Foreign Investors Continue to Find Relief from Soverign Retrospective Taxation Powers of States Under International Law

Introduction

On December 21, 2020, the international arbitral tribunal (Tribunal) constituted in the case of Cairn Energy Plc and Cairn UK Holdings Limited (collectively ‘Cairn’) v. The Republic of India1 held that India had failed to uphold its obligations under the 1994 Bilateral Investment Treaty between Republic of India and United Kingdom (India - UK BIT) and under international law. The Tribunal ordered India to compensate the Claimants for the total harm suffered by Cairn as a result of India’s breaches. Reports of passing of the award became public on December 23, 2020. The award is not in public domain, save for an excerpt.

The ill-reputed retrospective taxation by India in 2012 spurred three investment treaty arbitration cases against India, viz. (i) Vodafone International Holdings BV v. The Republic of India (Vodafone case); (ii) Cairn Energy Plc and Cairn UK Holdings Limited v The Republic of India (Cairn case); and (iii) Vedanta Resources Plc v. The Republic of India (Vedanta case). In the past three months, two of the three cases (Vodafone case and Cairn case) have been ruled in favour of the foreign investors against India. For a detailed analysis of the Vodafone case, please see our Case Analysis here. For a detailed analysis of various investment treaty arbitration cases involving India in 2019, please see here.

In this piece, we endeavour to provide a comprehensive understanding of the subject transaction, the retrospective taxation measures and other measures adopted by India against Cairn, the arbitration proceedings initiated in 2015; and set out the reported portion of the award. While we do not have the benefit of reviewing the awards in Vodafone case and Cairn case to understand the manner in which the Tribunal has considered subject issues, we conclude with an analysis of the contentious defence of sovereign taxation powers, and how the Vodafone and Cairn cases are a stern reminder of the limits placed by international law upon the State’s sovereign rights of taxation.

The Transaction--3006HE TRANSACTION - 2006

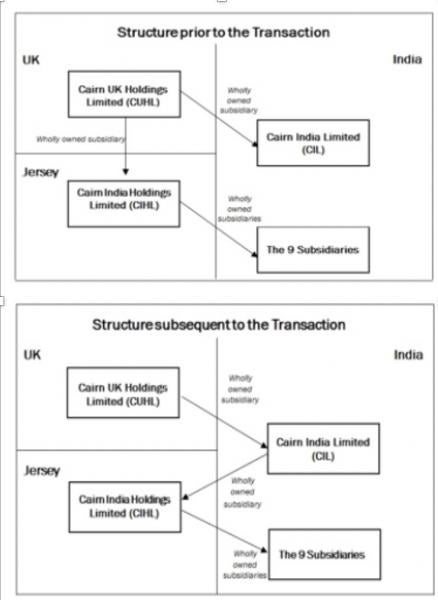

Cairn India Holdings Limited (“CIHL”) was incorporated in Jersey in August, 2006 as a wholly owned subsidiary of Cairn UK Holdings Limited (“CUHL”), a holding company incorporated in the United Kingdom in June, 2006. Under a share exchange agreement between CUHL and CIHL, the former transferred shares constituting the entire issued share capital of nine subsidiaries of the Cairn group, held directly and indirectly by CUHL, that were engaged in the oil and gas sector in India.

In August 2006, Cairn India Limited (CIL) was incorporated in India as a wholly owned subsidiary of CUHL. In October 2006, CUHL sold shares of CIHL to CIL in an internal group restructuring (the Transaction). This was done by way of a subscription and share purchase agreement, and a share purchase deed, through which shares constituting the entire issued share capital of CIHL were transferred to CIL. The consideration was partly in cash and partly in the form of shares of CIL. CIL then divested 30.5% of its shareholding by way of an Initial Public Offering in India in December 2006. As a result of divesting Approx. 30% of its stake in the Subsidiaries and part of IPO proceeds, CUHL received Approx. INR 6101 Crore (Approx. USD 931 Million).2

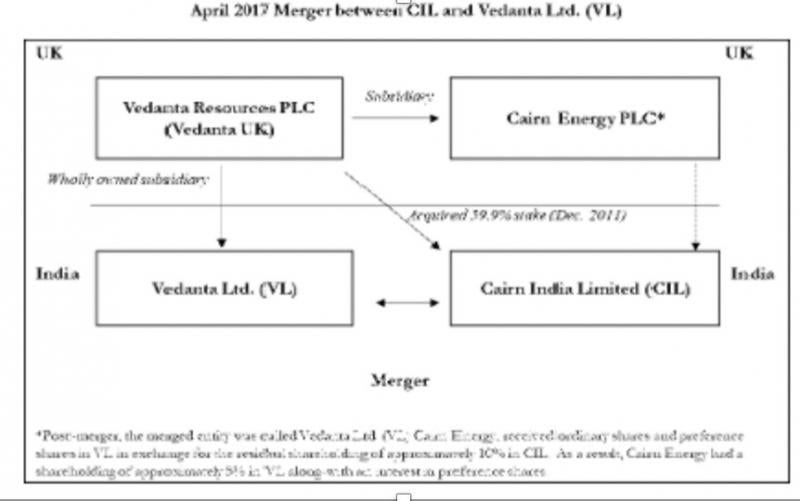

In December 2011, UK-based Vedanta Resources Plc (Vedanta UK) acquired 59.9% stake in CIL. In April 2017, CIL merged with Vedanta Ltd. (VL), a subsidiary of Vedanta UK. Under the terms of the merger, Cairn Energy, a subsidiary of Vedanta Resources Plc, received ordinary shares and preference shares in VL in exchange for the residual shareholding of approximately 10% in CIL. As a result, Cairn Energy had a shareholding of approximately 5% in VL along-with an interest in preference shares. As on December 31, 2017, this investment was valued at approximately US$ 1.1 billion.3

STRUCTURE

THE SUPREME COURT DECISION IN VODAFONE CASE - 2012

On January 20, 2012, pursuant to a challenge by Vodafone International Holdings B.V in the Supreme Court of India against imposition of tax by ITD,4 the Supreme Court of India5 discharged VIHBV of the tax liability. The Supreme Court held that sale of share in question to Vodafone did not amount to transfer of a capital asset within the meaning of Section 2(14) of the Income Tax Act. The Apex Court not only quashed the demand of INR 120 billion by way of capital gains tax but also directed refund of INR 25 billion deposited by the Vodafone in terms of the interim order dated November 26, 2010 along with interest at 4% p.a. within two months.

THE INDIAN RETROSPECTIVE TAX LEGISLATION - 2012

Soon after the above judgment, in March 2012, the Indian Parliament passed the Finance Act 2012, which provided for the insertion of two explanations in Section 9(1)(i) of the Income Tax Act (2012 Tax Amendments).6 The first explanation clarified the meaning of the term “through”, stating that: “For the removal of doubts, it is hereby clarified that the expression ‘through’ shall mean and include and shall be deemed to have always meant and included ‘by means of’, ‘in accordance of’ or ‘by reason of’.” The second explanation clarified that “an asset or a capital asset being any share or interest in a company or entity registered or incorporated outside India shall be deemed to be and shall always be deemed to have been situated in India, if the share or interest derives, directly or indirectly, its value substantially from the assets located in India”.

The 2012 Tax Amendments also clarified that the term “transfer” includes and shall be deemed to have always included disposing of or parting with an asset or any interest therein, or creating any interest in any asset in any manner whatsoever, directly or indirectly, absolutely or conditionally, voluntarily or involuntarily, by way of an agreement (whether entered into in India or outside India) or otherwise, notwithstanding that such transfer of rights had been characterized as being effected or dependent upon or flowing from the transfer of a share or shares of a company registered or incorporated outside India.

MEASURES BY INDIA AGAINST CUHL - 2014 AND 2015

In January 2014, the Indian tax Assessing Officer initiated reassessment proceedings against CUHL under Sections 147 and 148 of the Income-tax Act, 1961 which provide for reassessment proceedings in cases where income has escaped assessment. The Indian Income Tax Department (ITD) issued a notice to Cairn Energy, requesting information related to the Transaction. The ITD claimed to have identified unassessed taxable income resulting from the Transaction, such transactions having been allegedly undertaken in order to facilitate the IPO of CIL in 2007. The notification sought to implement the 2012 tax Amendments which the ITD sought to apply retrospectively to the Transaction. CUHL was also restricted from selling its shareholding of approximately 10% in CIL, which at that time had a market value of approximately US$ 1bn.

On March 9, 2015, a draft assessment order was passed against CUHL, assessing a principal tax due on the 2006 Transaction to INR 102 billion (US$1.6bn), plus applicable interest and penalties. (CUHL preferred an appeal against the order before the Income Tax Appellate Tribunal, Delhi. On March 9, 2017, the ITAT upheld the capital gains tax demand on CUHL, but rejected the ITD’s demand for interest. In August 2017, CUHL filed an appeal against the ITAT order before the High Court of Delhi, challenging ITAT’s imposition of capital gains tax demand. In October 2017, a cross-appeal was filed by ITD, challenging ITAT’s rejection of the interest demand.

INVOCATION OF INDIA UK BIT BY CUHL AND VEDANTA UK - 2015

On March 10, 2015, Cairn Energy initiated international arbitration proceedings under the India-UK BIT against the aforesaid measures adopted by the Indian government. It reportedly sought restitution of the value effectively seized by the ITD in and since January 2014.7 Cairn’s principal claims were that the assurance of fair and equitable treatment and protections against expropriation afforded by the Treaty have been breached by the actions of the ITD, which had sought to apply punitive retrospective taxes to historical transactions already closely scrutinised and approved by the Government of India.

Soon thereafter, on March 13, 2015, a draft assessment order was passed by the AO against CIL for failure to deduct withholding tax on alleged capital gains arising during 2006 Transaction in the hands of CUHL. The tax demand comprised INR 10247 Crores of tax, and the same amount as interest (approximately USD3.293 billion). On March 27, 2015, Vedanta UK served a notice of claim against the Government of India under the India-United Kingdom BIT, challenging the tax demand (Vedanta case).

The Treaty proceedings in the Cairn case formally commenced in January 2016. Cairn’s submitted its statement of claim in June 2016. In June 2016, India sought a stay on proceedings in Cairn Energy's arbitration, stating that it is "unfair" that India has to defend two cases at once. On October 6, 2016, India filed an application for bifurcation of the proceedings to decide issues of jurisdiction and admissibility of claims. India submitted its statement of defence in February 2017. On March 31, 2017, the tribunal rejected the application for 'stay'. On April 19, 2017, the Tribunal rejected the bifurcation application.

DEVELOPMENTS DURING PENDENCY OF ARBITRATION – 2016 TO 2018

Between 2016 and 2018, during the pendency of the international arbitration proceedings, the ITD seized and held CUHL’s shares in VL for a value of approximately USD 1 billion. While the seizure of those shares remained in place, CUHL could not freely exercise its ownership rights over those shares and could not sell them. Further aggravating matters, the ITD sold part of CUHL’s shares in VL to recover part of the tax demand, realising and seizing proceeds of USD 216 million. It continued to pursue enforcement of the tax demand against CUHL’s assets in India. These enforcement actions seizure of dividends due to CUHL worth USD 155 million, and offset of a tax refund of USD 234 million due to CUHL as a result of overpayment of capital gains tax on a separate matter.

Since the ITD attached and seized assets of CUHL to enforce the tax demand, CUHL pleaded before the Tribunal that the effects of the tax assessment should be nullified, and Cairn should receive recompense from India for the loss of value resulting from the attachment of CUHL’s shares in CIL and the withholding of the tax refund, which together total approximately USD 1.3 billion. The reparation sought by CUHL in the arbitration was the monetary value required to restore Cairn to the position it would have enjoyed in 2014 but for the Government of India’s actions in breach of the Treaty.

THE AWARD – DECEMBER 21, 2020

The following excerpt of the award is available in public domain:8

“ X. DECISION

2032. For the foregoing reasons, the Tribunal:

Declares that it has jurisdiction over the Claimant’s claims and that the Claimant’s claims are admissible;

Declares that the Respondent has failed to uphold its obligations under the UK-India BIT and international law, and in particular, that it has failed to accord the Claimants’ investments fair and equitable treatment in violation of Article 3(2) of the Treaty; and finds it unnecessary to make any declaration on other issues for which the Claimants request relief under paragraph 2(a), (c) and (d) of the Claimants’ Updated Request for Relief;

Orders the Respondent to compensate the Claimants for the total harm suffered by the Claimants as a result of its breaches of the Treaty, in the following amounts:

(this portion is not available).”

The Tribunal has reportedly ordered the government to desist from seeking the tax, and to return the value of shares it had sold, dividends seized and tax refunds withheld to recover the tax demand.9

CONCLUSION

The Vodafone and Cairn cases are a stern reminder of limits placed by international law upon States’ sovereign rights of taxation. The fundamental argument in favour of upholding treaty obligations, in the wake of other sovereign powers, is that treaties also constitute sovereign commitments by State to protect foreign investment in their territory. This places sovereign powers defined under national laws against sovereign commitments under international law. However, does the latter trump the former? The answer is clichéd; it depends.

Tax disputes present a strong case for non-arbitrability under majority national laws. They are also safeguarded by special statutes, special fora and specific redress mechanisms. Most States would urge that special statutory mechanisms be fully utilised prior to knocking the doors of fora under international investment treaties. Further, availability of redress under special international tax treaties could also remove tax disputes from the ambit of an investment treaty and place them before a special alternate forum.

Additionally, not only the forum but the stage at which investment treaty protection is invoked may also be important. Tribunals have held that claimants cannot simply treat as irrelevant their statutory rights of appeals and available constitutional review processes, and bring before tribunals a decision made by the lowest revenue officer in the assessment chain and purport to treat it as a finally adjudicated demand.10

It may be possible to decipher limits on international law commitments. For instance, it may be possible to adopt interpretations that narrow the scope of treaty application, restrict the qualifying requirements of ‘investment’ and ‘investors’, restrict the standards of treatment to certain circumstances, or interpret implied exclusions in the absence of express ones. What prevails will therefore depend on the language of the treaty and the creative interpretations adopted by lawyers and tribunals.

However, it is also possible to cut the clutter of a ‘tax dispute’ and bring the dispute within the four corners of an ‘investment dispute’ under the treaty. For instance, in the Vodafone and Cairn cases, it may have been possible to make a case for a tax-related investment dispute covered under a BIT, rather than a pure tax dispute that could be arguably excluded. This is also discernible from the fact that while accepting jurisdiction, Vodafone and Cairn tribunals have not directed India to annul the retrospective tax amendments.

This would be beyond the powers of an investment treaty arbitral tribunal, which has jurisdiction solely over the dispute between the State and the investor. Hence, an investment treaty arbitral tribunal that recognises a dispute as a tax-related investment dispute can provide restitution by restraining application of the tax-related measure on the investment. Yet, this continues to be a broad power placed in the hands of investment treaty tribunals, and must be wielded carefully.

In Cairn case, as much as in the Vodafone case, several questions relating to jurisdictional objections seem to have been put to rest by acceptance of jurisdiction by the Tribunal. Most of these objections and rulings could come to light as India has challenged the award in the Vodafone case in Singapore on December 24, 2020 - the final day of the limitation period of 90 days since the award was passed on September 24. It is likely that India will challenge the award in Cairn case as well before the Dutch courts. Hopefully, this will throw light on key issues decided by the Tribunal.

Further, Cairn could also face hurdles in enforcement of the award in India, and may have to find alternate avenues, if the existing rulings of the Delhi High Court are maintained by the enforcing courts in India.11 As per these rulings, there is no scheme for enforcement of treaty arbitration awards under the Indian Arbitration & Conciliation Act 1996, since it purportedly covers only commercial arbitration. It will also be interesting to see how the Indian courts consider an award restraining Indian tax authorities from imposing tax against the foreign investor, under Indian public policy.

1 PCA Case No. 2016-7. Tribunal comprising Mr. Laurent Levy, Mr. Stanimir Alexandrov and Mr. J. Christopher Thomas QC

3 https://www.cairnenergy.com/news-media/news/2018/update-on-cairn-s-assets-in-india/#Tabundefined=1

4 For details of the transaction in Vodafone and the developments post transaction, see our analysis at https://www.nishithdesai.com/information/research-and-articles/nda-hotline/nda-hotline-single-view/article/vodafone-investment-treaty-arbitration-award-part-i.html?no_cache=1&cHash=8fb65ba0b511a1193bc061ee430fcf1f

5 Civil Appeal No.733/2012

6 Section 9 provides: “The following incomes shall be deemed to accrue or arise in India :—

(i) all income accruing or arising, whether directly or indirectly, through or from any business connection in India, or through or from any property in India, or through or from any asset or source of income in India, or through the transfer of a capital asset situate in India.”

7 https://www.cairnenergy.com/news-media/news/2018/update-on-cairn-s-assets-in-india/#Tabundefined=1

8 https://www.taxsutra.com/news/27257/Cairn-Energy-wins-international-arbitration-under-India-UK-BIT

10 Generation Ukraine v. Ukraine (ICSID Case No ARB/00/9) (“Generation Ukraine”), Award of 16 September 2003

11 ‘BIT award enforcement at bay in India as Indian court rules out applicability of the Indian A&C Act, 1996’, Kshama A. Loya and Moazzam Khan in Asian Dispute Review, January 2020 at http://www.asiandr.com/journal-detail.php?issue=202001. Also see https://www.nishithdesai.com/information/news-storage/news-details/article/vodafone-investment-treaty-arbitration-award-part-iii.html

12 The authors thank Purvi Shrivastava, student of Government Law College, Mumbai, for her assistance on this article.

/>i

/>i