To raise revenue and address its struggling K-12 education system, Nevada legislators made several major changes to the state’s tax structure in 2015. These include introduction of the Commerce Tax, which is a gross revenue tax on each business in the state whose Nevada gross revenue exceeds $4 million in a fiscal year, a $1 per pack increase in the tax on cigarettes, and an increase in the state business license fee for corporations from $200 to $500.

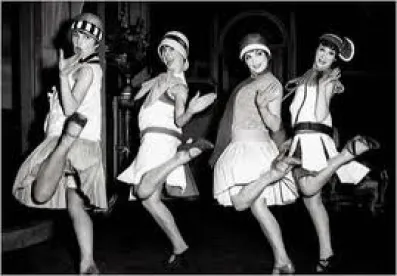

Perhaps the most interesting change for gaming and entertainment companies, however, is the modifications to Nevada’s Live Entertainment Tax (“LET”).

The Old LET

Previously, the LET formula was that facilities with occupancy limits of fewer than 7,500 persons were required to charge the patron a 10% tax on admission, food, and merchandise. Facilities with occupancy above 7,500 persons were taxed at a 5% rate.

Exemptions included:

-

Events where all admission proceeds went to a nonprofit organization;

-

Facilities without gaming and with a maximum occupancy less than 200;

-

Unarmed combat (boxing/MMA);

-

Street vendors who sold merchandise outside the venue;

-

Live events at trade shows;

-

Live entertainment when only musical performers moved about the audience/venue;

-

Entertainment provided only in the common area of a shopping mall;

-

Entertainment during food or product demonstrations at a shopping mall or craft show;

-

Live entertainment as part of an amusement ride (but not the primary reason for the attraction);

-

Free entertainment provided in an outdoor area to the public;

-

Free entertainment provided as part of a restaurant’s ambience;

-

Outdoor concerts at nongaming establishments

-

NASCAR races; and

-

Minor league baseball games.

The New LET

The Nevada Legislature, with Senate Bill 266, set out to simplify the LET structure and clarify areas which have been too subjective in the application of the tax. Under the new LET structure, all live entertainment events are taxed uniformly. The new tax rate is a flat rate of 9% of the admission charge to a venue where live entertainment is provided.

There is no distinction based on whether live entertainment was provided by licensed gaming facilities or non-licensed entities or on the size of the facility. The new LET also makes it clear that it is a tax on admission charges. Simply put: if admission is charged and there is live entertainment, the LET will apply. If no admission is charged, the LET does not apply.

There are some previously exempt venues that are now under the LET umbrella. This includes outdoor entertainment on both gaming and non-gaming property, legal escort services, nonprofits that sell more than 7,500 tickets per event, and nonprofits where patrons provide the entertainment if the nonprofit sells more than 15,000 tickets to the event (e.g., the Burning Man festival in northern Nevada).

The subjectivity regarding whether or not the activity at the venue is “entertainment” or merely “ambient entertainment” is also addressed by defining the term “performance” to broadly include a “live entertainment activity” that is not an “ambient activity.” The Nevada Gaming Control Board (“Board”) felt it was simpler to define the exception than to define the activity of a “performance.” There were some comments by taxpayers at the Board’s July 23, 2015, LET workshop that the new definition of “ambient activity” – “live entertainment that is presented in the background of a facility in a manner that only serves to enhance or complement the mood, character, quality, tone or atmosphere of the facility” – may still be too unclear. The suggestion is that the term “background” may be confusing where, for example, go-go dancers are up on platforms or stages and that the Board should use a “primary purpose” analysis instead.

Similarly, the revised LET seeks to clarify that events where disc jockeys perform are live entertainment, regardless of whether or not the disc jockey speaks at the event. It does so by adding a definition of “performance by a disc jockey” as “the playing of recorded music, the mixing of audio or the adding of sound, video and lighting effects by a person or group of persons to a patron or group of patrons.”

This is a first in a series of article posts about changes to Nevada’s Live Entertainment Tax.

/>i

/>i