The Department of Interior (DOI), acting through the Bureau of Energy Management (BOEM), issued a new final rule titled Risk Management and Financial Assurance for OCS Lease and Grant Obligations, which became effective June 29, 2024, requiring oil and gas companies operating on the Outer Continental Shelf (OCS) that are without an investment-grade credit rating to provide supplemental financial assurance to cover the cost of potential decommissioning liabilities, which would equal $6.9 billion in the aggregate.

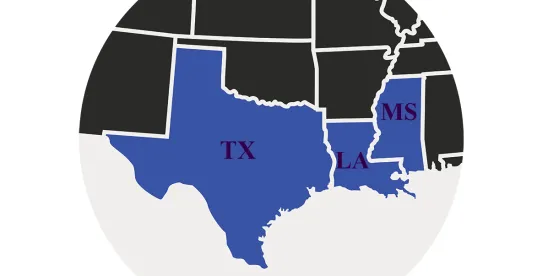

On June 17, 2024, the states of Texas, Louisiana, and Mississippi, along with several oil and gas trade associations (the Plaintiffs), filed suit against BOEM in the Western District of Louisiana challenging this rule. The Plaintiffs are seeking equitable relief from the agency’s action in the form of either a stay of effectiveness of the new regulations or an injunction to prevent the agency from implementing them.

The Plaintiffs claim that the proposed rule would prevent most small and midsize independent oil and gas companies from drilling and producing in the Gulf of Mexico, as they would be unable to obtain the required financial assurances to cover potential decommissioning costs. The credit rating exception essentially exempts major and large independent companies that would be able to continue drilling and producing without issue. The Plaintiffs also claim that small and midsize companies will be unable to satisfy the financial assurance requirements because the surety market has admitted that it cannot provide the required coverages without demanding impossibly high levels of collateral. Surety market availability does not exist for the $6.9 billion in supplemental financial assurance under the new parameters and for types of companies required to obtain them. If these companies cannot comply with the new rule, the DOI could stop those companies from operating and effectively put them out of business, which the Plaintiffs claim would cause a decrease in production of at least 55 million barrels of oil over a 10-year period, loss of employment for thousands of people, and a significant loss of royalties to both the state and federal governments.

The defendants have 90 days from the date of filing to answer the complaint, and in the meantime, the Plaintiffs have filed a Motion for Preliminary Injunction and Motion to Expedite, which will be heard by Judge James D. Cain on October 31, 2024, and if granted would prevent the rule from going into effect.

Should this rule stand, it would have significant impacts on the oil and gas exploration and production industry. Operators in the offshore oil and gas industry will face increased compliance costs due to the need to invest in additional insurance, technology upgrades, and staff training to meet the new regulatory requirements. Smaller operators or those with limited financial resources may find it more challenging to enter or remain in the market, causing the pool of companies able to operate on the OCS to shrink. The companies that are able to comply with the new rule will likely reassess and restructure how risks are allocated in operating agreements to ensure that contractual arrangements effectively address and comply with the regulatory framework while balancing operational and financial considerations.

Potential liabilities arising out of abandonment and decommissioning costs will be more significant, and consequently, operators will likely attempt to shift and share those risks among working interest owners. Additionally, it is likely that BOEM will enforce stricter environmental and safety standards, and operating agreements will need to reflect enhanced regulatory requirements to ensure compliance with BOEM’s standards for risk management and environmental protection. Contractual provisions related to liability and indemnity, which are always fiercely negotiated, will likely become more comprehensive, as parties will seek to allocate risks associated with regulatory compliance, environmental damages, and operational safety in a more structured manner and might attempt to establish mechanisms and penalties for noncompliance. Operators will also need to ensure flexibility and adaptability in their agreements to address future changes or revisions to BOEM’s rules.

/>i

/>i