Following its recent promulgation of the Marshall Islands Economic Substance Regulations, the Marshall Islands Registrar of Corporations now requires all non-resident domestic entities and foreign maritime entities to report annually on their compliance with or exemption from these Regulations. This article summarizes the Regulations as they are likely to apply to non-resident domestic shipping companies and foreign maritime entities and the newly applicable reporting requirements.

What Are the Marshall Islands Economic Substance Regulations?

To comply with requirements recently imposed by the European Union (the “EU”)1 and the Organisation for Economic Co-operation and Development (the “OECD”)2 intended to restrict the use of preferential tax regimes, the Marshall Islands Registrar of Corporations (the “Registrar”) responsible for non-resident domestic entities promulgated the Marshall Islands Economic Substance Regulations, 2018, which were last amended on August 29, 2019 (the “ESR”).3 The ESR require that all “relevant entities” that derive income from “relevant activities” demonstrate that they have economic substance in the Republic of the Marshall Islands (the “RMI”) in relation to those relevant activities. The ESR are enforced by the Registrar.

For the past 20 years, the EU, the OECD and other international organizations have intensified their efforts to identify and address harmful tax practices that cause base erosion and profit shifting. These efforts target companies that adopt tax planning strategies to shift profits to jurisdictions where the companies have little to no real activity but where taxes are low, resulting in lower taxes being paid. The objective of addressing and eradicating these harmful tax regimes is to prevent “no or only nominal tax” jurisdictions from attracting profits from certain mobile activities without corresponding economic activity. The rationale behind these efforts is threefold: First, the existence of such harmful preferential tax regimes distort competition. Companies that operate across borders and profit from such tax regimes have a competitive advantage over companies that operate only at the domestic level. Second, these regimes have an impact on the location of financial and other service activities and may distort investment decisions and erode the tax bases of other jurisdictions. Such distortion will ultimately lead to inefficient allocation of resources.

Third, harmful preferential tax regimes undermine the fairness and broad social acceptance of tax systems that may erode voluntary compliance by all taxpayers.4

The EU and OECD recognize that the issue does not lie with the companies that benefit from such tax regimes but with the tax rules themselves. They consider that the onus should be on governments to address these issues by amending or introducing new legislation, which should incorporate a mechanism for establishing the “economic substance” of corporations undertaking income generating activities. The absence of “economic substance” suggests that a jurisdiction may be attempting to attract investment and transactions that are purely tax driven. It may also indicate that a jurisdiction does not have an appropriate legal or commercial environment or that it does not offer any economic advantages to attract substantive business activities without offering tax minimizing opportunities. Following established economic research, economic substance regulations are supported by various mechanisms to identify the relevant entities carrying out income generating activities, as well as introducing a reporting mechanism and incentives for compliance, which should effectively address the harmful impact of preferential tax regimes.

The core requirement of the ESR is the economic substance test in Section 4(1) thereof, which requires that every “relevant entity” must, for each financial period in which it derives income from a “relevant activity,” have economic substance in the RMI in relation to that relevant activity.

Do the ESR Apply to Your Company?

Is Your Company a Relevant Entity?

The Marshall Islands flag is often described as a “flag of convenience” because its shipping regulations are more flexible than those applicable to vessels flagged in most other jurisdictions, and as a result, a large percentage of the owners of vessels engaged in international trade choose to flag their vessels in the Marshall Islands. The owner of a Marshall Islands flagged vessel engaged in international trade is almost always a non-resident domestic corporation, partnership or limited liability company incorporated, organized or formed in the Marshall Islands (a “non-resident domestic entity” or “NRDE”) or a company organized outside of the Marshall Islands and registered with the Registrar as a foreign maritime entity in the Marshall Islands (an “FME”).

The ESR provide that every NRDE is a “relevant entity” unless its business is centrally managed and controlled outside the RMI and the NRDE is tax resident outside the RMI.5 The ESR also provide that every FME is a “relevant entity” if its business is centrally managed and controlled in the RMI, unless the FME is tax resident outside the RMI.6

The Registrar may regard an entity as tax resident outside the RMI if the entity is subject to the tax regime of another jurisdiction by reason of its domicile, residence, or any other criteria of a similar nature.7 The Registrar will require any NRDE or FME claiming to be tax resident outside the RMI to produce satisfactory evidence to substantiate the same, such as a tax identification number, tax residence certificate, assessment or payment of a tax liability, or other proof the entity is subject to the tax regime of another jurisdiction.8

Does Your Company Derive Income from a Relevant Activity?

Section 3 of the ESR defines “relevant activities” to include a wide assortment of activities, including many of the activities performed by ship owners, charterers and their parent companies.

Among the activities that constitute “relevant activities” is the “shipping business,” which is defined as the operation of ships in international traffic for income from the transport of passengers or cargo and includes any of the following activities where the relevant activity is directly connected with, or ancillary to, such operation: (i) the rental on a charter basis of a ship; (ii) the sale of tickets or similar documents and the provision of services connected with the sale of tickets or similar documents, either for the enterprise itself or any other enterprise; (iii) the use, maintenance or rental of containers (including trailers and related equipment for the transport of containers) used for the transport of goods or merchandise; (iv) the management of the crew of a ship; (v) the registration of a ship; (vi) the recording of a financial instrument or lien in relation to a ship; (vii) the ownership of a ship; (viii) the financing of a ship; (ix) the obtaining of statutory certificates for a ship; (x) the surveying of a ship; or (xi) the provision of services related to the foregoing.9

Relevant activities are also defined to include the “holding company business,” which means the business of a “pure equity holding company,” which is defined as a company that only holds equity participations in other entities, only earns dividends and capital gains, and performs no commercial activity.10

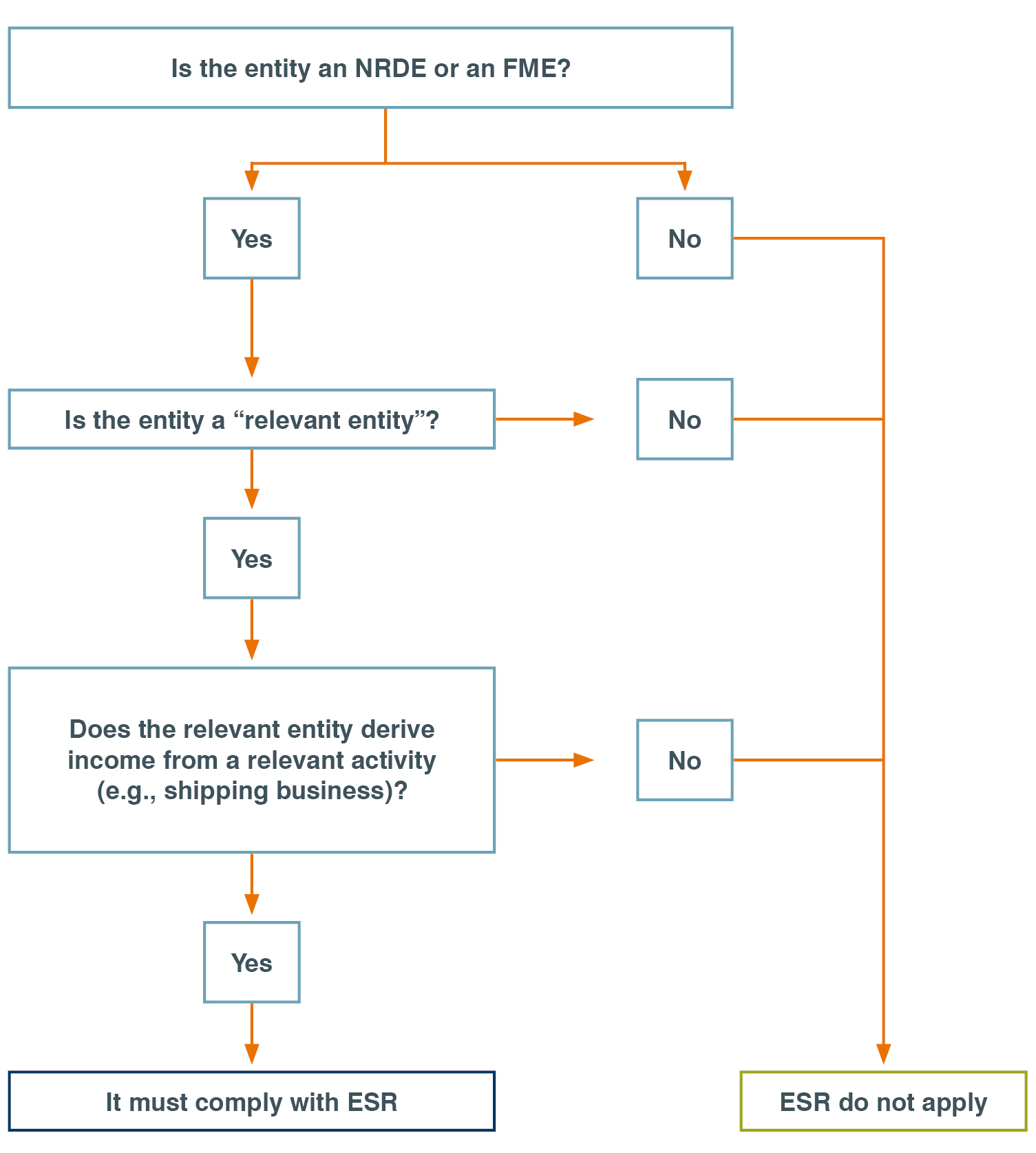

The requirements for determining whether the ESR apply to an entity are summarized by the following diagram:

If Your Company Is a Relevant Entity Deriving Income from a Relevant Activity, Does It Satisfy the Economic Substance Test?

As noted above, the ESR require that every relevant entity must, for each financial period in which it derives income from a relevant activity, have economic substance in the RMI in relation to that relevant activity.11

To demonstrate that a relevant entity has economic substance in the RMI in relation to a relevant activity, the relevant entity in most cases must show that:

- it is directed and managed (as defined in the ESR) in the RMI in relation to the relevant activity;

- having regard to the level of relevant activity carried out in the RMI, it has (i) an adequate number of qualified employees in the RMI, (ii) an adequate physical presence in the RMI and (iii) an adequate amount of expenditure incurred in the RMI; and

- it carries out core income-generating activity (“CIGA”) in relation to the relevant activity in the RMI.12

What Is Considered CIGA in a Shipping Business?

CIGA must be an activity of central importance to a relevant entity in terms of generating income and that is being carried out in the RMI.13

The following are considered CIGA in relation to a shipping business:

- managing crew (including hiring, paying and overseeing crew members);

- overhauling and maintaining ships;

- overseeing and tracking deliveries;

- determining what goods to order and when to deliver them; and

- organizing and overseeing voyages.14

The ESR note that the determination of economic substance in the context of a shipping business recognizes that significant CIGA within shipping is often performed in transit outside the RMI and that the value creation attributable to CIGA that occurs from a fixed location is more limited than for other types of regimes for mobile business income.15 The determination further considers whether the relevant entity complies with all obligations under the RMI Associations Law and RMI Maritime Act 1990, and with International Maritime Organization regulations, customs and manning requirements.16

What is Considered CIGA in a Holding Company Business?

CIGA for a holding company business includes all activities related to that business,17 but the economic substance test is different from the test applicable to applicable to relevant entities deriving income from other relevant activities. To satisfy the economic substance test applicable to relevant entities engaged in a holding company business, the relevant entity must confirm that it:

- complies with its statutory obligations under the RMI Business Corporations Act, Revised Partnership Act, Limited Partnership Act, or Limited Liability Companies Act, as appropriate; and

- has adequate human resources and premises in the RMI for holding and managing equity participations in other entities.18

What Are the Consequences If a Relevant Entity Deriving Income from a Relevant Activity Fails to Comply with the ESR?

If the Registrar determines that a relevant entity does not meet the economic substance test, it will issue a notice stating the reasons for that determination19 and the relevant entity will be liable to a fine of up to $50,000 for the relevant financial period, revocation of its formation documents and dissolution, or both.20 If a relevant entity fails to meet the test for two consecutive financial periods, it will be liable for a fine not exceeding $100,000, revocation of its formation documents and dissolution, or both.21

What Are a Company’s Reporting Obligations in Relation to the ESR?

All NRDEs and FMEs are now required to report their exemption from or compliance with the ESR annually. Starting on July 1, 2020, all NRDEs and FMEs are required to submit an annual report through the Registrar’s secure web portal to report, among other information:

- information relevant to whether the NRDE or FME is a relevant entity;

- information relevant to whether the NRDE or FME derives income from a relevant activity; and

- if the NRDE or FME is a relevant entity deriving income from a relevant activity, (i) the amount and type of its gross income, (ii) the amount and type of its expenses and assets, (iii) the number of its employees, and (iv) whether it has conducted CIGA in the RMI.22

The first reporting period for each NRDE and FME opens on the first anniversary of its incorporation, organization or formation to occur after July 1, 2020. The first reporting period for each newly formed NRDE and FME will open on the first anniversary of its incorporation, organization or formation. Each NRDE and FME is required to file its annual report no later than 12 months after each such anniversary and each anniversary of its incorporation, organization or formation occurring thereafter.

Must the Registrar Keep Reported ESR Information Confidential?

Except insofar as may be necessary under the ESR, the Registrar and any person acting on its behalf must preserve and aid in preserving confidentiality in relation to all information provided by an entity pursuant to the ESR.23

However, if (a) a relevant entity fails to meet the economic substance test for any financial period, the Registrar is required to forward information provided in respect of such financial period to (i) the competent authority of the European Union Member State in which the parent company, ultimate parent company and ultimate beneficial owner of the relevant entity resides and (ii) if the relevant entity is organized outside the RMI, to the competent authority of the jurisdiction in which the relevant entity is organized;24 and (b) an entity is not deemed to be a relevant entity because its business is centrally managed and controlled outside the RMI and is tax resident outside the RMI and has provided evidence to the Registrar to that effect, the Registrar is required to provide any relevant information or evidence that relates to such entity to (i) the competent authority of the European Union Member State in which the parent company, ultimate parent company and ultimate beneficial owner of the entity resides; and (ii) the competent authority of the European Union Member State in which the entity claims to be tax resident.25

1 See Council of the European Union Code of Conduct Group (Business Taxation), Conclusions of 5 December 2017 on the EU list of non-cooperative jurisdictions to tax purposes.

2 See OECD (2018), Resumption of Application of Substantial Activities for No or Only Nominal Tax Jurisdictions – BEPS Action 5, OECD, Paris.

3 The Republic of the Marshall Islands Economic Substance Regulations, 2018, as amended through August 29, 2019.

4 See OECD, Bitesize BEPS – Frequently Asked Questions.

5 See ESR § 2(s)(i).

6 See id § 2(s)(ii).

7 See id. § 8(4) n.4.

8 See id.

9 See id. § 2(u).

10 See id. §§ 2(j), 2(p).

11 Id. § 4(1).

12 See id. § 4(2).

13 Id. § 5.

14 Id. § 5(g).

15 See id. § 5(g) n.3.

16 See id.

17 Id. § 5(e).

18 See id. § 4(5).

19 See id. § 7(1).

20 See id. § 7(2)(a).

21 See id. § 7(2)(b).

22 See Update, The Marshall Islands Corporate Registry, Republic of the Marshall Islands Economic Substance Reporting Portal to Open 1 July 2020 (June 29, 2020), see also Republic of the Marshall Islands, Guidance and Frequently and Questions on Economic Substance (October 17, 2019, revised January 8, 2020); see also Republic of the Marshall Islands, Economic Substance Reporting Portal User Guide.

23 See ESR § 11.

24 See id. § 8(1).

25 See id. § 8(4).

/>i

/>i