House Democrats today released their long-awaited package of clean energy tax incentives, the Growing Renewable Energy and Efficiency Now (GREEN) Act. In a release accompanying the legislative text and section-by-section summary, Ways and Means Select Revenue Subcommittee Chairman Mike Thompson (D-CA) called it a “comprehensive approach to addressing the threat of climate change through our tax code.” Full committee Chairman Richie Neal (D-MA) applauded Thompson’s “framework,” stating that they “look forward to hearing from stakeholders to ensure this bill is effective in helping improve energy efficiency and eliminating carbon emissions.”

What’s In It?

While the draft is divided into seven sections, the majority of the action falls into three categories: renewable energy production and storage, energy efficiency, and electric vehicles. Some of these provisions renew and otherwise modify extenders themselves; others are pegged to finite quotas that require adjustment; and a few are entirely new incentives meant to spur energy innovation.

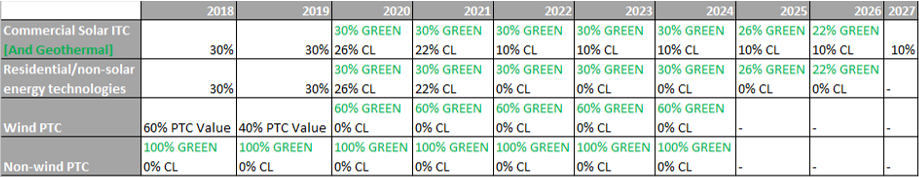

Generally speaking, the draft provides a five-year prospective extension for expiring energy provisions ranging from investment tax credits under Sections 48 and 25D, respectively, and production tax credits for wind (at the reduced 60 percent phase-down rate) and other eligible technologies under Section 45, to enhanced and reformed energy efficiency incentives for residential property (Section 25C), new homes (Section 45L), and commercial buildings (179D) to fuel cell electric vehicles under Section 30B and alternative vehicle refueling infrastructure under 30C.

Aside from straight extensions, the draft would expand ITC eligibility to energy storage, waste energy, biogas, and linear generators, while harmonizing geothermal with solar. It would push out the start construction deadline for offshore wind projects electing ITC through 2024. It would expand the publicly-traded partnership (PTP) structure to green energy, including PTC/ITC-eligible technologies, renewable fuels, and carbon capture projects under Section 45Q. It would create new credits for working families purchasing used EVs, and for manufacturers producing buses and heavy-duty EVs. The GREEN Act would create a new pool of $1 billion in environmental justice tax credits for qualifying EJ academic programs; and it would require the Secretary of Treasury to use EPA data on greenhouse gas emissions to determine GHG emissions by each taxpayer for purposes of imposing a carbon tax.

Parenthetically, however, the most important elements of this bill are the ones that are in the mix to ride on an end of year tax package, should one materialize. The through-line among these provisions is urgency—if they don’t happen now, it’s difficult to see when they would have a better chance to move, and regardless, stakeholders will take a hit.

To that end, the inclusion of a long term extension and multi-year phasedown of the biodiesel tax credit could be the most important signal. As a component of the GREEN Act, the future of the biodiesel credit is not just a Grassley priority, or a Hail Mary from a lame duck GOP House, but one that has the broad support of the Democratic caucus, as evidenced by a recent letter to leadership. Nearly two years into its lapse, long-term treatment for BTC won’t be easy to negotiate, but should a bigger deal come together, this draft will have been the breakthrough.

Likewise, at least for the two manufacturers who have exceeded the statutory 200,000 unit cap, the plug-in electric vehicle credit under Section 30D is an urgent end-of-year proposition. The GREEN Act would provide a reduced $7,000 credit for 400,000 additional units, pushing out the effective deadline years into the future. Without such a change by the end of the year, both Tesla and General Motors head into Q1 of next year with a credit to market their EV offerings.

Where is this going?

As you might surmise from the language from the Democratic tax-writers, this is not a package that will move on its own, at least not in the near term. The “discussion draft” tag is deliberate, and is meant to begin a conversation rather than providing the final word. That said, by dropping this draft now, Thompson and Neal accomplish a few things. First, they provided their members, particularly the dozen new faces on the committee, with an opportunity to weigh in under the rubric of one of the party’s biggest priorities. Second, they put out a formal marker on several items that have a chance to be a part of the transaction in any emerging year-end deal, including items of parochial importance to committee members. In doing so, they stand to reinforce the Senate Democratic position in ongoing “Four Corners” discussions, provide a menu of options for , and, perhaps, add a bit of grease to the slow-moving negotiations. And finally, for the vast majority of this package that won’t be in play this year, they have created a process that sets the table for stakeholder engagement and future legislative action.

The Bottom Line

The contours of this package have been clear for some time, and loyal readers will recognize much of this from last month’s update. Nothing in this draft, except perhaps the inclusion of a biodiesel phase-down, comes as much of a surprise. But the timing, along with the fact that Democrats conspicuously omitted any poison pill pay-fors, is reason enough for optimism as it relates to the tax policy endgame. Congress is poised to approve a stop-gap funding measure this week, giving them until December 20th to procrastinate. In the meantime, the trajectory must change for a tax deal to happen. The Four Corners need something to bring the terms of a deal into focus, and Democrats speaking with one voice on their ask—in this case regarding clean energy—will be critical. Perhaps a BTC olive branch could be the good faith catalyst that spurs a needed breakthrough. We’ll know more in the coming days—stay tuned.

/>i

/>i