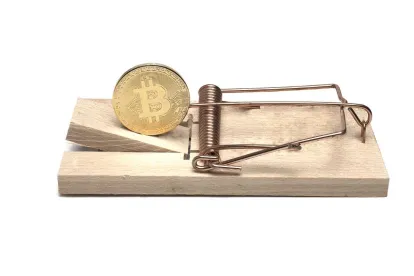

The Federal Deposit Insurance Corporation (FDIC) recently issued letters demanding that five crypto companies cease and desist from making false and misleading statements about FDIC insurance and take immediate corrective action to address false and misleading statements.

The letters follow an enforcement memorandum and new rule published by the Consumer Financial Protection Bureau (CFPB) earlier this year threatening enforcement for deceptive acts and practices relating to the use of the FDIC logo and statements concerning insurance coverage.

The crypto companies were cited by the FDIC for making false representations stating or suggesting that certain crypto-related products were FDIC-insured. Each of these digital asset providers made statements, including in marketing and product information published on websites and social media accounts and, in one case, registered domain names indicating certain crypto products or accounts were insured or endorsed by the FDIC.

Digital assets, virtual currency, tokens, and cryptocurrency are receiving heightened regulatory oversight, scrutiny, and review as new and traditional laws and regulations gain traction in application to digital asset markets, participants, and products. Providers must take care to remain abreast of regulatory notices, updates, and informational releases published by regulatory bodies like the CFPB and FDIC, along with other state and federal regulators.

The Federal Deposit Insurance Act (FDIA), which can be enforced by both the FDIC and CFPB, prohibits any person from representing or implying that an uninsured product is FDIC-insured or from knowingly misrepresenting the extent of deposit insurance applicable to a product. Companies, including digital asset and crypto providers, are prohibited from implying their products are FDIC-insured by using “FDIC” in the company’s name, advertisements, or other documents and websites.

In short, a company may not indicate that customer accounts are insured, nor that pass-through insurance applicable to company accounts may provide coverage to customer accounts. These prohibitions include statements that imply deposits to certain crypto providers are insured and or are stored in insured deposits accounts with participating financial institutions.

The FDIA often requires that non-bank institutions identify the ultimate institution at which deposits are actually insured by name. Such that, when pass-through or deposit accounts are advertised as insured, the actual FDIC-insured institution is identified as providing the insured accounts.

The FDIC issued letters to one crypto commodities exchange, three crypto product news providers, and one crypto-related domain holder relating to their statements, claims and indications that certain accounts, products, exchanges, and providers were FDIC insured or FDIC endorsed. Three providers that listed information concerning FDIC coverage for certain other digital asset businesses as an information or news service were ordered to cease and desist from including false insurance coverage information in their news and informational webpages.

The FDIC letters reflect an increase, across government agencies, regulators, and regimes, in the oversight and scrutiny applicable to digital asset platforms, products, and service providers. Digital asset platforms, cryptocurrency offerors, and virtual asset businesses may be subject to oversight when making statements concerning the coverage, status, and insurance applicable to their accounts and customer deposits.

/>i

/>i