Securities Class Action Filings—2021 Midyear Assessment

Executive Summary

Overall filing activity dropped considerably in the first half of 2021, falling to 112 filings from 150 filings in the second half of 2020. This decline was largely driven by a substantial reduction in the number of M&A class actions and federal and state 1933 Act filings, although core filings with Section 10(b) allegations were also down modestly.

Filings in the first half of 2021 were generally smaller, resulting in lower MDL and DDL indices. DDL fell 50% from $162 billion in 2020 H2 to $80 billion in 2021 H1. Similarly, MDL fell 64% from $991 billion in 2020 H2 to $361 billion in 2021 H1.

Special purpose acquisition company (SPAC) IPOs have continued to explode. Filings against SPAC-related entities increased sharply in the first half of 2021. There were also 10 filings related to COVID-19, largely concentrated in the first four months of the year.

1933 Act Filings

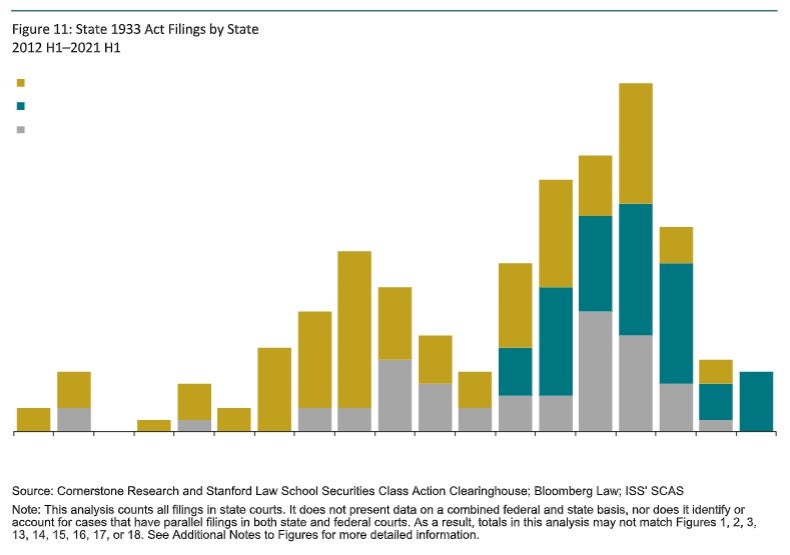

The following data include 1933 Act filings in California, New York, and other state courts. Filings from prior years are added retrospectively when identified. These filings may include Section 11, Section 12, and Section 15 claims, but do not include Rule 10b-5 claims.

-

The number of state 1933 Act filings in the first half of 2021 is dramatically lower than 2018 H1–2020 H1 levels, continuing the trend observed in the Securities Class Action Filings—2020 Year in Review.

-

All five state 1933 Act claims in the first half of 2021 were filed in New York.

-

Four of the five state 1933 Act filings in 2021 H1 were against companies in the Technology sector. Three of these Technology sector filings were in the Software subsector.

-

In the first half of 2021, three of the five 1933 Act filings were against Chinese companies, while two were against companies headquartered in the United States

State 1933 Act filing activity decreased 83% relative to the record high in 2019 H2, with no filings outside New York.

Dollar Loss on Offered Shares Index™ (DLOS Index™)

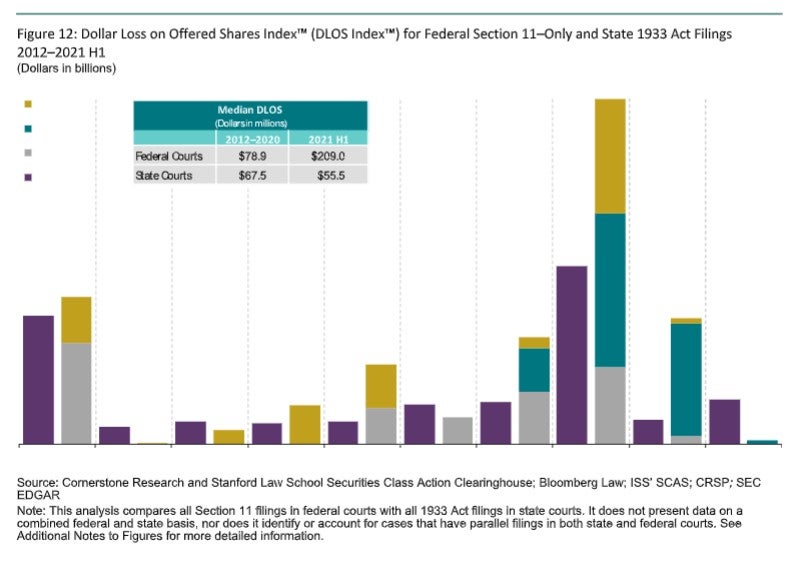

This analysis calculates the loss of market value of shares offered in securities issuances that are subject to 1933 Act claims. It measures the difference in the price of offered shares (i.e., from the date the registration statement becomes effective through the end of the class period) multiplied by the shares offered.

This alternative measure of losses has been calculated for federal filings involving only Section 11 claims (i.e., no Section 10(b) claims) and 1933 Act filings in state courts. Dollar Loss on Offered Shares (DLOS) aims to capture, more precisely than MDL, the dollar loss associated with the specific shares at issue as alleged in a complaint.

The DLOS Index for federal Section 11 filings in 2021 H1 is already the third-highest yearly federal DLOS Index

since 2010.

-

Filings in New York state courts were the source of all state DLOS. This continues a trend of an increasing share of DLOS being attributable to New York cases, with 44% in 2019 and 89% in 2020.

-

The median DLOS in federal courts in the first half of 2021 is more than two-and-a-half times the historical median.

Federal Section 11 Filings and State 1933 Act Filings

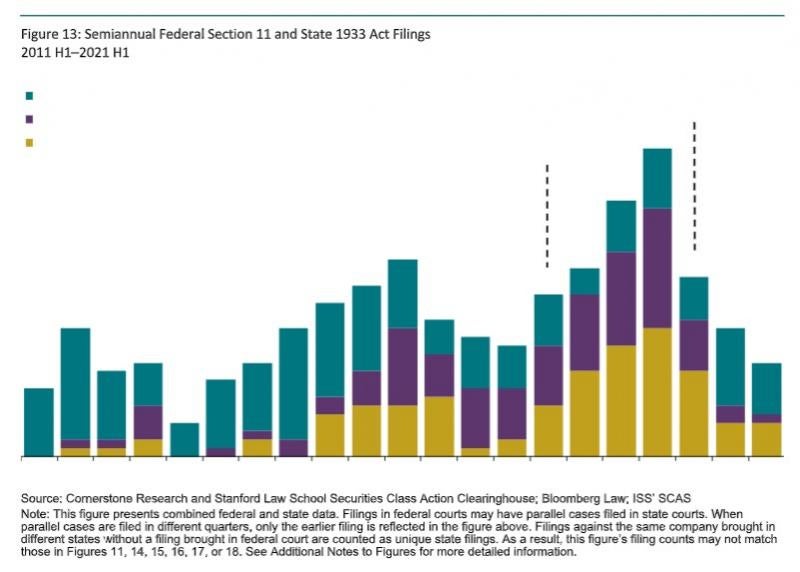

The figure below is a combined measure of Section 11 filing activity in federal courts and 1933 Act filings in state courts. It highlights parallel (or related) class actions in federal and state courts. We continue to note the apparent impact of Sciabacucchi on the venue of Section 11 and 1933 Act filings.

-

Federal Section 11 and state 1933 Act filing activity in 2021 H1 was down 27% relative to 2020 H2, largely driven by a 33% decline in federal-only Section 11 filings. This continues the steep downward trend observed in federal Section 11 and state 1933 Act filings since 2019 H2.

-

Post-Sciabacucchi (2020 H1–2021 H1), federal-only filings have risen to 43% of total Section 11 and state 1933 Act filings, more than double the 21% during the Cyan-Sciabacucchi interim period (2018 H1–2019 H2).

State 1933 Act filing activity for both state court only and parallel filings remains depressed post-Sciabacucchi, totaling only about 17% of its 2019 H2 high.

-

The share of state-only filings has remained stable at 41% and 38% during the interim and post periods, respectively. These levels are elevated relative to the pre-Cyan (2011 H1–2017 H2) share of just 18%.

-

The share of parallel filings has plummeted post-Sciabacucchi to 19% of total Section 11 and 1933 Act filings, around half of the 38% observed in the interim period, and in line with the 23% observed pre-Cyan.

Type of Security Issuance Underlying Federal Section 11 and State 1933 Act Filings

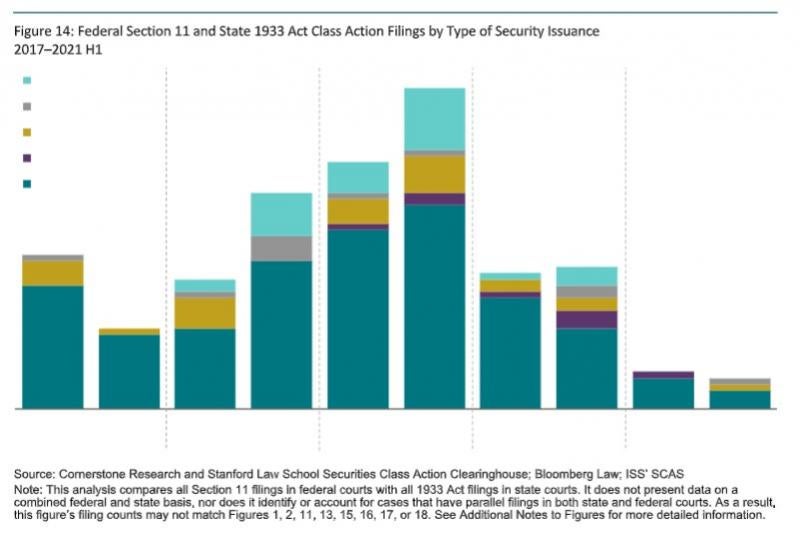

The figure below illustrates Section 11 claims in federal courts and 1933 Act claims in state courts based on the type of security issuance underlying the lawsuit.

To the extent that there were any Section 11 and state 1933 Act filings, claims based on IPO issuances were predominant in 2021 H1.

-

In the first half of 2021, there were no filings related to mergers or spin-offs and only two related to seasoned equity offerings (SEOs), which differs from the trend observed in the last two years, particularly in state courts.

-

There were no state court filings based on both an IPO and an SEO in the first half of 2021 and only one such filing in federal court.

-

The filing in state court in 2021 H1 characterized as “Other” was related to a SPAC.

/>i

/>i