I write this article from home on the third day of working remotely due to the public health crisis that has emerged because of the coronavirus (also known as COVID-19).

In North Carolina, the government has prohibited mass gatherings of one hundred (100) or more people, recommends that the general public avoid gatherings of fifty (50) or more people, and is encouraging the public to stay home if at all possible. Many people find themselves working from home or not working at all. It has now become clear that the coronavirus, and our country's response to mitigating it, will have a major impact on every aspect of the American economy, including the construction industry. As my colleague Jason Strickland writes in his article addressing the financial impacts of the coronavirus crisis on the construction industry, an economic recession is considered a given. As the economy becomes less stable, parties on the paying side of a construction contract are more likely to experience financial difficulties. In light of these changing economic realities, it is now imperative that you understand how to protect your payment rights and the investments that you make in your construction projects.

Liens

The primary tools by which you can protect your rights to payment for labor and material investments on a construction project with a private owner are the lien rights provided by North Carolina's materialman's lien statute. The materialman's lien statute serves to protect the interests of contractors who supply labor and material that improve the value of an owner's property. The main methods by which you can protect your rights to be paid for labor and/or materials furnished towards a construction project are through filing a lien against the real property you've improved and/or filing a lien upon funds owed to the contractor with whom you dealt. These liens, if used properly in a timely fashion, serve as security for the labor and materials you supply and the payments you're owed as a result.

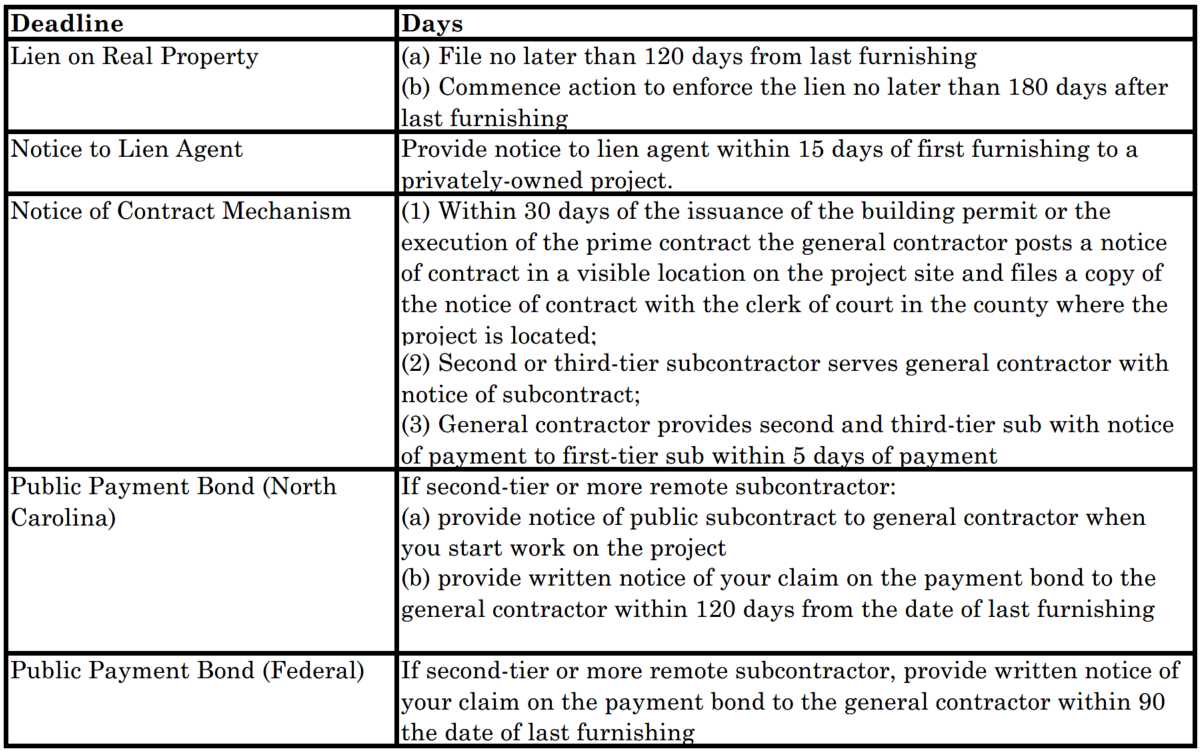

While these liens can be very useful in protecting your payment rights, they are valueless if not exercised in a timely manner. Given the destabilizing impacts of the coronavirus on the economy and its likely impact on the abilities of those in the construction chain to make timely payments, knowing and complying with the timing requirements to assert these lien rights is paramount. With that in mind, you should be aware of the following deadlines for asserting and enforcing a lien claim against the real property improved:

-

The deadline for filing a claim of lien on the real property improved is no later than one hundred twenty (120) days after your last furnishing of labor or materials at the site of the improvement.

-

The deadline for commencing a legal action to enforce a claim of lien on real property is no later than one hundred eighty (180) days after the last furnishing of labor or materials at the site of the improvement.

With regard to a claim of lien upon funds, there is no set deadline for serving the upper-tier contractor or the owner with a notice of your claim of lien upon funds. However, because the lien is secured primarily by funds owed to the contractor with whom you've dealt, the sooner you serve a lien upon funds, the better. If the contractor with whom you work is paid in full before the lien upon funds is served, there are no funds for the lien to attach to, and the lien upon funds is worth less. Thus liens upon funds should be served as soon as possible after performing the work in question.

Lien Agents

General contractors, subcontractors, and suppliers should make sure that they provide a notice to lien agent through the North Carolina lien agent system (liensnc.com) within fifteen (15) days of their first furnishing to a privately-owned project. Although failure to do so will not necessarily bar a lien claim, such failure will cause the priority of a lien on real property to shift from first furnishing to the date the lien is filed—this can severely diminish if not eliminate that recovery that can be had through the lien.

Notice of Contract

North Carolina's lien statute includes a risk-shifting mechanism that allows the general contractor and second-tier and third-tier subcontractors to file and serve notices to mitigate or shift the risk of defaults by first-tier subcontractors. This Notice of Contract mechanism potentially alters or mitigates the general rule that a second-tier or third-tier subcontractor, through a subrogation lien on real property, may recover funds owed the general contractor by the owner without regard to the amounts that are owed to or that have been paid to the first-tier subcontractor. The Notice of Contract mechanism works as follows:

-

Within thirty (30) days of the later of the building permit issuing or the prime contract being signed the general contractor posts a notice of contract in a visible location on the project site and also files a copy of the notice of contract with the clerk of court for the county where the project is located.

-

The second-tier or third-tier subcontractor, in response to the posting and filing of the notice of subcontract, serves upon the general contractor (via certified mail, UPS, or FedEx, with receipt confirmation) a notice of subcontract.

-

For any second-tier or third-tier subcontractor that has provided the general contractor with a notice of subcontract, the general contractor must provide, within five (5) days of each payment, the subcontractor with a notice of payment each time it pays the first-tier subcontractor that hired the second-tier or third-tier subcontractor.

If the general contractor properly performs steps one and three, then the second-tier and third-tier subcontractors cannot force the general contractor to pay twice for the same work. Otherwise, the general contractor is at risk of having to pay the second-tier and third-tier subcontractors regardless of whether the first-tier subcontractor has been paid in full; i.e., the general contractor is at risk of double payment.

Payment Bonds

With projects with a public owner (e.g., the State of North Carolina or its subdivisions, or the federal government), lien rights are generally not available. In place of lien rights, the unpaid subcontractor has a claim against a payment bond obtained by the general contractor. The payment bond insures subcontractors and the owner against the risk of nonpayment by the general contractor. In these cases, pursuing an action against the payment bond provides another means to recover money owed to a subcontractor from the contractor for whom it's working. As with the lien claims discussed above, pursuing an action against a payment bond in a timely fashion is also of critical importance.

If the project owner is the State of North Carolina (or one its subdivisions) and you are not in a direct contractual relationship with the general contractor (i.e., you are a second-tier or more remote subcontractor or supplier), you must provide written notice of your claim on the payment bond to the general contractor within 120 days from the date on which you last performed labor or furnished materials to the project. The written notice must be transmitted through mail, UPS, or FedEx with delivery confirmation. If the notice is not timely sent, you lose your right to bring a claim against the bond. Similarly, if you are a second-tier or more remote subcontractor on projects owned by the federal government (or one of its subdivisions like the U.S. Army at Fort Bragg), you must also provide this notice, but it must be sent within 90 days from the date on which you last performed labor or furnished materials to the project. On both state-owned and federal-owned projects, a lawsuit must be filed against the payment bond surety within one-year of your last furnishing to the project, regardless of whether you are a first-tier, second-tier, or more remote-tier subcontractor.

Additionally, if you are a second-tier or more remote-tier subcontractor on a state-owned project, then you must provide a Notice of Public Subcontract to the general contractor when you first start work on the project. If a Notice of Public Subcontract is not provided, then you're total recovery against the payment bond is limited to $20,000.00. If a Notice of Public Subcontract is not provided until after you realize you have a payment problem, i.e., at the end of the Project, then your recovery is limited to the amount of work you performed within 75 days prior to service of your Notice of Public Subcontract.

Many private projects will also have payment bonds obtained by either the contractor or subcontractors. In this situation, a subcontractor would potentially have both a lien claim and a payment bond claim. Payment bonds on private projects have their own timing and notice requirements which must be complied with before claims against the payment bond can be pursued. Those requirements will be governed by the terms of the payment bond. Thus, it is in your best interest to ask for a copy of all payment bonds on your project from the outset and to comply with any timing or notice requirements if you ultimately pursue a payment bond claim.

No Tolling, Yet

Critically, though the coronavirus has delayed or suspended many local and national events and resulted in the Chief Justice of the North Carolina Supreme Court postponing most superior and district court proceedings for at least thirty (30) days, it has not tolled any of the deadlines discussed above for pursuing lien rights or taking other actions to protect your rights to payment. So, you should remain vigilant in taking any necessary actions to protect your payment rights in a timely manner.

Conclusion

In conclusion, the coronavirus will have lasting impacts on the construction industry and the way that parties to a construction project interact and deal with one another. As a participant in this industry, you should expect that the looming economic instability will likely lead to disputes regarding payment for work performed or materials furnished on current or future projects. Understanding and timely exercising your lien and bond rights can help to protect you from the threat of nonpayment by the contractors you work with. Thus, being aware of the deadlines addressed above is very important. If you need assistance in navigating the best way to protect your payment rights, my colleagues and I at Ward and Smith would be honored to assist.

/>i

/>i