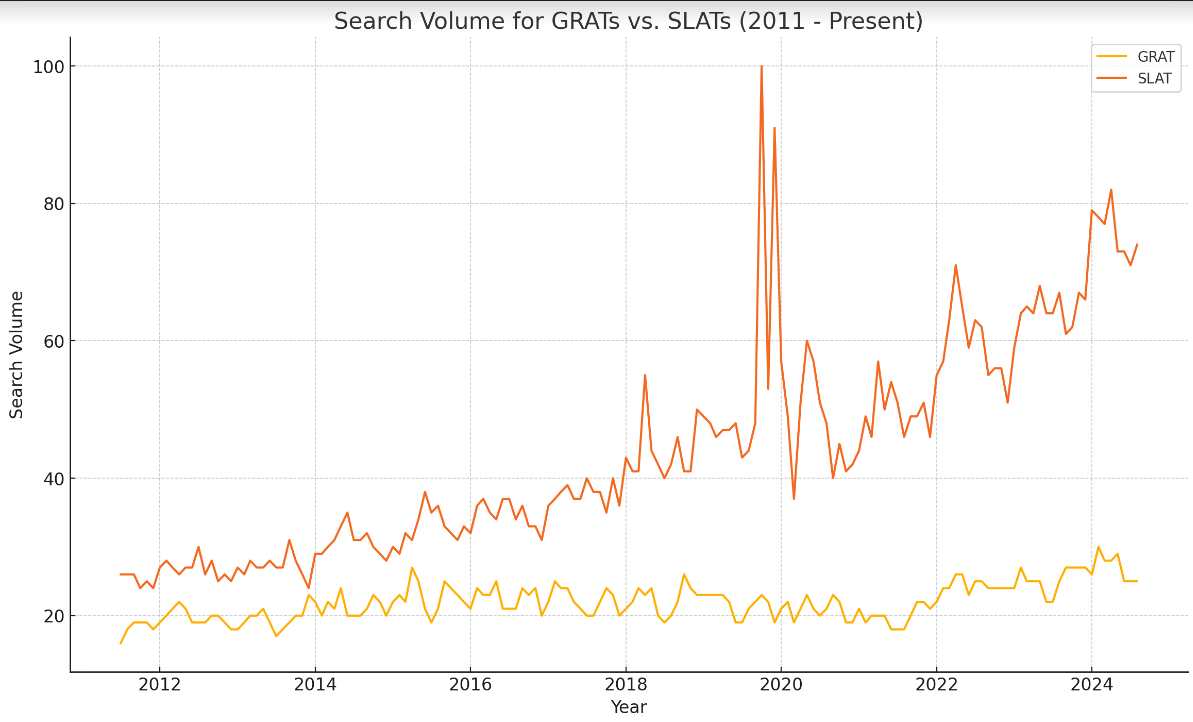

The 2010 Tax Relief Act temporarily increased the federal estate and gift tax exemption to $5 million per individual, a significant rise from prior years. As the 2012 fiscal cliff approached, concerns grew that these higher exemptions might be reduced, prompting a surge in estate planning activities. During this period, Spousal Lifetime Access Trusts (SLATs) gained popularity as estate planners promoted them as a strategic tool to lock in the increased exemption, allowing one spouse to make substantial gifts to a trust benefiting the other spouse while still retaining some access to the assets.

Figure 1: Google Search Volume Jul 2011 - Aug 2024 for GRATs (yellow) and SLATs (red)

The outlook - Estate tax exemption down to $3.5 Million in 2025?

Since the introduction of a higher gift and estate tax lifetime exemption after 2017, the focus of tax planning for many clients has shifted from reducing estate taxes to minimizing income taxes. In 2024, each taxpayer can pass up to $13.61 million to beneficiaries without incurring gift and estate taxes or $27.22 million for married couples. With the top estate tax rate at 40% for amounts exceeding these limits, many believe that the high exemption eliminates the need for complex end-of-life tax planning. However, these elevated exemption amounts are set to revert to pre-2017 levels in 2026, potentially lowering the exemption to around $5 million per individual.

Adding to this urgency, proposals like Elizabeth Warren’s tax plan (1) could further reduce the estate tax exemption to $3.5 million per individual, with increased tax rates on larger estates. Such changes would significantly broaden the scope of estates subject to taxation, making proactive planning essential. In this context, many savvy taxpayers are turning to strategies like Spousal Lifetime Access Trusts (SLATs) to maximize the current exemption while it remains high, allowing them to lock in tax advantages before the expected changes take effect.

What to do?

Use the higher exemption amounts before they go away by establishing trusts that remove assets from the taxable estate. Spousal Lifetime Access Trusts, or “SLATs,” have emerged as one of the most popular and effective estate planning tools for this purpose.

| Type of Trust | Purpose | Key Features | Tax Implications |

|---|---|---|---|

| Spousal Lifetime Access Trust (SLAT) | Remove assets from taxable estate while providing spouse access | One spouse creates trust for the benefit of the other; assets grow outside estate; irrevocable | Assets removed from grantor’s estate; no estate tax on appreciation; spouse can access funds |

| Grantor Retained Annuity Trust (GRAT) | Transfer asset appreciation to heirs with minimal gift tax | Grantor retains an annuity for a set period; remaining assets pass to beneficiaries | Minimal gift tax on remainder interest; potential to transfer appreciation tax-free |

| Irrevocable Life Insurance Trust (ILIT) | Exclude life insurance proceeds from taxable estate | Owns and controls life insurance policy; proceeds not included in estate | Life insurance proceeds are estate tax-free; may have gift tax on premiums paid |

| Charitable Remainder Trust (CRT) | Provide income stream to grantor and charity, reduce estate size | Income stream to grantor or beneficiaries; remainder to charity; irrevocable | Partial estate tax deduction; reduces taxable estate; income stream taxed |

| Qualified Personal Residence Trust (QPRT) | Transfer primary or vacation home out of estate | Grantor retains right to live in home for set period; home passes to heirs afterward | Reduces estate tax by freezing value of home; gift tax on remainder interest |

How do SLATs work?

SLATs allow one spouse, known as the donor spouse, to transfer assets into an irrevocable trust for the benefit of the other spouse, the beneficiary spouse. This transfer uses the donor spouse’s lifetime exclusion amount, effectively removing the assets from their taxable estate, including any future appreciation. The beneficiary spouse can access the trust’s assets as needed, providing flexibility and financial security. Meanwhile, the donor spouse maintains indirect access to the assets through their marriage. The donor spouse also controls how the trust assets will be managed and distributed when the SLAT is created. Additionally, SLATs offer strong asset protection, as the trust structure can help defend against potential creditor claims.

Some Caveats

It’s important to also consider and discuss with clients the potential drawbacks of SLATs. Some of the key disadvantages include:

Risk of Divorce or Death: If the donor spouse and beneficiary spouse divorce or if the beneficiary spouse predeceases the donor spouse, the donor risks losing access to the assets in the SLAT. To mitigate this risk, a “floating spouse” provision can be included in the trust, identifying the beneficiary as the “person to whom the settlor is currently married” rather than naming a specific individual. Additionally, the trust can be drafted to allow the trustee to make loans to the donor spouse for further protection.

Unwanted Tax Consequences: SLATs can lead to unfavorable estate, gift, and income tax outcomes. If the donor spouse retains certain powers over the trust, such as the unrestricted ability to replace the trustee, the SLAT’s assets might be included in the donor spouse’s estate, undermining the trust’s tax avoidance objectives. Contributions to a SLAT are also considered completed gifts, so if the contribution exceeds the annual gift tax exclusion ($18,000 in 2024), it will reduce the donor spouse’s lifetime exclusion. Additionally, because SLAT assets typically do not receive a “step up” in cost basis at either spouse’s death, this can increase capital gains taxes for beneficiaries when the assets are eventually sold.

Application of the Reciprocal Trust Doctrine: Couples must be cautious about creating reciprocal SLATs, as this could lead to the trusts being “uncrossed” and included in each spouse’s estate, defeating the primary purpose of the SLAT. Proper planning and drafting are essential to avoid this pitfall.

Indirect Gift Doctrine: According to Internal Revenue Code (IRC) § 2036, if an individual transfers assets but retains the right to income, possession, or enjoyment of the assets or retains control over who will benefit from them, those assets will be included in their gross estate for estate tax purposes.

This situation can easily occur when creating a Spousal Lifetime Access Trust (SLAT). For example, both spouses may intend to create SLATs with each other as beneficiaries while introducing various differences to avoid the “reciprocal trust” doctrine established in the Grace case, 395 U.S. 316 (1969) (see above). However, if one spouse lacks significant assets, the wealthier spouse might give assets to the less affluent spouse, who then uses those assets to fund a trust that names the wealthier spouse as a beneficiary. If the indirect gift principle is applied, the wealthier spouse could be considered the trust's grantor for estate tax purposes, thus including the trust’s assets in their gross estate under § 2036. Additionally, if the wealthy spouse is the trustee or holds certain tax-sensitive powers, estate inclusion may also result under § 2036(a)(2) or § 2038. This scenario is common among couples with significant differences in wealth. For this reason, many practitioners avoid reciprocal SLATs.

A practical example

James owns an LLC that he has held for about three or four years. He wants the LLC's investments to support his wife, Emma, during her lifetime and then pass on to benefit their children and later their grandchildren without being subject to federal estate tax.

To achieve this, James forms an irrevocable SLAT for Emma and the children, naming Emma and their friend, Grace, as co-trustees. James retains the right to replace the trustee of the trust at any time and for any reason, provided the replacement is someone who is not related to him or employed by him.

The trust stipulates that Emma can make distributions to herself based on what is reasonably needed for her health, education, maintenance, and support (HEMS standard). Grace, as an independent trustee who is not a beneficiary of the trust, has the power to distribute any or all of the trust assets to Emma at any time and for any reason, according to her sole and absolute discretion, with no obligation to make such distributions.

The trust also grants Emma the right to redirect how the trust assets will be distributed upon her death, provided they are used solely for their descendants. This is known as a “limited power of appointment.”

In this scenario, James retains the right to replace trust assets with assets of equal value, making the trust “disregarded” during James’s lifetime for federal income tax purposes. Additionally, Emma’s role as both a trustee and beneficiary of the trust also causes the trust to be “disregarded” for federal income tax purposes during James’s lifetime. In other words, James and not the trust pays income taxes (2).

Conclusion

As we look toward 2025, Spousal Lifetime Access Trusts (SLATs) are positioned for a significant surge in popularity. Initially gaining traction during the uncertainty of the 2012 fiscal cliff, SLATs have continued to evolve as a cornerstone of strategic estate planning, especially as clients face the prospect of a reduced federal estate tax exemption. With the exemption potentially dropping to $3.5 million per individual if the Warren tax proposals are enacted, SLATs offer a timely and powerful tool to lock in current tax advantages, allowing couples to transfer substantial wealth while maintaining flexibility and financial security.

However, SLATs are not without their complexities and potential pitfalls. The risks of divorce, death, and unfavorable tax consequences highlight the need for careful drafting and planning. By integrating provisions such as a “floating spouse” clause and adhering to the Health, Education, Maintenance, and Support (HEMS) standard, practitioners can mitigate these risks and enhance the trust's effectiveness.

Ultimately, as the landscape of estate planning continues to shift, the steady rise of SLATs will likely accelerate, making them an increasingly essential part of the conversation between clients and their advisors. Whether as a means to navigate the complexities of estate tax law or to ensure the financial well-being of future generations, SLATs stand ready to play a pivotal role in the years ahead.

References:

- American Housing and Economic Mobility Act of 2024 https://www.warren.senate.gov/imo/media/doc/final_text_-_ahem_2024.pdf

- Adapted from an example in Alan S. Gassman, Christopher J. Denicolo & Brandon Ketron, SLAT-OPEDIA: Considering All Options and a Client-Friendly Letter, Tax Mgmt. Est., Gifts & Tr. J. (2021). PermaLink https://perma.cc/5636-T5W5

A podcast that summarized the points of this article is available here:

/>i

/>i