As the first quarter of 2021 kicked off, we looked back at the worldwide data tracking issuance of Augmented Reality/Virtual Reality patents. As a brief overview, Augmented Reality/Virtual Reality (“AR/VR”) refers generally to a class of technologies that merge a view of a real-world environment with virtual objects and information or provide an entirely virtual environment as a user experience. AR/VR technologies are drawing renewed attention due in part to availability of cheaper and powerful mobile computing devices, faster and ubiquitous communication networks, plus the increased need for means of remote communication and collaboration in this work from home era. No longer are AR and VR restricted to entertainment and science fiction; they have now expanded into online shopping, workplace training and collaboration, healthcare delivery, and the real estate market, just to name a few. In this series, we track the growth in AR/VR patents worldwide that we expect will accompany the rapid innovation in this technology space. We highlight trends in patenting AR/VR technologies—who is obtaining AR/VR patent protection, and where. We track the various technology centers at the United States Patent and Trademark Office that handle AR/VR applications. And, from time to time, we shine the spotlight on interesting new AR/VR patents.

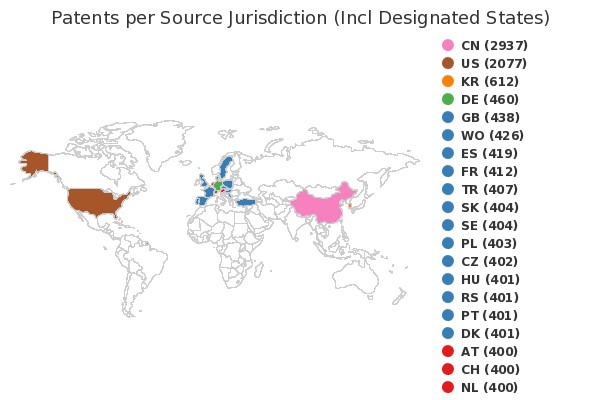

In the first quarter of 2021, the intellectual property offices around the world combined to issue over 7,240 patents related to AR/VR technologies, almost 500 more than the amount of patents issued in the final quarter of 2020 and more than double the amount issued in Q1 2020. China remained the top issuer by volume, with the Chinese patent office issuing more than 2,900 in Q1 2021 (up about 300 from Q4 2020). The United States remained in the second spot with a little over 2,000 relevant patents issued (down slightly from Q4 2020). Generally, there was a small uptick worldwide in issued AR/VR patents. While each jurisdiction continues to face its own challenges getting back to work during the worldwide pandemic, many have adjusted to remote options. Additionally, the overall embrace of digital interactions has no doubt spurred numerous applications for AR/VR technologies that were previously unexplored.

FIG. 1. Top jurisdictions for AR/VR patenting in Q1 2021

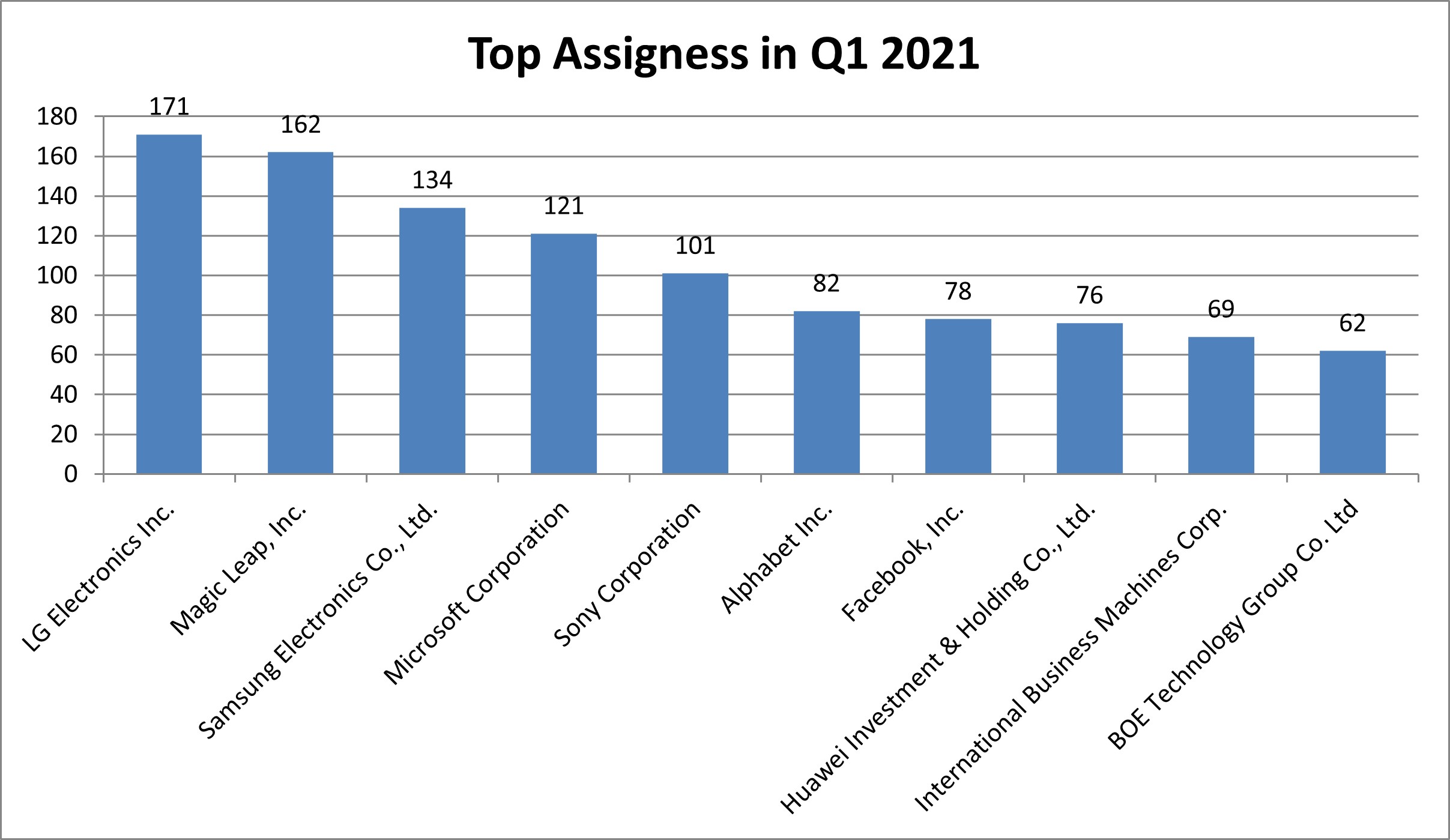

LG saw a surge in its AR/VR arsenal, launching ahead of Magic Leap and Microsoft with 171 relevant patents issuing in Q1 2021. We look forward to seeing how their innovations are presented in future products. A rookie in our top 10 was BOE Technogym Group which, among other areas, has plans for AR/VR applications in the healthcare space.

FIG. 2. Top 10 assignees by volume of AR/VR patents issued in Q1 2021

One example of a Q1 2021-issued AR/VR patent is Chinese Patent No. 112562375A assigned to Chery Automobile Co. Ltd. This utility patent covers a display method for displaying road names in augmented reality. This technology allow a driver to see the name of the road superimposed on the road itself, rather than having to rely on sporadic or hidden physical street signs.

With the first quarter’s data, we return to USPTO Technology Center 2600, which handles a large percentage of AR/VR applications to look at a particular Technology Center Group. Tech Center Group 2620 handles applications specific to selective visual display systems. This group has an average allowance rate of 70.7%. For allowed applications, around 73% had previously faced rejections based on prior art under 35 U.S.C. §§ 102 or 103. Moreover, about 30% of allowed applications had at least one Request for Continued Examination, with just over 25% of those requiring two or more Requests for Continued Examination. Rejections under 35 U.S.C. § 101 are less abundant than other Tech Center Groups, with 20% of all applications facing 101 rejection in a first office action, falling down to near 5% in a final office action. The average pendency for patents issuing from Tech Center Group 2620 is 3 years, 8 months, and 1 day from filing to issuance. Lastly, applicants have had some success appealing a Final Office Action to the Patent Trial and Appeal Board. Near 70% of the outcomes on appeal were in the applicant’s favor with the most success seen following a Pre-Appeal Brief Request for Review.

Design patent protection is available in the U.S. and Canada to protect the ornamental design of an object. (Europe and other jurisdictions operate on a registration system, rather than an examination system.) Companies and inventors may choose to protect hardware or graphical user interface elements using design patents. In the first months of 2021, a few of companies obtained patents protecting their designs. At no surprise to some, Magic Leap was the top receiver with 9 issued design patents. Spigen picked up where it left off at the end of 2020, adding 5 more patents to help protect its line of mobile accessories.

Patent Prosecution Statistics Methodology

Our analysis includes a search of all patents granted around the world in the first quarter of 2021, from January 1 to March 31, for keywords in the title, abstract, or claims related to AR/VR technologies. We then review the data to determine which offices are issuing relevant patents and which companies are focusing on protecting their innovations in the different parts of the world. For design patents, the same search was run, however, we note that the search was limited to the United States and Canada as design protection differs worldwide.

/>i

/>i