While Congress is busy debating changes to federal tax law, the IRS continues to operate on the basis of existing provisions. Over the last week, a number of updates have been issued by the IRS regarding inflation adjustments. Below is a summary of the recent announcements for calendar year 2022.

INCOME TAXATION

On November 10, 2021, the Internal Revenue Service announced the annual inflation adjustments applicable to income tax filers for tax year 2022. While the details regarding the more than 60 tax provisions impacted can be seen at Prev. Proc 2021-45, we highlight some of the key changes below:

Tax Brackets[1]

Basic Standard Deduction

An extra deduction is available if you’re 65 or over or blind. For single or head-of-household filers, the additional standard deduction for 2022 is $1,750 (up from $1,700 in 2021). For married taxpayers 65 or over or blind, an additional $1,400 is available in 2022 (up from $1,350 in 2021). For anyone who is both blind and at least 65, the additional deduction amount is doubled.

Alternative Minimum Tax

The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out when taxpayer income reaches $539,900. The exemption for married couples filing jointly is $118,100 and begins to phase out at $1,079,800. The 2021 exemption amount was $73,600 and began to phase out at $523,600 ($114,600 for married couples filing jointly for whom the exemption began to phase out at $1,047,200).[2]

ESTATE AND GIFT TAXATION

Estates of decedents who die during 2022 have a basic estate tax exclusion amount of $12,060,000, up from $11,700,000 for estates of decedents who died in 2021.[3]

The annual exclusion for gifts increases to $16,000 for calendar year 2022, up from $15,000 for calendar year 2021.

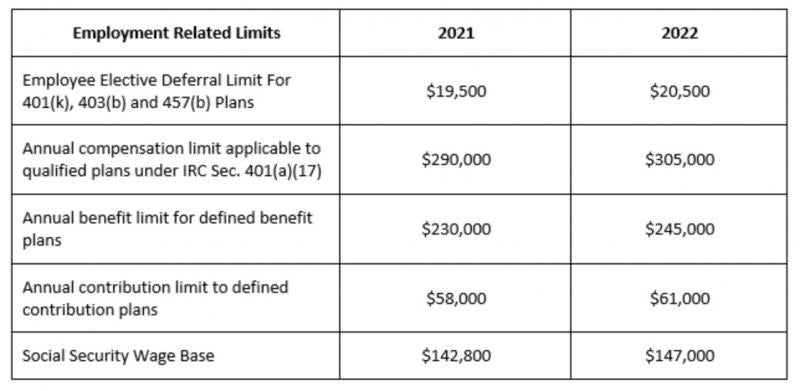

RETIREMENT PLANS

On November 4, 2021, the IRS issued technical guidance regarding all of the cost‑of‑living adjustments affecting dollar limitations for pension plans and other retirement-related items (including Social Security tax limitations). Full details are available at Notice 2021‑61 regarding these changes, with key highlights as follows:

The catch‑up contribution limit for employees aged 50 and over who participate in 401(k), 403(b) and most 457 plans is unchanged at $6,500. Therefore, participants in these plans who are 50 and older can contribute up to $27,000, starting in 2022.

IRAs

The limit on annual contributions to an IRA remains unchanged at $6,000. The IRA catch‑up contribution limit for individuals aged 50 and over is not subject to an annual cost-of-living adjustment and, therefore also remains unchanged at $1,000.

Income limits applicable to ROTH IRA contributions have changed as follows:

While the more favorable tax brackets will automatically be available all taxpayers, planning is required to take advantage of the opportunity to contribute more towards your retirement plans. Increasing contributions can both enhance retirement security and lessen your 2022 income tax obligations.

[1] The tax rate table above does not include proposed modifications under consideration by Congress as of this writing.

[2] Fewer individuals have been subject to this tax since the changes made to the standard and itemized deduction rules implemented as part of the Tax Cut & Jobs Act of 2017. However, this tax could become more relevant in the event of a change to the limitations presently applicable to the State and Local Taxes which are currently capped at $10,000 per year.

[3] The basic exclusion amount applies to the aggregate of both lifetime gifts and bequests at death.

/>i

/>i