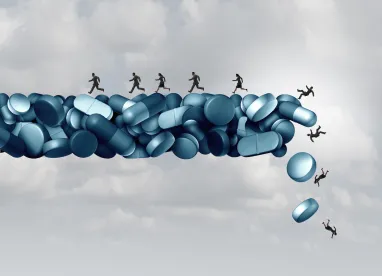

Every day we learn new horrors about America’s opioid epidemic. As discussed in my last entry, insurance issued to the prescription opioid industry may fund solutions to the crisis. In conjunction with litigation filed by governmental entities from across the nation, Gilbert LLP is analyzing that question.

One significant source of coverage may be comprehensive general liability or “CGL” policies. Thus far, rulings concern only CGL coverage for defense costs incurred by distributors and manufacturers of prescription opioids, but those rulings preview issues that will arise with regard to indemnity and suits against other members of the industry.

A preliminary and key issue is whether the claims seek coverage for an “occurrence.” This comes into play because the typical CGL policy covers sums that the policyholder becomes legally obligated to pay due to an “occurrence,” which typically is defined as “an accident, including continuous or repeated exposure to substantially the same general harmful conditions” that was neither “expected nor intended” by the policyholder. Note, however, that policy language can vary—an experienced insurance attorney will identify and emphasize distinctions in language that may impact policy application.

Four courts have ruled on the potential that lawsuits filed against the opioid industry by governmental entities constitute occurrences under CGL policies (I say potential because those courts have only ruled on coverage for defense costs, which typically are covered if there is a potential that the claim itself will be covered). Those rulings offer mixed results, and hinge primarily on the underlying allegations and applicable state law.

In Cincinnati Ins. Co. v. H.D. Smith, LLC, an insurer filed suit in Illinois seeking a ruling that it did not have to pay defense costs for a distributor that was alleged to have “negligently fail[ed] to recognize that the volume of prescription medications [it] distributed to pharmacies exceeded the legitimate medical need.” Relevant here, the insurer argued that there was no “accident” under the policy, and thus no “occurrence” to trigger coverage, because the underlying claims alleged willful and intentional misconduct. However, the court found that because the complaint also alleged negligent misconduct, and the court must read the complaint broadly under the potentiality rule, there was an occurrence and the insurer must pay defense costs.

In Liberty Mutual Fire Insurance Co. v. JM Smith Corp., the insurer filed suit in South Carolina, arguing that it had no obligation to defend a distributor that was accused of the same conduct discussed in H.D. Smith. The insurer again argued that there was no “accident” and thus no “occurrence” because the complaint alleged intentional conduct. The insurer also argued that the alleged conduct could not have been an “accident” because the results of the conduct were “natural and probable.” (Interestingly—at least to an insurance coverage attorney—the insurer did not make the latter argument under the “expected or intended” clause of the policy.) Both the trial court and the appellate court disagreed with the insurer and found that it must pay defense costs because (1) the underlying claims alleged negligent, unintentional behavior as well as intentional behavior, and (2) based on the underlying allegations, the policyholder could not reasonably anticipate the harm that was alleged.

In Cincinnati Insurance Co. v. Richie Enterprises, LLC, a court in Kentucky expressly considered how to apply an “expected or intended” provision to the underlying allegations discussed in both cases above. There, the policy’s definition of “occurrence” excluded harm “which may reasonably be expected to result from the intentional or criminal acts of the insured or which is in fact expected or intended by the insured, even if the injury or damage is of a different degree or type than actually expected or intended.” The court held that this language did not apply because it found that the policyholder did not intend for the alleged harm to occur, and ordered the insurer to pay defense costs. The court also held as relevant that the underlying complaint alleged negligence, rather than solely intentional conduct.

In Traveler’s Property Casualty Co. of America v. Actavis Inc.—the only court to date to rule publicly that a governmental entity’s opioid suit did not allege an occurrence—an opioid manufacturer was alleged to have engaged in a “‘common, sophisticated, and highly deceptive marketing campaign’” and “spent millions of dollars” to misrepresent knowingly “the risks, benefits, and superiority of opioids to treat chronic pain,” which allegedly led to the opioid epidemic in the counties that filed the underlying claims. As in the cases discussed above, the insurers argued that the underlying claim was not an “accident,” and thus not an “occurrence” because the policyholder was alleged to have acted intentionally. Unlike the cases discussed above, the court in Actavis found that the insurers did not owe defense costs. First, the court held that there was no “accident” because all of the underlying claims were based on misrepresentations, and under California law even negligent misrepresentations are deemed intentional for purposes of insurance coverage. Second, the court emphasized that, under California law, it was irrelevant whether the policyholder intended the result of its actions; the intentional nature of the conduct alone precluded an “accident.” The policyholder unsuccessfully appealed this ruling to the California Supreme Court.

The lessons from these cases are interconnected: (1) the specifics of the underlying claims matter—the three courts that found an occurrence did so because of alleged non-intentional conduct or harm; and (2) applicable law matters—the one court that found no occurrence did so because under California law it was immaterial whether the claim alleged non-intentional conduct or harm. Thus, at least with regard to “occurrence” arguments, policyholders would be wise to review the interaction between potentially applicable law and the allegations against them or their fellow industry members promptly. Note that distinctions in policy language also may impact how these cases apply to different facts and law.

And, as we will discuss next time, once you clear the “occurrence” hurdle, you need to analyze whether underlying claims seek coverage for “bodily injury.”

/>i

/>i