Climate change is now a regular feature of boardroom discussions. Companies have acknowledged that it will directly impact their business, with the former Bank of England Governor Mark Carney recently noting that “changes in climate policies, new technologies and growing physical risks will prompt reassessments of the values of virtually every financial asset”. However, climate change is beyond just an asset valuation issue. Investors and other stakeholders are keenly interested in the policies that companies are adopting to confront it and are using that information to make investment decisions. Recognising this increasing demand for transparency surrounding climate-related risks, the FCA has this month issued a consultation paper setting out proposals to enhance climate-related disclosures by listed companies and to clarify existing disclosure obligations.

In the UK and globally, there is increasing appreciation of the need for adequate disclosure of information on how companies are preparing for a lower-carbon economy to enable investors to make informed choices when allocating capital. Although the FCA consultation is the latest of these steps towards more rigorous disclosure, greater regulation of this issue has been foreshadowed for some time. The Taskforce on Climate-related Financial Disclosures (TCFD) published recommendations in 2017 with the aim of helping investors understand which companies are most at risk from climate change, which are best prepared to deal with those risks and which are already taking action.

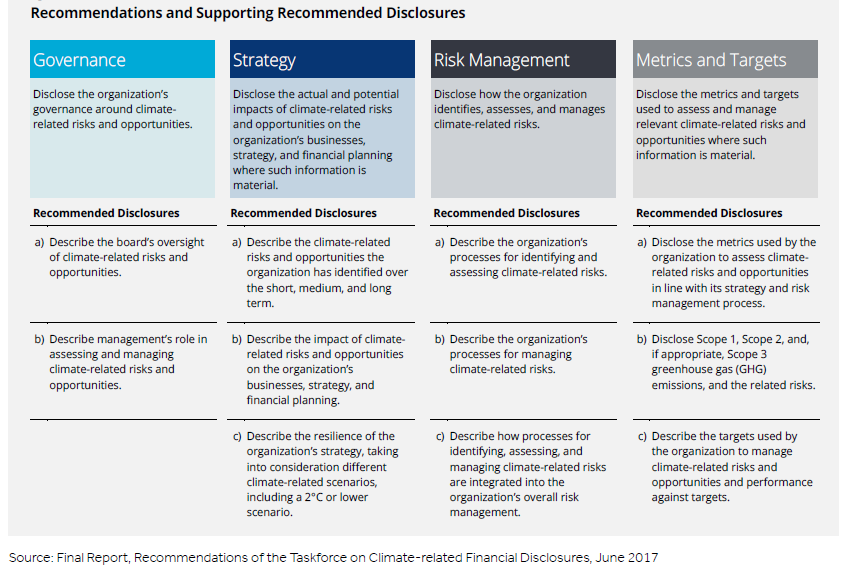

Figure 1: TCFD Recommendations on Climate-related Disclosures

The primary proposal in the new FCA consultation paper is the adoption of a new listing rule requiring commercial companies with a premium listing to either make climate-related disclosures consistent with the TCFD’s recommendations or explain why they have not. Premium-listed companies will be required to include a statement in their annual report setting out whether they have made TCFD-aligned disclosures (and where to find them), or to explain any non-compliance. A “comply or explain” approach has been proposed at this stage, with the FCA accepting that some companies may still be developing the data and capabilities they need to be able to model and report information in the manner prescribed by the TCFD. Initially, the new rule will apply only to premium-listed companies, but it is likely that the FCA will consult further on whether the rule should ultimately be extended to a wider scope of companies.

Additionally, the consultation paper sets out a proposed Technical Note providing guidance on existing obligations set out in EU legislation and in the FCA Handbook that may already require issuers to disclose information on climate-related and other environmental, social and governance (ESG) matters. This guidance will relevant for all, not just premium, listed companies. The Technical Note identifies the relevant provisions in the Listing Rules, Prospectus Regulation, Disclosure Guidance and Transparency Rules and Market Abuse Regulation that may already require or relate to ESG-related disclosures, and is intended to clarify the existing obligations that issuers should already be meeting.

The new rule is proposed to take effect for accounting periods beginning on or after 1 January 2021, meaning that the first reports to be issued in compliance with the rule would be published in 2022. The FCA is seeking views on the scope and implementation of the proposed rule, with the consultation period closing on 5 June 2020.

Whilst the issue of climate-related disclosure is relevant for all listed companies, the FCA’s proposals are particularly significant for companies operating in the energy sector and those with high carbon emissions. Such companies are clearly more directly exposed to the risks of climate change and are therefore likely to be required to make more extensive disclosures to meet their regulatory obligations.

The consultation paper is a step towards wider adoption of TCFD’s recommendations within the FCA rules, but it is clear that further consultation can be expected on expanding the scope of issuer disclosures and strengthening compliance obligations. The TCFD’s recommendations have also underpinned the work of the Climate Financial Risk Forum (CFRF), which was established last year between the FCA and the Bank of England’s Prudential Regulation Authority. The CFRF is currently finalising guidance, expected to be published later this spring, relating to climate-related disclosures, innovation, scenario analysis and risk management, to produce practical tools for companies to respond to climate-related risks and opportunities.

As awareness and understanding of the threat of climate change has developed – and with the UK and other countries committing to ambitious targets for emissions reduction – it is likely that we are seeing the beginning of a wave of new regulation relating to climate change and, more specifically, climate-related disclosure, aimed at helping investors to evaluate the risks and rewards of the transition to a low-carbon economy.

/>i

/>i