The US Department of Labor’s (DOL) April 2024 Final Rule (2024 Rule) increasing the minimum salary level required to meet the overtime exemptions (salary threshold) is null and void.

On November 15, 2024, a Texas federal district court set aside and vacated the DOL’s 2024 Rule, which dramatically increased the salary threshold for the overtime exemptions under the Fair Labor Standards Act (FLSA). This decision affects employers nationwide. State of Texas & Plano Chamber of Commerce, et. al v United States Depart of Labor, Civ. No. 4:24-CV 499/468 (Nov. 15, 2024, J. Jordan). [1]

In invalidating the 2024 Rule, US District Judge Sean Jordan of the Eastern District of Texas held that the DOL exceeded its authority by prioritizing the salary over duties in applying the exemption, and by including future automatic salary increases.[2]

The State of Texas and a coalition of trade associations and employers (Employers) filed the lawsuit, arguing that the salary threshold in the 2024 Rule effectively displaced the FLSA’s duties requirements with a salary-level test.

The Basis for the Decision

In a lengthy decision adopting the Employers’ argument, Judge Jordan began by providing the historical background of the various DOL overtime exemption rules, beginning with the salary threshold of $30.00/week for the overtime exemption in 1938 through the 2024 Rule. The court described with approval the DOL’s approach during its first 60 years of rulemaking for establishing salary thresholds that did not displace the duties-based test required by the FLSA. The court also noted that in 2004, even the DOL recognized that future automatic increases were beyond its authority. Yet, in 2016, the DOL implemented a rule that updated the salary threshold to $913/week and included these automatic increases (2016 Rule). The 2016 Rule was later invalidated.

The court concluded that the DOL’s 2024 Rule was a return to the invalidated rationale in the 2016 Rule. The 2024 Rule has three tiers of salary thresholds: it raised the current salary threshold from $684/week to $844/week effective July 1, 2024; $1,128/week effective January 1, 2025; and future automatic increases. Judge Jordan highlighted the dramatic number of exempt employees estimated by the DOL to lose the exemption under the new salary thresholds: 1 million employees on July 1, 2024, 3 million on January 1, 2025, and millions more with the automatic updates.

While not validating the July 1, 2024 increase, Judge Jordan observed that the amount was based upon the standard used in the 2004 Rule of matching the minimum salary level to the 20th percentile of weekly earnings of full-time salaried workers in the south and/or retail industry nationally based on contemporary data. Effective January 1, 2025, the 2024 Rule inexplicably based the amount on the 35th percentile.

Judge Jordan emphasized what he described as a fundamental principle of the exemption tests: “a salary test cannot displace the duties test.” The 2024 Rule, as of July 1, 2024, displaced more than 33 percent of the employees who meet the exempt duties test. As of January 1, 2025, the 2024 Rule would unreasonably exclude two of every five employees who otherwise meet the exempt duties test.

Following its in-depth review, the court held that the DOL exceeded the authority delegated by Congress. While the FLSA delegated to the DOL the authority to “define and delimit” the definitions of bona fide executive, administrative, or professional exemptions, that delegation was not without limits. Relying upon the reasonable and plain definition of these terms, the court reiterated that “what matters is the functions or duties of the employee.” The court also found that the automatic increases (also included in the vacated 2016 Rule) exceeded the DOL’s authority under the FLSA and violated the notice and comment requirements of proposed agency regulations under the Administrative Procedures Act.

What Next?

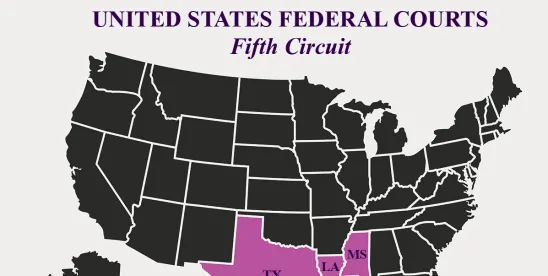

The court vacated the 2024 Rule and remanded to the DOL for “further consideration in light of this decision.” The DOL may appeal the decision to the US Court of Appeals for the Fifth Circuit or, more likely, propose regulations sometime in the future, presumably increasing the salary threshold with due deference to the duties requirement of the exemptions.

The current salary threshold under the FLSA returns to $684/week for the executive, administrative, and professional exemptions and $107,432/year for the highly compensated employee exemption.[3]

While employers may re-evaluate any recent exemption classification decisions based upon the now void 2024 Rule, employers should be thoughtful and prudent in determining future steps.

[1] This court previously enjoined the DOL from enforcing the 2024 Rule against Texas as an employer.

[2] See Bracewell’s April 25, 2024, client alert discussing the details of the 2024 Rule. The court also invalidated the thresholds for the highly compensated employee exemption.

[3] State laws establishing higher salary thresholds than the FLSA are unaffected by this decision.

/>i

/>i