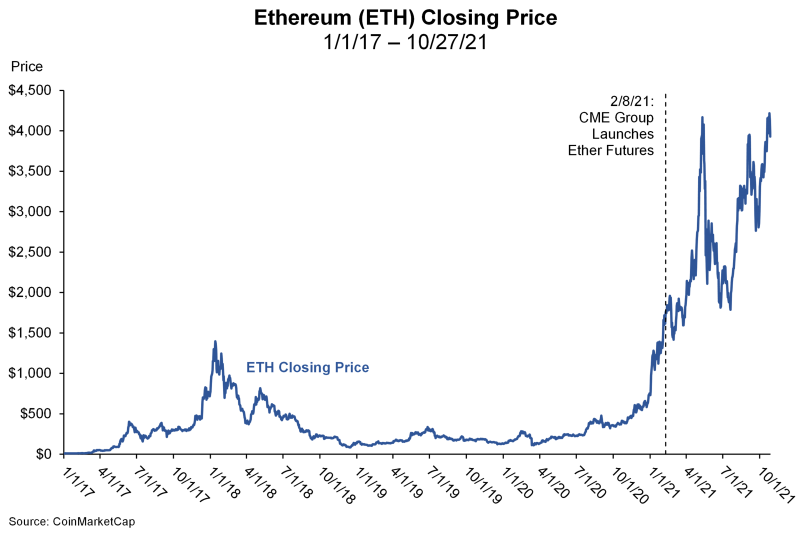

Following in the wake of the CME’s Bitcoin futures launched in December 2017, the CME’s exchange-traded Ether futures went live earlier this year and are gaining popularity. The Ether products take the form of futures contracts and share many similarities with the Bitcoin futures products also listed by CME.

These Ether futures contracts allow investors to hedge or speculate on Ether prices without actually transacting in the underlying “physical” cryptocurrency. In the first month of trading alone (February 2021), the traded volume surpassed 11,000 contracts. Since then, volume has steadily increased, with over 130,000 contracts traded during the month of September 2021. The growing acceptance of crypto-assets and the increased prominence of exchange-traded crypto-products are trends indicative of a general maturing of crypto trading markets.

One of the main requirements for futures contract design is identifying a robust, representative underlying commodity or product that the futures contract will be priced against. In this case, while the contracts are called “Ether” futures, there is no centralized price or exchange for physical Ether. Although the crypto-asset market continues to evolve and liquidity has trended towards consolidation among top exchanges, the market as a whole remains relatively diverse. The CME created an index of Ether prices from numerous Ether spot physical exchanges to serve as the underlying price and the cash-settlement mechanism. This article focuses on the design of the CME Ether futures contract.

CME’s Ether Reference Rate Index

In May 2018, the CME began publishing its daily Ether index called the CME CF Ether Dollar Reference Rate (ETHUSD_RR), which is now the underlying price for the CME Ether futures contract. The CME partnered with CF Benchmarks to facilitate the calculation and publication of the ETHUSD_RR.

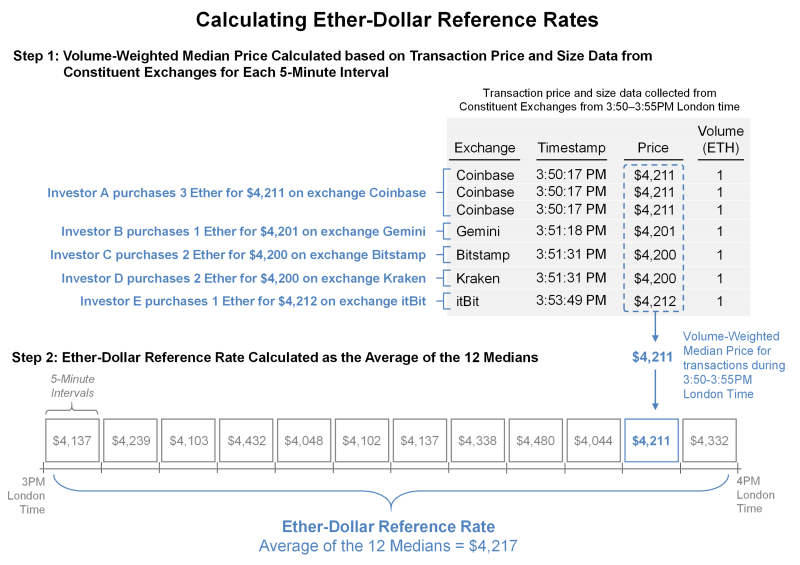

The CME sought to create an Ether price index that would have limited susceptibility to temporary swings in prices and outlier prices. The ETHUSD_RR uses a one-hour calculation time period and a median price calculation rather than a simple average across the full time period. The same methodology was employed in CME’s CF Bitcoin Reference Rate.

Constituent Exchanges

For purposes of calculating the ETHUSD_RR, the CME aggregates trade flows of the following five Ether spot exchanges, called Constituent Exchanges: Bitstamp, Kraken, itBit, Gemini, and Coinbase.

The CME provides guidance on how Constituent Exchanges are selected. It requires, among other criteria, that the “average daily volume the venue would have contributed during the observation window for the Reference Rate of the Relevant Pair exceeds 3% for two consecutive calendar quarters.”[1] The CME guidance also includes broad requirements that the Constituent Exchanges deliver transparent and reliable data, maintain fair and transparent market conditions to “identify and impede illegal, unfair or manipulative trading practices,” not place undue barriers to entry, and comply with applicable law, among others.

The ETHUSD_RR uses the Constituent Exchanges’ trade flow to calculate a once-per-day reference rate in USD per Ether. Between 3:00 PM and 4:00 PM London time, the Ether transaction price and volume data are collected and separated into 12 equal time partitions of five minutes each. The volume-weighted median trade price is calculated for each five-minute interval. The 12 medians from each of the five-minute intervals are then equally-weighted and averaged to determine the published ETHUSD_RR. Using a median for each of the five-minute intervals makes the index less susceptible to outlier transactions and temporary swings in price.

The example below shows the calculation of the volume-weighted median price in the 11th partition from Ether transactions on the five Constituent Exchanges. The resulting 11th partition price of $4,211 is one of the 12 partition volume-weighted medians that are averaged to yield the published ETHUSD_RR of $4,217 per Ether.

CME Ether Futures Contract

After tracking the ETHUSD_RR data for more than two years and fine-tuning the methodology, the CME launched Ether futures on February 8, 2021. The U.S. Commodity Futures Trading Commission (CFTC) is the regulatory body with exclusive jurisdiction over U.S. Ether futures markets.

Contract Unit

Each futures contract represents 50 Ether tokens and is measured by USD per Ether. For example, if an Ether is priced at $4,000, then a futures contract is priced at 50 times $4,000, or $200,000. The minimum price fluctuation for outright futures is $0.25 per Ether or $12.50 per contract.

Settlement at Contract Expiration

A futures contract is typically settled at expiration through either (1) physical delivery of the underlying commodity, or (2) financial cash settlement relative to a benchmark price. The CME Ether futures contract is a cash-settled futures contract that settles relative to the ETHUSD_RR if held until maturity.

Block Trades, EFPs, ad BTIC

The Ether futures contract is block trade eligible for a minimum block size of five contracts. Ether futures are also exchange for physical (EFP) eligible, which allows for privately negotiated trades between two counterparties that exchange a futures position for an equivalent physical cryptocurrency Ether. Further, the CME permits basis trade at index close (BTIC), which allows futures trades at a fixed spread to the reference benchmark index.

Position Limits and Accountability Levels

Ether positions in the nearest-to-expiry futures contract (spot month) are limited to 8,000 contracts per participant effective the first trading day of the expiring contract month (e.g., if the value of Ether is $4,000, then 8,000 contracts equates to $1.6 billion). Accountability levels for single month and all month contracts combined are each 20,000 contracts. In comparison, the corn futures contract spot month position limit is 1,200 contracts and positions for non-spot months single and combined are limited to 57,800 contracts (e.g., if the value of corn is $5 per bushel, the value of 1,200 contracts is $30 million).

Clearing

The CME Ether futures will be cleared through CME Clearport and CME Direct. The clearing procedure is similar to other CME-listed futures contracts.

Conclusion

In October 2021, the first Bitcoin ETF was approved for listing on the New York Stock Exchange Arca, and although it does not have formal approval from the SEC yet, investors continue to have appetite for different ways to speculate and mitigate risk in crypto-assets. CME’s new Ether futures provide another tool for this purpose. Tim McCourt, CME Group Global Head of Equity Index and Alternative Investment Products, stated, “The addition of Ether, along with our liquid Bitcoin futures and options, will create new opportunities for a broad array of clients, whether they are looking to hedge ether positions in the spot market or gain exposure to this cryptocurrency on a regulated derivatives marketplace.”[2] If the Ether futures contract succeeds, other financial instruments, such as Ether ETFs, may be approved for trading by regulatory authorities.

FOOTNOTES

[1] “CME CF Cryptocurrency Pricing Products: Constituent Exchange Criteria,” CF Benchmarks, updated May 20, 2020, https://docs-cfbenchmarks.s3.amazonaws.com/CME+CF+Constituent+Exchanges+Criteria.pdf.

[2] “CME Group Announces Launch of Ether Futures,” CME Group, February 8, 2021, https://www.cmegroup.com/media-room/press-releases/2021/2/08/cme_group_announceslaunchofetherfutures.html.

/>i

/>i