Congress passed the Corporate Transparency Act (the “CTA”) in 2021 with the aim of enhancing transparency in entity structures and ownership as well as combating terrorism, money laundering, and other forms of corporate misconduct. This sweeping new rule is designed to cast a wide net over entities that, except in the case of taxes, do not regularly report to federal agencies (i.e., non-publicly traded entities), regardless of the degree to which they are already regulated at the state level. This post specifically speaks to medical groups and management services organizations (“MSOs”) that now need to navigate the new CTA requirements and account for their complex contractual relationships (e.g., management services agreements, equity restriction or succession agreements). For additional information on a particular topic, links to helpful resources have been provided in the footnotes.

Broadly speaking, the CTA requires that any entity that qualifies as a “reporting company” file a Beneficial Ownership Information Report (“BOIR”) to the Department of the Treasury’s Financial Crimes Enforcement Network (“FinCEN”) disclosing identifying information for such entity’s key owners and leaders (“beneficial owners”). Companies formed on or after January 1, 2024, must also include information on the individual who supervised the preparation of the certificate of formation of the reporting company as well as the individual who filed such document with the Secretary of State in the state of formation (referred to as the “company applicant”). While this reporting requirement will be new for many privately owned entities, the good news is that the BOIR is fairly simple, and FinCEN has confirmed that any information submitted in a BOIR will be confidential. Government officials may only access such information for national security, intelligence, and law enforcement purposes. Additionally, financial institutions may only access the information with the consent of the reporting company.[1]

Even so, the CTA has sparked substantial public commentary around the nuances of reporting and the scope of potential exemptions. For entities that historically have not had to make these types of disclosures, the CTA raises a number of questions, including whether an entity can qualify for an exemption, and if not, what information must be reported to the federal government. There is time to think through those questions. Reporting companies that are not exempt and were registered to do business with their applicable Secretary of State prior to January 1, 2024, have until January 1, 2025 to file their BOIR. The timeline for newer reporting companies is a little shorter: those registered between January 1, 2024 and January 1, 2025, will have ninety (90) days following registration to file, and those registered after January 1, 2025, will have thirty (30) days following registration to file.

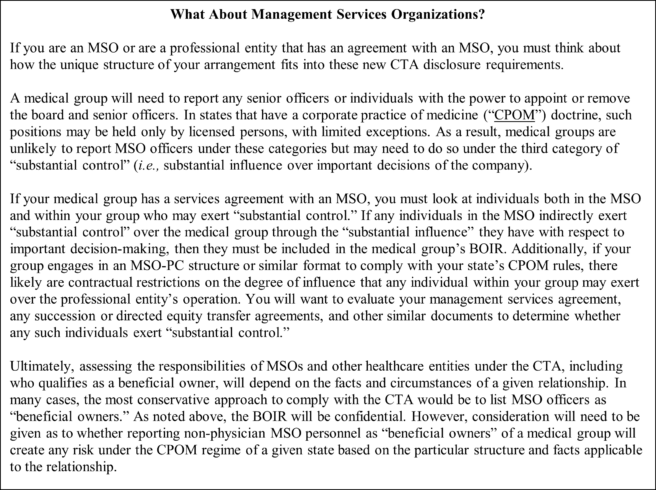

The CTA’s application to common corporate structures in the healthcare industry (e.g., “friendly physician” and MSO relationships) raises questions for reporting companies subject to the new requirements. In particular, medical groups will need to consider whether individual leaders of an MSO should be reported as “beneficial owners” of an affiliated medical group. Like other healthcare compliance issues, each reporting company should consider the facts and circumstances of its existing relationships and, for medical groups, whether an MSO relationship will impact its BOIR submission (e.g., the degree of control afforded to the MSO under its management services agreement, any applicable CPOM doctrine(s), and the involved reporting entity’s assessment of its legal duties and degree of risk tolerance).

Here, we detail three steps to consider with respect to CTA reporting for medical groups and MSOs:

Step 1: Are You a “Reporting Company” and, If So, Does an Exception Apply?[2]

An entity is a reporting company if it was formed or registered to do business by filing with any Secretary of State or similar office within the United States (e.g., a corporation or LLC). This means that any professional corporation or professional limited liability company is a reporting company, but a sole proprietorship or general partnership that is not registered with a Secretary of State or similar state office is not.

Even if your entity is a reporting company, it may meet one of the exceptions under the CTA that eliminates the reporting requirement. The exceptions are primarily designed to exempt larger companies with active operations, public companies, and other entities that already report to the federal government (i.e., those registered with the Securities Exchange Commission (“SEC”), including investment companies, investment advisers, venture capital fund advisers, and pooled investment vehicles). Tax exempt entities, such as charitable organizations organized under IRS Code 501(c)(3), as well as any entities wholly owned by one or more exempt entities are excluded as well. Inactive entities also do not need to report.[3] Finally, the Large Operating Company (“LOC”) exception waives an entity’s reporting obligation if it satisfies all of the following requirements: 1) employs twenty-one (21) or more full-time employees in the U.S. (independent contractors, leased employees, [4] or, for an S corporation, any shareholder owning two percent (2%) or more ownership[5] do not count as employees), 2) generates more than five million dollars ($5,000,000) in annual gross receipts (as reported in the federal income tax returns of the year prior), and 3) has an operating presence at a physical office in the U.S.[6]

If your company meets any of the above exceptions, it is not required to file a BOIR. Otherwise, you will want to start thinking about which individuals must be identified in the BOIR.

Step 2: If You Must File a BOIR, Identify Your “Beneficial Owner(s).”

A. Who is a “Beneficial Owner?”[7]

A beneficial owner is an individual who, directly or indirectly, either 1) exercises substantial control over a reporting company, or 2) owns or controls at least twenty-five percent (25%) of the “ownership interests” of a reporting company.

B. What is an “Ownership Interest?[8]

An ownership interest includes, but is not limited to, any of the following: 1) equity, stock, or voting rights, 2) a capital or profit interest, 3) convertible instruments, or 4) options or other non-binding privileges to buy or sell any such interests.

C. What is “Substantial Control?”[9]

An individual has “substantial control” if they meet any of the following three criteria: 1)serves as a senior officer of the company, 2) holds authority over the appointment or removal of senior officers or a majority of the board, or 3) has substantial influence over important decisions of the company. In defining “senior officers,” FinCEN expressly includes the President, CEO, CFO, GC, COO, or any other officer who performs a similar function, and expressly excludes any ministerial positions such as a Corporate Secretary or Treasurer. For healthcare entities, certain officer positions, such as CMOs, do not seem to fit neatly into either a “senior officer” or “ministerial” role. The safest approach is likely to include such individuals in the report, but the decision warrants case-by-case consideration.

When deciding whether an individual meets the third category of “substantial influence over important decisions,” the CTA looks to individuals who have substantial influence over any of the following decisions: 1) the nature, scope, and attributes of the company including the sale, lease, mortgage, or other transfer of principal assets, 2) any reorganization, dissolution, or merger, 3) the selection or termination of business lines or ventures, 4) any compensation schemes or incentive programs for senior officers; and 5) the entry into or termination of significant contracts.

The CTA includes a catch-all provision to clarify that substantial control can take additional forms not specifically listed. Additionally, substantial control also includes control exerted by any parent or intermediary entities. Thus, if any individuals from other entities exert control over your company pursuant to the above categories, you will need to include them in your BOIR.

Step 3: Consider the Who, What, When, Where and How of CTA Reporting

Reporting companies must include information on both the reporting company and any beneficial owners. Additionally, any companies formed after January 1, 2024, must include information on company applicants. FinCEN has additional resources available online for newly formed reporting companies. Reporting company information includes: 1) its full legal name, 2) any trade name (i.e., “d/b/a”), 3) a business street address (this cannot be a PO box or any third party’s address), 4) the state of formation where the company first registered, and 5) its taxpayer identification number.

Beneficial owner information includes each individual’s: 1) full legal name, 2) date of birth, 3) residential street address (this cannot be a company address), 4) ID number and issuing jurisdiction of a non-expired US passport, driver’s license, or other government-issued ID, and 5) an image/photocopy of such ID. If the individual does not wish for their ID to be stored in the BOIR (Items 4 and 5), they can apply for a unique identifying number through FinCEN (a “FinCEN Identifier”). To do so, an individual must submit all beneficial owner information outlined above (including an ID number and photocopy) through the FinCEN website here, FinCEN ID | Financial Crimes Enforcement Network (FinCEN). The FinCEN Identifier can then be submitted on the BOIR in lieu of Items 4 and 5 above.[10]

Companies can make the report electronically at BOI E-FILING (fincen.gov) by either submitting a pdf form or entering the information directly. Recall that reporting companies formed prior to January 1, 2024, do not need to include company applicant information. Simply check the box in Item 16 to skip Part II on company applicants. The deadlines for reporting companies based on their date of state registration are outlined above.

FOOTNOTES

[1] See Section A of Beneficial Ownership Information Reporting FAQ, Beneficial Ownership Information Reporting | FinCEN.gov.

[2] See Pages 2-14 of Small Entity Compliance Guide, FinCEN (hereinafter, the “FinCEN Guide”) https://www.fincen.gov/sites/default/files/shared/BOI_Small_Compliance_Guide.v1.1-FINAL.pdf.

[3] Id. at p. 14.

[4] 26 C.F.R. § 54.4980H-1; 26 C.F.R. § 31.3401(c)-1.

[5] 26 C.F.R. § 54.4980H-1.

[6] Although consolidated groups may aggregate gross receipts for the LOC exception, the number of employees in a group may not be consolidated, meaning each company must have 21 or more US employees to qualify for the exception.

[7] FinCEN Guide, p. 16.

[8] Id. at p. 18.

[9] Id. at p. 18.

[10] See Section M of Beneficial Ownership Information Reporting FAQ, Beneficial Ownership Information Reporting | FinCEN.gov.

/>i

/>i