personnel if such a plan is adopted going forward.

-

Information on gifts that now are required to be reported on Form 4 — requirements related to gifts under existing insider trading policies should be evaluated in light of the SEC’s cautionary guidance and their increased visibility under the new Form 4 two-business day reporting requirement.

-

-

Consider training for directors and officers regarding the new rules, changes in trading policies and applicable standards of compliance to highlight the changes, including how the new rules for reporting gifts and SEC guidance, might affect charitable giving plans.

-

Update the board and/or the appropriate committee on additional disclosure requirements with respect to granting of Option Awards and other similar compensation, and adopt (or modify existing) Option Award policies and procedures to address the timing of grants in relation to SEC filings and other events. Companies should be mindful that the disclosures connecting Option Awards to the release of MNPI may suggest causal links between the two when none in fact exists and, therefore, focus greater attention on companies’ Option Award timing. The required disclosure’s focus on percentage of stock price movements between the day before and the day after the release of the MNPI lacks the context of other relevant factors, such as stock price movements in the broader market. Depending upon the “optics” of the disclosures, companies should consider some supplemental disclosures to avoid the impression that Option Awards have been “spring loaded” (awarded in advance of the release of positive MNPI) or there has been “bullet-dodging” (delayed until after the release of negative MNPI).

Note that certain of the new 10b5-1 related disclosures included in periodic reports will now also be subject to the certifications required by Section 302 of the Sarbanes-Oxley Act of 2002. Those certifications require CEOs and CFOs to certify, among other things, that based on their knowledge, the form they have signed does not contain untrue statements of material facts or omit to state material facts necessary to make the statements made, in light of the circumstances under which such statements were made, not misleading with respect to the periods covered by the reports. As a result, these executives may have additional liability under Exchange Act Rule 13a-14, which provides the SEC with a cause of action against CEOs and CFOs who make false certifications.

FOOTNOTES

1 See Exchange Act Release No. 96492 (Dec. 14, 2022).

2 Rule 10b5-1 plans that are in effect on the effective date of the new rules will be entitled to the benefit of grandfathering and, accordingly, will not need to be amended to comply with the new rules. However, under the rule amendments, if a grandfathered plan is modified or amended in a manner that changes the amount, price or timing of transactions under the plan, the existing plan will effectively be deemed to be terminated and replaced with a new plan, with further trading under the plan having to comply with the new rules.

3 SRCs must comply with the additional disclosure requirements in the first filing that covers the first full fiscal period that begins on or after Oct. 1, 2023 — so, compliance begins for most SRCs with the Annual Report on Form 10-K for the 2023 fiscal year.

4 For purposes of all amendments to Rule 10b5-1 and most of the new disclosure requirements, “officers” means officers who would be subject to Exchange Act Section 16 and are required (or, in the case of foreign private issuers, would be required but for the exemption from Section 16) to file Forms 4 and 5.

5 Unlike the other changes to Rule 10b5-1 adopted by the SEC, this “acting in good faith” condition also applies to companies.

6 The SEC codified its prior guidance that a modification or change to the amount, price or timing of the purchase or sale of securities (or a formula or algorithm that determines such parameters) qualifies as a termination of the plan and the concurrent adoption of a new plan. Under the new rules, such a modification or change will therefore trigger a fresh cooling-off period.

7 Earnings releases that are furnished on Form 8-K do not count as disclosure of financial results for this purpose. This means that the cooling-off period can be extended beyond 90 days, especially for 10b5-1 plans adopted early in a quarter or during the fourth quarter. In the latter case, the cooling-off period may not end until two business days after the filing of the Form 10-K (or 20-F for foreign private issuers), even if the company otherwise opens its trading window after the fourth quarter earnings release has been issued and before the Form 10-K is filed.

8 The SEC declined to extend this exception to include plans covering sales incident to the exercise of option awards because generally the exercise of an option, unlike the vesting of compensatory awards, occurs at the discretion of the insider. “Sell-to-cover” Rule 10b5-1 plans designed to raise cash sufficient to meet tax withholding obligations incident to option exercises cannot, therefore, co-exist with a separate, price-driven Rule 10b5-1 plan, but “sell-to-cover” instructions for option exercises can be combined with price-driven instructions in a single Rule 10b5-1 plan.

9 A “Non-Rule 10b5-1 Trading Arrangement” is a written arrangement for trading in securities, adopted at a time when the individual adopting the arrangement asserts that he or she was not aware of MNPI about the security or issuer, that: (a) specified the amount of securities to be bought or sold as well as the price and date on which they were to be bought or sold, (b) included a written formula or algorithm for determining the amount of securities to be bought and sold and the price at which to buy or sell, or (c) does not allow the individual to otherwise influence the transaction. The SEC explained that the “Non-Rule 10b5-1 Trading Arrangement” disclosure requirements are designed to limit the ability of directors and officers to avoid the disclosure obligations of Rule 10b5-1 plans by asserting defenses to liability under Section 10(b) pursuant to plans that do not fully satisfy the Rule, as amended.

10 The rule requires a domestic issuer to include the new disclosure in both its annual report and proxy statement; however, General Instruction G to Form 10-K allows this disclosure to be incorporated by reference into the Form 10-K from the definitive proxy statement filed within 120 days after the end of the fiscal year.

11 If all of the company’s insider trading policies and procedures are included in its code of ethics (Item 406(b) of Regulation S-K) and the code of ethics is filed as an exhibit pursuant to Regulation S-K 406(c), that would satisfy the new exhibit requirement. Website posting, however, will not satisfy the requirement.

12 A company that is an SRC or an EGC may limit the disclosures in the table to its PEO, the two most highly compensated executive officers other than the PEO who were serving as executive officers at the end of the last completed fiscal year, and up to two additional individuals who would have been the most highly compensated but for the fact that the individual was not serving as an executive officer at the end of the last completed fiscal year.

/>i

/>i