As the economic slowdown from COVID-19 unfolds, accompanied by lingering uncertainty over its severity and duration, individual company disclosures may help investors understand the impact of the COVID-19 crisis on company prospects and those of their industry peers. This article discusses the application of the event study methodology when company disclosures affect their peers’ stock prices.

For decades, event studies have played a key role in the analysis of price impact, loss causation, and damages in securities litigation. As the first analytical step in the process of isolating the price effect of the event of interest—for example, the alleged fraud—an event study allows the financial economic expert to estimate the portion of company stock returns that is not attributable to market or industry effects.

Consider, hypothetically, a large retailer that is alleged to have misstated the effectiveness of its costly marketing strategy. Further, suppose the retailer later announces disappointing earnings that are attributed in part to the retailer’s unsuccessful marketing strategy (a disclosure curing the alleged misstatement) and in part to a sharp slowdown in sales due to COVID-19-related store closures that affected the entire industry. To isolate the price effect of the curative disclosure, an event study is required in order to remove the price effect of industry-wide information such as the disclosure of the sales impact from store closures.

Event Study Methodology

A properly conducted event study decomposes daily stock returns into the price effect of information affecting the company alone and the price effect of information with broader implications. The price effect of information with broader implications may include (1) the price effect of information that affects the overall stock market (the “market” effect) and (2) the price effect of information that affects the company’s industry peers (the “industry” effect). The price effect of information affecting the company alone is labeled the “company-specific” effect.[1]

To achieve that goal, event studies rely on statistical models (specifically, regression analysis) to estimate the relation between company stock returns and the returns of appropriately selected market and industry indices to estimate the market and industry effects, respectively.

Beta and the “Bellwether” Effect

Within the statistical model, the degree to which company stock returns move together with those of the market or industry indices is called “beta.” For example, if a company has an industry beta of 2, then, all else equal, one would predict its stock price would decline by 2% given an industry decline of 1%.

Academic research indicates that because industry betas measure the degree of co-movement between company stock returns and those of an industry index over a particular period, the industry beta for a particular company will be higher in periods when more information is released that causes both company and industry peer stock returns to move in the same direction. Over long periods with many days without such information (e.g., a full calendar year), the average industry beta may be lower than on specific dates when a large amount of information is released that may affect the returns of both the company and its industry peers (e.g., earnings announcement dates). Thus, the arrival of news can lead to a change in beta on the particular day in which the market learns such news. In the hypothetical example described above, news of the slowdown in sales due to store closures resulting from COVID-19 may cause stock prices of the retailer and its industry peers to decline at the same time, thereby causing the retailer’s industry beta to increase on the day the news becomes public.

There are various ways that the market may learn news, on a particular day, that affects the entire industry. A company might explicitly provide new information about the industry, for example during an earnings conference call. Even if a company does not explicitly provide industry-wide news, the company might be so important to the industry that its results likely provide insight into how other firms in the industry will perform (e.g., the market may learn about the industry-wide sales impact of prolonged store closures). Perhaps the company is the first to announce the current quarter’s earnings, again likely providing insight into the performance of the industry as a whole. We label the situation where one company announces news that has implications for the market or industry as a whole as well as the company itself as the “bellwether” effect.[2]

Bellwether effects may cause a company’s market and industry betas to change on specific dates. Thus, irrespective of how the market learns new information about a company’s industry, if the industry beta changes on a particular day, then that change must be accounted for in an event study to achieve reliable results. Failure to account for bellwether effects on beta can lead to unreliable estimates of the company-specific price change on a particular date, potentially undermining a financial economist’s analysis of price impact, loss causation, and damages.[3]

Such changes in beta on a particular day have been long recognized in the academic literature, which has documented as early as 1991 that betas can increase on earnings announcement dates.[4] Such early research documented changes in betas via statistical methods that required using data across many firms. Therefore, such methods provided no ability to account for bellwether effects in the context of single‑firm event studies such as those used in securities litigation.

The Patton and Verardo Methodology

More recent advances in the scientific, peer-reviewed literature in financial economics provide a method to estimate changes in betas on a particular day for one individual company, based on “high-frequency” analysis of intraday data. Those advances are presented in Andrew J. Patton and Michela Verardo, “Does Beta Move with News? Firm-Specific Information Flows and Learning About Profitability,” Review of Financial Studies 25, no. 9 (2012), pp. 2789–2839 (henceforth, “Patton and Verardo”), who apply the methodology to analyze whether beta increases on earnings dates, when companies disclose information that may have implications for both the company itself and a broader set of related companies.

The Patton and Verardo methodology can be used to test the hypothesis that the relation between an announcing firm’s stock returns and the returns of related firms (e.g., industry peers) is different on particular dates (e.g., earnings dates) when the information disclosed by the announcing firm has implications for the valuation of the related firms. In the hypothetical example above, the Patton and Verardo methodology can be used to test whether the retailer’s industry beta increased when it announced slower sales as a result of COVID-19.

The Patton and Verardo methodology does not assume the existence of a bellwether effect on beta on any particular day. Instead, it provides a technique to estimate any change in beta and to test whether it is statistically significant. Moreover, the technique allows the estimation of company‑specific price changes after accounting for changes in beta due to bellwether effects.

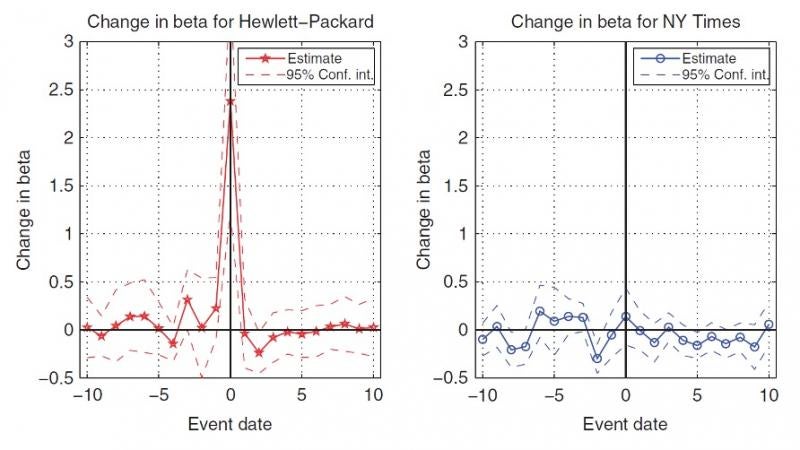

When Patton and Verardo applied their methodology to analyze changes in beta[5] around earnings dates, they found that some companies experience substantial increases in betas on earnings dates, while other companies’ betas are essentially unchanged. By way of example, they document that the beta for Hewlett-Packard increases statistically significantly “by almost 2.4 on [earnings] announcement days,” but that “the beta of NYT [New York Times] does not significantly change” (Patton and Verardo, p. 2799, and Figure 2, shown below). To put into perspective the increase of 2.4 in the beta for Hewlett-Packard, the average level of comparable betas across all firms is 1.0.[6]

Figure A: Patton and Verardo, Figure 2

Patton and Verardo in Securities Litigation

The Patton and Verardo methodology was applied in the context of securities litigation in Smilovits v. First Solar Inc. (“Smilovits”). The court found an event study using the estimated changes in beta from the Patton and Verardo methodology, in the Expert Report of Dr. Allan Kleidon, to be “a generally accepted methodology for determining loss causation.”[7] Moreover, the court found that “Plaintiffs cannot dispute that the peer reviewed article relied on by Dr. Kleidon specifically finds that higher betas occur on dates of significant public disclosures,”[8] opening the door to the application of the Patton and Verardo methodology beyond earnings dates.

In Smilovits, there was statistically significant evidence of bellwether effects on the industry beta based on the Patton and Verardo methodology, although nothing in this methodology necessitates any statistically significant change in betas on earnings announcement dates (as evidenced by the New York Times result as noted above). After accounting for bellwether increases in beta on the earnings announcement days at issue, there was no evidence of any statistically significant company‑specific price effects. This result supports the conclusion that there was no event study‑based evidence on those days of any losses caused by alleged corrective disclosures of information that had no industry-wide implications (e.g., a company-specific manufacturing defect).

Conclusion

Accounting for bellwether effects on beta may be critical to properly measuring the stock price effect of company-specific information in an event study analysis (e.g., measuring the effect of the alleged fraud in a securities class action) in situations where a company announcement has implications for other firms in the industry. This could occur if, for example, a COVID-19 slowdown affects both a company and its peers. The Patton and Verardo methodology provides a scientifically reliable and court-accepted approach to perform such analysis.

The views expressed herein are solely those of the authors, who are responsible for the content, and do not necessarily represent the views of Cornerstone Research. This article was first published in Law360.

[1] The company-specific effect does not necessarily coincide with the price effect of all new information that the company disclosed. Instead, in a properly conducted event study, when a company makes an array of simultaneous disclosures, the price effect of those disclosures with industry-wide implications will be included in the estimated industry effect whereas the price effect of other disclosures with company-specific implications will be included in the estimated company-specific effect. In the hypothetical example above, the price effect of the retailer’s announced sales impact of COVID‑19‑related store closures will be included in the estimated industry effect, whereas the price effect of the failed marketing strategy will be included in the estimated company‑specific effect. Alternatively, if the hypothetical company had also disclosed some impact of COVID-19 that affected that company alone, the impact of that information would be included in the company-specific effect.

[2] A bellwether effect is not restricted to one particular company within an industry. Depending on the context, multiple companies within the same industry can disclose new information with industry-wide implications, even over a short period of time.

[3] Financial economic experts typically focus on the company-specific portion of stock price declines on alleged misrepresentation and alleged corrective disclosure dates, implicitly assuming that the alleged fraud has no industry‑wide implications that would be reflected in the stock returns of industry peers on those dates. While this assumption is often reasonable (e.g., the disclosure of a failed marketing strategy affecting only the announcing firm), some situations may require additional analysis such as removing alleged fraud-related price changes from the returns of industry peers.

[4] See Ray Ball and S.P. Kothari, “Security Returns Around Earnings Announcements,” Accounting Review 66, no. 4 (1991), pp. 718–738.

[5] Patton and Verardo analyze increases in beta with respect to S&P 500 Index returns, and note (fn. 4) that their methodology also applies to multi-factor models (such as market and industry).

[6] See, e.g., Eugene F. Fama, Foundations of Finance (New York: Basic Books, Inc., 1976), Chapter 4, p. 121.

[7]Smilovits v. First Solar Inc., No. 2:12-cv-00555, slip op. at 20 (D. Ariz. Dec. 27, 2019).

[8]Smilovits v. First Solar Inc., No. 2:12-cv-00555, slip op. at 19 (D. Ariz. Dec. 27, 2019).

/>i

/>i