On June 29, 2021, the IRS released Notice 2021-41 (the Notice) extending the length of the Continuity Safe Harbor (as defined below) for purposes of claiming the investment tax credit (ITC) or the production tax credit (PTC). Developers and investors seeking ITCs or PTCs for qualifying solar and wind projects have welcomed the relief granted by the Notice, which, coming on the heels of Notice 2020-41 (the Prior Notice, discussed here), is further evidence of the IRS’s sensitivity to developer delays and other disruptions on account of the COVID-19 pandemic.

Background

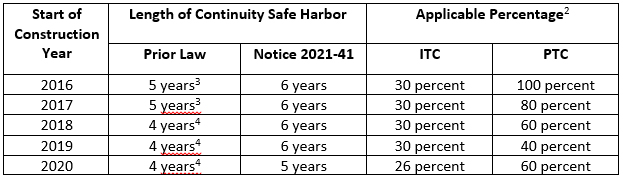

Due to the statutory phasedown of allowable credit percentages under current law, the amount of ITCs or PTCs that a taxpayer may claim with respect to a qualifying solar or wind project depends on the calendar year in which construction of the project is determined to begin for federal income tax purposes. A qualifying solar project is eligible for ITCs equal to a percentage of the tax basis of the energy property placed in service during a particular taxable year. Such percentage generally is based on the calendar year when construction of the project is determined to begin, starting at 30 percent for calendar years prior to 2020, and then moving to 26 percent for calendar years 2020 through 2022 and 22 percent for calendar year 2023. A qualifying wind project generally is eligible for PTCs per kilowatt hour (kWh) of electricity produced by onshore and offshore wind projects for the first ten years after the project is placed in service, also subject to a statutory phasedown based on the calendar year in which construction of the project is determined to begin.1 The maximum credit rate, 1.5 cents per kWh, is adjusted annually for inflation. We discussed the allowable ITC and PTC percentages, including certain changes under the Consolidated Appropriations Act, 2021 (the 2021 Act), in a previous article.

A taxpayer may establish that construction has begun on a qualifying solar or wind project in a particular calendar year by demonstrating that physical work of a significant nature has occurred (the Physical Work Test) or, under a safe harbor, by demonstrating that five percent or more of the total cost of the project has been incurred (the Five Percent Safe Harbor), in each case, during such calendar year.

In addition, the taxpayer must establish that, once construction is determined to begin for a qualifying solar or wind project, construction continues until the project is placed into service (the Continuity Requirement). A project satisfying the Physical Work Test will satisfy the Continuity Requirement if, after physical work of a significant nature has begun, construction of the project is continuous until completion (the Continuous Construction Test). By contrast, for projects satisfying the Five Percent Safe Harbor, continuous efforts, rather than continuous construction, are required until the project is completed (the Continuous Effort Requirement). A taxpayer is required to establish that the Continuous Construction Test or the Continuous Effort Requirement, as the case may be, has been satisfied based on all of the relevant facts and circumstances.

Prior IRS guidance provided a safe harbor (the Continuity Safe Harbor) for taxpayers seeking to satisfy the Continuity Requirement. Pursuant to this safe harbor, a taxpayer was considered to satisfy the Continuity Requirement if the qualifying solar or wind project was placed into service no more than four (4) calendar years after the calendar year when construction of the project was determined to begin. In June 2020, in response to the COVID-19 pandemic and the resulting contractor, supplier and other delays, the IRS issued the Prior Notice extending the Continuity Safe Harbor from four (4) calendar years to five (5) calendar years for projects that began construction in calendar year 2016 or 2017.

The Notice

Extension of Continuity Safe Harbor

The Notice extends the Continuity Safe Harbor period for solar and wind projects for which construction began in calendar year 2016, 2017, 2018, 2019 or 2020 as follows:

The Notice explains that the Treasury Department and IRS recognize that the COVID-19 pandemic has continued to delay the development of certain solar and wind projects otherwise eligible for ITCs and PTCs, and such delays may adversely affect taxpayers’ ability to place these projects into service in time to qualify for the Continuity Safe Harbor. Importantly, like the Prior Notice, the Notice does not require the taxpayer to provide evidence of, or otherwise assert that, the taxpayer’s ability to satisfy the Continuity Safe Harbor was impacted by the COVID-19 pandemic or any related circumstance.

The Notice will be particularly welcomed by developers and investors with projects underway that are seeking to preserve ITC or PTC eligibility based on start of construction during the highest available credit years (that is, calendar years 2016 through 2019 for the solar ITC and calendar year 2016 for the wind PTC (or ITC in lieu of PTC)).

Clarification Regarding Continuity Requirement

The Notice provides that if a qualifying solar or wind project does not satisfy the Continuity Safe Harbor, the Continuity Requirement will be satisfied if the taxpayer meets either the Continuous Construction Test or the Continuous Efforts Test, regardless of whether the Physical Work Test or Five Percent Safe Harbor initially established the start of construction. The stated purpose of this clarification was, at the request of commenters, to harmonize the methods for satisfying the Continuity Requirement under the Physical Work Test and the Five Percent Safe Harbor. As a practical matter, however, this clarification will allow taxpayers with projects satisfying the Physical Work Test to rely on the Continuous Efforts Test, which is considered to be a broader and less onerous standard than the Continuous Construction Test.

No Private Rulings or Determination Letters

The Notice provides that the IRS will not issue private letter rulings or determination letters regarding the application of the Notice, prior notices concerning the ITC or PTC or the start of construction requirement. The Prior Notice included a similar “no rulings” policy.

1. The taxpayer may elect to claim the ITC in lieu of PTC in connection with a wind project that otherwise qualifies for PTCs.

2. Includes changes to the applicable credit percentages under the 2021 Act.

3. See Notice 2020-41.

4. See Notice 2018-59 (ITC); Notice 2017-4 (PTC).

/>i

/>i