Don’t wait to implement your California Consumer Privacy Act (CCPA) compliance as it could require changes to your operations. CCPA can apply to businesses even if they do not have offices or employees in California. It can also reach activities conducted outside of California. See our prior alert here to see if CCPA applies to your business.

On Monday, February 10, 2020 the California Attorney General’s office released an updated version of the proposed regulations, addressing errors in the draft released before the weekend and extending the comment period to February 25th at 5p PST. For those trying to keep track of what the eventual regulations will require, the challenge is greater than the AG’s version control. MediaPRO reported on February 11th in their 2020 State of Privacy and Security Awareness Report that almost two-thirds of U.S. employees are unaware if the CCPA applies to their organization. This presumably translates to confusion at the business level or at least slow communication or progress on the compliance front, reinforcing the fact that although the revised regulations are still in draft form (and subject to further revisions), the AG will begin enforcing the CCPA July 1st so businesses should consider the implications of the current draft regulations and take prompt action.

While the AG’s redline of the updated draft rules demonstrates that a great deal of time and thought (and, ahem, lobbying) have been put into the effort, what would be helpful is if the AG included a detailed explanation of why the changes have been proposed. Some make sense, and some continue to baffle. Onward to some of the most notable of the proposed changes.

Common Sense Prevails on Interpretive Guidance

Proposed Change: Insertion of interpretive guidance emphasizing that whether information is “personal information” depends on whether the business maintains information in a way that “identifies, relates to, describes, is reasonably capable of being associated with or could be reasonably linked, directly or indirectly, with a particular consumer or household.”

Years ago, Americans were typically confused or skeptical of when the EU held that an IP address (even a dynamic IP address) constituted personal data. This has been used in some U.S. contexts, such as protected health information under HIPAA and recent FTC settlements. But as a rule, most businesses have no ability to determine that an IP address alone relates to an individual. In the latest version of the regulations, the AG emphasizes that personal information depends upon whether the detail “is reasonably capable of being associated with, or could be reasonably linked” to a person or household.

While the proposed “test” or triggering factors the AG sets forth mirror commonly-used concepts under privacy laws, it’s likely businesses will focus more on application of the example included in the “guidance.” The AG suggests that if a business collects or receives an IP address absent any other linked details then that IP address is not personal information. This will not permit willful ignorance by the business, as the proposed standard is whether the business links the IP address to other details or could reasonably do so. Expanding this example to other data points, a person’s name (say, James Smith) is the ultimate identifier, no? Maybe- until you realize that except for a small subset, individual names are surprisingly common.

Relief for Service Providers

Proposed Change: Service Providers must still be prohibited from retaining, using or disclosing personal information for purposes other than providing services to the business. However, they are now afforded exceptions for certain processing such as engaging downstream service providers; internal uses to enhance the service provider’s services (not to include amassing manipulating data because it’s helpful); to detect security incidents and prevent fraud; or complying with law and part of the other exceptions afforded to businesses at Cal. Civ. Code Section 1798.145(a)(1) - (a)(4).

Service providers should be largely happy with the addition of a simple three lines that proposes the internal use of personal information by a service provider to improve the quality of its services is now permissible. This had been an unreasonable obstacle under the prior version as most service providers use some level of data to improve product and service quality. While there are still some restrictions here, service providers and their business customers no longer have to worry whether a data transfer is a sale simply because the service provider would use the personal information to build or improve the service. This may cause service providers to revisit those freshly-inked contract addenda if they can convince businesses that these changes in the draft regulations are certain to stick.

When Is a Household Not a Household?

Proposed Change: A business should not comply with a request to know specific pieces of information or a deletion request unless all of the following are met: all consumers of the household jointly make the request; the business independently verifies the identify of each member of the household; the business verifies that each member is currently a member of the household.

The original definition was that a person or group occupy the same dwelling. This made imminent sense but was impractical absent a common identifier such as a street address. The proposed change largely guts the household aspect of the CCPA because a business would now potentially need to know that: 1) the individuals reside at the same address, 2) they use a common device (smart TV?) or the same service (ISP? AppleTV? Netflix?), and 3) the business identifies these individuals as sharing a group account or a common identifier. The revised definition sharply narrows the impact of the statute’s text, but also corrects for what many perceived as an odd (at best) component of a privacy law centered on individual data.

Notice Requirements – Timing and Visibility across Platforms

Proposed Change: The notice required at collection must be readily available where consumers will encounter it and or before the point of collection. Specific examples on providing notice in mobile apps, by phone or in person were added. The accessibility requirements for notices must follow the Web Content Accessibility Guidelines version 2.1 (June 5, 2018) issued by the World Wide Web Consortium.

Seeing versus encountering means what exactly? In discussing the delivery of a privacy notice at the collection of personal information, the text now reads “The notice at collection shall be made readily available where consumers will see encounter it at or before the point of collection…”. Does this mean that the privacy notice must be a pop up a la EU ePrivacy hell? “Encounter” suggests something more than a link in the footer of a web page or in a mobile app’s settings. But the remainder of the draft regulations provide no indication that something so dramatic is necessary.

Proposed Change: When collecting personal information from a mobile device in a way not reasonably expected by a consumer, a business must provide just-in-time notice within the app with a link to the full notice. In addition, where previously prohibited from using personal information for any purpose other than what is stated in the notice, the prohibition now only applies if the purpose is materially different than disclosed in the privacy notice.

This means a flashlight app can still collect your (completely unnecessary) location data.

Wait, what?! It’s reassuring that the AG’s office has been reading FTC enforcement actions and the revised draft proposes a helpful “When a business collections personal information from a consumer’s mobile device for a purpose that the consumer would not reasonably expect, it [the business] shall provide a just-in-time notice…”. After all, the FTC found that there was a great deal of consumer surprise that the app captured user location. The AG suggests a pop-up window to highlight the data collection undoubtedly included with the conspicuous privacy notice but still likely to surprise consumers, because none of us reads privacy notices anyway.

Third Party Collections

Proposed Change: Businesses that do not collect information directly from consumers no longer have to provide notice at collection if the business has appropriately registered as a data broker.

The earlier version of the rules included a GDPR-like requirement for those collecting personal information indirectly, such as through an ad network or even through the purchase of marketing lists. Under the earlier draft, the receiving business could either send the consumer whose details were acquired a timely notice along with a sale opt-out or get an attestation for the data provider.

Those details have been deleted and now a business collecting indirectly need not “provide a notice at collection to the consumer” if the business is a registered data broker. So as an incentive to data brokers, registration relieves the obligation to tell a consumer that their details have been acquired. But an unregistered data broker or a regular business purchasing a marketing list appear to have the GDPR-like consumer notification that, hey, we’ve bought your data, here’s our privacy notice, and so on. Curious concession to the much-maligned data broker industry.

Individual Rights – the Good, the Bad and the TBD

Proposed Change: In responding to a request to know specific pieces of information (i.e., a right to access your own data), the business is not required to complete a complex expedition if a series of parameters are met.

While it may be difficult for most commercial business to check all of these boxes to avoid the time and resource-intensive search for data to address a right to know request, if all of the following conditions are met, the business does not have to complete the search: 1) business does not keep the personal information in a searchable or reasonably accessible format; 2) business maintains the information solely for legal or compliance purposes; 3) business does not sell personal information or use it for any commercial purposes; and 4) business tells the consumer the categories of records that may contain personal information but were not searched based on these criteria. Even if this doesn’t get them out from under the requirement altogether, it may allow businesses to eliminate certain systems or applications from the scope of searches.

Proposed Changes: For the right to know and the right to delete, businesses: have 10 business days to acknowledge receipt of requests to know or to delete; can deny a request if the consumer cannot be verified in the first 45 days; and requiring notarized documentation now comes at a cost to businesses.

Businesses have a bit more time to acknowledge receipt of right to know and deletion requests and can now flat out deny a request if the business cannot verify the consumer in the first 45-day period. However, for businesses that hoped to rely on notarized documentation as part of the verification process for authenticating consumers or their agents, the revised regulations require the business to compensate the requestor for the cost of notarization. In other words, businesses cannot charge a fee (or cause consumers to incur fees) for verification of the request to know or delete.

Proposed Change:

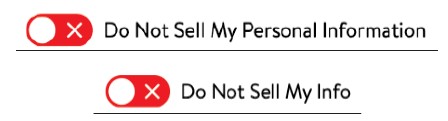

As promised, the AG has proposed an opt-out button for Do Not Sell My Personal Info requests. Not being User Experience experts, we find it confusing. The privacy geeks on Twitter exploded over the weekend and generally used impolite words to describe the consumer-friendliness of the graphic. Anyway, you can use your own ‘button,’ but be sure that it is clear to the consumer wishing to opt-out.

Proposed Change: The opt-out right no longer provides for preemptive opt-out if the business does not currently sell personal information. Businesses have 15 business days to comply with a request and have more limited obligations with regard to telling third parties not to sell information.

A plain reading of the original language allowed a consumer to direct a business that sells or “in the future may sell” personal information to stop selling the information and to “refrain from doing so in the future.” The revised regulations focus on current activities that constitute a “sale.” Businesses are no longer on the hook for the 90-day lookback to tell any third parties to whom the business has “sold” information about the opt-out request. Under the proposed change, businesses need only notify third parties if the business sells information to the third party after the consumer opts out and before the business complies with the opt-out.

/>i

/>i