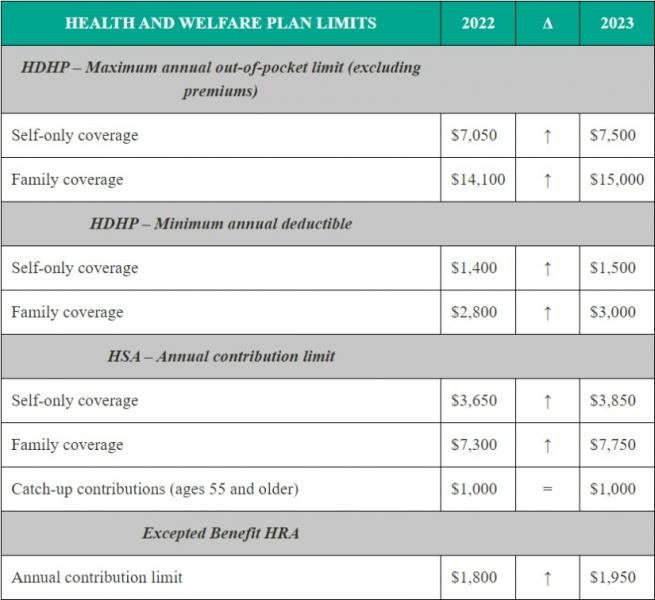

Recently, the Internal Revenue Service (IRS) announced (See Revenue Procedure 2022-24) cost-of-living adjustments to the applicable dollar limits for health savings accounts (HSAs), high-deductible health plans (HDHPs) and excepted benefit health reimbursement arrangements (HRAs) for 2023. All of the dollar limits currently in effect for 2022 will change for 2023, with the exception of one limit. The HSA catch-up contribution for individuals ages 55 and older will not change as it is not subject to cost-of-living adjustments.

The table below compares the applicable dollar limits for HSAs, HDHPs and excepted benefit HRAs for 2022 and 2023.

NEXT STEPS

Plan sponsors should update payroll and plan administration systems for the 2023 cost-of-living adjustments and incorporate the new limits in relevant participant communications, such as open enrollment and communication materials, plan documents and summary plan descriptions.

/>i

/>i