This piece was co-authored by:

Sherbir Panag, Partner at the Law Offices of Panag & Babu in New Delhi, India.

J.S. Bhullar, Associate at the Law Offices of Panag & Babu in New Delhi, India.

This year, India celebrates Diwali on October 19, 2017. “The Festival of Lights,” as Diwali (or Deepavli) is commonly called, is celebrated across India with great aplomb, joy and, of course, delicious sweets. Diwali signifies the victory of light over darkness and, traditionally, family, friends and business acquaintances will often exchange gifts as part of the festivities. Apart from the Diwali cheer, however, the provision of gifts to Indian public servants can also present risk under the U.S. Foreign Corrupt Practices Act (FCPA) of 1977 and Indian law.

Diwali conveniently provides a fitting opportunity to review the legal framework and best practices surrounding the provision of gifts under U.S. and Indian law. The hope is that, with this guidance, your company can focus more on celebrating Diwali than worrying about compliance risks.

What’s the Risk?

The exchange of business courtesies, such as providing gifts, meals, entertainment and travel, can help strengthen existing relationships, foster new opportunities and express respect and appreciation for business partners. However, companies run the risk of triggering the FCPA and Indian anti-corruption laws if their provision of business courtesies to Indian public servants crosses a line into conduct that could be characterized as bribery, or if it lends to the appearance of attempting to induce a breach of trust or impartiality on the part of the public servant.

While the U.S. Department of Justice (DOJ) and Securities Exchange Commission (SEC) have recognized that a “small gift or token of esteem is often an appropriate way for business people to display respect for each other” and “[i]tems of nominal value ... are unlikely to improperly influence an official, and, as a result, are not, without more, items that have resulted in enforcement action by DOJ or SEC,” companies continue to find themselves in the FCPA-enforcement crosshairs for inappropriate or excessive gift-giving.1 Indeed, many recent FCPA enforcement actions have involved excessive gift-giving, travel accommodations and entertainment to foreign officials.2

Likewise, India’s Prevention of Corruption Act (PCA) of 1988 regulates the provision of gifts or other things of value to Indian public servants. As detailed below, public servants in India are further subject to Conduct Rules established by their respective services or organizations, which set specific threshold limits as the value of business courtesies that they may accept.

Who Qualifies as a Public Servant under Indian Law?

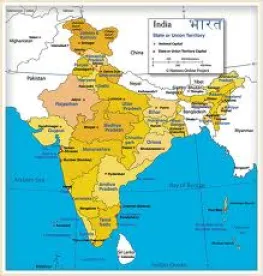

Section 2(c) of the PCA has a fairly exhaustive definition of a public servant. A public servant includes all government officials, local authorities, judicial officers, any holder of office to perform a public duty and – worth highlighting – all employees of government-owned or government-controlled entities.

The PCA’s definition of “public servant” overlaps with the FCPA’s definition of a “foreign official.” Thus, for compliance purposes, companies should assume public servants under Indian law would be deemed foreign officials under the FCPA.

What Regulations Govern Gift-Gifting to Indian Public Servants?

The FCPA does not set any fixed values or limits on permissible gift giving to foreign officials. Rather, in the FCPA Guide, the DOJ and SEC identify some hallmarks of appropriate gift-giving. Specifically, gifts must be of “modest value” and may be provided “when the gift is given openly and transparently, properly recorded in the giver’s books and records, provided only to reflect esteem or gratitude, and permitted under local law.”3

Under Indian law, the PCA prohibits “any gratification whatsoever, other than legal remuneration” when such gratification is given with the intention to (i) motivate, influence or reward a public servant to perform or forbear performance of an official act; (ii) show favor or disfavor to any persons; or (iii) render, or attempt to render, any service or disservice to a public servant. The provision of gifts or hospitality to public servants, in any amount, may thus qualify as a bribe under Indian law if provided with the intent to influence a public servant into performing (or not performing) his or her public duties. To this extent, the PCA’s prohibition against giving gifts for improper purposes aligns with the FCPA’s restrictions on gift-giving.

In India, every public servant is also governed by the Conduct Rules of his or her service or organization. And, in contrast to the FCPA, the Conduct Rules do establish specific threshold limits on the value of business courtesies that can be accepted by the public servant and the circumstances under which he or she can accept them. For example, the All India Services (Conduct) Rules, 1968, cover public servants in the Indian Administrative Services and the Indian Police Service; employees of the state-owned Oil and Natural Gas Corporation (ONGC) are governed by the ONGC Conduct, Discipline, and Appeal Rules, 1994 (Amended 2011); and government ministers of both the Union and the States are governed by the Code of Conduct for Ministers. These threshold values vary among the different services and organizations, based on the class and seniority of the recipient public servants, and can range broadly between 500 – 25,000 Rupees (approximately $8 – $375 U.S. dollars).

Gift-Giving Best Practices for India

When providing Diwali gifts or other business courtesies to public servants in India, companies should read the Conduct Rules alongside the applicable provisions and objectives of the PCA and the FCPA. The following bullet points offer some best practices to consider when developing gift-giving policies and procedures for companies (or subsidiaries) operating in India:

-

Companies should review the Conduct Rules applicable to the public servants who may receive gifts or other business courtesies from the company and maintain a system of tracking and communicating to employees the specific threshold limits of allowable gift-giving to these public servants.

-

Company executives and employees should receive periodic training on business courtesies/gifts and entertainment policies, and should be instructed to confirm the threshold values for each class of public servant before giving a gift or extending hospitality to him or her.

-

Threshold values of allowable gift-giving should be communicated in Indian Rupees, to ensure clarity and to avoid potential misunderstandings due to fluctuating foreign exchange rates.

-

Gifts should never be given with the expectation of, or as a reward for, the public servant taking a favorable official action that benefits the company.

-

Gifts should be of modest value (subject to the threshold limits noted above). Gifts of cash or cash equivalents (e.g., gift cards, shopping cards) should not be provided.

-

Gifts should not be provided by non-Indian companies, contracting with the Indian government, to public servants who are involved with official dealings relating to those contracts.

-

Employees should consult with legal counsel before providing gifts to public servants with whom the company has official dealings or to public servants with regulatory oversight of the company.

-

Employees should not provide gifts that have been specifically requested by public servants and should notify their supervisors of any such requests.

-

Gifts should be accurately documented and reported in the company’s books and records, including identifying recipients who qualify as public servants (and, accordingly, foreign officials under the FCPA) in order to satisfy the FCPA’s books and records and internal controls provisions.

-

U.S.-based compliance officers with responsibility for India should mark their calendars and follow up with their Indian counterparts on compliance procedures and process at least four-to-six weeks in advance of Diwali.

1A Resource Guide to the U.S. Foreign Corrupt Practices Act, (the “FCPA Guide”), U.S. Department of Justice and Securities & Exchange Commission, November 14, 2012, available at: https://www.justice.gov/sites/default/files/criminal-fraud/legacy/2015/01/16/guide.pdf.

2See, e.g., Avon Products, Inc., ($8 million in gifts, cash, travel, meals and entertainment to Chinese government officials); FLIR Systems, Inc. ($40,000 in gifts and travel to Saudi Arabian officials); and NCH Corporation ($44,545 in cash, gifts, meals and entertainment to employees of China state-owned companies).

3Id., p. 15.

/>i

/>i