Welcome to the latest issue of Bracewell’s FINRA Facts and Trends, a monthly newsletter devoted to condensing and digesting recent FINRA developments in the areas of enforcement, regulation and dispute resolution. This month, we report on ongoing constitutional challenges to FINRA’s enforcement authority, the possible expansion of the SEC’s WhatsApp record-keeping probe to Zoom and other video calling platforms, several multimillion-dollar settlements of FINRA enforcement actions, and more.

Federal Court Allows FINRA Enforcement Action to Proceed Despite Constitutional Challenges

In the wake of the DC Circuit’s July 2023 ruling that granted an injunction staying a FINRA enforcement proceeding against a broker-dealer based on constitutional challenges of FINRA’s authority, two more FINRA member firms have recently filed federal lawsuits seeking to enjoin FINRA proceedings against them on the same basis. First, in August, Eugene H. Kim filed a lawsuit in the District Court for the District of Columbia (the District Court) seeking a stay of a FINRA enforcement action brought against him for allegedly misusing customer funds. More recently, on October 18, Sidney Lebental filed a similar lawsuit in the District Court, seeking a stay of a FINRA enforcement action brought against him for alleged misconduct in connection with his execution of certain trades.

As we reported in July and September, the DC Circuit’s ruling in July granted a preliminary injunction based on a finding that the plaintiff in that case, Alpine Securities Corporation, had “raised a serious argument that FINRA impermissibly exercises significant executive power.” The two more recent lawsuits filed by Kim and Lebental seek to apply this logic to their own cases, and thus to enjoin FINRA’s Department of Enforcement from proceeding with the actions against them.

But in a ruling issued earlier this month, the District Court declined to grant a stay of the FINRA Enforcement proceeding against Kim. While the District Court acknowledged that it takes guidance from the DC Circuit’s preliminary injunction opinion in Alpine, it held that that opinion “does not suggest that courts must enjoin every challenged FINRA enforcement action pending the Alpine merits decision.” To interpret the DC Circuit’s decision as effectively halting all FINRA enforcement actions, the District Court said, “would upend FINRA’s work—a result that would put investors and US securities markets at risk.”

Will the SEC Turn Its Focus to Zoom Recordings After WhatsApp?

The SEC’s highly publicized sweep of financial service providers’ improper use of WhatsApp and other off-channel communication platforms has resulted in settlements exceeding $2.5 billion. Now, people familiar with the scope and findings of the SEC’s WhatsApp probe have raised concerns that the SEC will expand its record-keeping requirement to include calls over video calling platforms, including Zoom and Microsoft Teams. Those who believe that this expansion is inevitable have already taken steps to meet the SEC’s anticipated scrutiny.

Reuters has reported that the proactive steps taken by some firms include retaining technology specialists and risk consultants not only to ensure that video calls are properly monitored and retained, but also to prevent the use of these platforms for sharing non-public information. Already, two “major global banks” are capturing Zoom sessions, said sources with knowledge of the matter. One of these firms is recording calls by traders and other staff, while the other is capturing all calls so they can be accessed at a future time, if necessary. As of now, video calls are subject to little or no formal record-keeping requirements, as they are viewed as proxies for face-to-face encounters. That may change very soon, with regulators apparently poised to begin assessing the potential for compliance failures over video platforms.

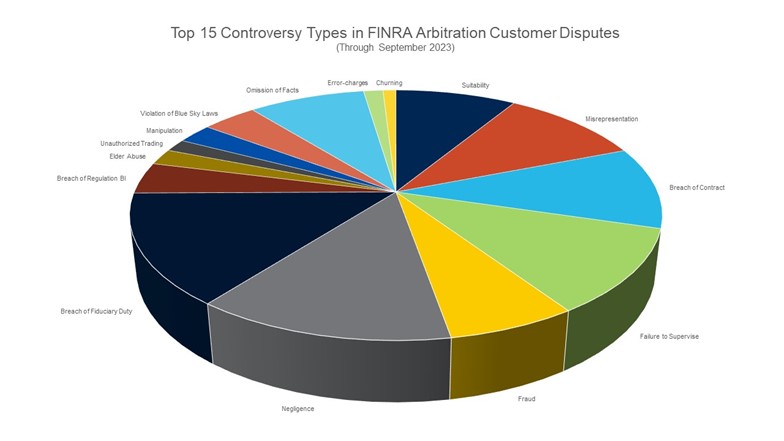

Latest FINRA Dispute Resolution Statistics Point to an Increase in Arbitration Filings

FINRA has released its latest dispute resolution statistics for the current year through September 2023. According to FINRA, the number of arbitration filings has increased nearly 25 percent from this time last year. Customer claims have gone up 14 percent, and breach of fiduciary duty was cited as the most frequent customer claim with a total of 1,127 cases, up from 967 this time last year. The number of industry disputes was 43 percent higher than in September 2022 and breach of contract claims have been the most popular claims so far in 2023, with a total of 201 cases, up from 162 cases a year ago. Notably, filings of Regulation BI arbitration claims by customers continue to rise, with 320 claims filed so far this year, compared to just 216 claims in all of 2022. After cracking the top 15 controversy types in May 2022, Reg BI claims through September have moved the category up to 9th place, and the expectation is that heightened Reg BI scrutiny will give rise to even more claims.

We will report on year-end statistics in early 2024.

Source: FINRA, Dispute Resolution Statistics, https://www.finra.org/arbitration-mediation/dispute-resolution-statistics (last visited Oct. 31, 2023).

Lawsuit Against Broker-Dealer Highlights Risks of Online Impersonators

A Swedish woman recently filed a lawsuit in New Jersey federal court against a New Jersey-based FINRA broker-dealer, AlMax Financial Solutions. The complaint alleges that the plaintiff was defrauded out of more than $180,000 — not by AlMax, but by an impostor website that maintained a website falsely impersonating AlMax.

Notably for FINRA members, the plaintiff’s complaint references FINRA Regulatory Notice 20-30 (Fraudsters Using Registered Representatives Names to Establish Imposter Websites), which informs member firms about reports of fraudsters who run imposter websites while posing as FINRA members.

It is unclear whether the lawsuit, which asserts claims for negligence and violation of the New Jersey Consumer Fraud Act, has any legal merit. For one thing, FINRA Regulatory Notice 20-30 prescribes no mandatory measures that member firms must take to root out impostors, and instead only provides certain actions that members “can take” or that they “may also consider.” Nevertheless, the case is a reminder to member firms of the guidance provided by FINRA concerning these imposter websites, and the risks they may pose.

SDNY Judge Halts FINRA Arbitration Brought by Non-Customers

In a ruling issued on October 13, 2023, US District Judge Naomi Buchwald of the Southern District of New York confirmed that FINRA arbitrations may not be commenced by investors who are not customers of a FINRA member firm, and enjoined an ongoing FINRA proceeding on that basis.

The FINRA proceeding in question was filed against Interactive Brokers LLC, a FINRA member firm, by a group of investors in funds managed by EIA All Weather Alpha Fund I Partners, LLC (EIA). According to the FINRA Statement of Claim, EIA misled its investors and misappropriated their investment assets.

EIA separately maintained trading accounts with Interactive Brokers during the relevant period, the FINRA Statement of Claim said. The investor-claimants filed claims against Interactive Brokers, arguing that — even though the investors themselves had no direct relationship with Interactive Brokers — Interactive Brokers had a responsibility to detect and prevent EIA’s misconduct, but failed to do so. And, because EIA’s relationship with Interactive Brokers was governed by an agreement that contained a broad arbitration provision, the investors contended that its claims against Interactive Brokers were subject to FINRA arbitration, either as third-party beneficiaries of EIA’s agreement with Interactive Brokers, or pursuant to FINRA Rules.

In its ruling after Interactive Brokers filed a lawsuit to stay the arbitration, the Court rejected these arguments. Most significantly, the Court reiterated the Second Circuit’s bright-line rule that to qualify as a “customer” for purposes of FINRA Rule 12200, a person must either purchase a good or service from a FINRA member, or maintain an account with a FINRA member. Since the EIA investors had no such relationship with Interactive Brokers, the Court rejected their claim to be “customers” entitled to avail themselves of FINRA Rules. The Court also found that the investors were not third-party beneficiaries of EIA’s agreement with Interactive Brokers, since they did not meet the “heightened threshold for clarity” required to find that a third party has the right to compel arbitration.

Reminder: New Expungement Rule Is Now Effective

This is a reminder that effective October 16, 2023, FINRA amended its rules to provide a stricter standard and procedural process for registered representatives seeking to expunge negative customer-related complaints. We previously provided a comprehensive analysis of the new FINRA expungement rule.

Notable Enforcement Matters and Disciplinary Actions

- Inaccurate Trade Data. A multinational financial services firm was sanctioned a total of $12 million by FINRA and the SEC for allegedly submitting inaccurate trading data to the two regulators for nearly a decade. The Letter of Acceptance, Waiver, and Consent (AWC) detailing FINRA’s findings on this matter is available here, and the SEC’s administrative order is available here.

Firms submit electronic blue sheets (EBSs) to regulators in response to requests for trade information. These EBSs provide examiners with trade details, including the nature of each transaction, the buyer and seller, and the transaction price. According to the SEC and FINRA, the respondent firm submitted tens of thousands of EBSs between November 2012 and October 2022 that were rife with inaccuracies for hundreds of millions of individual transactions.

The firm’s reporting failures allegedly stemmed from outdated and inaccurate code, manual validation errors and inadequate verification procedures. Prior to being notified of the inaccuracies, the firm had already begun voluntary remedial efforts, including a full-scale, line-by-line analysis of the code underlying its EBS program, automation of the EBS processing procedures and migration of data to a new reporting system.

- Trading Approval. A multinational brokerage firm agreed to pay more than $1.6 million to FINRA and the state of Massachusetts to settle claims that it failed to exercise due diligence when approving investors for options trading. The AWC detailing FINRA’s findings is available here.

According to regulators, at least some of the alleged violations resulted from a deluge of new account applications in response to the “meme stock” craze of 2020 and 2021. Among other things, the firm’s automated screening system allegedly approved approximately 400 teenagers under the age of 19 to trade options (an impossibility, since the firm’s rules required all customers seeking to trade options to have at least one year of investment experience after the age of 18). The firm also permitted customers to re-submit rejected applications after artificially inflating their trading experience, income and net worth.

- Inaccurate Research Reports. A multinational brokerage firm incurred a $2 million sanction over claims that it published thousands of equity and debt research reports with inaccurate conflicts disclosures between 2013 and 2021. The AWC detailing FINRA’s findings is available here.

According to FINRA, the firm not only failed to disclose conflicts, but also disclosed conflicts that did not exist. The violations, amounting to more than 300,000 disclosure inaccuracies, allegedly resulted from a series of technical and operational issues, including problems with data feeds, mistakes in the aggregation of client information and a failure to update old data.

FINRA Notices and Rule Filings

- Regulatory Notice 23-16 – FINRA amended its By-Laws to exempt from the Trading Activity Fee any transaction by a proprietary trading firm that is executed on an exchange of which the firm is a member. This exemption relates to the SEC’s recent amendments to Exchange Act Rule 15b9-1, which we reported on last month. The TAF exemption for proprietary trading firms will be effective November 6, 2023.

- SR-FINRA-2023-013 – FINRA has proposed a rule change that would amend the FINRA Codes of Arbitration Procedure to disallow compensated representatives who are not attorneys from representing parties in FINRA arbitrations and mediations. The proposed rule change would also codify that law students enrolled in a law school clinic and practicing under the supervision of an admitted attorney may represent parties in FINRA arbitrations and mediations.

/>i

/>i