Tax legislation that was included in the massive spending bill signed by the President included provisions affecting the charitable sector. We previously reported on one provision that will be welcomed across the sector. Another provision will be good news for donors making charitable contributions for disaster relief.

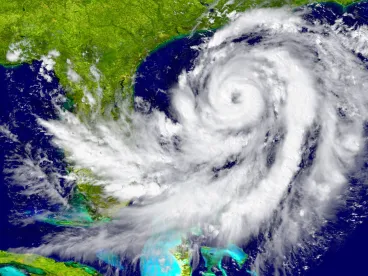

The Taxpayer Certainty and Disaster Relief Tax Act signed into law on December 20 includes various tax provisions intended to mitigate a portion of the enormous financial cost of recent hurricanes, tornadoes, forest fires, earthquakes and other natural disasters. Included was an enhanced tax benefit for donors making charitable contributions to organizations providing disaster relief.

Charitable contributions by individuals may generally be claimed as income tax deductions with limitations based on their adjusted gross income. In general, contributions to public charities of appreciated capital assets may be deducted up to 30% of AGI, while contributions of cash may be deducted up to 60% of AGI. In both cases, contributions that exceed these limitations may be carried forward for up to five additional years, subject to the same limitations every year.

The new law temporarily eliminates these limitations for qualified contributions for disaster relief. This means that contributions of cash may be deducted up to100% of AGI. These requirements must be satisfied to qualify for this enhanced tax benefit:

-

The contribution must be paid in cash during the period beginning January 1, 2018 and ending sixty days after the date of enactment. This means that the contribution must be made on or before February 18, 2020.

-

-

Note that 2018 contributions for disaster relief made at any time during 2018 will qualify for enhanced deductibility on the donor’s 2018 tax return, so long as the other requirements are met.

-

-

The contribution must be made to a public charity (as opposed to a private foundation)

-

It must be made for relief efforts in one or more areas for which a major disaster was declared by the President

-

The donor must obtain from the charity a contemporaneous written acknowledgment satisfying the normal rules for these tax receipts plus confirmation by the charity that the gift was used, or will be used, for relief efforts described in item 3.

-

Contributions to supporting organizations defined in IRC 509(a)(3), or contributions to establish a donor advised fund, don’t qualify for this benefit.

The special deduction, essentially 100% of AGI, is allowed only to the extent the qualified contribution does not exceed the excess of AGI over the charitable income tax deductions otherwise allowable in 2018 and 2019 under the normal rules.

Example: A Donor has 2019 AGI of $1,000,000, and contributed in that year to the symphony (a public charity) appreciated securities with a value of $500,000; and to a disaster relief organization cash of $1,000,000 for use in a designated disaster area. Assuming she receives a contemporary written acknowledgement from both organizations, the donor may claim the following charitable deductions on her 2019 tax return:

-

Symphony donation is limited to 30% of AGI = $300,000. The remaining $200,000 carries over to 2020, subject to the 30% AGI limitation in 2020.

-

Disaster relief donation is limited to AGI $1,000,000 less the $300,000 symphony deduction = $700,000. The remaining $300,000 carries over to 2020, subject to the special 100% AGI limitation in 2020.

/>i

/>i