In light of the economic uncertainty triggered by COVID-19 related events, many businesses are looking to access Government stimulus packages. As events continue to move quickly, and the incentives and eligibility requirements vary across jurisdictions, the challenges in identifying and taking timely advantage of all available opportunities is intensifying.

Focusing solely on tax related measures, this guide provides a high level summary of the key incentives that are presently on offer at a Federal, State and Territory level.

While this guide provides high level information, it is not a substitute for advice on specific matters. This is particularly important at the present time as the incentives and eligibility requirements can change quickly and without notice.

International Considerations

Central management and control:

• If a foreign company is not an Australian tax resident, but is required to either:

• conduct board meetings in Australia; or

• have directors attend meetings from Australia, during the COVID-19 crisis that will not result in the central management and control of the foreign company being in Australia. • To this effect, we would recommend appropriate documentation be prepared and retained with the company’s books to record why the company has suspended their normal pattern of board meetings and make alternative arrangements.

Permanent establishments:

• The temporary relocation or unplanned presence of employees (due to travel restrictions) in Australia will not result in a foreign company having a permanent establishment in Australia.

• Relocating employees back to Australia, however, may have GST implications, (e.g. it may be considered that the entity is carrying on an enterprise in Australia for GST purposes). As stipulated in LCR 2016/1, the test for when an enterprise of an entity is carried on Australia is used in the GST legislation in a variety of ways, and may affect the extent to which an entity is accountable for GST on supplies or acquisitions.

Thin Capitalisation

The ATO’s position:

• The Assistant Commissioner at the ATO has acknowledged that taxpayers may encounter disruptions with the thin capitalisation regime in this climate, including difficulties with their reporting obligations as well as changes to the underlying economic rationale for the choice of ‘method’ for calculating the maximum allowable debt.

• Specifically, for tax years covering the February-March 2020 period (“the relevant year”), nonADI taxpayers may no longer be able to rely on the safe harbour or worldwide gearing tests to determine their maximum allowable debt as a result of balance sheet impacts brought by COVID-19, (e.g. from the impairment or decline of asset values or short term drawdowns on debt facilities). As such, the Assistant Commissioner has advised taxpayers to consider the following for the relevant year:

• For the purpose of calculating average values for thin capitalisation amounts, the selection of alternative valuation measurement periods may allow a degree of smoothing of values in situations where wide variations have occurred throughout the income year.

• A simplified arm’s length debt test (“ADLT”) may be used for the relevant year. Whilst further guidance is expected to be issued by the ATO later this week, the Assistant Commissioner has indicated the following:

- Taxpayers would need to show that they would have satisfied the safe-harbour test, but for the COVID-19 related balance sheet impacts; •

- The ATO will still have an expectation that taxpayers use their best endeavours to apply all the criteria of the ALDT;

- For inward investing entities that are not also outward investing entities, the ATO’s compliance approach will apply only to the extent that no additional related party funding is received, save for short term (

- The ATO is not expecting inward investing entities to require the use of ALDT because dividends were paid.

Practical Considerations

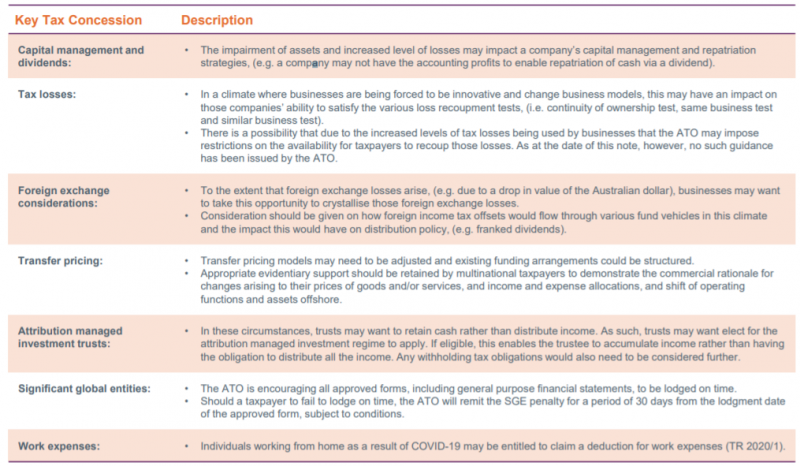

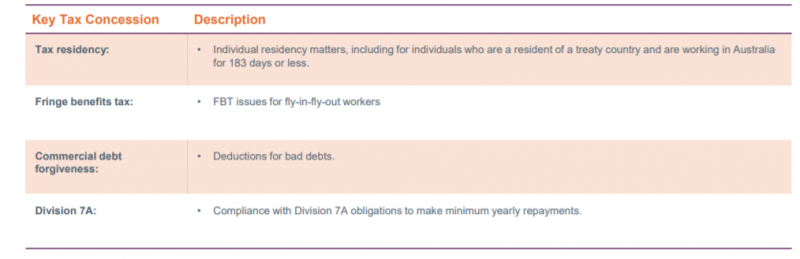

Due to COVID-19 and the rapidly changing domestic and international tax environment, there are practical considerations which taxpayers should bear in mind as they continue to operate in this uncertain market. We have outlined some of these key considerations below.

The ATO is also expected to provide further guidance on the following issues:

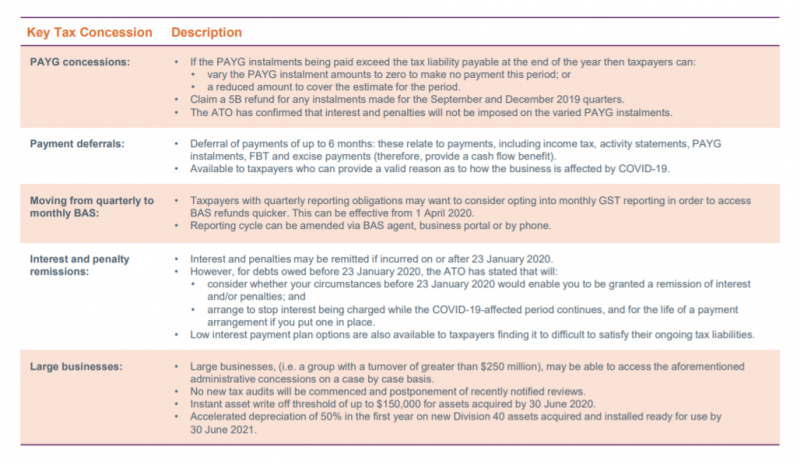

Administrative Tax Concessions

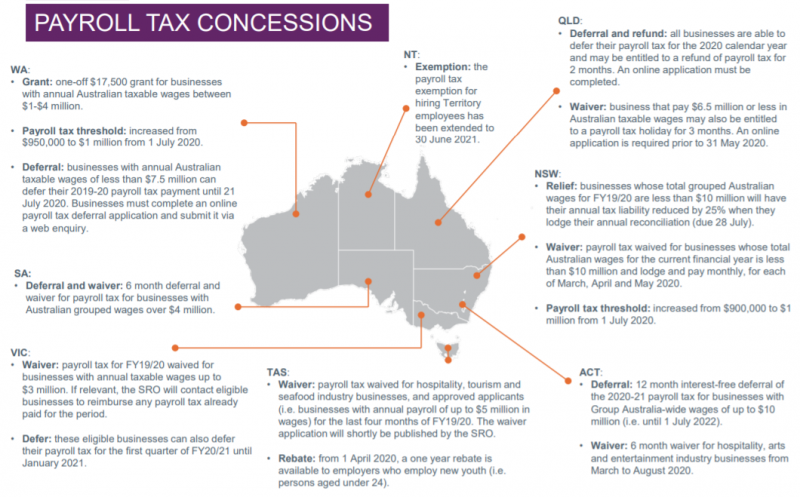

PayRoll Tax Concessions

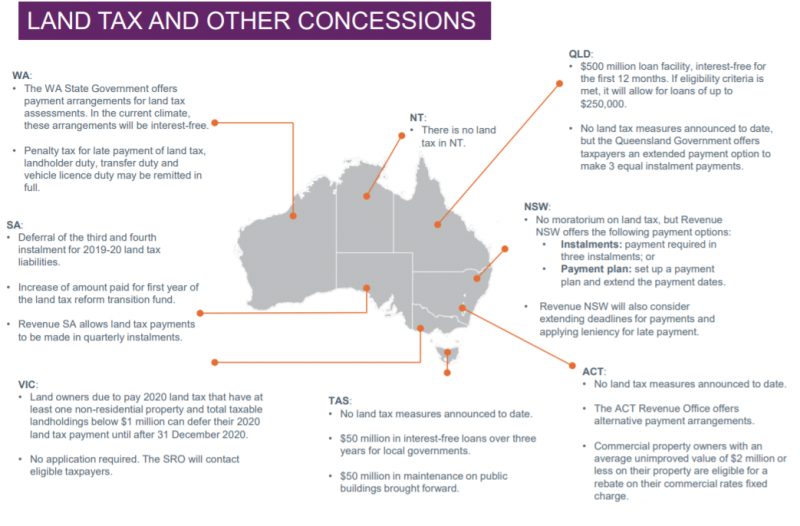

Land Tax and Other Concessions

*This information is accurate as of 9.00 am Wednesday 8 April 2020 and is subject to change as this situation evolves. New information will be updated once announced.

/>i

/>i