The concept of “joint employment” is an important workplace legal issue and often arises in the real estate industry because industry employers want to avoid liability for another business’s employees’ legal claims. The risk of one entity being deemed to jointly employ another entity’s workforce is real, and proactive steps can help identify and mitigate such risk.

Background

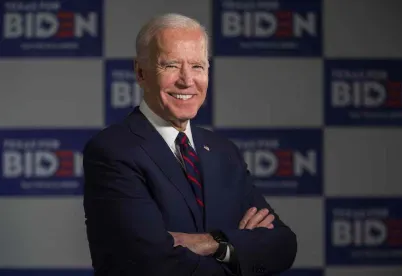

Whether one business can be held jointly liable for workplace law claims of another business’s employees requires a fact-intensive analysis. The legal standard for such assessment varies, depending upon which statutory framework is considered. During the Trump Administration, the standard for evaluating joint employer status under the Fair Labor Standards Act (FLSA) and the National Labor Relations Act (NLRA) changed. Further changes during the Biden Administration can be expected.

In the real estate industry, a joint employer allegation typically arises in the context of a contractor relationship. For example, in the commercial real estate setting, a property owner or manager may be deemed to jointly employ the employees of a cleaning contractor. It is common for the contractor’s employee to name both the contractor and building owner in litigation alleging violation of a workplace law (alleging, for example, discrimination, harassment, or unpaid wage claims). Whether the building owner or manager will be deemed a joint employer and liable for the claims asserted by the contractor’s employee will depend on a host of factual inquiries and application of a legal standard that will depend on the basis for the statutory claim. Similar issues can arise in the residential real estate setting. For example, a managing agent may be deemed to jointly employ a service worker employed by a building owner, even when the managing agent does not directly employ the employee.

Joint Employer Test under NLRA

On April 27, 2020, the National Labor Relations Board (NLRB) final rule on the standard for determining joint employer status under the NLRA became effective. The NLRB’s final rule reversed a key decision from 2015, Browning-Ferris Industries of California, Inc., 362 NLRB No. 186. There, the NLRB significantly broadened the joint employer doctrine used to hold an otherwise completely separate legal entity jointly responsible for another employer’s labor law obligations with respect to the other employer’s employees.

For the 30 years before Browning-Ferris, the joint-employer doctrine applied only “when one company exerts sufficient control, which is both direct and immediate, and neither limited nor routine in nature, over another company’s workers’ terms and conditions of employment.” That test protected employers who exerted only limited and direct control commonly found in contractor-subcontractor relationships from unsuspected liability for the other company’s labor law violations.

The final NLRB rule creates a “direct and immediate control” standard and has granted employers greater clarity with respect to their legal obligations. Under the final rule, to be found a joint employer, a business must possess and exercise substantial, direct, and immediate control over at least one essential term and condition of employment of another employer’s employees. The NLRB’s rule lays out specific terms and conditions of employment that should be considered in assessing whether a joint employer relationship exists.

Joint Employer Test under FLSA

In January 2020 the U.S. Department of Labor (DOL) issued a final rule updating its regulations governing joint employer status under the FLSA. The 2020 regulations were the first such updates to the rule in more than 60 years and provided a test viewed as more favorable to businesses seeking to avoid liability claims asserted by employees of a different legal entity.

The test focuses on four factors:

-

Whether the entity hires or fires the employee;

-

Whether the entity supervises and controls the employee’s work schedules or conditions of employment;

-

Whether the entity determines the employee’s rate and method of payment; and

-

Whether the entity maintains the employee’s employment records.

In September, a federal judge struck down a significant portion of the DOL’s rule, creating uncertainty in this legal area. The DOL’s rule limits the circumstances when a business would be liable for the wages of another business’s employees. While the district court decision affects only litigation in the Southern District of New York (for now), the DOL has appealed the ruling to the U.S. Court of Appeals for the Second Circuit. The Biden Administration may change course, withdraw the appeal, or write a new joint employer rule.

/>i

/>i