The substance over form doctrine (and related step transaction and economic substance doctrines) are often invoked by courts to disallow tax consequences that seem too good to be true. Courts have struggled for years with how to properly apply these doctrines. Those advocating against application usually rely on the famous passage by Judge Learned Hand in Helvering v. Gregory, 69 F.2d 809, 810 (2d Cir. 1934): “Any one may so arrange his affairs that his taxes shall be as low as possible; he is not bound to choose that pattern which will best pay the Treasury; there is not even a patriotic duty to increase one’s taxes.” Those advocating for this position seek shelter in cases like Commissioner v. Court Holding Co., 324 U.S. 331, 334 (1945), in which the Supreme Court of the United States stated, “the incidence of taxation depends upon the substance of a transaction. …. To permit the true nature of a transaction to be disguised by mere formalisms, which exist solely to alter tax liabilities, would seriously impair the effective administration of the tax policies of Congress.” But ultimately, as the Supreme Court explained in Gregory v. Helvering, 293 U.S. 465, 469 (1935), “the question for determination is whether what was done, apart from the tax motive, was the thing which the statute intended.”

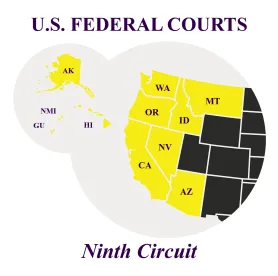

However, what the statute intended is not always easy to determine. In Mazzei v. Commissioner, No. 18-82451 (9th Cir. June 2, 2021), the US Court of Appeals for the Ninth Circuit answered this question in the context of tax motivated transactions involving the since-repealed foreign service corporation (FSC) regime that was complied with all the formalities required by the Internal Revenue Code but which the Internal Revenue Service (IRS) asserted should nonetheless be recharacterized under the substance over form doctrine. The Court noted it is a “black-letter principle” and courts follow “substance over form” in construing and applying the tax laws. However, this doctrine is not a “smell test” but rather a tool of statutory construction that must be applied based on the statutory framework at issue. Thus, in appropriate situations where Congress indicates that form should control, the substance over form doctrine is abrogated.

That is exactly what happened in Mazzei. Agreeing with the First, Second and Sixth Circuits, which had previously addressed similar issues, the Ninth Circuit found that the statutory framework and history indicated that Congress did not intend for the substance over form doctrine to apply to the FSC regime. While “[i]t may have been unwise for Congress to allow taxpayers to pay reduced taxes” under the statutory scheme, “it is not our role to save the [IRS] from the inescapable logical consequence of what Congress has plainly authorized.”

Practice Point: The distinction between tax avoidance (permissible) and tax avoidance (impermissible) is not always an obvious line. Taxpayers should be able to rely on the words used by Congress when enacting tax laws, but courts have recognized that there are circumstances where formal compliance is not enough. The substance over form and related doctrines should always be analyzed—like other tools of statutory construction—when structuring transactions. Where there is evidence that statutory provisions deliberately elevate, or have been construed to elevate, form above substance, these doctrines may not be applicable. The Ninth Circuit’s opinion, along with the other related appellate cases cited therein, provide a useful framework for taxpayers and their advisors in making these determinations.

/>i

/>i