Bonuses and their impact on an employee’s “regular rate of pay” have long been a proverbial thorn in the side of California employers. The nondiscretionary nature of most bonuses (even those bonuses employers attempt to characterize as “discretionary”) makes them part of a non-exempt employee’s regular rate of pay for purposes of determining the appropriate overtime rate. Cal. Labor Code § 226 requires all hourly rates of pay to be reflected in employees’ pay statements. The ambiguity surrounding the extent to which this “hourly rate of pay” includes bonuses in all of their various forms and the related overtime adjustments can sometimes leave employers feeling uncertain as to how to ensure compliant paystubs when nondiscretionary bonuses are paid to non-exempt employees.

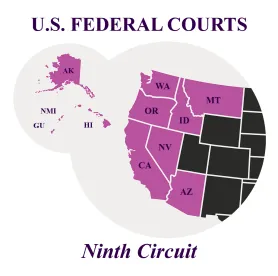

A recent decision from the Ninth Circuit Court of Appeals offered some clarity. In Magadia v. Wal-Mart Associates, Inc., No. 19-16184 (9th Cir. May 28, 2021), the Court addressed performance-based quarterly bonus payments and subsequent overtime adjustment pay, and how such payments must be reflected on employees’ pay statements.

In Magadia, nondiscretionary incentive bonuses were paid to certain high-performing employees on a quarterly basis based on sales, performance and profits. When the bonuses to qualifying employees were paid, the overtime rate would be simultaneously adjusted for the relevant period to include the bonus amount and the employees would receive an adjusted overtime payment, such that their total overtime pay—following the end of the quarter—would properly reflect the total compensation earned for the hours worked.

The plaintiff in Magadia argued that Cal. Labor Code § 226(a)(9), which requires California employers to provide pay statements reflecting each “hourly rate in effect during the pay period,” meant that his bonus payment and subsequent overtime adjustment should have included a corresponding “rate” and “hours worked.”

Rejecting this argument, the Court observed that Section 226(a)(9) restricted its requirements to hourly rates “in effect during the pay period.” Because eligibility was determined for the incentive bonus, and the bonus payments and overtime adjustments were made after the corresponding pay periods had concluded, the Court determined that the incentive bonus payment and overtime adjustments were not a “rate” that was “in effect during” the pay period. Instead, the Court described the payment as “a non-discretionary, after-the-fact adjustment to compensation based on the overtime hours worked,” that was, in fact, corresponding to a “fictional hourly rate calculated after the pay period closes in order to comply with the [Cal.] Labor Code section on overtime.” Id. at *23.

In providing a helpful test to assist in determining whether a particular rate of pay must be listed on an employee’s pay statement under Section 226(a)(9), the Court noted that their reading of the law “is confirmed by § 226(a)(9)’s second requirement: that the employer must list the ‘corresponding number of hours worked at each hourly rate,’” and that “at no time during the preceding two-week period did the employee work under that overtime rate because it’s calculated after the close of the pay period . . . .” Id. at *25.

In short, employers now have strong guidance from the Ninth Circuit that after-the-fact overtime adjustments made to compensate for nondiscretionary bonus payments are not a “hourly rate in effect during the pay period,” that might require inclusion on a compliant wage statement. Employers should take this opportunity to review their bonus payments and related overtime adjustments to ensure they are compliant, keeping in mind that the guidance from the Magadia Court is only persuasive (not binding) authority for California state courts and agencies.

/>i

/>i