In Taxpayer Alert TA 2017/1, the Australian Tax Office (ATO) has announced that it will be targeting arrangements which fragment integrated trading businesses, with particular emphasis on the inappropriate use of stapled structures. The Alert emphasises that the ATO is not concerned with the use of stapled structures of itself, and recognises that such structures have been used by taxpayers for many years. Rather, the ATO is concerned with inappropriate use of those structures, as detailed below.

The Alert does not extend to:

Australian real estate investment trusts (A-REITs), provided they derive most of their rental income from unrelated third party tenants and have not entered into any of the specific arrangements the ATO is concerned about

Privatisations of businesses which are effectively land (and land improvement). (Separate guidance has been issued with respect to privatisations in the draft Privatisation and Infrastructure – Australian Federal Tax Framework (the Framework), updated in January 2017.)

The concerns expressed in the Alert are not new. In the draft Framework published in February 2016, the ATO highlighted the issue of inappropriate exploitation of the tax benefits of stapled structures as being 'high risk' from a compliance perspective and warned that they would be the subject of focus by the ATO compliance teams.

The Alert does not have the same legal status as a Ruling. The purpose of the Alert is to act as a deterrent to those taxpayers entering into stapled structures where there are all or some of the features which the ATO is concerned about.

Structures the ATO is targeting

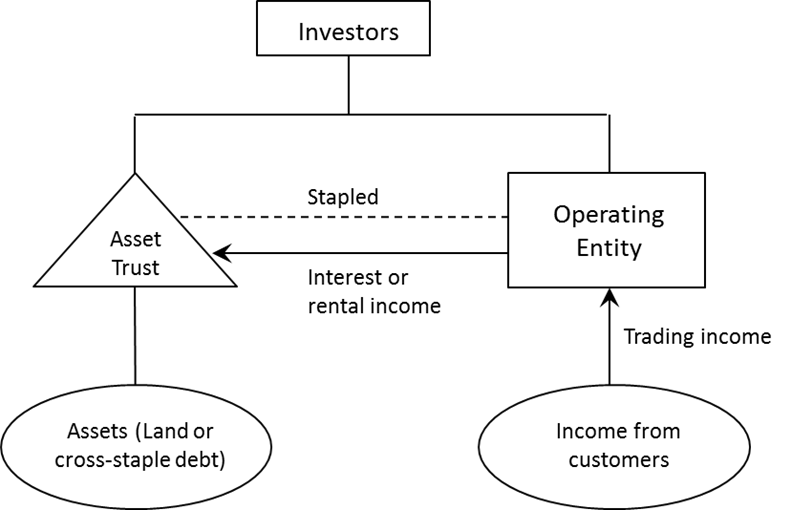

The ATO is concerned about the arrangements where a single business is divided into separate businesses, and trading income derived by an entity which runs a trading business (Operating Entity) is offset by payments to an asset-holding trust (Asset Trust) and is effectively re-characterised into more favourably taxed passive income.

Once the income is diverted to the Asset Trust:

Asset Trust is usually not taxed (as it is assessed on a flow-through basis)

When the Asset Trust distributes the income, the income is generally subject to tax at a rate of significantly less than 30%

The Operating Entity's taxable income is significantly reduced, largely because of deductions in respect of payments to Asset Trust. While the Operating Entity is taxed at 30%, the amount of income subject to that tax rate is minimal.

If the structure was not in place, the ATO considers it would be reasonable to expect the Operating Entity to be taxed on the operating income at 30%. Distributions to investors would be treated as dividends for tax purposes.

Illustration – Finance Staple and Rental Staple

Two of the arrangements covered by the Alert which are relatively common are the finance staple and the rental staple, illustrated above.

Finance Staple

In this structure, the Operating Entity carries on business with a small amount of equity. Asset Trust on the other hand has a significant amount of equity capitalisation. Asset Trust lends its excess equity to the Operating Entity at interest, creating a cross-staple debt. The Operating entity claims tax deductions for the interest payments made to Asset Trust, thereby reducing Operating Trust's taxable income and Asset Trust distributes the interest to investors on a flow through basis. The interest deduction offsets income taxable at 30%, while the interest is taxed at a lower rate: a maximum of 10% if paid to offshore unit holders of Asset Trust.

The ATO outlines how it might deal with the features of the stapled arrangement which it does not consider appropriate.

1. Interest deductions

The interest payments may be recharacterised as non-deductible dividends for tax purposes. More technically, the interest payments by the Operating Entity may be classified as returns on a non-share equity interest (under section 26-26 of the Income Tax Assessment Act 1997 (Tax Act)). This may occur if the cross-staple debt is characterised as an equity interest under Division 974 of the Tax Act.

According to the latest version of the Framework, the areas on which the ATO may focus in this context may include whether the cross-staple loan:

a related scheme to the equity interest the investors hold in the Asset Trust under section 974-70

is "designed to fund a return" on the equity interest in the Asset Trust under section 974-80.

The ATO may also consider the particular manner in which the loan is funded, as well as the existence of any margin charged on the cross-staple loan.

2. Control of a trading business

Asset Trust will not qualify as a managed investment trust (MIT) if it controls a trading business. The ATO considers such control may exist where there is a finance staple because the Asset Trust effectively controls, or is able to control, the Operating Entity which carries on a trading business for the purposes of Division 6C of the Tax Act.

The ATO takes the view that control may exist where the Operating Entity's continuation as a going concern is contingent on Asset Trust deciding not to exercise a right it has to trigger the Operating entity's insolvency.

Rental Staple

In this structure, the Asset Trust holds assets which are land or fixtures on land, while the Operating Entity has an arrangement with the Asset Trust whereby it leases or has access to the assets to enable the Operating Entity to run its business.

The Operating Entity would claim a deduction for rent and the Asset Trust, which will often be a MIT under Division 275 of the Tax Act, would be able to distribute the rental income as a fund payment to non-resident at lower rates of withholding tax (typically 15%).

The Alert considers that this type of transaction is an inappropriate use of a stapled structure if it is not a transaction that arm's-length parties would enter into, particularly if it is not possible to divide the business in a commercially meaningful way.

Issues the ATO has highlighted in the Alert:

1. Not carrying on an eligible investment business

The Asset Trust may not qualify as a MIT because it does not carry on an eligible investment business, on one or more of the following grounds:

a. it controls, or is able to control, the Operating Entity

b. the assets of the Asset Trust may not constitute 'land' in the circumstances

c. the income derived by the Asset Trust could be classified as trading business; income, rather than rental income

d. it is not investing in land for the required purpose.

2. Non-arm's length income

The cross-staple payment may be characterised as non-arm's length income under subdivision 275-L of the Tax Act on the basis that the transactions entered into would not be entered into by parties dealing with each other at arm's length.

Again, this is likely to be a factual matter, and the rental income charged by the Asset Trust would likely determine the character of the payment.

Conclusion

While the Alert might seem to raise new issues and concerns for structures of this kind, in fact the ATO has been monitoring these structures for some time. Stapled structures are most common when bringing in a mix of resident and non-resident investors, and complement the terms of the MIT (and more recently) the AMIT regimes designed to promote investment into Australian infrastructure, farming and real estate assets.

Ensuring that the arrangements between the stapled entities are at arms' length and commercially defensible will be important in the light of the ATO's focus on these types of structures.

/>i

/>i