Securities Class Action Filings—2021 Midyear Assessment

Executive Summary

Overall filing activity dropped considerably in the first half of 2021, falling to 112 filings from 150 filings in the second half of 2020. This decline was largely driven by a substantial reduction in the number of M&A class actions and federal and state 1933 Act filings, although core filings with Section 10(b) allegations were also down modestly.

Filings in the first half of 2021 were generally smaller, resulting in lower MDL and DDL indices. DDL fell 50% from $162 billion in 2020 H2 to $80 billion in 2021 H1. Similarly, MDL fell 64% from $991 billion in 2020 H2 to $361 billion in 2021 H1.

Special purpose acquisition company (SPAC) IPOs have continued to explode. Filings against SPAC-related entities increased sharply in the first half of 2021. There were also 10 filings related to COVID-19, largely concentrated in the first four months of the year.

Trending Cases and Statistics

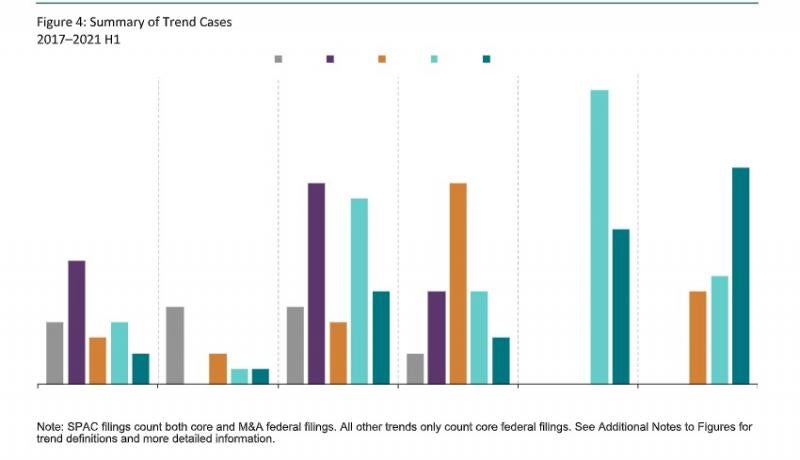

This figure highlights recent trends that have appeared in core filing activity.

-

In the first half of 2021, there were 14 filings related to SPACs. Of those, eight filings (57%) alleged that the potential targets misrepresented their product’s viability before the merger and thus defrauded investors.

-

Nearly two-thirds (six) of COVID-19 filings occurred in January and February 2021, while only one COVID-19 action was filed in May or June. In 2021 H1, half of these filings concerned companies developing COVID-19 treatments or vaccines that failed to make it to market.

-

Cryptocurrency filings are on pace to match the elevated levels of filings experienced in 2020.

-

The number of filings related to the opioid epidemic has remained low.

-

Cannabis filings have remained substantially lower in 2021 H1 after reaching a peak of 13 filings in 2019.

Filings related to SPACs and COVID-19 surged in the second half of 2020 and first half of 2021 while other trend filings decreased.

One of the two cybersecurity cases filed in 2021 H1 was an instance of ransomware. While cybersecurity cases are in line with previous years, it is unclear if the number of cybersecurity cases will grow after the high-profile ransomware attacks during 2021 H1. In particular, there have already been four cybersecurity filings in July, three of which have been the result of cybersecurity reviews from the Cyberspace Administration of China.

New: Industry Comparison of Federal SPAC Filings

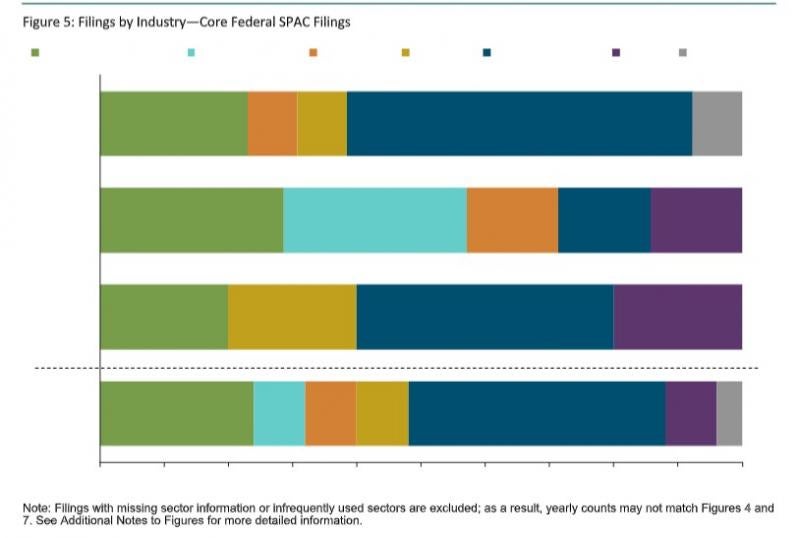

This analysis of core federal SPAC filings examines the industry composition associated with the substantial increase in securities class action filings against current and former SPACs observed over the last three years.

-

Of the 10 SPAC Consumer Cyclical filings in the last three years, seven had a subsector classification of Auto Manufacturers or Auto Parts & Equipment. Six of these auto-related actions were filed in 2021 H1.

-

Within the Consumer Cyclical sector, three subsectors—Entertainment, Retail, and Leisure Time—each had one SPAC filing.

-

The Consumer Non-Cyclical sector was the second most common sector for SPAC filings

Half of all core SPAC filings in 2021 H1 involved the auto industry.

-

Consumer Non-Cyclical SPAC filings have included the following subsectors: Biotechnology (two filings), Commercial Services (two filings), Food (one filing), and Healthcare-Services (one filing).

-

The Communications, Technology, Industrial, and Energy sectors each had two filings against former SPACs over the last three years.

New: Lag between De-SPAC Transaction and Core Federal Filings

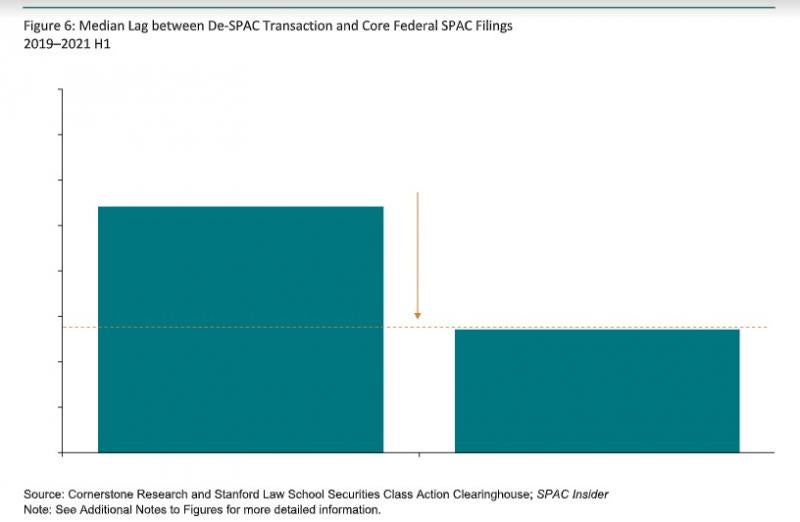

This analysis reviews the median number of days between the closing date of the SPAC merger transaction (De-SPAC Transaction) and the filing date of a core federal securities class action.

-

The median filing lag after a De-SPAC Transaction was much greater in 2019 and 2020 (271 days) than in 2021 H1 (136 days).

-

All federal SPAC M&A filings in 2019 and 2020, except one, were filed before the closing date of the SPAC transaction. The median filing lag of federal M&A SPAC actions indicates that these filings typically took place a month and a half before the closing date of the De-SPAC Transaction.

-

Core SPAC filings were much less frequent in 2019 and 2020, with only one and five core filings, respectively. (See Figure 7)

From 2019 through 2021 H1, the median filing lag for a SPAC subject to a core federal filing was roughly four and a half months.

New: Federal SPAC Filing Allegations

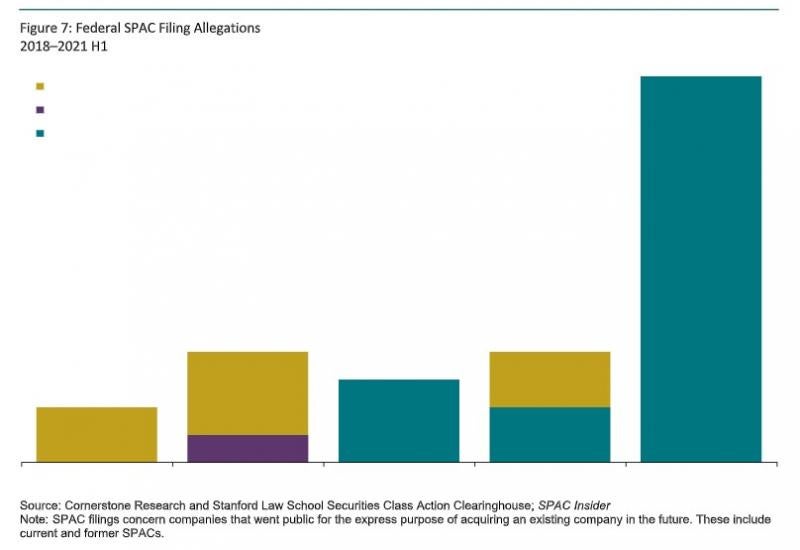

The figure below illustrates how the types of allegations in filings against current and former SPACs have changed over time. Allegations are based on the first identified complaints.

The SPAC core litigation rate over the last three years is approximately 14%—comparable to the cumulative core litigation rate for public companies in the first three years after IPOs.

-

According to SPAC Insider, as of July 15, 2021, 166 SPAC merger transactions have closed since the start of 2019. Over this same period, there have been 23 core federal SPAC filings, three of which were in July 2021. This equates to a litigation rate of roughly 14%, comparable with the cumulative core litigation rate that newly public issuers face in the first three years after IPOs.1

-

While nearly all federal SPAC filings were M&A filings in 2019, by 2021, no SPAC filings had M&A allegations and all such filings included Section 10(b) claims.

-

Over the last three years, only one federal SPAC filing has included Section 11 allegations.

/>i

/>i