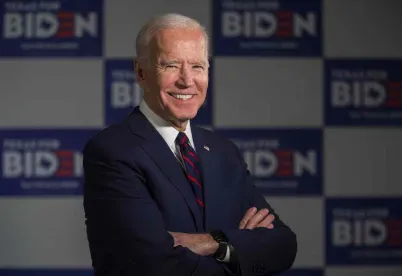

Given the current political dynamic within Congress, the chances of the Biden Administration enacting significant, substantive health care legislation appear slim in the short-term. Thus, the Biden Administration has sought alternative routes to advance its policy priorities, mainly through budget reconciliation (see here for a comprehensive explainer from the Congressional Research Service) and agency regulation. For example, we have previously written here and here about the “No Surprises Act”, enacted through the legislative short-cut of budget reconciliation as part of the 2021 Consolidated Appropriations Act, and the Biden Administration’s new regulations implementing consumer protections against surprise medical bills. In this mold, President Biden’s July 9 Executive Order on Promoting Competition in the American Economy (the “Order”) appears to lay out an aspirational, yet somewhat more practical agenda to implementing reforms in the health care sector, as compared to relying on new legislation coming through Congress.

The Order tasks federal agencies across the “whole-of-government” to “protect competition in the American economy” by acting on 72 regulatory initiatives, to be coordinated by a newly established “White House Competition Council” with representatives from key federal agencies. While the “whole-of-government” is involved and the entirety of the U.S. economy is targeted, there is a distinct focus among these initiatives on “improving health care” by addressing “overconcentration, monopolization, and unfair competition” in the sector. The Order specifically cites four areas in the health care sector ripe for renewed enforcement and regulatory attention with the goal of lowering prices, promoting competition, and benefiting consumers.

Hospitals. Perhaps most notably to health care provider stakeholders, the Order takes specific aim at hospital consolidation and monopolization, asserting that hospital mergers have harmful market effects and can increase prices without improving quality. Leading industry stakeholders understandably pushed back on the Order, contending that implementation of its priorities could further reduce access to care and ignores the value provided by such stakeholders.

The Order sets forth a number of priority steps for the Federal Trade Commission (“FTC”), the Department of Justice (“DOJ”) and the Department of Health and Human Services (“HHS”) to take to improve hospital competition and consumers’ access to care.

The Order directs the FTC and DOJ to revisit and revise their hospital merger guidelines and “vigorously” enforce the antitrust laws to challenge future mergers, as well as “prior bad mergers that past administrations did not previously challenge.” Notably, just a week earlier, the FTC voted to (i) prioritize investigations into hospitals, pharmaceutical companies, and pharmacy benefit managers, and (ii) streamline its rulemaking procedures while broadening its interpretation of authority to challenge “unfair methods of competition.” Following the order, The FTC and the DOJ issued a joint statement emphasizing that the “merger guidelines must reflect current economic realities and empirical learning” and that they must “guide enforcers to review mergers with the skepticism the law demands.” More action on merger guidelines (both horizontal and vertical) is sure to come in the following months.

As part of a regulatory update, the FTC could leverage its evolving toolkit for assessing competitive harms beyond traditional econometric measures to investigate acquisitions prior to their consummation, acting more as an interventionist than a reactive force. Despite the staffing and resource shortage at such agencies, between these statements, the Order, actions taken to revamp the FTC’s merger retrospective program, and increased enforcement actions in health care (per the FTC annual highlights, almost 50% of all FTC enforcement actions in 2020 were in health care), private equity companies and health systems contemplating new hospital acquisitions should be particularly prudent in evaluating the impacts such transactions will have on market concentration, prices for health care services, and consumers’ access to care.

The Order also directs HHS to support implementation of hospital price transparency rules (which Proskauer has previously written on here, here, and here), and to bolster protections against surprise billing (prior blog posts on this topic mentioned in the first paragraph). Specifically regarding hospital price transparency rules, the White House is advocating for increased compliance and more stringent enforcement following reports of non-compliance by hospitals across the country and commencement of HHS’s oversight actions. Non-compliant hospitals should now officially be on alert that they may be receiving warning letters from HHS.

Insurance. After years of the prior administration undermining of the Affordable Care Act’s insurance markets, the Biden Administration seeks to restore trust in and standardization to healthcare.gov and state insurance marketplaces. The Order calls for standardized health plan options in the national insurance marketplace so that consumers without employer-sponsored health coverage can more easily comparison shop for quality, affordable health plans.

Prescription Drugs. The Order directs the Secretary of HHS to implement mechanisms that lower the prices of and improve access to prescription drugs and biologics, and that continue to promote generic drug and biosimilar competition. In addition to referencing support of particular legislative reforms, such as prescription drug inflation caps and Medicare-negotiated drug prices, the Order encourages the regulatory prohibition of “pay for delay” arrangements and directs coordination between the FTC and HHS to support competition in generic drug and biosimilar markets. For additional detail on the Order’s provisions targeting the pharmaceutical industry, and its potential impact on patents and innovation, see Proskauer’s separate blog post here.

Hearing Aids. The Biden Administration specifically calls out hearing aids as a widely-used but unnecessarily expensive product, and asserts that the prices of hearing aids are propped up by both significant consolidation by manufacturers and excessive red tape restricting consumer’s purchase of the product. The Order directs the Food and Drug Administration (“FDA”) to promulgate rules within 120 days of the Order to enable the over-the-counter purchase of hearing aids, thereby spurring competition, affecting manufacturers’ and retailers’ pricing strategies, and improving consumer access.

Non-Competes. In addition to these four health care-specific targets of the Order, the Biden Administration also directs the FTC to use its resources to curtailing the use of non-compete clauses and other restrictive covenants that “unfairly limit worker mobility.” Such clauses and covenants vary in degree of restrictiveness and are commonly used in some form within physician and hospital agreements as a way of protecting legitimate business interests involving highly skilled workers, such as preventing poaching of providers or sharing of patient information and trade secrets after hospitals, private equity firms, or practice owners invest heavily in a provider’s practice. The FTC has invalidated overly restrictive non-competes in past health care enforcement actions and has generally expressed concern over the use of non-competes to suppress wages and labor market competition. Limiting the use of non-competes on the scale envisioned by the Biden Administration may come in the form of official agency guidelines, rulemaking subject to public comment processes (as advocated for in the Order), or, perhaps most likely given the FTC’s evolving enforcement toolkit and similar to its recent actions challenging horizontal no-poach agreements, vigorously pursuing enforcement actions to challenge non-competes in various contexts as anticompetitive. Conversely, the FTC’s authority is much less clear with regard to challenging occupational licenses, which the Order similarly contends suppress wages and limit worker mobility, as occupational licensing is traditionally within the purview of state regulation.

Certainly, the Order is only the beginning of the Biden Administration’s regulatory action targeting competition, workforce issues, and pricing in the health care sector. As agencies such as DOJ, FTC, and HHS ramp up oversight and enforcement operations and coordinate their priorities in the coming months, expect to see many more rulemakings and investigations announced. Whether such regulations and enforcement actions can withstand public and political pressures, and judicial scrutiny, is another matter entirely, and will depend in part on how aggressively the Biden Administration wields its pen (or its sword). In the meantime, health care companies would do well to evaluate current and future employment arrangements, business practices, and acquisitions with a particularly close eye on how the competitive effects of such conduct might be viewed by regulators across the federal government.

/>i

/>i