A major disruption to the global economy is coming in the form of a seismic shift in energy markets. Largely driven by energy storage, this disruption will create exciting opportunities for the renewable energy market and will, in our view, drastically change the time of day electricity price curve (that is, the ‘duck curve’).

The increased availability and adoption of battery storage will enable solar energy generators to match for the first time the supply of electricity to the time of customer use, which has historically been the major impediment to the growth of direct renewable electricity supply. In time, the ability for renewable energy to supply generation as needed throughout a 24 hour window has the potential to widen and eventually flatten the electricity price curve, such that the head and the tail will almost be completely “cut off” the duck.

The Duck Curve

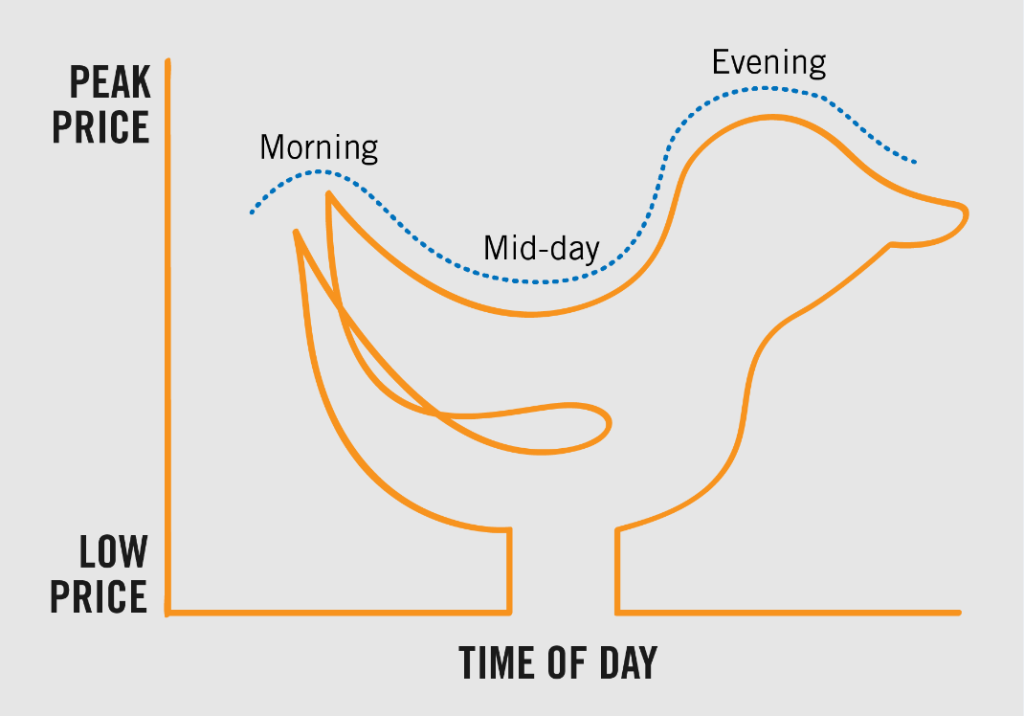

For those wondering if this is an article about the energy market or a recipe for Peking duck, the ‘duck curve’ refers to the graph of the price of electricity across a day, which peaks in the morning (the tail), slumps in the middle of the day (the belly) and peaks again in the early evening (the head). With a bit of creative licence this curve resembles a duck – see Figure 1 below.

Figure 1: traditional intraday energy price curve

The “Fat Duck” – How Solar Generation has Impacted Energy Market Supply to Date

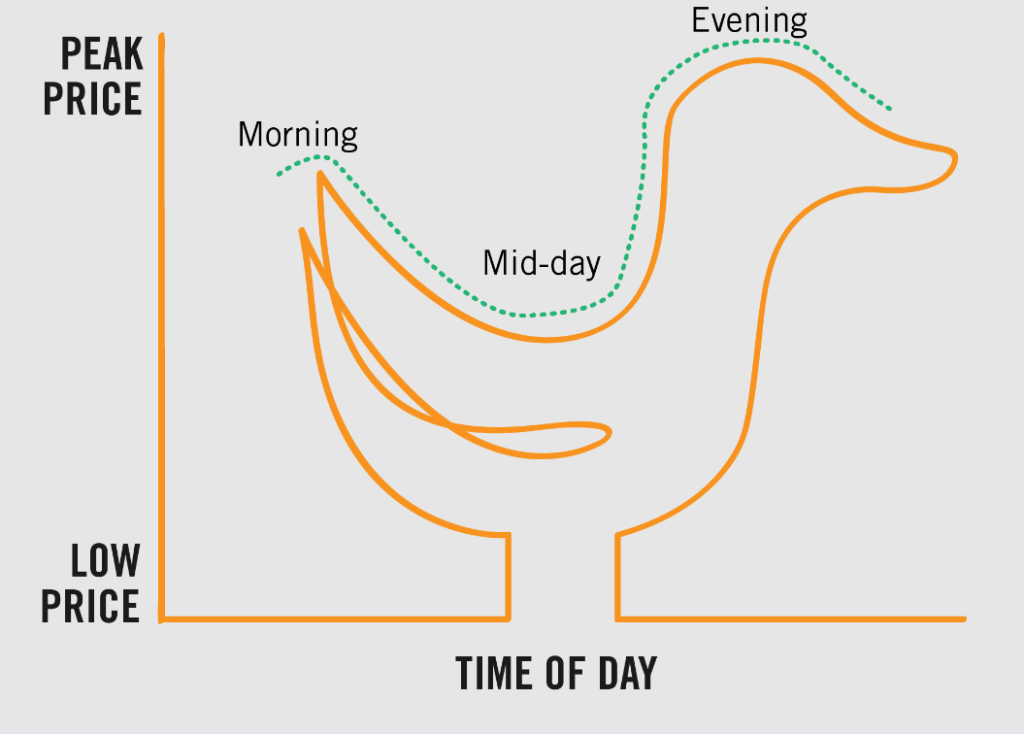

Over the last decade the price of electricity has been falling significantly from mid-morning, bottoming out around 12 noon and then increasing in the early evening. Graphically, this has resulted in the day price energy curve resembling a “fatter” duck, as the duck’s belly has been hanging lower and lower – see Figure 2 below.

Figure 2: the fattening duck

So what is causing this fattening? Mid-day reductions in electricity demand are being driven by the increase in behind the meter solar generation, particularly residential rooftop solar. Macro-economic trends are also reducing commercial and industrial electricity demand as the economy shifts more and more towards a service-based economy from a manufacturing and industrial base.

Meanwhile our lives have become more and more electrified, including through internet usage (data being directly correlated with electricity), the use of electricity for heating and cooling our homes, and the electrification of transportation through the increased adoption of electric vehicles. All of this results in a mismatch between when we need electricity and when it is created.

Battery Storage: The Era of a Fatter, Wider or Even Flat Duck?

Behind the meter battery storage generation is increasing year on year, with continued exponential growth forecast over the next decade and beyond.

In Australia we have been seeing this growth in two key areas.

-

The first is in the context of commercial solar generators, who are increasingly adopting battery storage to:

-

access new customer markets, including those with strict power requirements such as hospitals or data centres, who because of their need for a constant and reliable supply of electricity have not been incentivised to contract directly with renewable energy generators to date, and

-

leverage time of day pricing variation. In particular, we are seeing generators looking to shift the time of day when the energy they produce is dispatched or sold into the electricity market, to a time when market prices have been historically higher. This is referred to as “generation shifting” and is usually focused on moving generation of a solar farm from midday to the evening peak, and generation of a wind farm from overnight to the morning peak.

-

The second key area in which we are seeing growth in battery storage is on a residential scale as:

-

governments support battery storage deployment (for example, the South Australian Government announced at the end of last year that 40,000 homes would be able to access grants and low-interest finance for both battery storage and new rooftop solar installations), and

-

production scale and competition increase.

Both of these trends are resulting in payback periods becoming shorter and shorter.

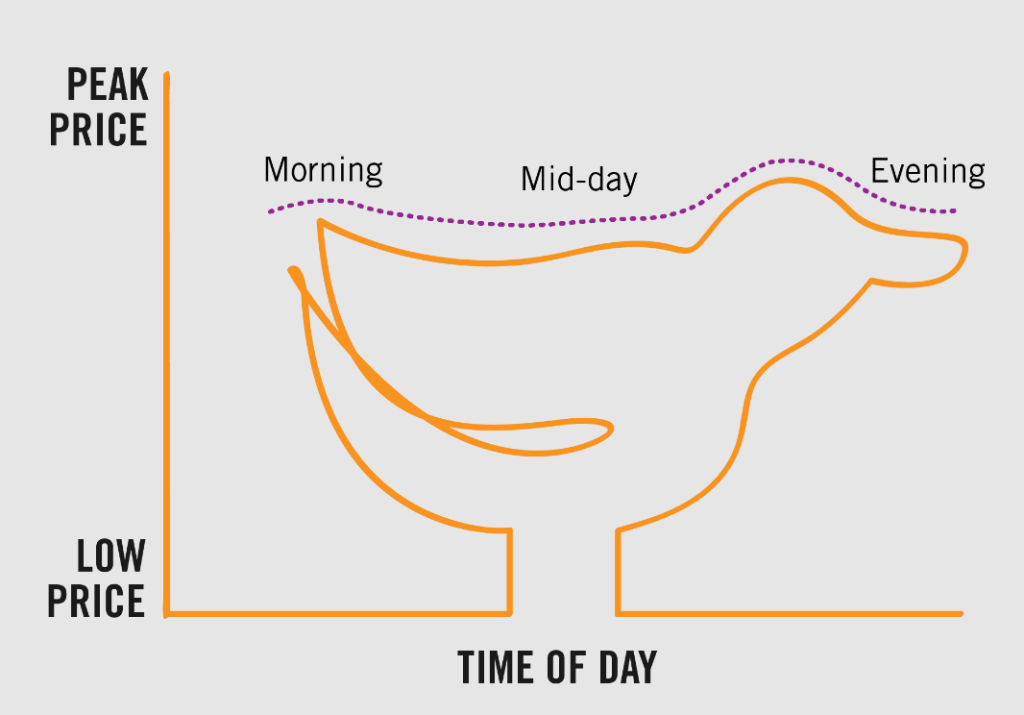

These trends are not unique to Australia, as similar patterns can be observed in other regions. The combined effect of these trends is that peak morning and evening prices are coming down or “flattening”, such that the head and tail of the duck (representing those peak prices) are falling away. Over time, energy storage has the potential to cause an almost flat electricity price curve – see Figure 3 below.

Figure 3: the flattening duck

The Firm Duck: The New Frontier

The ability to balance energy demand and generation resulting from energy storage will allow both electricity price and supply firming like never before.

It is easy to anticipate that this will result in significant changes in the Power Purchase Agreement (PPA) market for derivative or hedge contracts, whose demand and value has blossomed in the market largely due to the dramatic price fluctuation and volatility that has plagued the energy market more generally.

Renewable energy generators who can offer a firm supply of electricity, as a result of being able to store energy and supply electricity not just when the sun is shining or the wind is blowing, will drive the next wave of corporate PPAs.

Energy storage allows generators to supply and customers to purchase green electricity at the time of day and in the quantity the customers require. This opens the renewable energy market to a whole host of new customers with smaller or more stringent power requirements. Examples include hospitals or data centres, which have a need for guaranteed supply and have therefore traditionally required an electricity retailer to “firm” their electricity supply. Large scale energy storage allows customer demand to be matched with generator supply, opening direct contracting of renewable energy to customers who do not have the resources or inclination to manage the timing mismatch between renewable generation and customer electricity demand.

The winners will be the parties that can structure these transactions in a way that efficiently allocates risks to the party most capable of mitigating them, and ultimately make the project investable and bankable.

Furthermore, the energy market is likely to see an increased level of innovation and creative economies. This could include, by way of example, an increase in the PPA price to compensate for the increased value created by the flexibility of energy storage, or contracts for ‘peak only’ energy supply. Bespoke contractual structures are being developed to address specific energy customer requirements, with renewable energy generators being forced to meet the requirements of their customers.

The opportunities afforded by battery storage will only grow as the efficiency of energy storage technology improves (that is, as we see a reduction in the amount of electricity lost or consumed in the process of storing and then releasing electricity), and as the capital cost of energy storage inevitably decreases. This will result in more and more energy storage being deployed and will cause a seismic shift in the electricity market.

As the duck curve goes from fat to flat to firm, electricity generators, retailers and consumers alike will need to hold on tight, or risk falling off the curve entirely.

*no ducks were harmed during the writing of this article.

/>i

/>i