Executive Summary

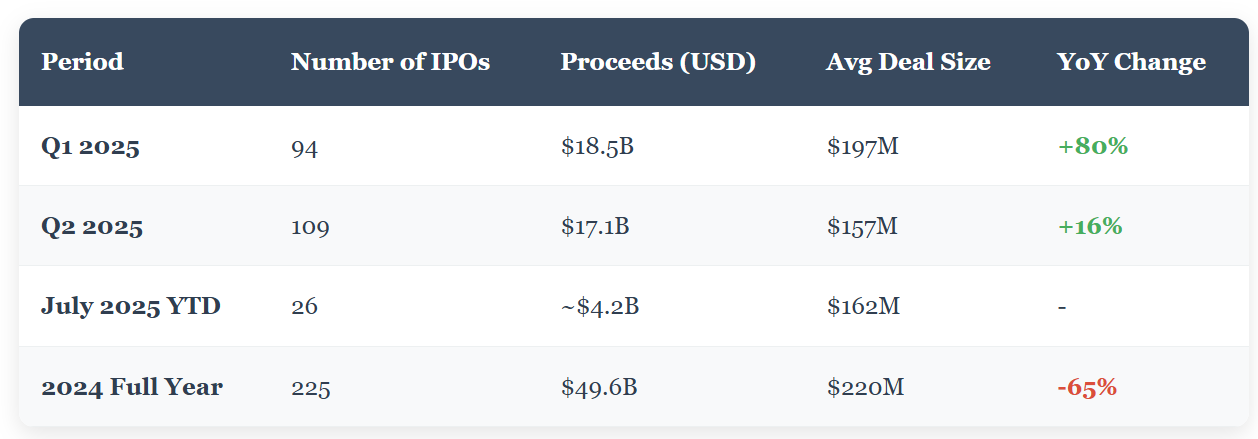

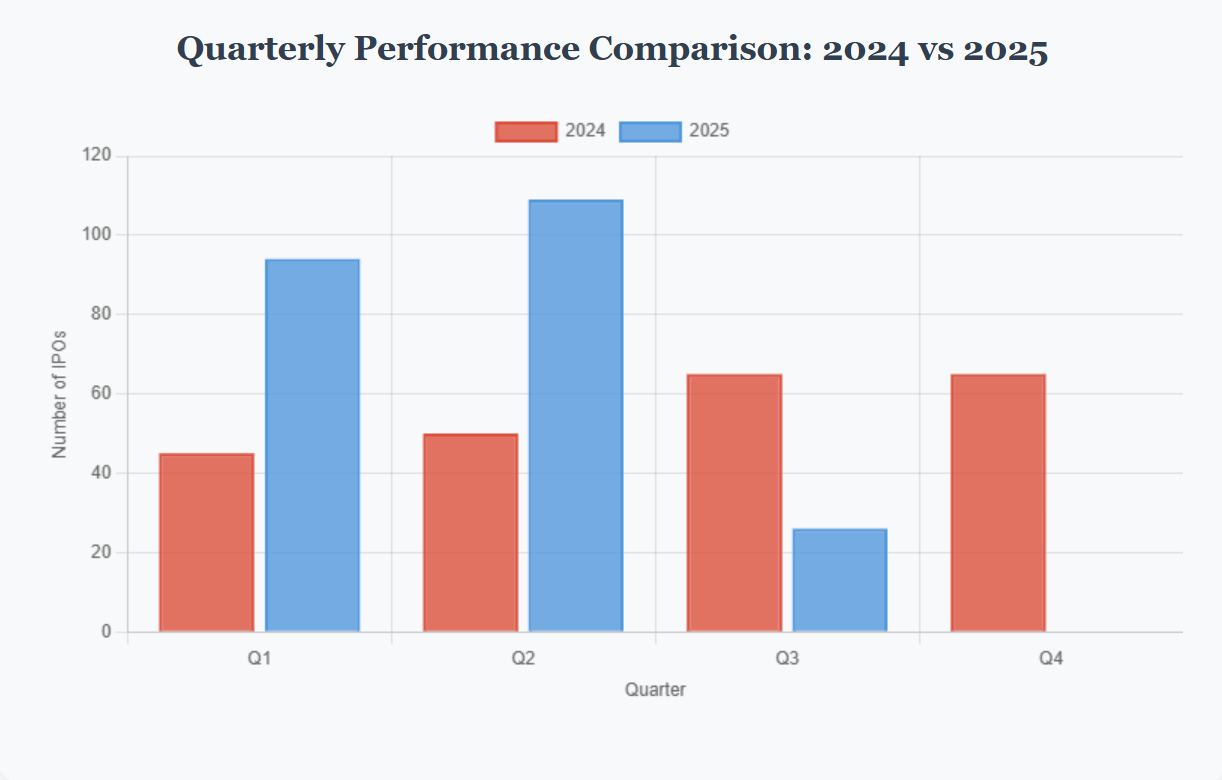

The IPO market is showing encouraging signs of recovery in 2025, with 201 companies going public year-to-date compared to 225 for all of 2024. While deal volumes are increasing and aftermarket performance is strong, average deal sizes remain smaller than historical norms. Key sectors including AI, fintech, crypto, and defense tech are driving investor interest, supported by favorable regulatory and political tailwinds.

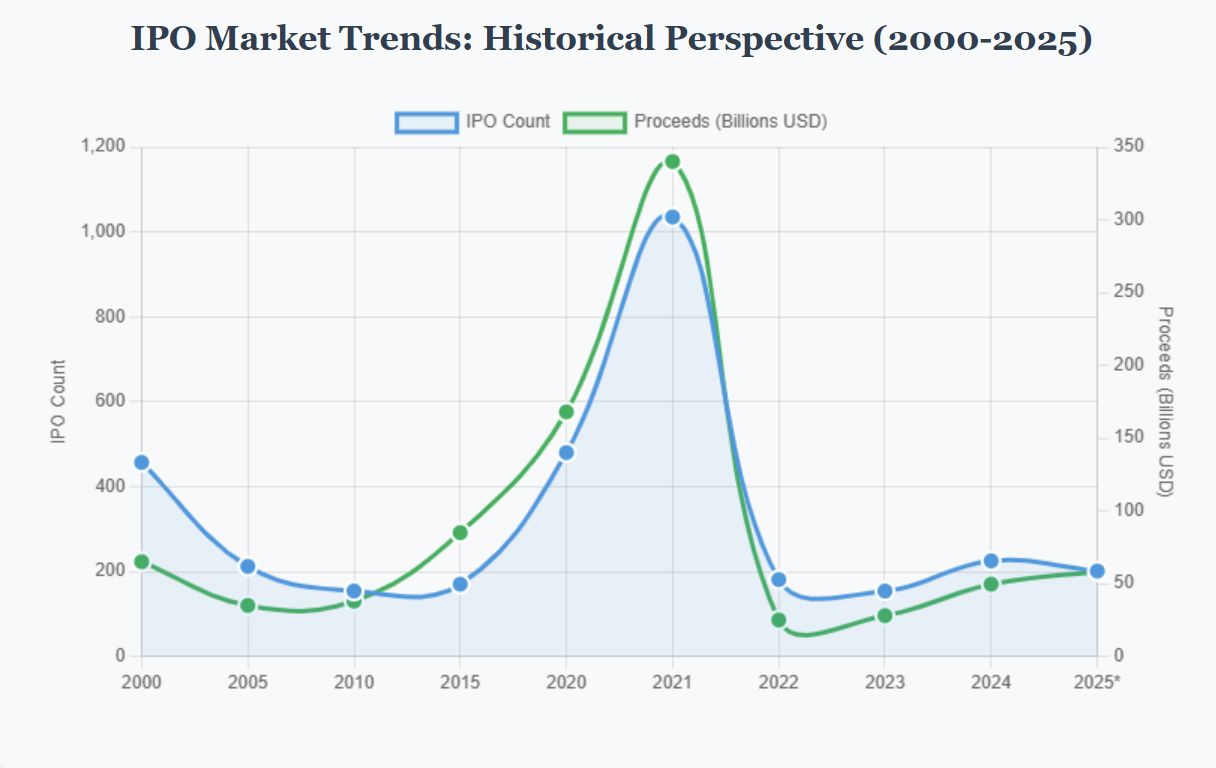

Market Recovery in Historical Context

FIGMA’s spectacular debut exemplifies the potential for exceptional performance when market conditions align. Pricing at $33 per share, opening at $85, and closing its first full day at $115, FIGMA achieved a market cap of $67.6 billion—more than triple Adobe’s blocked $20 billion acquisition offer from 2022. This performance signals that investors remain enthusiastic about high-quality growth companies when the timing is right.

Q2 2025 Performance Analysis

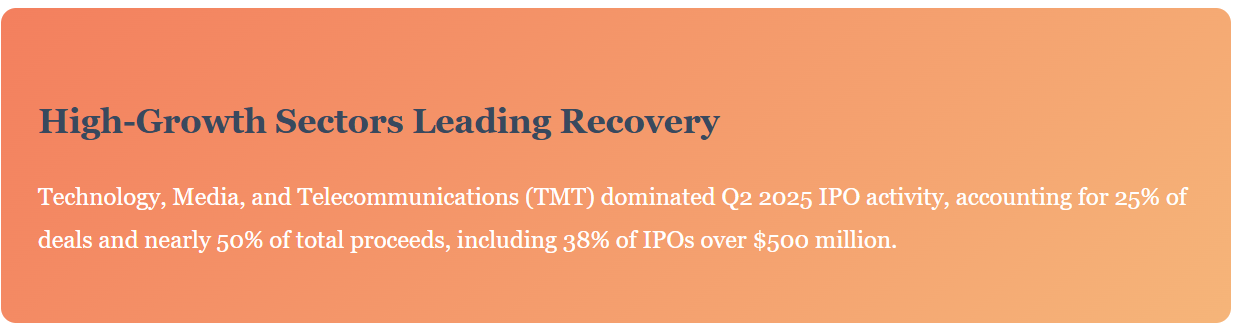

According to EY’s Global IPO Trends report, the U.S. IPO market gained significant momentum in Q2 2025, with 109 companies going public and raising $17.1 billion in proceeds. This represents a 16% increase in deal count compared to Q2 2024, though total proceeds declined by 20%, indicating a shift toward smaller average deal sizes.

Key Q2 2025 Highlights: June proved to be the standout month, accounting for nine of the 16 IPOs that raised over $50 million, including the quarter’s two largest deals. Strong aftermarket performance helped buoy investor confidence heading into Q3, with median first-day returns topping 20%.

PitchBook’s Q2 VC Market Update reinforces these trends, noting that despite initial volatility from Liberation Day tariff announcements, venture exit activity picked up significantly, particularly in fintech. Notable success stories include Coreweave (high-performance cloud computing), which saw its value more than double post-IPO, and Circle Internet Group (USDC stablecoin issuer), which surged more than 5x after its June IPO.

Sector-Specific Trends and Political Tailwinds

PitchBook identifies several sectors particularly well-aligned with current administration priorities that are commanding significant investor attention:

- Artificial Intelligence: Continued momentum from AI infrastructure and application companies

- National Security & Defense Tech: Increased focus on homeland security and defense innovation

- Fintech: Robust activity driven by digital transformation and regulatory clarity

- Cryptocurrency: Favorable crypto legislation boosting sector confidence

- Cloud Computing: Enterprise demand for AI-enabled cloud services

Cross-border IPOs made up two-thirds of U.S. listings in Q2, and investor interest in AI and crypto continues to fuel cautious optimism across the market. Chime Financial’s successful debut, with shares jumping 59% and reaching a valuation exceeding $18 billion, demonstrates continued appetite for well-positioned fintech companies.

Market Challenges and Risk Environment

Despite positive trends, significant challenges remain. PitchBook notes that the current risk environment is complicating company pricing at a time when down-round IPO pricing has become “the norm.” The absence of a surge in new IPOs during Q2 highlights that many startups are still waiting for major macroeconomic questions to be resolved.

Secondary Market Growth: The secondary market has become an essential outlet for investors seeking liquidity, with PitchBook estimating its size between $48.1 billion and $71.5 billion (midpoint ~$60 billion). While significant, this represents less than 2% of total unicorn valuations, highlighting a substantial liquidity gap.

This secondary market size roughly matches Q2’s primary exit value of $67.7 billion, underscoring its growing importance as an alternative path to liquidity, even if it can’t fully satisfy broader market appetite.

Strategic Outlook: H2 2025 and Beyond

Looking ahead to Q3 and beyond, anchored by FIGMA’s early Q3 blowout success, steady progress in the IPO market remains likely. However, uncertainty still looms amid unresolved national and global challenges. With recession concerns continuing to surface, companies must stay agile and prepared to act when windows of opportunity open.

Key Success Factors for H2 2025:

- Market Readiness: Companies should prepare for volatile timing and be ready to move quickly

- Sector Alignment: Focus on politically favored sectors (AI, defense, fintech, crypto)

- Realistic Pricing: Accept that valuations may be lower than peak periods

- Strong Fundamentals: Emphasize profitability path and sustainable growth metrics

- Strategic Flexibility: Consider alternative liquidity options including secondary markets

From my perspective as a Silicon Valley lawyer, we are seeing many clients and prominent private technology companies rushing to prepare for a potential IPO market window in late 2025 and early 2026. The combination of improving market conditions, strong aftermarket performance, and sector-specific tailwinds suggests that well-prepared companies with compelling growth stories may find receptive audiences.

Bottom Line: While we’re not yet seeing a full return to 2021 levels, the IPO market is demonstrating clear signs of stabilization and selective strength. Companies that can navigate the current environment with realistic expectations and strong execution may find significant opportunities in the months ahead.

/>i

/>i