On April 12, 2021, the SEC’s Acting Director of the Division of Corporation Finance, John Coates, and Acting Chief Accountant, Paul Munter, issued a joint statement (“Statement”) highlighting concerns about the accounting treatment of warrants issued in conjunction with special purpose acquisition companies (“SPACs”).[1] Initial funding for a SPAC often includes warrants that have typically been classified as equity in the SPAC’s financial statements. However, in their Statement, Mr. Coates and Mr. Munter described certain common features of those warrants that would require them to be classified as liabilities rather than equity. They explained that if, after considering the Statement, SPACs concluded that an error in prior reporting had occurred, it might trigger the need for them to restate their financial statements and to revise prior disclosures about the effectiveness of internal controls over financial reporting (“internal controls”).[2]

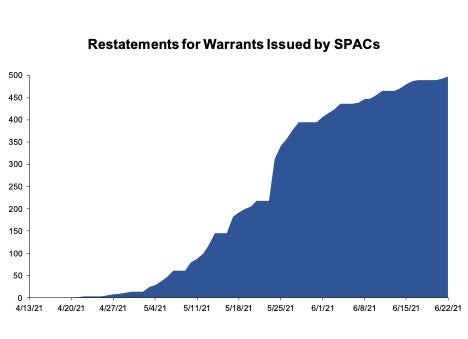

Only nine days after the release of the Statement, on April 21, 2021, a publicly-traded firm created through a SPAC restated its accounting for warrants and disclosed material weaknesses in its internal controls. To date, almost 500 SPACs have restated their accounting for warrants, and additional restatements may be forthcoming.[3] Many have commented that the volume of restatements demonstrates that the accounting is complex and nuanced.

For at least one entity created through a SPAC (Virgin Galactic Holdings, Inc.), a securities class action has been filed alleging improper accounting and deficient internal controls following a warrant restatement.[4] Whether other class actions will follow depends, at least in part, on the magnitude of stock price reactions in response to the financial statement restatement and/or disclosures of material weaknesses in internal controls.

Financial Statement Restatements

As shown in the chart above, the financial statement restatements for warrants issued by SPACs that began in April following the release of the Statement have continued at a rapid pace to date. Of the 497 SPACs that reclassified warrants as liabilities, the majority corrected previously-issued financial statements to reflect a restatement, while some implemented a revision, whereby the correction was applied only to the current and future financial statements.[5] Not all of the SPACs that restated were smaller issuers – approximately 5% were large accelerated or accelerated filers as of the date of the restatement.[6]

In connection with a restatement of the accounting for warrants, a SPAC will report higher liabilities and lower equity, but there is no effect on cash flows. The liabilities are recognized at fair value, with changes in fair value recognized in earnings (potentially creating income statement volatility). Some have commented that the financial statement effects of the restatement (e.g., the lack of impact on cash flows) may not result in a stock price reaction large enough to prompt a securities class action filing.

Material Weaknesses in Internal Controls

Nearly all SPACs that have restated their financial statements have also determined that material weaknesses existed in their internal controls. In particular, out of the 497 firms that restated for SPAC warrants to date, we found that more than 90% identified a material weakness in the SEC filing in which the restatement was reported.[7]

Based on our review, a common plan disclosed by firms to remediate the material weaknesses reported in conjunction with the SPAC restatements is to improve the processes involved in financial reporting, including providing enhanced access to accounting literature, as well as improving communications with third parties consulted for complex accounting issues. Some firms also disclosed that their plans contemplated supplementing existing accounting staff. These types of enhancements tie closely to concerns regarding SPAC-related internal controls expressed by Mr. Munter in a Public Statement released on March 31, 2021 (“Mr. Munter’s Statement”).[8] For example, Mr. Munter described that because the SPAC merger process happens quickly, previously-private firms will have to focus on the “people, processes, and technology, that will need to be in place to meet SEC filing, audit, tax, governance, and investor relations needs post-merger.”[9]

In Shane Levin et al. v. Virgin Galactic Holdings, Inc. et al, plaintiffs have alleged that the company had “deficient disclosure controls and procedures and internal controls over financial reporting” and that, “as a result, the Company improperly accounted for [the SPAC’s warrants] that were outstanding at the time of the Business Combination.”[10] While the classification of SPAC warrants is an emerging development, and it is too early to determine whether additional securities case allegations will incorporate this issue, allegations by plaintiffs related to weaknesses in internal controls are not new and have frequently been observed in securities class actions. For example, our research shows that almost 60% of securities class action cases involving accounting allegations filed in 2020 included claims related to weaknesses in internal controls.[11]

Moreover, by definition, the presence of a material weakness means that “there is a reasonable possibility that a material misstatement of the registrant’s annual or interim financial statements will not be prevented or detected on a timely basis.”[12] In addition to accounting for complex financial instruments (of which warrants are an example), Mr. Munter’s Statement identified several other “complex issues” that firms may face in the de-SPAC process such as accounting for compensation in earn-outs, the adoption of new accounting standards on the timeline for public rather than private entities, and the application of GAAP in areas not previously faced by private companies, including earnings per share and segment disclosures.

Further, securities class actions have already been filed against SPAC entities alleging issues related to related party transactions and revenue recognition. For example, in Jesus Mendoza, et al. v. HF Foods Group, et al., plaintiffs allege that defendants failed to disclose that “HF Foods insiders and related parties were enriching themselves by misusing shareholder funds and HF Foods’ related party transactions violated company policy, SEC regulations, and Generally Accepted Accounting Practices….”[13] In Thomas Jedrzejczyk, et al. v. Skillz Inc., et al, plaintiffs allege that “the enormous amount of incentive Bonus Payments that Skillz routinely provides to its gamer customers, ... who are expected to use them for game entry fees, … artificially inflates Skillz revenue.”[14] Revenue recognition allegations are commonly included by plaintiffs in securities class actions. For example, in prior research on securities class action filings, we found that such allegations were included in over 35% of securities case filings involving accounting allegations.[15]

Conclusion

At least one securities class action with allegations focused on the restatement of SPAC warrants and related internal control issues has been filed to date (Shane Levin et al. v. Virgin Galactic Holdings, Inc. et al.). It remains to be seen whether stock price declines in response to restatements and/or disclosures of material weaknesses by SPACs are of sufficient magnitude to prompt securities class action filings in the future. However, based on the above, as well actions taken by plaintiff law firms such as the formation of a task force on SPACs,[16] it seems likely that accounting issues involving SPACs will be a continuing area of interest for plaintiff counsel involved in securities class actions.

[1] See https://www.sec.gov/news/public-statement/accounting-reporting-warrants-issued-spacs.

[2] Unless otherwise indicated, we use the term “restatements” to include both restatements and revisions. The Statement explained that material errors related to the accounting for warrants could be corrected by amending the SPAC’s most recent Form 10-K and any subsequently filed Forms 10-Qs. A SPAC may also need to revise its prior disclosures on the effectiveness of internal controls and/or disclosure controls and procedures. See “Registrant Filing Considerations” in the Statement for additional discussion (https://www.sec.gov/news/public-statement/accounting-reporting-warrants-issued-spacs).

[3] For ease of exposition, we use the term “SPACs” to refer to SPACs and entities created through SPACs. Our research identifies restatements and revisions to the accounting for warrants in response to the April 12, 2021 Statement based on a search of Form 10-Ks, 10-K/As, 10-Qs, and 10-Q/As filed with the SEC between April 13, 2021 and June 22, 2021 obtained through the SEC’s Edgar database. The search included filings listed on the SEC’s website “Latest Filings Received and Processed at the SEC,” accessed at 9 am eastern on June 22, 2021, that contains the most recent filings for the current official filing date (https://www.sec.gov/cgi-bin/browse-edgar?action=getcurrent).

[4] On May 28, 2021, plaintiffs filed a securities class action against Virgin Galactic Holdings, Inc. and certain of its officers following the Company’s announcement of delayed reporting of its financial results due to pending changes to its accounting for warrants. See https://securities.stanford.edu/filings-documents/1077/VGHI00107744/2021528_f01c_21CV03070.pdf.

[5] See, for example, Staff Accounting Bulletin No. 108, “Correcting prior year financial statements for immaterial errors would not require previously filed reports to be amended. Such correction may be made the next time the registrant files the prior year financial statements.” https://www.sec.gov/interps/account/sab108.htm

[6] For definitions of large accelerated and accelerated filers, see https://www.sec.gov/corpfin/secg-accelerated-filer-and-large-accelerated-filer-definitions.

[7] Note that the vast majority of SPACs that restated are emerging growth companies. Emerging growth companies are not required to provide an auditor attestation of internal controls under Sarbanes-Oxley Act Section 404(b) (https://www.sec.gov/smallbusiness/goingpublic/EGC).

[8] Paul Munter, Acting Chief Accountant, Financial Reporting and Auditing Considerations of Companies Merging with SPACs, March 31, 2021 (https://www.sec.gov/news/public-statement/munter-spac-20200331).

[9] Mr. Munter’s Statement (https://www.sec.gov/news/public-statement/munter-spac-20200331).

[10] See para 39 at https://securities.stanford.edu/filings-documents/1077/VGHI00107744/2021528_f01c_21CV03070.pdf.

[11] See Accounting Class Action Filings and Settlements, Cornerstone Research (2021), p. 16. (https://www.cornerstone.com/Publications/Reports/Accounting-Class-Action-Filings-and-Settlements-2020-Review-and-Analysis.pdf)

[12] See https://www.sec.gov/rules/final/2007/33-8829.pdf, page 2.

[13] See para 5 at https://securities.stanford.edu/filings-case.html?id=107365.

[14] See para 3 at https://securities.stanford.edu/filings-case.html?id=107731.

[15] See Accounting Class Action Filings and Settlements, Cornerstone Research (2020), p. 1. (https://www.cornerstone.com/Publications/Reports/Accounting-Class-Action-Filings-and-Settlements-2020-Review-and-Analysis.pdf)

[16]https://www.rgrdlaw.com/news-press-Launches-SPAC-Task-Force.html.

/>i

/>i