Following public consultation in March 2014, the Financial Services and the Treasury Bureau (FSTB) has now published the “Consultation Conclusions on Open-ended Fund Companies”, and the related Securities and Futures (Amendment) Bill 2016 (Amendment Bill) was gazetted on 15 January 2016.

Currently, an open-ended investment fund may only be established in Hong Kong in the form of a unit trust but not in corporate form (mainly due to various restrictions on capital reduction under the Companies Ordinance (Cap. 622) (CO)). Pursuant to the Amendment Bill, there will be a choice to allow such fund be set out in the form of a company. It is hoped that with the extra option for fund structure, more funds (whether public or private) will choose to domicile in Hong Kong, which will in turn deepen and broaden Hong Kong’s asset management industry.

Key Features of an Open-ended Fund Company

An open-ended fund company (OFC) is an open-ended collective investment scheme, which is structured in corporate form with limited liability and variable share capital.

Similar to a conventional company incorporated under the CO, an OFC will have the following characteristics:

-

it will have separate legal personality and can sue and be sued;

-

it will have a constitutional document known as the “Instrument of Incorporation”;

-

it will be governed by a board of directors who are subject to the same fiduciary duties as directors of a conventional company;

-

the liability of its shareholders will be limited to the amount unpaid on their shares in the company;

-

it could be a publicly or privately offered fund – a “publicly offered fund” is a fund that is offered to the public in Hong Kong and subject to prior authorization of the SFC;

-

it will need to appoint an auditor for each financial year; and

-

it may be wound up, whether solvent or insolvent, by a winding-up process similar to that applicable to conventional companies under the Companies (Winding Up and Miscellaneous Provisions) Ordinance (Cap. 32).

On the other hand, being an investment vehicle, an OFC will have the following additional characteristics:

-

it will not be bound by the usual restrictions on capital reduction under the CO, and will have the flexibility to vary its share capital to meet shareholder subscription and redemption requests;

-

it will not be bound by restrictions on distribution out of share capital, subject to solvency and disclosure requirements;

-

it will not be required to be a licensed corporation under the Securities and Futures Ordinance (Cap. 571) (SFO), but will have to be registered with the Securities and Futures Commission (SFC);

-

it will need to delegate the investment management functions to an investment manager licensed by or registered with the SFC for Type 9 (asset management) regulated activity;

-

it will have to entrust its assets to a separate, independent custodian for safe keeping, segregated from the assets of the investment manager;

-

it may be created as an umbrella fund. That is, the OFC could consist of a number of sub-funds, with each sub-fund having a pool of assets managed in accordance with the investment objectives and policies for that particular sub-fund. A protected cell structure will be made available such that the assets of a sub-fund could not be used to discharge the liabilities of the umbrella OFC or any other sub-fund; and

-

publicly offered OFCs will be allowed to invest in asset classes in accordance with the SFC’s product code requirements and authorisation conditions (i.e. mainly in securities, futures and over-the-counter derivatives) whereas privately offered OFCs should have their investment scope align with Type 9 (asset management) regulated activity, with a 10% de minimus exemption (i.e. a maximum of 10% of the total gross asset value of the fund) for other asset classes; and

-

it could voluntarily terminate for commercial reasons by applying to the SFC for cancellation of registration.

Roles of SFC and the Registrar of Companies

An OFC will be incorporated under the SFO rather than the CO. The SFC will be the primary regulator responsible for the registration and regulation of OFCs under the SFO. The SFC will be empowered by the SFO to make subsidiary legislation and to publish a code or guideline to regulate and provide guidance on the incorporation, management, operation, and business of OFCs.

The Registrar of Companies (CR) will be responsible for the incorporation and administration of statutory corporate filings of OFCs. The CR will keep records of information relating to OFCs and provide the public with services to access the OFC information that it holds.

Major Provisions of the Amendment Bill

The Amendment Bill provides for the broad structure of OFCs in Hong Kong, leaving the more detailed provisions on the creation of, the carrying on of collective investments by, and regulation of, the OFCs in the rules and codes/guidelines to be made by the SFC after further public consultation.

The Amendment Bill consists of 10 divisions as follows:

|

Division 1 |

Preliminary – prohibition of carrying on business as open-ended fund company without registration etc. |

|

Division 2 |

Incorporation, registration, name and registered office of an OFC |

|

Division 3 |

Capacity and powers of an OFC |

|

Division 4 |

Contracts made by or on behalf of an OFC |

|

Division 5 |

Share capital and shareholders’ liability |

|

Division 6 |

Sub-funds and segregated liability |

|

Division 7 |

Directors, investment manager, custodian, sub-custodian and auditor |

|

Division 8 |

Supervision by the SFC |

|

Division 9 |

Empowering SFC to make rules |

|

Division 10 |

Miscellaneous provisions |

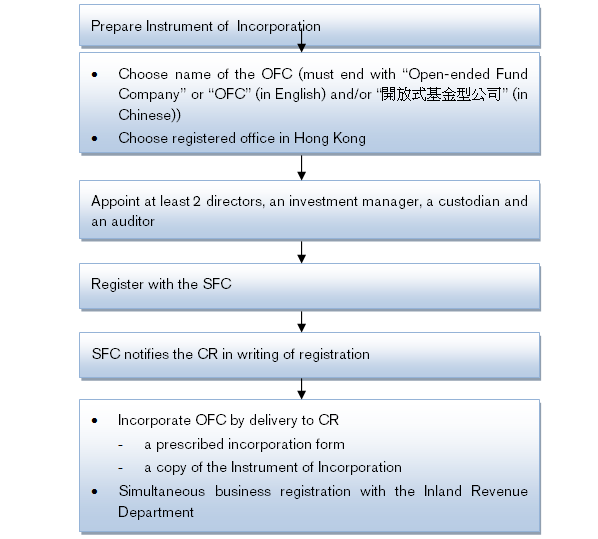

Incorporation procedures for OFCs

The Amendment Bill provides that it is a criminal offence for a person to carry on business as an OFC or hold out as an OFC without registration with the SFC. A person who, without reasonable excuse, contravenes this provision will, on conviction on indictment, be liable to a fine of HK$5 million and to imprisonment for 7 years.

The incorporation procedure for privately offered and publicly offered OFCs is the same under the Amendment Bill. It was envisaged in the initial Consultation Paper that if the shares of an OFC is to be offered to the public, it must seek separate SFC’s authorization under section 104 of the SFO which would be processed concurrently with its application for registration as an OFC.

Qualifications of persons managing an OFC and its assets

-

It is a requirement that an OFC should have at least two directors who must not be a body corporate or adjudged bankrupt, and must have attained the age of 18.

-

The day-to-day investment management functions of an OFC must be delegated to an investment manager licensed or registered with the SFC to carry out Type 9 (asset management) regulated activity.

-

An OFC must entrust all of its assets to a custodian for safekeeping. An overseas custodian is allowed provided that it meets certain eligibility requirements. A custodian must take reasonable care, skill and diligence to ensure the safekeeping of the assets entrusted to it.

-

Each of a director, investment manager and custodian is a “specified officer” under the Amendment Bill. It is expressly stated that a provision in the Instrument of Incorporation of, or a contract made or executed by, an OFC, that purports to exempt a specified officer from any liability that would otherwise attach to the officer in connection with the officer’s misconduct, will be void. In addition, any provision pursuant to which the OFC directly or indirectly provides an indemnity for a specified officer against any of the officer’s liability in connection with misconduct will also be void. “Misconduct” means negligence, default, breach of duty or breach of trust on the part of a specified officer in the course of performing his/her/its duties as the specified officer in relation to the OFC. The Court of First Instance may grant relief from liability for misconduct on specified grounds.

-

The SFC has wide power to make rules (OFC Rules) to provide for:

Supervision by the SFC

(a) the carrying on of collective investments by means of OFCs; and

(b) the regulation of OFCs.

The OFC Rules may:

(i) make it an offence for a person to do, or omit to do, any specified act; and

(ii) provide that the offence is punishable by a fine, imprisonment or both (subject to limits set out in the Amendment Bill).

The SFC is also empowered to make codes or guidelines to provide guidance relating to incorporation, registration, management, operation and business of the OFCs. While such codes or guidelines are not subsidiary legislation, they are admissible in evidence, and could be taken into account in determining a question arising in, any court proceedings.

-

The SFC also has the power to make the following directions:

(a) a direction to OFC or its investment manager that the company is to cease to issue or redeem shares (or any class of shares) in the OFC; and

(b) a direction to a director of the OFC that the director is to cease to transfer shares (or any class of shares) in the OFC to or from, or to and from, the director’s own holding of shares,

if it appears to SFC that:

(i) any of the registration requirements for the OFC is no longer met;

(ii) any of the OFC, its director, investment manager, custodian or sub-custodian has contravened any of the provisions of the Amendment Bill, any notice/requirement given or made by the SFC or any condition imposed on registration of the OFC;

(iii) any of the persons in (ii) above has, in purported compliance with any of the provisions of the Amendment Bill, any notice/requirement given or made by the SFC or any condition imposed on registration of the OFC, knowingly or recklessly provided to the SFC any information that is false or misleading in a material particular;

(iv) an investment manager of the OFC has contravened any of the terms and conditions of its licence or registration under the SFO, or in purported compliance with any such terms and conditions, knowingly or recklessly provided to the SFC any information that is false or misleading in a material particular; or

(v) it is desirable to do so in order to protect the interest of the investing public.

Cancellation of registration and winding up

Subject to certain exceptions, the SFC must cancel the registration of an OFC on an application made by the OFC in accordance with OFC Rules. The SFC may also cancel the registration of an OFC in specified circumstances including (i) breach of provisions of the Amendment Bill by the OFC, its director, investment manager, custodian or sub-custodian, (ii) the SFC not being satisfied that the continued registration of the OFC is in the interest of the investing public, and (iii) an order for winding up of the OFC having been made by court under the OFC Rules. On cancellation of the registration of an OFC, the SFC:

(a) must, as soon as reasonably practicable notify the CR in writing of the cancellation; and

(b) may publish notice of the cancellation and the reasons for the cancellation in any manner that it considers appropriate.

The SFC may permit an OFC to carry on “essential business operations” (i.e. business operations that are essential for closing down its business) after cancellation of its registration.

While SFC’s approval is required for the streamlined termination of registration described above, its approval is not required in the case of a winding up of an OFC. It is anticipated the winding up rules to be devised in the OFC Rules will follow closely those applicable to conventional companies in the Companies (Winding Up and Miscellaneous Provisions) Ordinance.

The Amendment Bill makes it a criminal offence for an OFC (and every person who is knowingly a party to) carrying on its business:

(a) with intent to defraud creditors of the OFC or creditors of any other person; or

(b) for any fraudulent purpose.

A person who commits an offence of fraudulent trading is liable for maximum fine of HK$10 million and imprisonment for 10 years. This provision applies whether or not the OFC has been, or is in the course of being, wound up.

Others

The Amendment Bill will also amend certain other Ordinances including:

(a) Business Registration Ordinance (Cap. 310) – to cater for simultaneous business registration applications of OFCs and related matters;

(b) Stamp Duty Ordinance (Cap. 117) – to provide for exemption of stamp duty in respect of allotment or redemption of shares in an OFC; and

(c) Contracts (Rights of Third Parties) Ordinance (Cap. 623) – to exclude the Instrument of Incorporation of an OFC from the application of that Ordinance.

Next Step

The Amendment Bill will be introduced into the Legislative Council for first reading on 27 January 2016. The SFC will conduct a separate public consultation on the draft OFC Rules and the OFC Code setting out more detailed operational requirements.

Copies of the Consultation Conclusions and the Amendment Bill can be downloaded via the links below:

http://www.fstb.gov.hk/fsb/ppr/consult/doc/ofc_conclu_e.pdf

http://www.gld.gov.hk/egazette/pdf/20162002/es3201620022.pdf

/>i

/>i