In late October, a New York district court refused to dismiss the Department of Justice’s (DOJ) indictment against defendant Nathaniel Chastain, who was charged with wire fraud and money laundering relating to his using insider knowledge to purchase non-fungible tokens (NFTs) prior to them being featured on OpenSea, an online NFT marketplace, and later selling them at a profit. (U.S. v. Chastain, No. 22-cr-305 (S.D.N.Y. Oct. 21, 2022)). Despite the headlines and the fact that the DOJ’s press release labeled this enforcement as charges brought in “the first ever digital asset insider trading scheme,” the Chastain indictment was not actually based on the typical insider trading statutes involving securities law violations, but instead the federal wire fraud statute. Indeed, despite having an insider trading flavor, the word “security” does not appear in the indictment and the court, in refusing to dismiss the DOJ’s wire fraud claim, ruled that the Government’s wire fraud claim does not require the presence of a “security.”

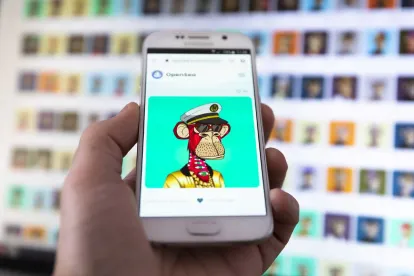

As we’ve previously related in a prior post about the case, Chastain, a former product manager at OpenSea, was indicted in New York in June 2022 for his NFT profit scheme. As part of his role, Chastain was responsible for selecting NFTs to be featured on OpenSea’s homepage; OpenSea kept these special NFT selections confidential until they went live, as a main page listing often translated to a jump in prices for the featured NFTs and others by the same creator. During a period from June 2021 to September 2021, Chastain pre-purchased these to-be-featured NFTs (or others by the same creator) and then sold them at substantial profit. To conceal the alleged fraud, the DOJ claimed Chastain conducted these transactions using anonymous digital cryptocurrency wallets and OpenSea accounts. The DOJ asserted one count of wire fraud (18 U.S.C. § 1343) and one count of money laundering (18 U.S.C. § 1956(a)(1)(B)(i)) against Chastain.

Subsequently, Chastain moved to dismiss the indictment, contending, among other things, that: (1) the wire fraud count should be dismissed because the information that he allegedly misappropriated was not “property” within the meaning of the statute (a position supported by one amicus brief filed in the case); (2) the money laundering count was deficient because the Government failed to allege sufficiently two elements of the crime (namely, the concealment and financial transaction elements) and sought to criminalize the mere movement of money; and (3) the wire fraud count was insufficiently pleaded because an “insider trading” wire fraud charge requires the presence of a trading in securities or commodities.

The court refused to dismiss the indictment (citing the high standard for dismissal at the Rule 12(b) stage), and characterized Chastain’s points as “about the sufficiency of the evidence, not the adequacy of the Indictment” that are better left for the jury. Still the court noted that “Chastain’s first two arguments have some force,” depending on what the evidence in the case ultimately demonstrates:

-

The court found the indictment was sufficient at this time, but stated that, perhaps, the Government would not be able to prove beyond a reasonable doubt that the information at issue with respect to the wire fraud count (i.e., what NFTs would be featured and when on the OpenSea website) constituted “confidential business information” and, thus, “property” within the meaning of the statute. (18 U.S.C. § 1343: “Whoever, having devised or intending to devise any scheme or artifice to defraud, or for obtaining money or property by means of false or fraudulent pretenses, representations, or promises….” [emphasis added]).

-

Similarly, as to the money laundering charge, the court noted that “given that the Ethereum blockchain is public, the Government may have trouble proving beyond a reasonable doubt that the transactions at issue were ‘designed in whole or in part . . . to conceal or disguise the nature, the location, the source, the ownership, or the control of the proceeds.’”

The court was more emphatic about Chastain’s final point, finding no merit in his argument that that the Government’s “misappropriation theory” of wire fraud requires trading in securities or commodities. As previously discussed, while the Government’s statements about the indictment referenced “insider trading,” the court clarified that Chastain was “not charged with insider trading, at least in the classic sense of the term which is a means of engaging in securities fraud in violation of Section 10(b) of the Securities Exchange Act of 1934 and [SEC Rule 10b-5].” The court added that unlike a Section 10(b) insider trading claim, which is limited to fraud “in connection with the purchase or sale of any security,” Section 1343 makes no reference to securities or commodities and no court has ever held that a conviction of this type requires trading in securities or commodities. The court suggested that perhaps the “insider trading” label was “misleading,” but such an issue could be handled separately by striking it from pleadings or precluding it at trial.

The final part of the ruling underscores how federal prosecutors can broadly apply the wire fraud (and companion mail fraud) statutes to a host of conduct, including more modern activities in the digital asset space and beyond, without having to lay out or describe how the property or asset at issue is a “security.” Using this statute arguably offers the DOJ more flexibility than the SEC, which is responsible for enforcing potential violations of the federal securities laws and regulations.

Jonathan Mollod also contributed to this article.

/>i

/>i