This is part one of a three-part series exploring the recent uptick in securities class action filings in the First Circuit and examining recent decisions issued by the District of Massachusetts. This post examines current trends in securities class action filings and recent decisions on motions to dismiss in the District of Massachusetts.

Securities Class Action Trends in the First Circuit and District of Massachusetts

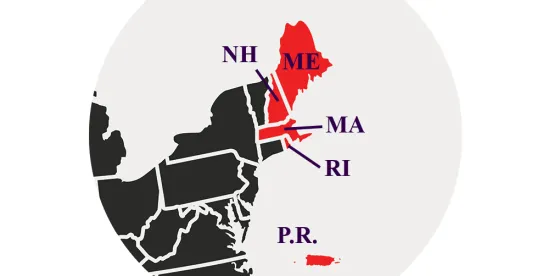

Securities fraud class action filings have surged within the First Circuit over the past five years. The rate of filings has more than doubled in a five-year period. In 2020, there were only six filings. By 2024, that number had climbed to twenty. As of June 2025, nine securities class actions have already been filed—on pace to exceed last year’s total. The vast majority of securities class action filings within the First Circuit have been in the District of Massachusetts, with twenty-three of the twenty-nine filings in the past eighteen months.

Within the First Circuit, plaintiffs are mainly bringing claims for securities fraud under Section 10(b) of the Securities Exchange Act of 1934 and Securities and Exchange Commission Rule 10b-5. To bring a Section 10(b) claim, plaintiffs must allege six key elements. These elements include: (1) a material misrepresentation or omission, (2) scienter, (3) a connection with the purchase or sale of a security, (4) reliance, (5) economic loss, and (6) loss causation. These allegations must meet the heightened pleading standards imposed by Federal Rule of Civil Procedure 9(b), as well as the Private Securities Litigation Reform Act (“PSLRA”).

Dismissal Rates in Securities Fraud Class Actions: District of Massachusetts Remains a Decisive and Rigorous Jurisdiction

Despite the rise in securities class action filings in the District of Massachusetts, they face intense scrutiny from the court at the pleading stage. Over the past five years, the court has granted motions to dismiss these claims at a higher rate than the national average, with 58% of motions to dismiss securities class actions granted in the District of Massachusetts (compared with 49.6% across all federal district courts). Further, the District of Massachusetts is more likely than other federal district courts to take an “all or nothing approach,” with only 8% of motions to dismiss receiving split decisions (compared with a 24.2% split decision rate across all federal district courts).

Recent opinions on motions to dismiss securities class actions by the District of Massachusetts have given particular scrutiny to the elements of material misrepresentation and scienter. The court’s analyses of these elements provide guidance for litigants bringing and defending securities fraud claims at historically high rates.

Part two of this three-part series will examine the District of Massachusetts’ approach to analyzing the material misrepresentation element in recent securities fraud class action cases.

* * *

Thank you to firm summer associate Jeff Supple for his contribution to this series.

/>i

/>i