An Intro to the world of ‘backdoor IPOs’

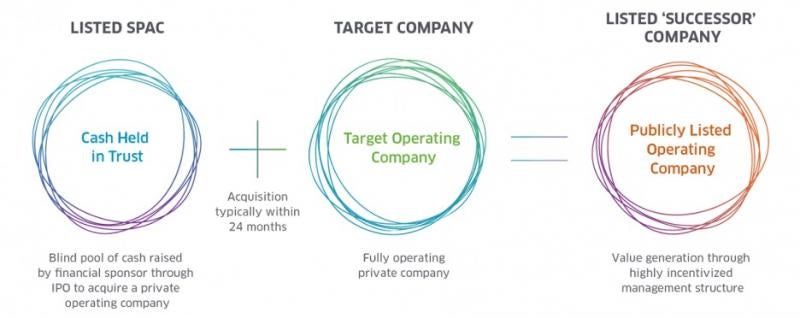

The ‘SPAC’, short for ‘Special Purpose Acquisition Company’ has become ubiquitous in financial markets. SPAC structures have existed since the 1990s but 2020 has been the best year for SPACs in terms of the number of deals and capital raised.[1] SPACs are companies formed to raise capital in an initial public offering (‘IPO’) and they use the IPO proceeds to acquire one or more unspecified businesses or assets to be identified after the IPO.[2] SPACs don’t have any operations and their sole purpose is to raise capital through IPO so that they can acquire an existing target company.

Image Source: NASDAQ

Companies have three ways of going public and raising capital (i) the traditional IPO, (ii) direct listing, and (iii) merger with a public company – in this case, SPACs.[3] The SPAC process is emerging as the preferred way of going public for the following reasons. First, the SPAC process is simpler because the target company looking to go public only negotiates with one investor (i.e., the SPAC sponsors), who have already raised funds.[4] In a traditional IPO, a company would do a roadshow to attract dozens of investors. The investors in turn would have to complete due diligence on the target company. Second, the IPO price in a SPAC transaction is a result of the negotiated price between the target and the SPAC.[5] The traditional IPO price fluctuates based on the demand from investors. Third and relatedly, the IPO price depends on stock market condition and volatility and companies must wait for the right time to go public. This is not the case in a SPAC, as capital has already been raised through the SPAC IPO. This would explain why SPACs were on the rise in 2020 – when markets suffered from high market volatility and economic uncertainties.

Fourth, as compared to traditional IPOs, SPAC IPOs can be considerably quicker (approximately 2 months vs. 6-7 months for a traditional IPO).[6] This is because SPAC financial statements in the IPO registration statement are very short and can be prepared in a matter of weeks (compared to months for an operating business).[7] The merger of the target with the listed SPAC (‘De-SPAC’) involves many of the onerous requirements as would apply to an IPO of the target business.

SPAC structures in India

SPACs cannot be incorporated in India. SPACs may be categorized as a financial services company. Registrar of companies can strike off a company if it does not start operations within one year of incorporation. Further, listing norms in India mandate a track record of profits and net tangible assets.

The International Financial Services Centres Authority has invited comments on draft regulations that would allow setting up SPACs within the GIFT City. The GIFT City SPAC can acquire or merge with an Indian target. Under the framework contemplated, the GIFT City SPAC may get some tax benefits for the acquisition or merger. But the acquisition or merger of the Indian target may be subject to regulatory approvals, including the RBI.

Under the current framework, a SPAC cannot merge with an Indian target. Ordinarily, the Indian target would first have to be re-domiciled outside India. Alternatively, dealmakers interested in an Indian target can merge their foreign SPAC with the Indian company’s foreign holding company. The merger with the foreign target will result in indirect acquisition of shares or voting rights in the foreign target’s direct or indirect subsidiaries in India (‘Target’s Indian Affiliates’). This indirect acquisition of shares or voting rights in the Target’s Indian Affiliates can trigger the requirement of seeking antitrust approvals in India.

In this article, we explore some of the available Indian antitrust exemptions and relaxations to SPAC structures that result in the indirect acquisition of shares or voting rights of the Target’s Indian Affiliates. The article is structured in the following manner.

-

Section III sets out an overview of the merger control regime in India and the merger control notification exemptions relevant to SPAC transactions.

-

Following this, based on some of the commonalities in SPAC transactions, Section IV provides an illustrative list of exemptions from competition law approvals.

-

Finally, for those SPAC transactions that might not meet the exemption cut, read through to Section V. In Section V, we discuss nifty filing relaxations that may make the competition law approval process less onerous.

Overview of Merger Control in India

The Competition Commission of India (‘CCI’) is the agency responsible for enforcement of the Competition Act, 2002 (‘Competition Act’). The CCI assumes jurisdiction over combinations based on jurisdictional thresholds. There are 8 alternate tests prescribed under the Competition Act and related notifications.[8] The tests are based on the value of worldwide and India assets and turnover of the parties and their group. The basic idea behind adoption of jurisdictional thresholds is that the parties (either directly or through their group) must have a significant presence in India. Looked at another way, combinations by parties with non-significant India presence are unlikely to impact competition in India in any market.

Mergers and acquisitions that cross the jurisdictional thresholds set out under Section 5 of the Competition and that do not qualify for any exemptions are considered combinations. Combinations require mandatory CCI approval prior to consummation. Combinations are subject to the standstill provisions of the Competition Act and parties have a suspensory obligation on implementing the combination prior to the CCI approval.

To filter combinations that are unlikely to lessen competition, the CCI and the Ministry of Corporate Affairs have introduced a set of exemptions. As hinted above, the following set of exemptions may be of interest to most SPAC structures.

Small Target Exemption[9]

Mergers and amalgamations where the target either hold assets less than INR 3.5 billion or generates turnover of less than INR 10 billion in India are currently exempt from mandatory CCI notification obligation. Asset acquisitions where the value of the relevant assets being acquired is less than INR 3.5 billion in India or turnover of the business division being acquired is less than INR 10 billion in India also qualify for this exemption.

Minority Acquisition Exemption[10]

The Minority Acquisition Exemption is the most common exemption available to private equity investors. The acquisition of shares, assets or voting rights of an enterprise are exempt if:

-

The acquirer or the group acquire less than 25% of the shares, assets or voting rights in the target; and

-

There is no acquisition of control in the target by the acquirer or acquirer group.

-

The acquisition must be made solely as an investment (i.e., there are no business overlaps between the target and the acquirer making the transaction strategic); and

-

The acquisition of shares or voting rights must be in the ordinary course of business (as opposed to market facing strategic reasons).

In the context of the Competition Act, ‘control’ could be de facto, de jure or material influence. The Competition Act defines it to include controlling the affairs or management by (i) one or more enterprises, either jointly or singly, over another enterprise or group; or (ii) one or more groups, either jointly or singly, over another group or enterprise.[11] Based on past precedent, the CCI has considered affirmative rights such as right to approve business plan, commencement of new business line, closing of existing business line, approval of budget and appointment of key managerial persons as being exemplary of control conferring rights.[12] The CCI in the past has also considered negative control (by virtue of ability to block special resolutions of a company) or operational control (by virtue of commercial cooperation agreements with or without involving equity) as control conferring.

Intra-Group Exemptions[13]

The following two exemptions available to intra-group restructurings.

-

Intra-group Acquisition Exemption: An acquisition of shares or voting rights or assets, by one person or enterprise, of another person or enterprise within the same group, except in cases where the acquired enterprise is jointly controlled by enterprises that are not part of the same group.

-

Intra-group Merger Exemption: A merger or amalgamation of two enterprises where one of the enterprises has more than fifty per cent (50%) shares or voting rights of the other enterprise, and/or merger or amalgamation of enterprises in which more than fifty per cent (50%) shares or voting rights in each of such enterprises are held by enterprise(s) within the same group. Provided that the transaction does not result in transfer from joint control to sole control.

The term ‘Group’ has been defined under the Competition Act to mean two or more enterprises which, directly or indirectly, are able to:

-

exercise 50% or more of the voting rights in the other enterprise or,

-

appoint more than 50% of the members of the board of directors in the other enterprise, or

-

exercises ‘control’ the management or affairs of the other enterprise. Control means controlling ‘affairs or management’ of one or more enterprises, either jointly or singly over another enterprise or group.

Applicability of Exemptions to Multi-Step Combinations

According to the CCI’s interconnection rule, if one or more transactions in a series of transactions are exempt from CCI notification but are interconnected to a notifiable transaction then parties must (i) file a single composite notice to the CCI and (ii) ensure that no transactions (including the exempt steps) are implemented prior to the CCI approval.

To decide on inter-connection, the CCI considers (i) commonality of parties, (ii) simultaneity of the transactions, (iii) whether the transactions are interdependent and (iv) cross-functionality in deal documents or public announcements.

CCI Exemptions Relevant to SPAC Structures

The CCI jurisdictional thresholds seek to capture sizable transactions that lead to the acquisition of control, shares, voting rights, or assets through any type of structure. Units, shares, and warrants are the three types of assets that are associated with the capital that is raised from the SPAC IPO.[14] The CCI filing assessment would be triggered every time any of the assets are likely to be acquired by a party.

As elaborated in the section above, there are some types of combinations that might not be worth the CCI’s time as they are unlikely to cause AAEC. Thus, transactions that meet the criteria for the Minority Acquisition Exemption or the Small Target Exemption do not need CCI approval. However, as we noted, in the case of a multi-step transaction each step must qualify for at least one exemption for the entire transaction to be exempt.

While taking the SPAC public, the sponsors must issue a disclosure statement that a target is yet to be selected. Having a target in sight before the IPO may subject the sponsors to additional disclosures concerning the target; making the listing cumbersome. Arguably, since at the SPAC IPO stage, it is unknown which target(s) the SPAC would acquire (if at all), the SPAC IPO and De-SPAC are two separate transactions and cannot be considered as interconnected.

Since both the SPAC and De-SPAC transactions are multi-step, we look at each step and available exemption or relaxation. The steps are based on an illustrative model we constructed based on commonalities between SPAC transactions.

Transaction 1: SPAC IPO

Step 1: Incorporation of SPAC

At the time of the incorporation of the SPAC, the founder (also called the sponsor) owns founder shares in the SPAC. Currently, SPACs cannot be incorporated in India. Since, the SPAC does not have presence in India, it cannot cross jurisdictional or the Small Target Exemption thresholds..

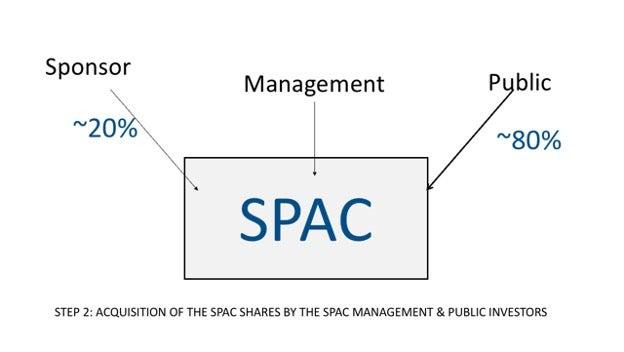

Step 2: Acquisition of SPAC shares by IPO investors and the SPAC management

- The second step involves the SPAC IPO. In this step, the SPAC completes the minimal listing formalities and goes public. At this stage, the SPAC units are offered to the public. Units are comprised of one share of the common stock and a portion of a warrant (or a full warrant) to purchase common stock.[15] The warrant portion is intended to compensate investors for agreeing to have their capital held in the trust account until the SPAC consummates a business combination or liquidates.[16] A whole warrant gives an investor the option to purchase a share of common stock in the future at a fixed strike price (commonly $11.50).[17]

At the end of the IPO, around 20% of the units in the SPAC are owned by the sponsor and management and 80% by the IPO investors.

IPO Investors

The SPAC IPO raises capital through retail investors and institutional investors. From the IPO investors’ perspective, the SPAC is an opportunity to co-invest with successful sponsors.[18] In case the SPAC is unable to acquire the target or if the IPO investor is not happy with the choice of target, their shares are redeemable on a pro-rata portion of the funds held in the SPAC account.[19]

SPAC Management

Directors of the SPAC are selected by the sponsor at IPO, and thereafter additional directors, if necessary, are appointed by the SPAC board.[20] In most instances, a SPAC will not hold a public election for directors until the De-SPAC transaction or thereafter, and some SPACs provide that only the founder shares vote in director elections until the De-SPAC transaction.[21] SPACs may compensate the officers and directors by issuing shares in the SPAC.[22]

The acquisition of shares in the SPAC by the IPO investors and SPAC management would continue to be exempt because the SPAC has no assets or turnover in India.

Transaction 2: De-SPAC

After the IPO, the SPAC will pursue an acquisition opportunity and negotiate a merger or purchase agreement to acquire a business or assets.[23] The IPO proceeds are held in a trust account until released to fund the business combination or used to redeem shares sold in the IPO. Offering expenses, including the up-front portion of the underwriting discount, and a modest amount of working capital will be funded by the sponsor and management team.[24]

Once the target is identified, the SPAC will re-assess its financing needs. Although the capital for the merger with the target has already been raised through the IPO, it may be insufficient to fund the merger with the target.

Step 1: Additional Investments by the Sponsor in the SPAC

If the SPAC needs additional capital to pursue the business combination or pay its other expenses, the sponsor may loan additional funds to the SPAC. Even if the sponsor acquires additional shares in the SPAC through this, the step would be exempt because the SPAC is not present in India.

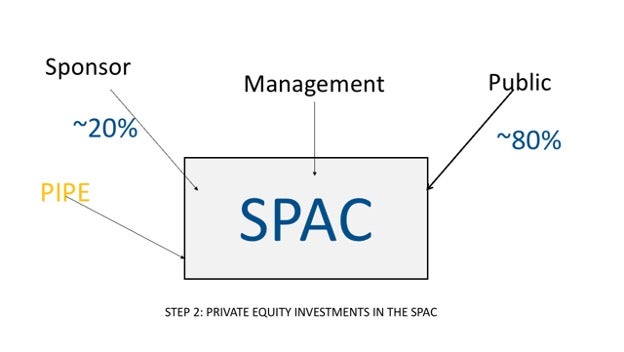

Step 2: Private equity investment in the SPAC

In advance of signing an acquisition agreement, the SPAC will often arrange committed debt or equity financing, such as private investment in public equity (‘PIPE’) commitment, to finance a portion of the purchase price for the business combination and thereafter publicly announce both the acquisition agreement and the committed financing.

Even if the PIPE acquires shares control, shares, voting rights, or assets in the SPAC in exchange for the investment, this step would be exempt because the SPAC has no assets or turnover in India.

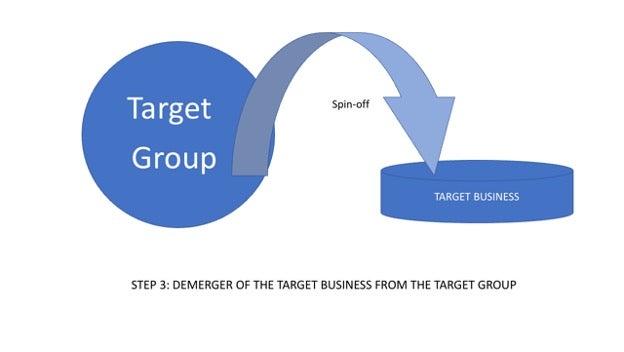

Step 3: Spin-off of the Target Business

If the target business is not already assimilated within one legal entity, an additional spin-off step might be involved.

As mentioned above, the SPAC cannot merge with an Indian target. However, the merger with the foreign target may also result in indirect acquisition of shares or voting rights in the Target’s Indian Affiliates. Should this happen, the target’s worldwide and India assets and turnover (through the Target’s Indian Affiliates i.e., direct or indirect subsidiaries) may breach the CCI jurisdictional thresholds. The De-SPAC Transaction would require CCI approval, unless all the steps are exempt. We discuss the relevant exemptions for each step.

As explained in the previous section, the intra-group restructuring may benefit from the intra-group exemption. This step would be considered as an intra-group restructuring if (i) any acquisition of shares, assets, or voting rights to effectuate the de-merger is undertaken by group entities and (ii) the transaction does not lead to a joint to sole control.

Step 4: SPAC merges with the Target

Following the announcement of the signing, the SPAC will undertake a mandatory shareholder vote or tender offer process, in either case offering the public investors the right to return their public shares to the SPAC in exchange for an amount of cash roughly equal to the IPO price paid.[25] If the business combination is approved by the shareholders (if required) and the financing and other conditions specified in the acquisition agreement are satisfied, the merger will be consummated, and the SPAC and the target business will combine into a publicly-traded operating company.

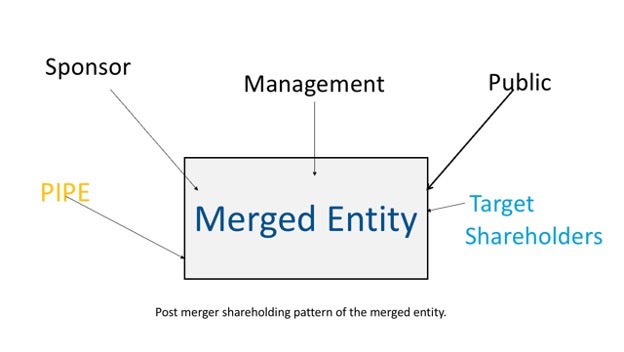

Step 4 (i.e., the merger) typically results in the acquisition of shares in the merged entity by the following entities: (i) sponsors, (ii) retail & institutional investors, (iv) PIPE investors, (v) shareholders of the target, and (iv) the management of the merged entity to the extent they are compensated through shares. The India leg may be triggered if the merger also results in direct or indirect acquisition of the shares or voting rights in the Target’s Indian Affiliates.

Scenario A: Merged Entity qualifies for the Small Target Exemption

If the value of the merged entity does not exceed either INR 350 crores (in assets) or INR 1000 crores (in turnover) in India (either directly or indirectly) in the financial year preceding the transaction, then this step would also qualify for the Small Target Exemption. Should this happen, the last step of the De-SPAC would also be exempt. This implies that the entire De-SPAC transaction would also be exempt from the CCI approval requirement.

Scenario B: Merged Entity does not qualify for the Small Target Exemption

Since the target would likely have existing business operations in India through direct or indirect subsidiaries, the Small Target Exemption may not always apply to Step 4. The assessment of shares or voting rights acquired would take place at the direct target level (i.e., the foreign merged entity), even though the jurisdictional thresholds are breached because of the Target’s Indian Affiliates.

As a next step, we can assess if the Minority Shareholding Exemption is available to Step 4. Although the CCI makes this determination on a case-by-case basis, the simultaneous investment in the merged entity may be construed by the CCI as interconnected. This means that each of the acquisitions by the (i) sponsors, (ii) retail & institutional investors, (iv) PIPE investors, (v) shareholders of the target, and (iv) the management of the merged entity (to the extent they are compensated through shares in the merged entity) must qualify for an exemption for Step 4 to be exempt.

The Minority Acquisition Exemption may be available to the retail and institutional investors provided they meet the following criteria:

-

The acquirer or the group acquire less than 25% of the shares, assets or voting rights in the target; and

-

There is no acquisition of control in the target by the acquirer or acquirer group (as per the criteria discussed above).

-

The acquisition must be made solely as an investment (i.e., there are no business overlaps between the target and the acquirer making the transaction strategic); and

-

The acquisition of shares or voting rights must be in the ordinary course of business (as opposed to market facing strategic reasons).

That said, the Minority Acquisition Exemption is unlikely to be available to the Sponsors, SPAC management (to the extent they are compensated through shares in the merged entity), shareholders of the target, and PIPE investors. To secure their investment or ability to manage the merged entity, the aforementioned classes of shareholders may acquire the type of shares, assets, or voting rights in the merged entity that may disqualify them from the Minority Acquisition Exemption. For instance -:

-

In most cases, majority shareholders of the target participate in a share-swap and acquire proportional control-conferring rights in the merged entity.

-

PIPE investors or Sponsors may also acquire affirmative voting rights to protect their investment.

In this case, Step 4 is unlikely to qualify for the Minority Acquisition Exemption. Since step 4 of the multi-step De-SPAC transaction is notifiable, the entire transaction is notifiable. Notifiable De-SPAC transactions may benefit from some relaxations in the CCI notification requirements. We discuss this in the next section.

CCI Relaxations Relevant to SPAC Structures

In the previous section, we saw that in some cases the De-SPAC transaction may be notifiable to the CCI. In this section we consider the CCI filing requirements and discuss applicable CCI process relaxations. First, we start by understanding the process that kicks in once the determination on seeking CCI approval is made. As mentioned in Section III, there is a standstill obligation on all the steps of the De-SPAC transaction (even the exempt steps). This would continue till the CCI approval comes through.

To start the CCI review, the acquirers in the non-exempt steps must file a notification with the CCI. In our case the sponsors, majority target shareholders and PIPE investors can be considered as the notifying acquirers. This is because their individual acquisitions in the merged entity did not qualify for any of the CCI exemptions.

Choice of CCI Form

The CCI has three relevant notification formats – the Form I, Form II and Green Channel Form.

-

Form I: Under Form I, parties are required to share corporate information and market facing information including overlaps and market size and shares of the parties.

-

Form II: In addition to the corporate and market facing information, Form II requires parties to disclose additional information like estimates of concentration levels, regulatory overview of the businesses conducted by the parties, imports and exports etc.

-

Green Channel: Combinations that qualify for the Green Channel can file a short declaratory form. Once the Green Channel form is filed with the CCI, the combination is deemed approved and the parties need not wait for a formal CCI approval.

The parties make the determination on the choice of form (although the CCI can invalidate the form if a more detailed form was required to assess the combination). The CCI does offer informal consultations that can assist the parties in making the choice of form.

The parties to a combination may opt to file the notification in Form II if the combined shares of the parties exceed 15% (horizontally) or 25% (vertical/complementary markets). In case the overlaps between the parties fall below 15% (horizontally) or 25% (vertical/complementary markets), they may file a notification in Form I. In case of Form I and II, the CCI has 30 working days to take a prima facie view on the transaction (i.e., whether to approve it, block it or approve it with conditions).

To avail of the benefit of the Green Channel route, the parties to the combination, their group entities and each of their, affiliates or entities controlled[26] should: (i) not produce/provide similar or identical or substitutable product or service or; (ii) not engage in any activity relating to production, supply, distribution, storage, sale and service or trade in product or service which are at different stage or level of production chain or; (iii) not engage in any activity relating to production, supply distribution, storage, sale and service or trade in product or service which are complementary to each other. Overlaps must be mapped at an India level.

Choice of Form in SPAC Transactions

The Green Channel offers an automatic CCI approval route. Parties also do not need to provide any market facing information. However, as mentioned above, the acquirers (including the acquirer group and affiliates) must not have horizontal, vertical or complementary overlaps with the target or its affiliates in India.

The De-SPAC transaction can qualify for the Green Channel if all the notifying acquirers (i.e., sponsors, PIPE and target shareholders) determine that they (or their group companies, controlled entities or affiliates) do not have horizontal, vertical or complementary overlaps with the target (or its controlled entities or affiliates) in India. Deal makers would prefer this option, but it is hard to qualify for this. However, deal makers can think of diluting rights acquired in the merged entity to make themselves eligible.

Sponsors investors are generally solely stockholders and warrant holders following the consummation of the initial business combination.[27] Sponsor managers may be requested by the acquired company management to continue in some capacity or may become unaffiliated outside investors.[28] If they agree to become outside investors with diluted rights, the sponsor’s acquisition may quality for the Minority Acquisition Exemption.

Although most PIPE investors are likely to acquire less than 25% of the shareholding of the merged entity, they typically acquire affirmative voting rights to protect their investments. PIPE investors can be persuaded to dilute their rights, so that they qualify for the Minority Acquisition Exemption. Since control is determined by a combination of rights, PIPE investors can drop rights like a board seat or appointment of key management person. They can instead retain an innocuous set of rights like information rights to protect their investment. This would require a case-by-case determination. For instance, if the PIPE investors have stake in competing investee companies, acquisition of information rights may be perceived by the CCI as a strategic investment.

In our experience, the target shareholders almost always opt for a share swap. Notably, the target shareholders acquisition of proportional rights in the merged entity is treated as an acquisition in an out of group entity (as opposed to the continuation of earlier rights).[29] Thus, acquisition of shares in the merged entity by the target shareholders would not qualify for the minority investment exemption. This contrasts with a regular IPO, where acquisition of new shares or rights by existing or new investors may require CCI approval. Here, the target shareholders must notify because their existing rights have been switched over to an out-of-group legal entity.

In some cases, the Green Channel route may not be available even after excluding the Sponsors and PIPE investors out of the equation. This may be a case where the target shareholders have overlaps with the merged entity. Since overlaps between the target shareholders and merged entity always existed, the parties have grounds to state that the market will not be impacted by the De-SPAC. In such cases, removing the Sponsors and the PIPE investors out of the equation would make the CCI notification less onerous because the target shareholders are the only set of notifying acquirers. So, mapping overlaps and collection of market facing information is limited to the target shareholders (including their groups, controlled entities and affiliates) and the target (and its affiliates and controlled entities). Logically, mapping overlaps, collection of market facing information and assessing the impact on the market for an additional group of investors (like the Sponsors and the PIPE) would make the process more time-consuming and cumbersome.

Conclusion

SPACs can be made more spectacular. The Competition Act and related regulations offer flexibility for innovative financial capital structures like SPACs to thrive. That said, the availability of exemptions and relaxations must be determined on a case-by-case basis.

India is yet to allow SPAC to list directly in any Indian stock exchange. Proposals have asked to allow SPACs to be listed on a special financial zone called GIFT City and relaxing rules for a special class of institutional investors.[30] Given India’s thriving start-up culture and the volatility of the stock exchange market following the pandemic, the time is ripe for the securities regulator to legitimize SPACs.

Krithika is a competition lawyer. She completed her LL.M at the University of Michigan Law School and received the Hugo Grotius Fellowship. She completed her first degree in law from Dr. Ram Manohar Lohiya National Law University, Lucknow.

[1] https://medium.com/@dorian.janvier/a-comprehensive-guide-to-understand-spacs-5a056665071

[2] https://corpgov.law.harvard.edu/2018/07/06/special-purpose-acquisition-companies-an-introduction/

[3] https://medium.com/@dorian.janvier/a-comprehensive-guide-to-understand-spacs-5a056665071

[4] https://medium.com/@dorian.janvier/a-comprehensive-guide-to-understand-spacs-5a056665071

[5] https://medium.com/@dorian.janvier/a-comprehensive-guide-to-understand-spacs-5a056665071

[6] https://corpgov.law.harvard.edu/2018/07/06/special-purpose-acquisition-companies-an-introduction/

[7] https://corpgov.law.harvard.edu/2018/07/06/special-purpose-acquisition-companies-an-introduction/

[8] The CCI’s latest jurisdictional thresholds are available here: http://cci.gov.in/sites/default/files/quick_link_document/Revised%20thresholds.pdf

[9] Ministry of Corporate Affairs Notification available here: http://cci.gov.in/sites/default/files/notification/SO%20673%28E%29-674%28E%29-675%28E%29.pdf

[10] Schedule I of the CCI (Procedure in regard to the transaction of Business relating to Combinations) Regulations, 2011.

[11] Explanation to Section 5 of the Competition Act.

[12] Century Tokyo/Tata Capital Financial Services Ltd C-2012/09/78 available here: https://www.cci.gov.in/sites/default/files/faq/C-2012-09-78.pdf; Bandhan Bank/Caladium Investment C-2015/05/278 available here: https://www.cci.gov.in/sites/default/files/C-2015-05-278.pdf.

[13] Schedule I of the CCI (Procedure in regard to the transaction of Business relating to Combinations) Regulations, 2011.

[14] https://medium.com/@saileshpatnala/spacs-capital-structure-de-spac-transaction-64eec8fa93f9

[15] https://www.winston.com/images/content/1/3/v2/135061/Winston-Strawn-SPAC-Basics-Presentation-2018.pdf

[16] Id.

[17] Typically after the first 45 days of the SPAC IPO, the common shares and warrants are introduced to be traded independently. Starting at this point, investors have the choice to split their units to their individual components of stock and warrants. The portion of warrant that is part of units can be seen as additional compensation for being an early investor. Warrants can only be exercised 30 days after the target company merger (De-SPAC) and after the 12-month anniversary of the SPAC IPO. In addition, most SPAC warrants expire 5 years after the merger of the target company, at which point the warrants are worthless. For more details refer to: https://corpgov.law.harvard.edu/2018/07/06/special-purpose-acquisition-companies-an-introduction/

[18] https://www.winston.com/images/content/1/3/v2/135061/Winston-Strawn-SPAC-Basics-Presentation-2018.pdf

[19] Id.

[20] https://corpgov.law.harvard.edu/2018/07/06/special-purpose-acquisition-companies-an-introduction/

[21] Id.

[22] Id; SPACs enter into a letter agreement with their officers, directors and sponsor. The letter agreement may include, among other things, a voting agreement obligating the officers, directors and sponsor to vote their founder shares and public shares, if any, in favor of the De-SPAC transaction and certain other matters, a lock-up agreement, an agreement from the sponsor to indemnify the SPAC for certain claims that may be made against the trust account, an obligation to forfeit founder shares to the extent the green shoe is not exercised in full, and an agreement not to sponsor other SPACs until the SPAC enters into a definitive agreement for a De-SPAC transaction. The letter agreement also documents the agreement of the officers, directors and sponsor to waive any redemption rights that they may have with respect to their founder shares and public shares, if any, in connection with the De-SPAC transaction, an amendment to the SPAC’s charter to extend the deadline to complete the De-SPAC transaction or the failure of the SPAC to complete the De-SPAC transaction in the prescribed timeframe (although the officers, directors and sponsor are entitled to redemption and liquidation rights with respect to any public shares that they hold if the SPAC fails to complete the De-SPAC transaction within the prescribed timeframe).

Some sponsors compensate the independent directors of the SPAC through the sale of founder shares, at cost. For example, in several recent SPAC IPOs, the sponsor transferred between 30,000 and 40,000 founder shares to each of the SPAC’s independent directors. This provides compensation to the independent directors for their service, as independent directors are typically not otherwise paid for their service.

[23] Id.

[24] Id.

[25] https://www.sia-partners.com/en/news-and-publications/from-our-experts/spacs-and-reverse-mergers-whats-different-time

[26] The following alternate tests determine if an investee company is an affiliate or entity controlled. Whether the target or acquirer (either directly or through their group):

A. holds direct or indirect shareholding of 10% or more in the entity; or

B. a right or ability to exercise any right (including any advantage of commercial nature with any of the party or its affiliates) that is not available to an ordinary shareholder; or

C. a right or ability to nominate a director or observer in another enterprise.

Further, while considering the affiliates and entities controlled by the target group, only the entities belonging to the group starting from the Target are considered.

[27] https://clearthink.capital/blog/comprehensive-faq-spac-sponsorship-spac-mergers/

[28] Id.

[29] If the target shareholders acquire 50% or more of the shareholding in SPAC before the De-SPAC, the merger between the SPAC and the target would have been considered as an intra-group merger and exempt. Since, in typical SPAC structures, the public holds 80% of the SPAC, we have not explored this.

[30] https://economictimes.indiatimes.com/markets/stocks/news/indias-buoyant-startup-culture-shut-out-of-global-spac-hunt/articleshow/82226538.cms

/>i

/>i